A Case For: An Active Fundamental Approach to Climate Transition

A determined global effort to bring about a 50% reduction in greenhouse gas emissions by 2030 offers the potential for significant capital growth in equities, in our view. We believe this new era of climate transition, on the path to net-zero emissions by 2050, presents equity investors with clear opportunities for generating significant alpha using an active, high-conviction approach to investing.

The global economy is fast transitioning from being dependent on fossil fuels to being driven by clean energy. Countries with net-zero targets together represent 88% of global emissions,1 92% of global GDP,2 and 89% of the global population.3

While the financial markets are expected to mobilize trillions of dollars to build a global zero-emissions economy, we anticipate that vast investment in new technologies and capital equipment will also be required to realize emissions reductions of 50% or more by 2030 and a net-zero transition by 2050.

In November 2021, the United Nations Climate Change Conference (COP26) focused the world spotlight on the need for urgent global action. COP26 also spurred a series of impactful regulatory and economic drivers that, by our assessment, have the potential to dramatically reshape equity investing.

One key regulatory outcome from COP26 was the establishment of the International Sustainability Standards Board (ISSB), which is overseen by the International Financial Reporting Standards (IFRS) body. For the past two years, the ISSB has worked to develop standardized corporate climate-related disclosure guidelines to inform investors, leveraging existing global frameworks like TCFD4 and the former SASB.5 In June 2023, the ISSB unveiled its inaugural standards (IFRS S1 and IFRS S2) with the aim to improve trust and confidence in company sustainability-related disclosure for financial markets worldwide.

On the carbon front, mandatory emissions disclosures and carbon pricing may eventually be applied all along the supply chain,6 which could upend current company scores for carbon-intensity and other greenhouse gas (GHG) measures.

Corporate Transition Planning

In a climate-focused world, we believe public companies will be expected to have a credible transition plan for achieving net-zero emissions. We expect mandatory disclosure on climate-related factors and hard carbon pricing will benefit the planning process, leading to greater accuracy in quantifying the true cost of emissions. In our view, public companies will be assessed on their transition plans as well as on their current progress with regard to their carbon footprint. We expect that regulatory and physical risks to public companies, including the short- and long-term impacts of climate change, will also be assessed.

By definition, transition plans will be forward-looking, and some companies may find themselves having to make new investments or undertake restructuring in order to achieve net-zero emissions in the allotted timeframe. Other companies may find themselves already advantageously positioned to benefit from efforts to tackle climate change.

We believe corporate transition plans will be subject to sharp stock market scrutiny. In our opinion, climate transition planning and competency will become key areas of differentiation for companies — and will become key drivers of valuation for all equities. In the shifting climate landscape, there will be re-ratings, valuation dislocations, and corporate winners and losers — all creating an environment that we believe to be ripe for active stock-picking.

Climate Investing Using an Active Fundamental Approach

State Street’s Fundamental Growth & Core Equity (FGC) team takes an active, high-conviction approach to equity investing in general, and to climate investing specifically. The team looks for quality companies at reasonable valuations that can deliver growth that is stronger and more enduring than the market’s expectations. Since relatively few companies meet our strict criteria for investment, we concentrate our portfolios in our highest-conviction names.

As a team, we get to know our portfolio companies very well, through deep due diligence and engagement. We seek to hold companies for the long term — five years is a typical holding period. While the market tends to focus on short-term results, we believe that investors who have the judgment, patience, and perspective to look beyond the horizon of the average investor — as is necessary with climate investing — have an enormous advantage in the market because sustainable growth compounds over time.

FGC Climate Assessments

ESG considerations are integral to the FGC team’s alpha thesis and have been fully integrated into the team’s investment process since 2002. In recent years, we have continued to enhance our ESG research efforts to align with the evolving climate landscape. FGC analysts now conduct proprietary, in-house climate assessments across companies in their respective industries, scoring three key areas:

Climate Transition Readiness Which includes disclosure practices, transition plan credibility, and management accountability

Climate Risks Both financial and physical — including direct exposure to carbon pricing, risk of stranded assets, exposure to regulation or litigation, and exposure to severe weather and/or supply chain disruption

Climate-enabling Opportunities Including green products, services, and solutions

Analyst climate assessments are captured on a Climate Scorecard, which is fully integrated into the FGC research framework and shared across the FGC platform. These climate scores and analyst insights form the foundation of our climate investing efforts.

State Street’s Global Climate Transition Strategy

The FGC-managed Global Climate Transition Strategy is a dedicated ESG strategy that aims to generate long-term capital growth through investment in companies that lead their respective industries in climate change transitionpreparedness and progress. The Global Climate Transition Strategy’s “alpha thesis” capitalizes on the following attributes:

• Fundamental Business Knowledge FGC research analysts are subject-matter experts in their respective industries, well-positioned to assess company risks and opportunities as transition plans evolve.

• Time-arbitrage Corporate climate transition plans will play out over the next decade (and beyond) and require patience as frameworks develop and market valuations adjust.

• Data Inadequacy Forward-looking, fundamental analysis of companies is essential because much of the available climate data is historical or represents a snapshot in time.

• Engagement FGC has access to firmwide ESG and Asset Stewardship resources. FGC meetings with current and potential portfolio companies, and collaboration with State Street’s Asset Stewardship team, generate key insights into each company’s intended net-zero pathway and progress.

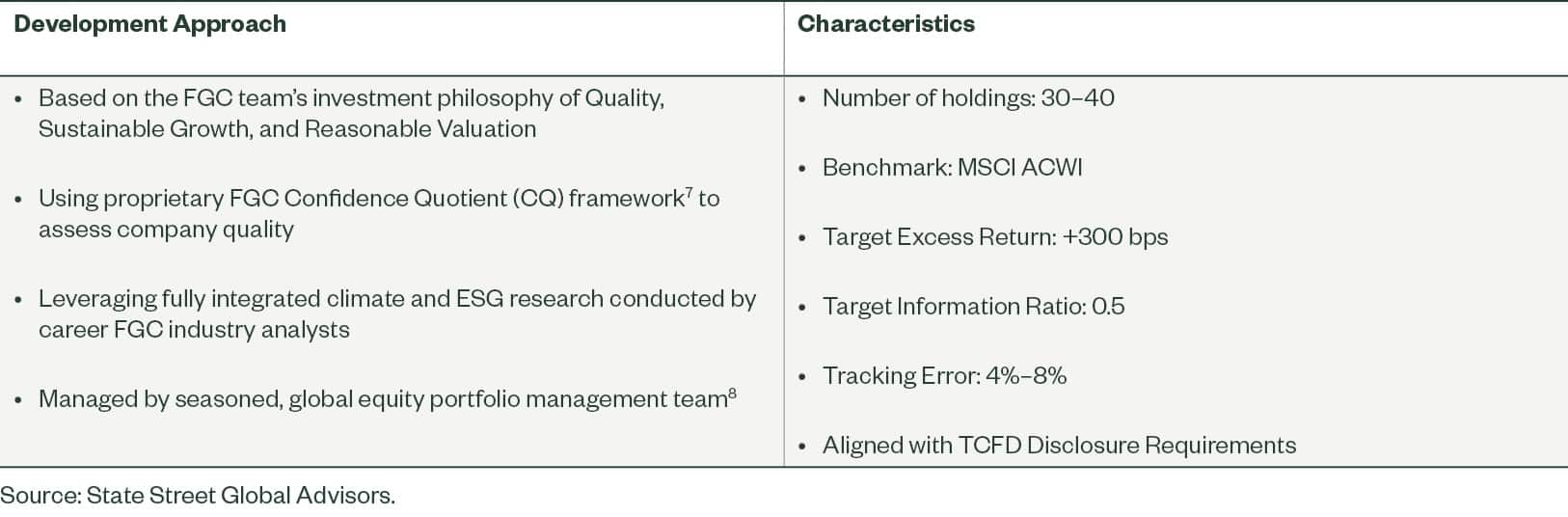

Figure 1: Global Climate Transition Strategy Overview

An integrated portfolio focused on industry leaders in climate transition planning and progress

Conclusion

Global equity markets are being changed by country, corporate, and investor efforts to reduce greenhouse gas emissions and achieve net-zero objectives — at a pace never seen before. To discern the winners and losers in this evolving landscape, State Street’s FGC team believes that an active, forward-looking approach, based on in-depth fundamental analysis, is most effective. Our team invests for the long term, informed by an assessment of corporate climate risks and opportunities as well as readiness for climate transition — characteristics that are fully integrated into our overall ESG framework.

Our concentrated portfolios reflect our highest-conviction, best ideas based on our rigorous and time-tested investment philosophy of quality, sustainable growth, and reasonable valuation. Our track record reflects the strength of our global analyst team and the stock-picking expertise of our seasoned portfolio managers.

We look forward to continuing this important conversation with you.