Energy: A High Voltage Sector

The energy sector has charged ahead during the past couple of months. We can ascribe that turnaround in relative performance to a rapid bounce in oil prices. This price rise in turn is reigniting inflation fears, and the energy sector is often see as one of the best plays in such an environment. In our latest Weekly ETF Brief, we look at both these angles as well as how energy looks on the SPDR Sector Momentum Map.

Higher Crude Oil Prices

Oil prices (we look at Brent crude, as measured by CO1) hit $71 per barrel in mid-June on disappointing Chinese recovery (largest importer of crude oil). Since then, prices have sharply recovered to a yearly high of $94/b within the last week. The pressure has mainly come from the supply side. Of interest has been the extension of Saudi Arabia’s 1mb/d production cut and Russian reduction in crude supply. Any reduction of supply has more impact when stock levels are lower. The much-watched US Strategic Petroleum Reserve is now at its lowest levels for decades. Meanwhile, commercial inventories of crude oil stocks are not so low globally but are below their below 10-year seasonal average.

Looking forward, commodities analysts are watching the potential return of pipeline shipments from Iran and higher exports from Venezuela as the US looks set to relax sanctions, which could ease pressure. US shale production remains on watch. The industry’s reinvestment rate in facilities rose to 72% in Q2, but there is still a high capital discipline among the companies and the rig count is falling, suggesting that there will not be much enhanced supply from this source.

On the demand side, key factors include consumer growth in the US, which has so far surprised on the upside, and Chinese industrial activity, which could finally be turning up.

Natural gas prices are not as important as oil to the earnings of the energy sector and neither have they seen the recent spike. However, they are off 2023 lows and could go higher as winter approaches. This is a particular issue in European markets (where we watch the Dutch TTF). European prices are expected to remain elevated compared with levels prior to the war in Ukraine (given the closure of the Nordstream pipeline) but not reach the extremes and volatility seen a year ago.

Reflation Hedge

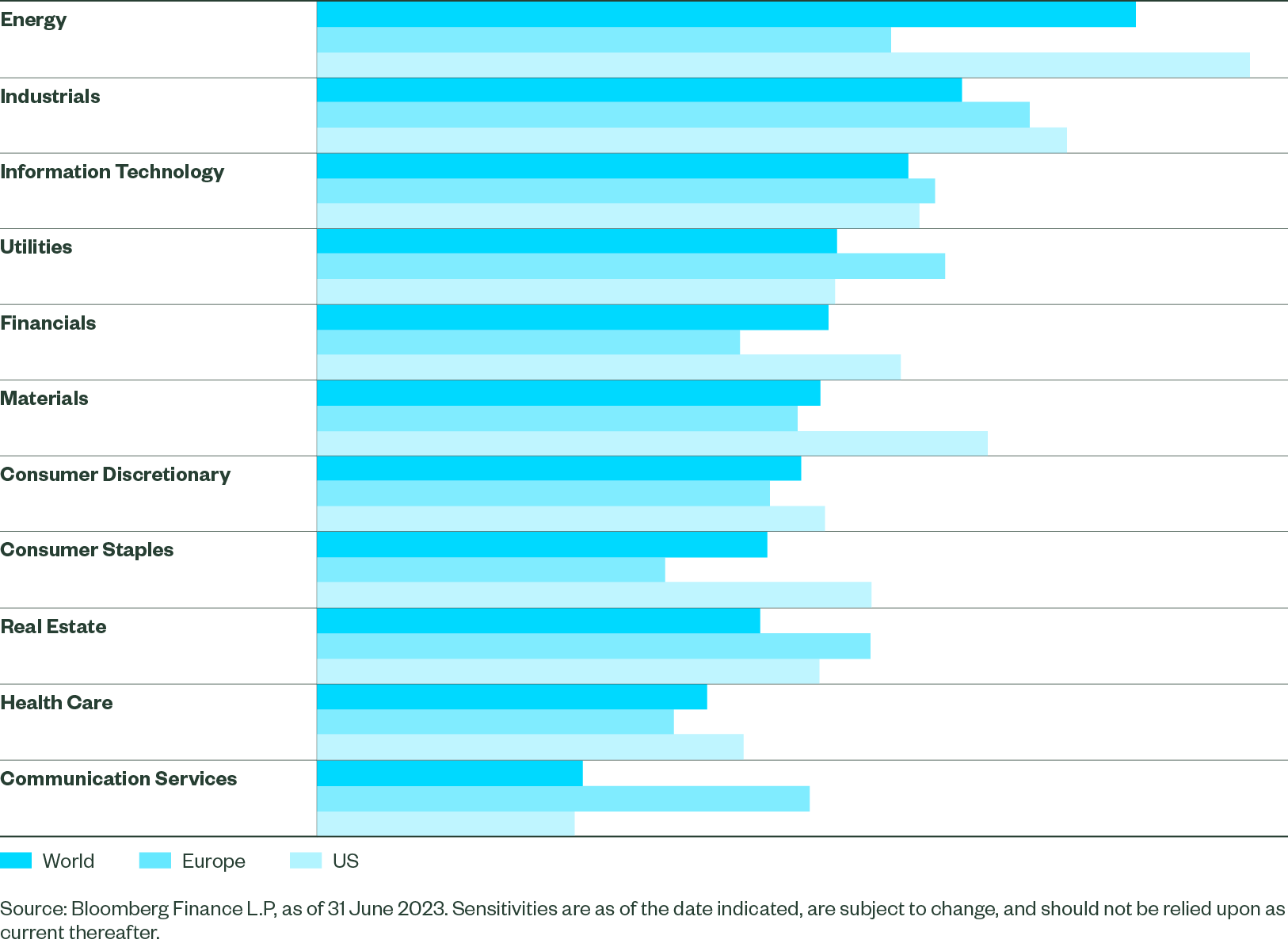

It is too early to declare victory on inflation, and we do not expect developed markets to reach their central bank CPI targets of 2% for a few more years. We believe that the slowdown in inflation may stall, due in part to higher fuel prices. In an environment where inflation becomes a worry again, the energy sector has always been an obvious trade for investors, and we have seen a turnaround to positive flows in sector ETFs in recent weeks. The sector has the highest sensitivity to inflation, as measured by US 5yr-5yr forward levels (see chart below).

Energy has Highest Inflation Sensitivity among GICS Sectors (36 months)

Relative Strength and Momentum

Energy is the most attractively positioned sector in all three regions (US, Europe and world), relative to other sectors, based on the SPDR Sector Momentum Map. Energy entered the Leading Quadrant two weeks ago and has a strong heading with momentum and Relative Strength continuing to improve. Of note, this movement is happening at a time when technology and the related sectors of consumer discretionary and communication services are experiencing a worsening trend.