A Window of Opportunity for Income-Focused Asset Allocation

Long-dated Treasury yields have soared close to the highest levels in more than a decade, while high-yield bonds offer absolute yields of 8.4% (see Case for US High Yield Bonds).1 Attractive bond yields are prompting some investors to pit bond ownership against public equity investment. The forward earnings yield for the Russell 1000 stands at 5.0%,2 which is below the 5.4% yield to worst3 for the Bloomberg US Corporate Intermediate Bond Index. In this piece, we explore whether investors could be well served by looking higher in the capital structure and taking advantage of the substantial income available in the bond markets.

Fixed Income Back in the Running

The Investment Strategy and Research Team’s intermediate asset return expectations suggest that investors may need to look outside the US equity market and into Europe, emerging markets (EMs), or fixed income markets to achieve a 7% return target over the next three to five years. Allocations outside of US equities could allow investors to reap the benefits of both income generation and diversification. Fixed income may be preferable to EM or European securities due to trends in the geopolitical and global market landscape. Furthermore, with an increased allocation to US Treasury bonds, investors can potentially improve risk-adjusted returns while maintaining a balanced cash reserve.

Overall, fixed income may be better positioned than equities due to a higher yield profile and a more favorable macro backdrop. However, as investors contend with the end of “the Great Moderation,” a focus on income-generating assets (both bonds and equities) may allow them to shield against declines in valuation, rises in volatility, and increases in uncertainty. While investors brace for slower economic growth, they are now presented with better opportunities for income generation.

Income Opportunities Have Resurfaced in the Bond Market

Prior to the 2022–2023 hikes, the Federal Reserve’s (the Fed’s) benchmark rates were close to 0%, and the holders of cash or high-quality bonds grappled with low levels of income. These investors often traveled down in quality to find yield, and capital flowed toward direct private investment at the expense of public market equity and bond allocations. However, the Fed’s aggressive hikes since early 2022 have pushed rates to levels that are attractive for yield-seeking investors. On the shorter end, investors can now earn a 5.4% yield on liquid cash (US Treasury 3-month Treasury bills), while US long Treasury yields have risen to 4.2%, and intermediate US high-yield bonds offer yields of 8.4%.4 The 30-year Treasury bond last hit 4% in the fall of 2022.

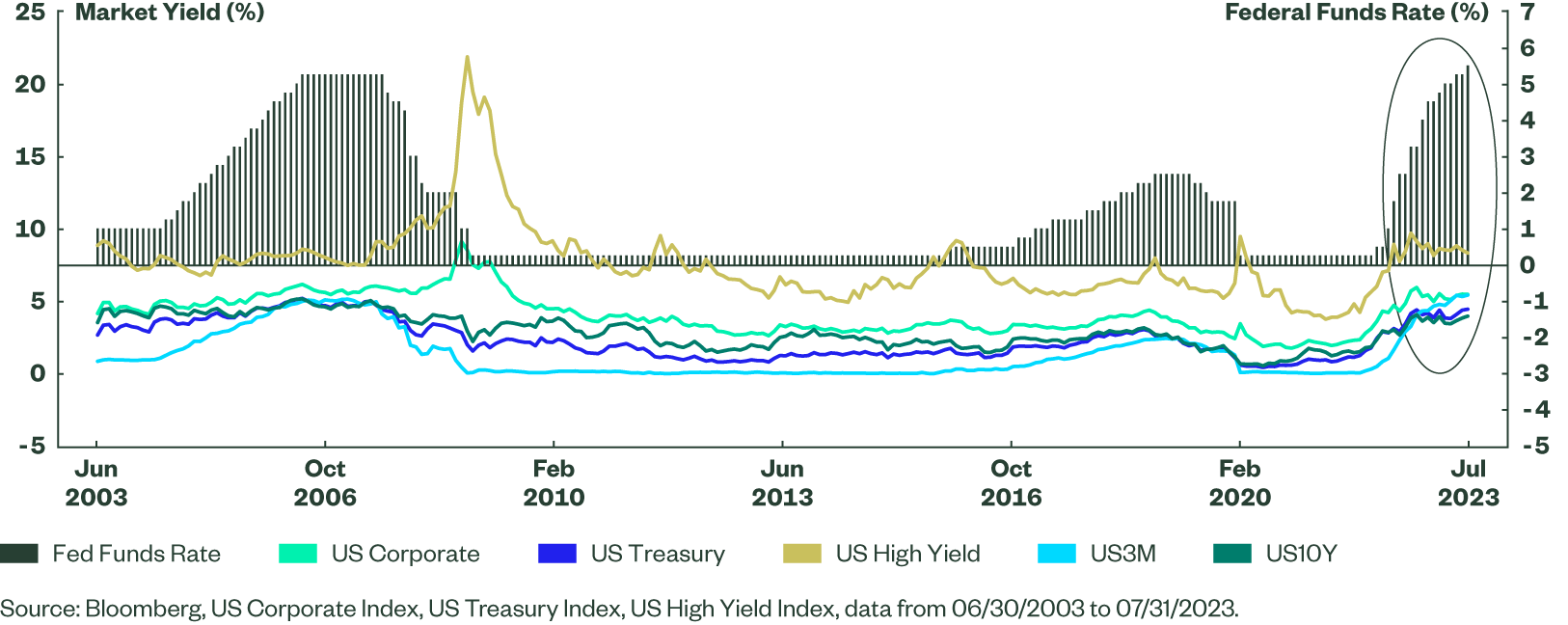

For further historical context, US bond market yields sit above the 70th percentile over the past 20 years. The 3-month US Treasury yield has reached a new high (Figure 1).

The Macro Environment Is Constructive for Fixed Income

Fixed Income Market Prices Could Get a Boost From Fed Pivot

We believe that the Fed’s latest 25-basis point hike in July may be the start of a respite from tightening. Historically, the Fed has paused raising interest rates when disinflation has picked up momentum. The CPI peaked at 9.1% in June 2022 and has dropped to 3% as of the year ended June 2023. With a meaningful decline in the Producer Price Index in recent months, a fall in commodity prices, and a still-elevated level of goods consumption providing room for Consumer Price Index contraction, we think that the macro backdrop continues to put downward pressure on inflation.

As a result, we believe the Fed has completed its hikes for 2023, and we expect cuts in 2024.5 The US Treasury yield and the federal funds rate are highly correlated (Figure 2). If policy rates decline in the near future, US high yield, US Corporate, and US 10-year Treasury yields — all already off their 2022 highs — could begin to turn lower. The circled area in Figure 2 shows how bond yields have ratcheted higher with the fed funds rate, and the end of tightening could pave the way for lower market yields.

Figure 2: Corporate and Government Yields Have Historically Followed the Path of Policy Rates

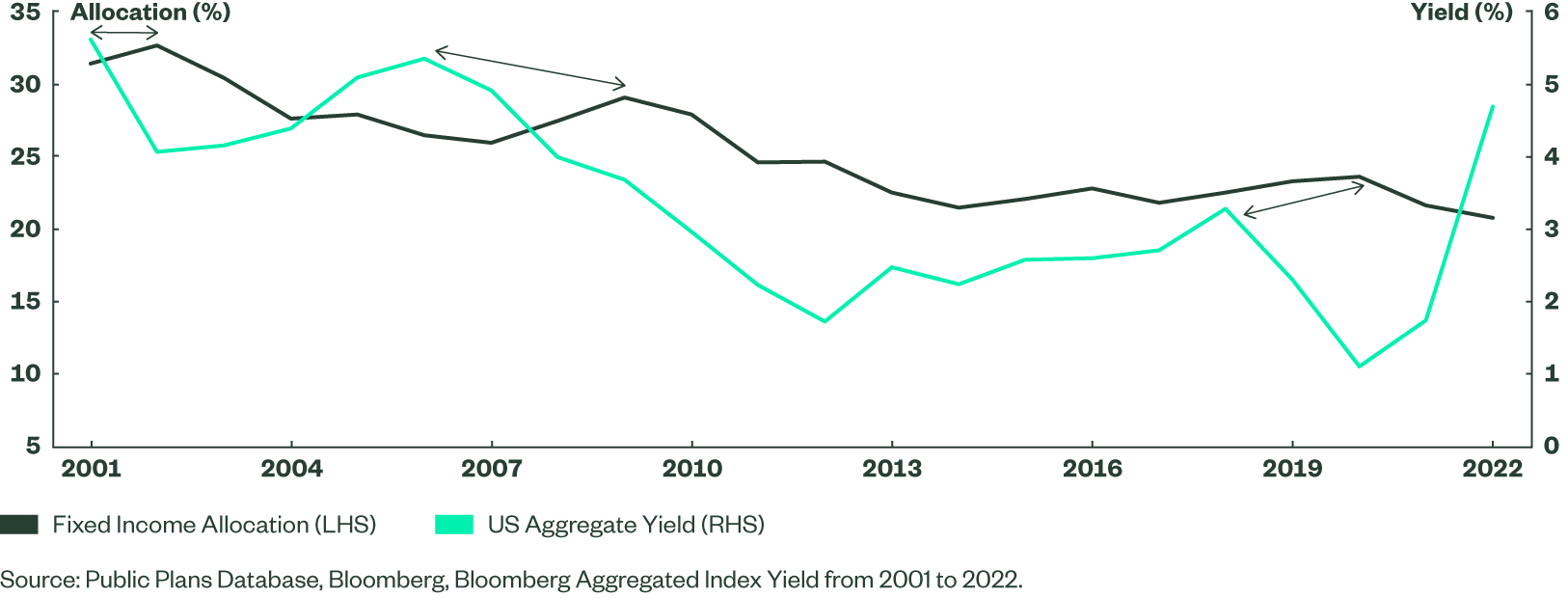

Peak Rates Could Point to Shift in Sentiment

US Public Plan Data can provide insight into the ways bond investors may respond to a peaking in bond yields. Fixed income allocation peaked in 2002, 2009, and 2020, One to two years after yields reached a high point in those cycles (Figure 3).6 The shift into bonds could reflect a combination of (1) appreciating asset values as yields dropped, which passively increased allocations, and (2) increasing active investments in bonds. This data suggests that investors may be primed to return to fixed income following years in which equity and other higher-beta assets have been investors’ preferred allocation.

Figure 3: Fixed Income Allocations Have Risen Following Rate Peaks

The End of the Great Moderation: Volatility in Equity Markets

In addition to a lower yield profile, we believe US equities have a weaker macro setup. We warrant caution due to macro risks such as inflation, recession, and geopolitical concerns that could increase volatility. Notably, the VIX Index is at 15.85 as of August 11, 2023, which is a level comparable to the volatility last seen in 2019. In our view, the low level of the VIX exhibits a disconnect between the market’s expectation and the reality of risks facing global stocks. Figure 4 shows the frequency of various levels of the VIX Index in three periods. We note that the VIX has been elevated with greater frequency in the 2020 and later period, a testament to the economy’s drift away from the Great Moderation.

So far in 2023, the US equity market has been able to sustain its rally because a narrow group of mega-cap stocks benefited from earnings expectations beats, artificial intelligence buzz, and risk-on investor mentality, but with financial conditions tightening, we believe there are fewer certainties in the equity market. In fact, with the Equity Risk Premium at 1.16%, its lowest level in over two decades,7 and the S&P 500 Index trading at 20.8x FY1 estimates, the risk is to the downside. Second quarter earnings came in better than expected, but a small handful of technology-driven companies delivered these results. These names also dominate the market capital weight of the index. Any misstep with earnings will likely be cause for a correction. Additionally, our projection is that global growth will slow and, given the strong signal from an inverted yield curve, the economy will feel recessionary, even if that outcome is unofficially realized. For 2023, we now forecast growth of around 1.2% in the United States and incrementally lower in the eurozone.8

What About Dividend Stocks?

In this environment — an economic slowdown — we do see some opportunities in equities. Specifically, companies with characteristics of quality/growth, dividend-paying, and low-volatility are favored, as evidenced by past US business cycles (Figure 5).

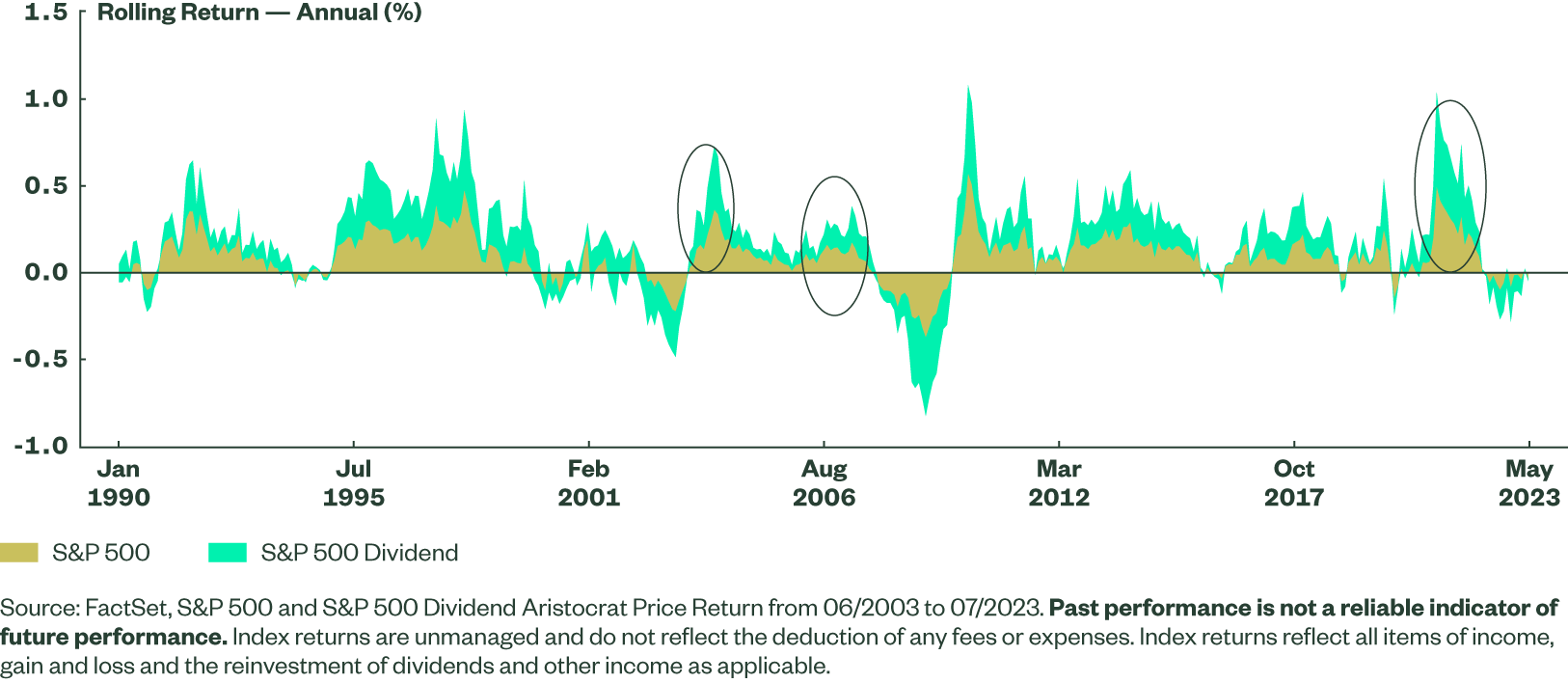

Dividend stocks have outperformed during bear markets, as seen in Figure 6. In 2002, 2009, and 2022, the S&P 500 saw the worst returns, but the S&P 500 Dividend Aristocrats improved over the same period (Figure 6). This bodes well for dividend indices as we approach a Fed tightening–led slowdown.

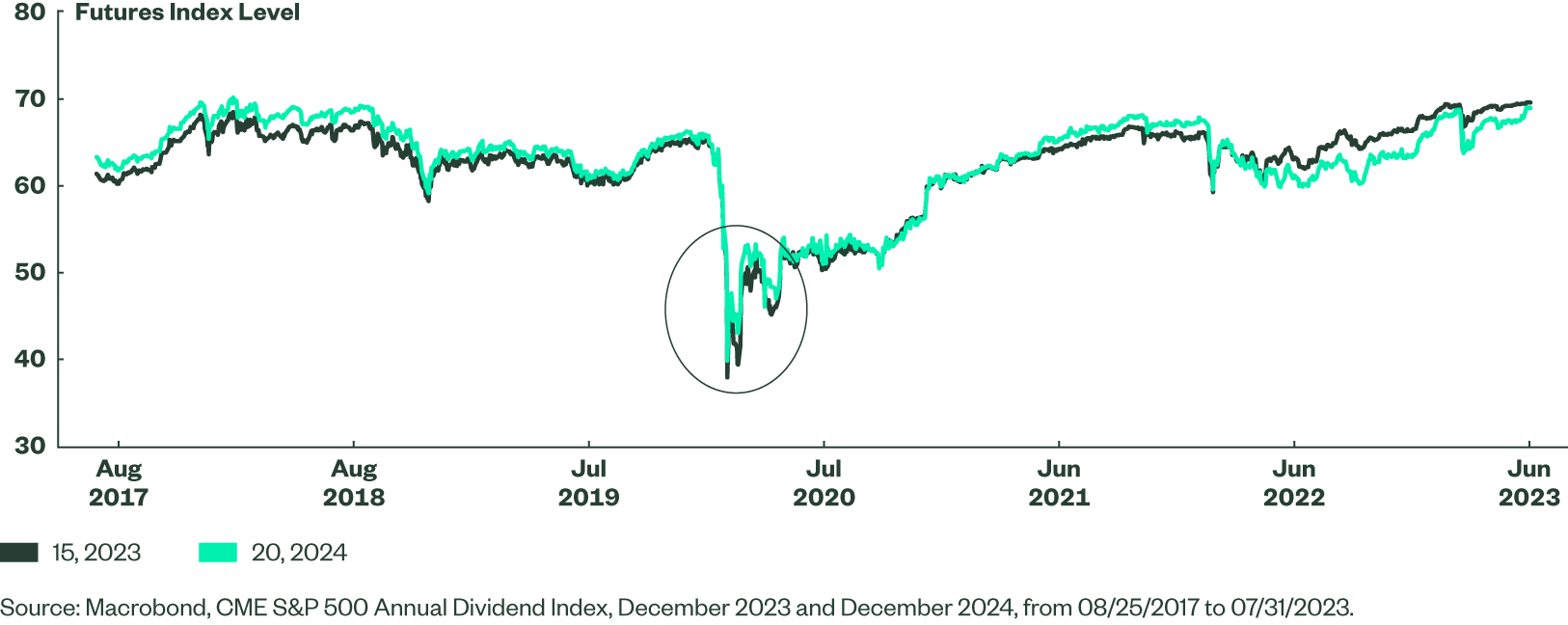

Importantly, investors have regained confidence that companies in the S&P 500 Annual Dividend Index will make scheduled dividend payments in 2023 and 2024. The index reached its lowest point in March 2020 but rebounded fairly quickly after, and is now back to pre-pandemic levels (Figure 7).

Figure 6: Dividend Stocks Have Outperformed in Bear Markets

Figure 7: Dividend Stock Sentiment Has Rebounded

Conclusion

The Fed tightened monetary policy and created difficult market conditions in 2022. However, the rout led to levels of bond yields that now outpace equity market yields, opening a window of opportunity for asset allocators to maximize potential income in a period of potentially muted forward returns.

Looking forward, despite an unusually constructive first half of 2023 and decreasing inflation pointing to a soft landing, global real GDP growth is currently estimated around 2.6% for calendar year 2023, and the world is heading to a slowdown. Market expectations continue to outpace this economic reality. We think volatility will again pick up on a forward-looking basis, as we continue to move away from the Great Moderation.

We believe investors should consider income-paying assets as a way to improve the probability of meeting forward return expectations. Fixed income may be preferable because of the higher yield profiles in debt markets versus equity markets, along with some potential for capital appreciation after a year of steep drawdowns in 2022. However, dividend-paying and higher quality stocks are also compelling given their historical outperformance in periods of economic slowdown.