The Banking Crisis, Regulations and Alternative Investments

The recent banking crisis has raised concerns regarding the future path that financial regulation and supervision may take in the US. Any kneejerk increase in regulation could disproportionally affect asset classes that are undergoing structural changes or are sources of hidden leverage, such as commercial real state and private equity. Given this background, we offer our thoughts on how regulatory and supervisory changes should respond to the crisis and assess the current state of these alternative asset classes.

At his 22 March press conference, Fed Chair Jerome Powell echoed the views of many when he stated, “clearly we do need to strengthen supervision and regulation”. Given the spectacular failures of Silicon Valley Bank (SVB), Signature Bank and First Republic Bank, this much is a foregone conclusion at this point. In our view, supervision and regulation are two facets of the same oversight function – both must be scrutinized and any changes to either must be considered in their totality.

Supervision Versus Regulation

There are costs associated with both overly lax and overly restrictive regulatory environments, although the distribution of those costs can be quite different. Often, an overly lax regulatory environment requires a “post-crisis” involvement by authorities and a broad-based distribution of costs across society. By contrast, a very restrictive regulatory environment places high ongoing costs on the regulated market participants but only indirect and broadly deferred costs on the broader society. Finding the right balance is not easy.

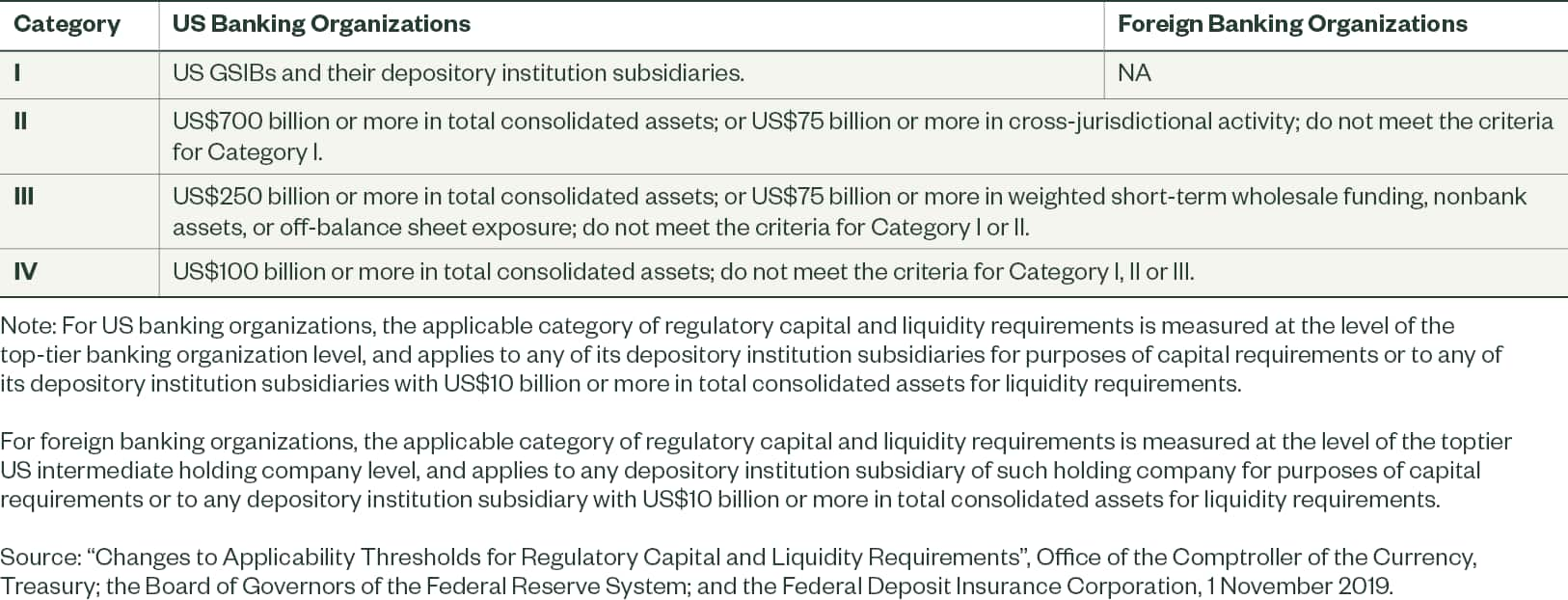

Much attention has been focused on the idea of regulatory “tailoring” and the rule changes that the Fed announced in late 2019. Following that review, banks were grouped into four broad categories, with top tier institutions subjected to the most stringent regulatory requirements. SVB fits into category IV (Figure 1).

Figure 1: Scoping Criteria for Categories of Regulatory Capital and Liquidity Requirements

Critics contend that had these tailoring rules not been eased, SVB would have been subject to a higher regulatory burden that might have forced better risk management at the bank. This is not an unreasonable argument, but it is not a complete one. We believe it is worth asking whether more effective supervision within the existing regulatory framework might not have accomplished the same goal. If the answer is yes, we would argue that better supervision, rather than more regulation, is the preferred road ahead.

How Might Supervision be Improved?

There are several different types of risks in various parts of the economy, but the buildup of vulnerabilities has some common characteristics irrespective of where they occur. A good rule of thumb is to look for areas that are new, have grown rapidly and are leveraged. Any of these characteristics is a red flag in and of itself, and any combination is doubly alarming. Our point here is that just as we believe the concept of regulatory tailoring to be a valid one, so is supervisory tailoring.

A term often used in banking circles is “enhanced due diligence,” often in connection with “know your customer” requirements. Formally enforcing a similar approach in respect to supervision should go a long way in helping to spot risks early on and minimizing trouble down the road.

We emphasize the value of effective supervision because when done well, supervision is not only much nimbler but also very cost effective when compared with regulation. In the same spirit, we hope the lesson from the recent banking debacle would not simply be a kneejerk increase in regulation.

When trying to assess brewing risks, we also look for areas that have undergone some structural change or where there is a general lack of transparency. Given the totality of these risk criteria, we see commercial real estate and private equity as flashing yellow warning signs.

Commercial Real Estate in the Wake of SVB

Commercial real estate has seen a strong inflow of capital over the past number of years as investors searched for yield in the low interest rate environment following the Global Financial Crisis (GFC). The additional capital raised in the sector resulted in more competition for assets, resulting in higher property values/lower cap rates.

Investors, however, remained bullish on the asset class as cap rates remained well above interest rates on mortgages (positive leverage), liquidity was strong and tenant rents grew at a record pace. Even more capital rushed into real estate as the Fed lowered interest rates further during the COVID-19 pandemic, driving cap rates down to historically low levels. But the recent rapid rise in interest rates has significantly changed the market, making debt more expensive and slowing the growth in tenant rents. Property cap rates have been increasing across the board for all asset classes as these rates typically increase in tandem with interest rates and bond yields.

There has also been a large impact on the capital markets, but it will not be felt evenly. Commercial mortgage-backed securities (CMBS) are likely to suffer more as they are secured by generally lower-quality assets, less well-capitalized sponsors and less flexible structures, such as that of real estate mortgage investment conduits (REMIC). The results here will also vary greatly with longer-term fixed rate issuances likely to fare better than some of the shorter-term floating rate deals that are immediately impacted by the increase in interest rates.

While banks are generally in better financial shape today than they were in 2007 thanks to regulations put in place as a result of the GFC, the spike in interest rates and the slowdown of the economy will put some stress on their real estate portfolios. Debt service coverage ratios will get tighter and overall loan-to-value leverage levels will be higher as a result of rising interest rates and market cap rates. Given this environment, lenders have become very selective on new originations, focusing on the best quality assets in the strongest markets while tightening terms and conditions.

However, office property loans are facing a much more difficult challenge. The ongoing popularity of the hybrid work model puts office tenants in a position to significantly reduce costs by shrinking the amount of square footage they occupy once their existing leases expire. According to Cushman & Wakefield, just 9% of existing office stock has experienced positive leasing absorption since 2020. According to CoStar, this has resulted in a national vacancy rate of about 13%, which is higher than the vacancy rate experienced during the GFC.

This is happening at the same time that operating costs, insurance premiums, taxes and renovation costs are increasing rapidly, causing large drops in property net operating income levels. As a result of these conditions, lenders have shut down origination of new office loans and are focused instead on troubled debt restructures and asset foreclosures in their existing office books. It is likely that all of this will also result in lenders having to book higher losses or reserves against their office loans in the near term.

Impact of Anticipated Regulation on Real Estate

The biggest concern surrounding the recent failures of SVB, Signature Bank and First Republic Bank is the impact that anticipated additional supervision and regulation on regional banks will have on real estate lending volume. These smaller banks represent less than a third of all commercial real estate lending today but have been growing over the past few years and are a large provider of construction loans to the marketplace (Figure 2).

Potential bank regulations that result in a reduction in the availability of construction debt capital would likely result in private credit lenders stepping into the space in an attempt to fill the void, but it would be at a higher cost and would contain stronger covenants than what developers are used to receiving from regional banks in the past.

Private Equity in the Wake of SVB

Private equity has also been the beneficiary of strong capital flows in recent years, with record amounts of commitments made by institutional investors to general partners in the sector. The immediate impact of SVB’s failure will be felt by the venture capital sector where the bank was a dominant provider of capital to startups. It will be more difficult for those companies without positive operating cash flow to refinance their loans and/or raise the next round of capital.

While there are some private credit funds that specialize in venture capital lending, we expect there will be a large gap left assuming SVB’s lending does not resume under First Citizens. The impact will be felt most strongly in recent vintage venture capital funds that deployed most or all of their capital prior to the banking crisis. We would expect strong risk-adjusted returns for funds with substantial dry powder or new funds that invest over the next several years.

Separately, SVB was an active participant in the subscription facilities of many funds in the private markets, including funds with strategies outside of the US. To date, it seems that the general partners of those funds have had no difficulty in substituting other lenders to replace SVB in those facilities. We have heard of isolated examples of funds with Cayman structures that had deposits with SVB outside of the US that are not covered by the Federal Deposit Insurance Corporation.

Increased costs of financing and a general tightening of the credit markets are impacting all sectors of private equity. Companies that took advantage of the easy credit conditions of the last few years may be faced with having to pay down their loan or refinance at a lower principal amount to meet debt service coverage requirements at the same time as being impacted by rising costs and the potential for falling sales/revenues in a downturn.

Highest Quality Companies to Fare Best

Generally speaking, the highest quality companies with strong cash flows and contractual revenues will fare best, the middle tier will most likely still be refinanced but at far more painful terms and the lowest tier companies will face an uphill battle. These conditions will favor larger and middle market companies (where private credit funds have made more inroads over the past few years ) over smaller companies (Figure 3).

The impact of additional supervision on lower middle market companies that are more dependent on the banking sector is not yet clear but is likely not positive. Survey data from the National Federation of Independent Business (NFIB) Research Center from March shows that small businesses expect tougher business conditions and that both current job openings and those planned for the next three months are beginning to decline (Figure 4).

Given that nearly half of all US employees are employed by small businesses, the importance of proper supervision in the banking sector is magnified.

Finally, the recent announcements by various regulatory organizations in the US, UK, and Europe to explore the growth of private credit in the wake of the GFC have enormous implications for not only private credit and private equity but also for commercial real estate and the public markets.

Conclusion

The banking crisis has raised genuine concerns regarding the state of financial regulation and supervision in the US. While some critics characterize the crisis as a regulatory failure, any hasty implementation of new regulations might put regional banks in a position where they are no longer able to provide their traditional products at competitive terms to alternative asset classes. This potential loss of liquidity comes at a difficult time as the real estate and private equity markets are already struggling from the recent sharp increases in interest rates and the general slowdown in the economy.

As a result of all of these factors, we see lenders continuing to limit financing activity to the highest quality opportunities in alternatives for the foreseeable future. In real estate the focus will be on stabilized properties in the best locations, with office lending continuing to be dormant until property values are reset to levels supported by tenant leasing activity in the current hybrid work environment. For private equity the credit markets will favor larger companies with strong cash flows and contractual revenues in non-cyclical sectors over smaller companies with weaker balance sheets.