A Close Look at Concentration Risk

Looking beyond the headline grabbing performance of a few mega-cap US stocks, we see opportunities for active managers in less concentrated, and therefore less risky, parts of the market.

Performance of a few mega-cap stocks has been well commented on in prior commentaries as well as by other asset managers. Yet, we do not think equity markets should be solely defined by the headline grabbers. The Systematic Equity-Active1 team believes that there are opportunities, especially after recent events, to generate excess returns outside the largest names with the benefits of reduced concentration risk.

A Comparative Look at Concentrations

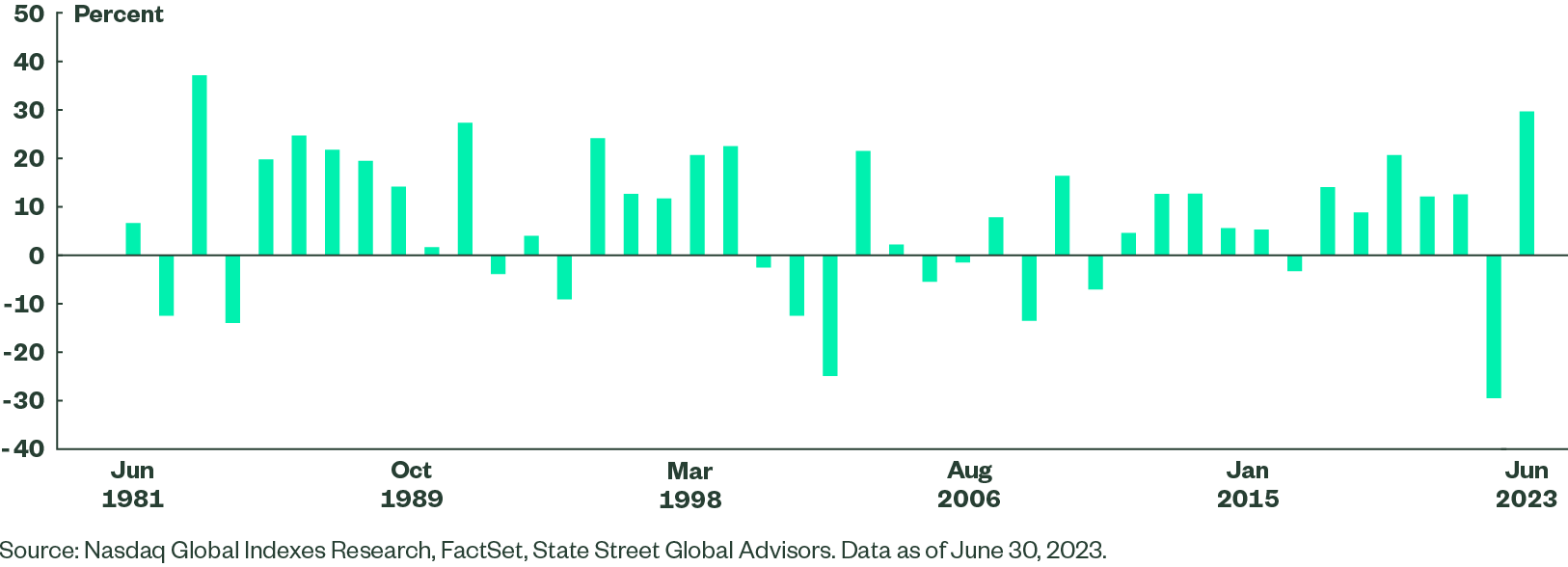

The artificial intelligence (AI) craze which ignited after the release of ChatGPT at the end of November 2022 has driven equity markets to extremes over the first half of 2023. The Nasdaq Index, which serves as the poster child for this enthusiasm, has delivered as of June 2023 its strongest first half of the year in over 40 years (Figure 1).

Figure 1: Nasdaq Index’s First Half Returns

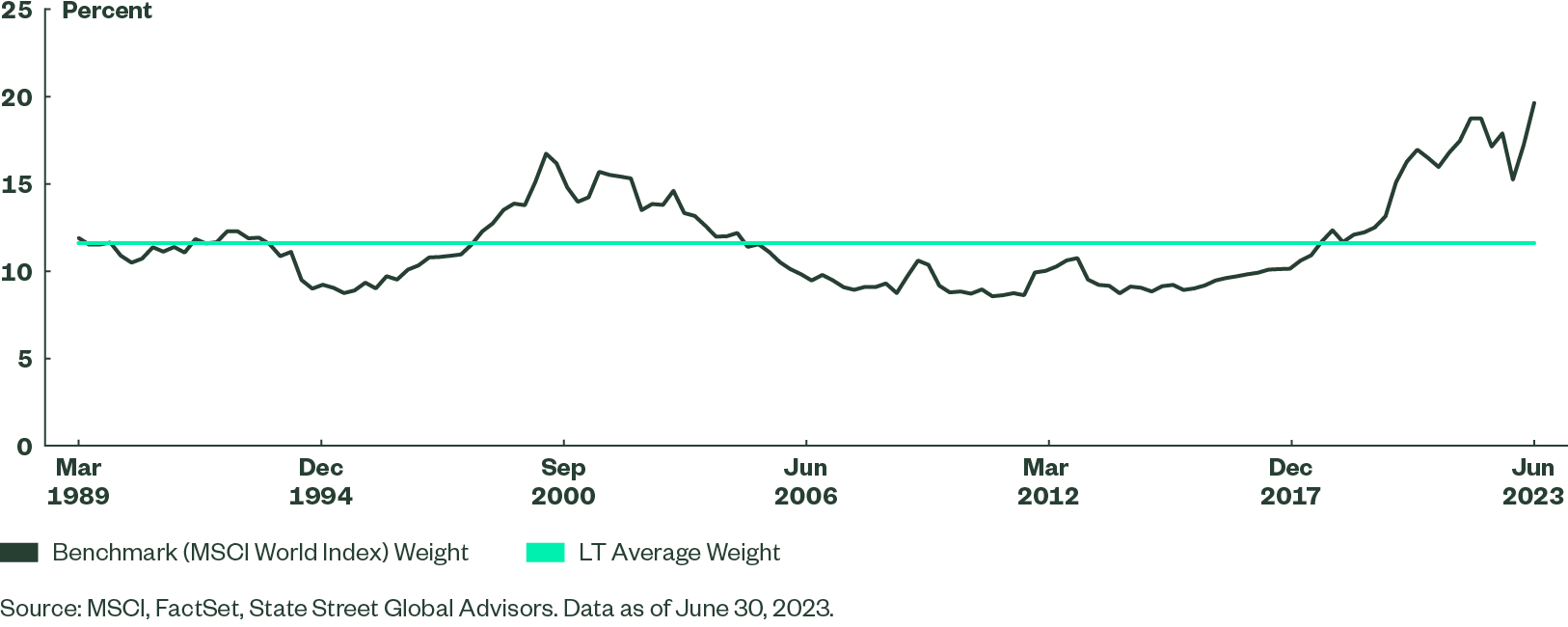

Even in broader cap-weighted indices, such as the MSCI World Index, we have noted a phenomenal concentration in weight and return contribution to just a few securities — all of them are listed in the US. The largest 10 stocks now account for over 20% of the weight of the index, which is far greater than what we have witnessed over the past few decades (Figure 2).

Figure 2: Concentration Levels of 10 largest stocks at Historic Highs

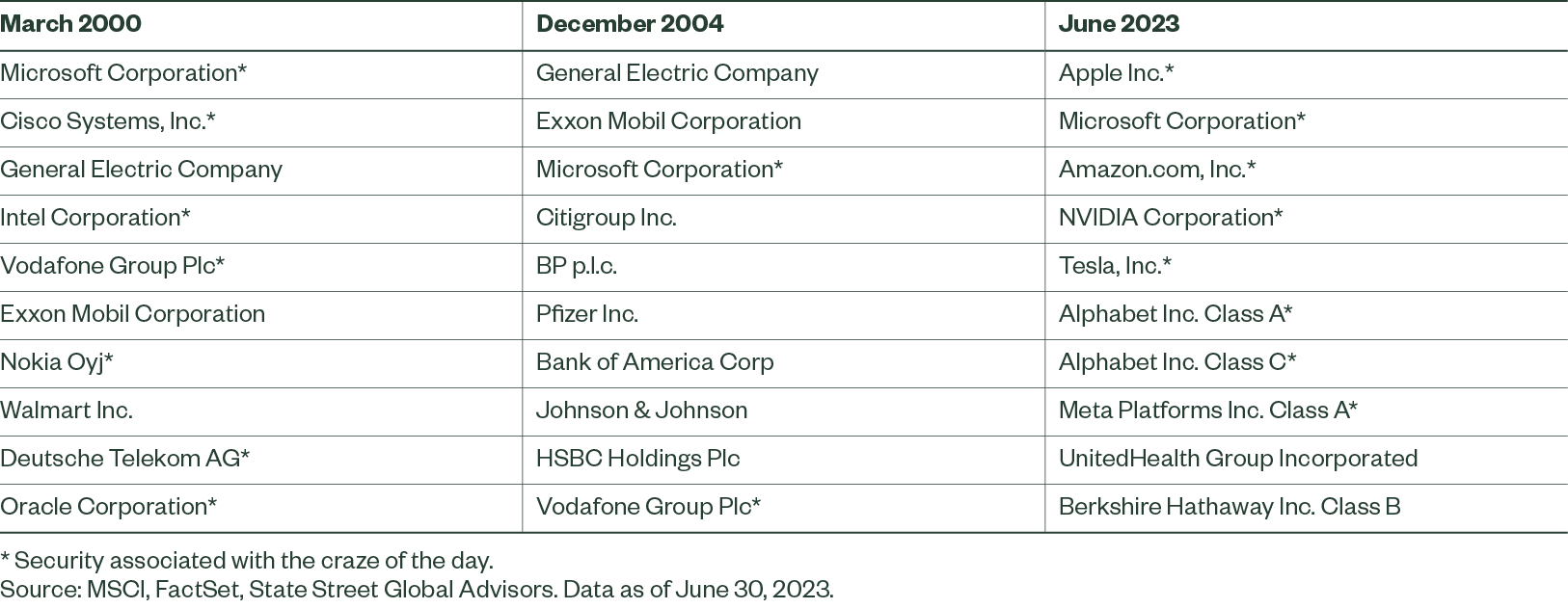

The previous peak in concentration was in early 2000 driven by a bubble in technology, media, and telecommunication (TMT) stocks amid wild enthusiasm for the possibilities from the broadening adoption of the internet. By the end of March 2000, the top 10 stocks in the world by market capitalization were dominated by stocks affiliated with the TMT bubble.

The internet has had a tremendous impact on the way we live and work today, justifying in many ways the excitement in 2000. However, this euphoria did not justify the excessive valuations and hype around a few internet names, in our view. By the end of 2004, the market had returned to its long-term average, in terms of concentration in the largest 10 names, and only two of those previous high-fliers were still ranked among the largest 10 stocks (Figure 3).

If we look at today’s market we see a similar pattern. Currently, eight of the largest securities in the market are affiliated with the technology and AI themes, albeit with only one stock (Microsoft) still present from the last bubble. When the market concentration reverts this time around back to more normal levels, who knows what the composition of this top end of the market will look like?

Figure 3: Top 10 Stocks in the MSCI World Index: Then and Now

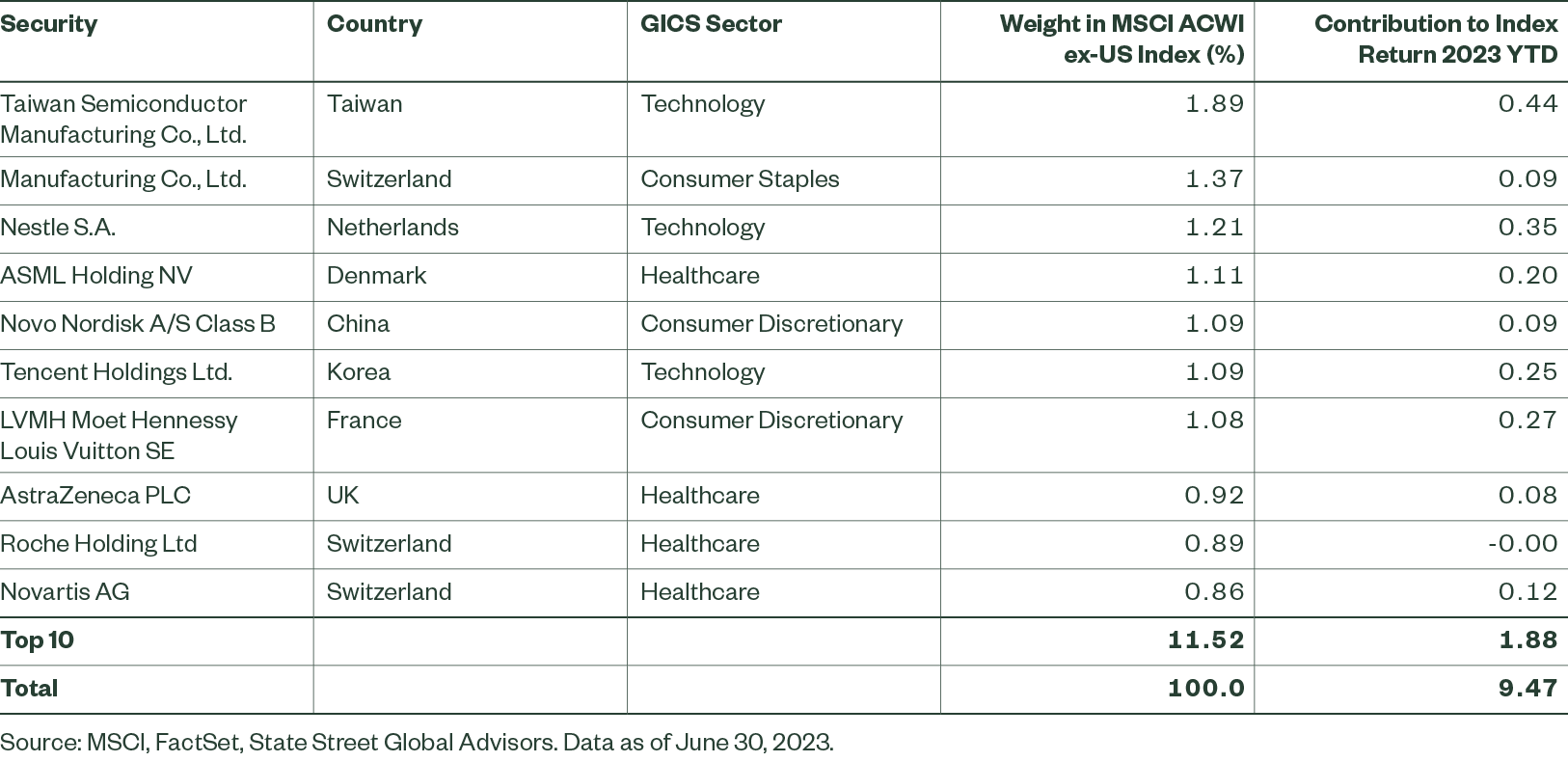

As active investors, we believe it pays to look beyond the headlines and in this case outside the US market. In the MSCI ACWI ex-US Index, which covers developed and emerging markets, we see far less concentration in names and return contribution. The largest names are diverse in terms of geography and sector, and only account for 11.5% of the index weight (Figure 4).

Figure 4: Top 10 Stocks in the MSCI ACWI ex-US Index

The Bottom Line

Using our systematic investment process, our team generates return expectations for more than 18,000 stocks globally on a daily basis. This enables us to seek out attractive return opportunities wherever they may be found. Often, we identify opportunities that are outside the glare of the headlines and the largest names.