Could Emerging Market Debt Keep on Running?

- Emerging market local currency debt has provided a much-needed boost to fixed income returns in 2023. While US Treasury and global aggregate strategies have returned c. 2%, the Bloomberg Emerging Markets Local Currency Liquid Government Bond Index has returned 6.7% year to date.1

- At its core, the driver has been returns of 10% or more from half of the 18 countries included in the index and, most notably, returns of around 20% from Brazil and Mexico, both of which account for close to 10% of the index.

After Strong H1, 3 Areas to Monitor in H2

Following the strong first half for emerging market local currency debt, the question for investors is now whether the second half of the year will prove as fruitful. We certainly expect that some of the key themes prevalent in H1 could continue running. There are three important areas for investors to consider as we move through the year:

- Coupon returns were a key source of yield in the first half, totalling 2.3% for the Bloomberg Emerging Markets Local Currency Liquid Government Bond Index. These returns should continue to accrue.

- Price returns are 2.4% year to date and the market continues to wait for some of the emerging market central banks to start to cut their policy rates. China has eased its Loan Prime Rates but does seem to be on a different policy cycle to much of the rest of the emerging market universe. As we have argued in previous pieces2, there may be some hesitance to start easing policy before it is clear that the Federal Reserve has finished its own cycle. With this expected to occur soon, the window for policy easing may open.

- Currency returns are 2% year to date. There are never any guarantees on which way the USD will go, given its sensitivity as a geopolitical barometer as well as the world’s favoured medium of exchange. However, as we note in the Midyear Global Market Outlook, the longer-term outlook remains for further weakness even if near-term factors may prove supportive. The State Street Global Advisors long-term gauge of fair value suggests that the USD was still 11.1% overvalued against the basket of currencies that make up the Bloomberg Emerging Markets Local Currency Liquid Government Bond Index3.

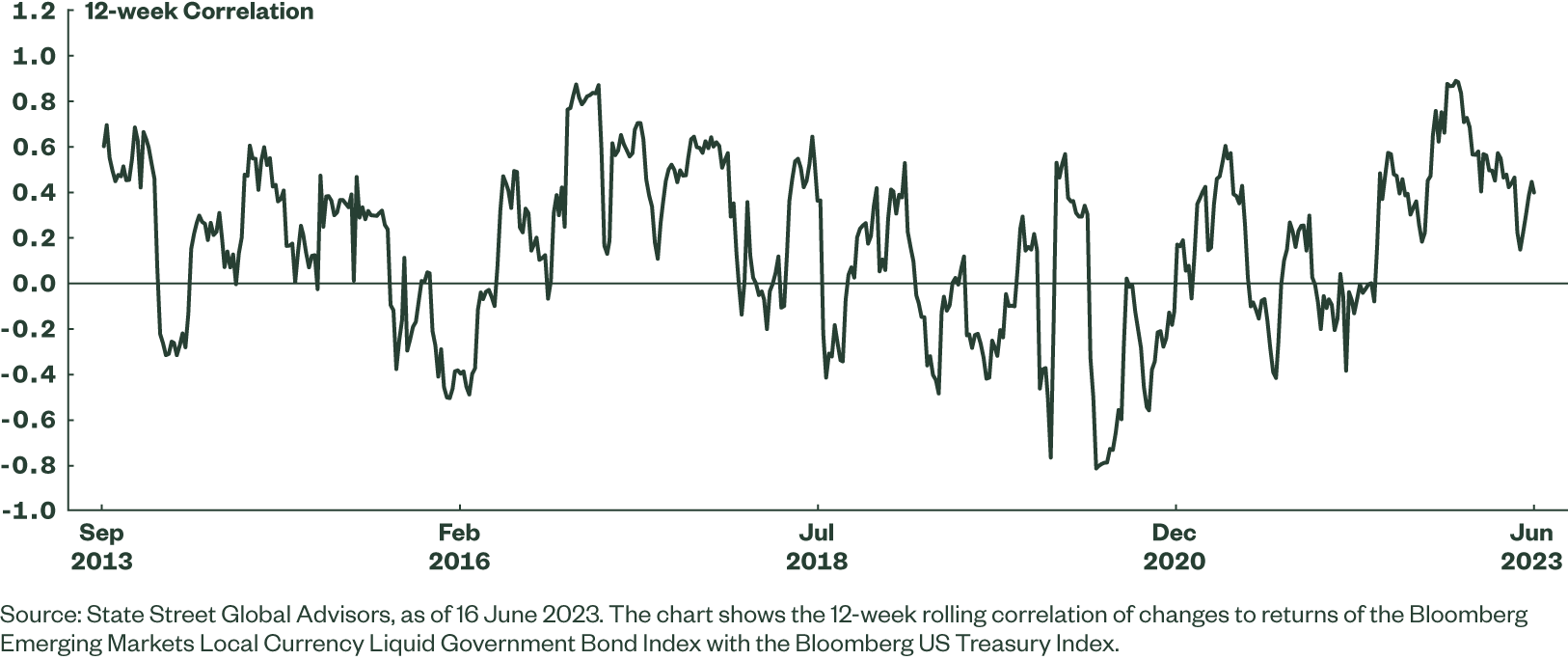

So these three potential drivers of returns look likely to be supportive in the coming quarters. The divergence in performance from Treasuries may add another reason to include emerging market exposure in fixed income portfolios. Figure 1 shows the rolling 12-week correlation in the changes in the returns from the Bloomberg Emerging Markets Local Currency Liquid Government Bond Index with the Bloomberg US Treasury Index. While correlations were high in the closing stages of 2022 (almost all bond markets sold off in 2022, with the inflection point in October, following which there was a widespread bounce), they have fallen quite sharply during 2023. This fall hints that the diversification benefits of emerging market bonds are returning.

Figure 1: Correlation of Changes to Returns of Emerging Market Local Currency Liquid Government Bonds with US Treasuries

There undoubtedly remain some challenges within the emerging market environment. Indeed, 5 of the 18 countries included in the Bloomberg Emerging Markets Local Currency Liquid Government Bond Index have posted negative returns year to date, largely due to currency depreciation against the USD. However, aside from South Africa and of course Turkey, the negative returns have been relatively small. Moreover, Turkey, a key drag on performance this year, appears to at least be stable. With a new team now in charge of managing the economy, bonds have rallied, although the lira remains weak.

Questions around global growth are also likely to persist but, having got on the front foot in the fight against inflation by hiking early, emerging market central banks are better able to respond to weaker growth by lowering rates. If we do see the long-awaited peak in US rates, this is only likely to give emerging market central banks more confidence that any easing will not trigger sharp declines in their currencies.