Dividend Income for Stability As We Approach Peak Rates

The Federal Reserve (Fed) may have finally reached its terminal rate – but potential for a recession in 2024 still remains. In the face of uncertainty, investors may find US Dividend Aristocrats, with their earnings stability and downside protection potential, beginning to look attractive.

Last week’s FOMC decision to hold the fed funds target rate at 5.25-5.50% has gone a long way to support the narrative that the central bank has reached a peak (the so called “terminal rate”). The bond market is currently indicating that it expects the rate to remain in this range until at least June 2024. The yield on 10-year US Treasuries, which briefly breached 5% in late October, has fallen approximately 35 basis points (bps) since the Fed’s decision1. The impact of interest rate policy expectations has been seen as the key driver for equity prices since the global pandemic. As we reach the terminal rate of this monetary cycle, we see two factors becoming an increased focus for investors: earnings and downside protection.

With respect to both of these factors, dividends are starting to look more attractive.

Earnings

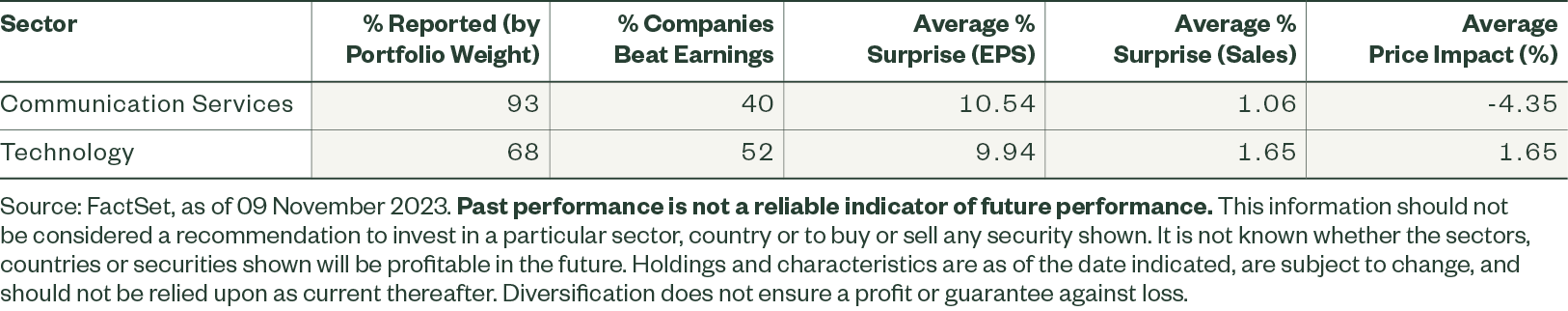

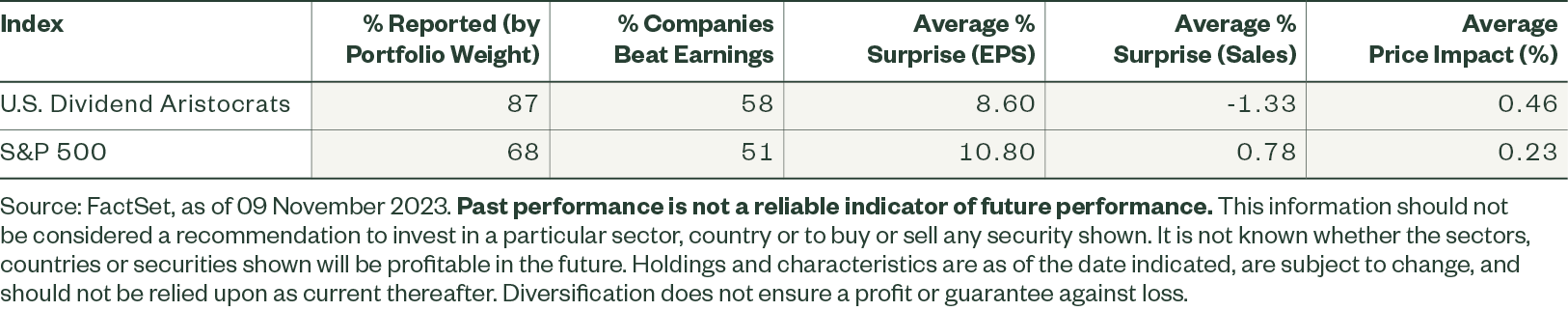

The Dividend Aristocrats Index has underperformed significantly in 2023, primarily due to the unexpected rally in the hyper growth ‘magnificent seven’ stocks. Following the multiple compression experienced in 2022, stocks in the Technology and Communication Services sectors have been beneficiaries of a structural upswing (e.g., the artificial intelligence trade)2. Both sectors have reported strong earnings in Q3, with each surprising by approximately 10% based on the weighted average earnings per share (EPS). The concern for some has been the price impact since earnings (Figure 1). Investors are facing slowing (technology) and negative (communication services) momentum just at a time when interest rate increases are expected to slow. At the index level (Figure 2), we can start to see a levelling of the volatility effect. Dividend Aristocrats do not display the same degree of upside surprise benefit enjoyed by the narrow leadership of the S&P 500. However, the breadth and price impact suggest that investors may start to favour stable earnings (and distributions) heading into an uncertain 2024.

Figure 1: Communication Services and Technology Earnings Scorecard (S&P 500® Index)

Figure 2: Dividend Aristocrats Earnings Scorecard (All Sectors)

Downside Protection

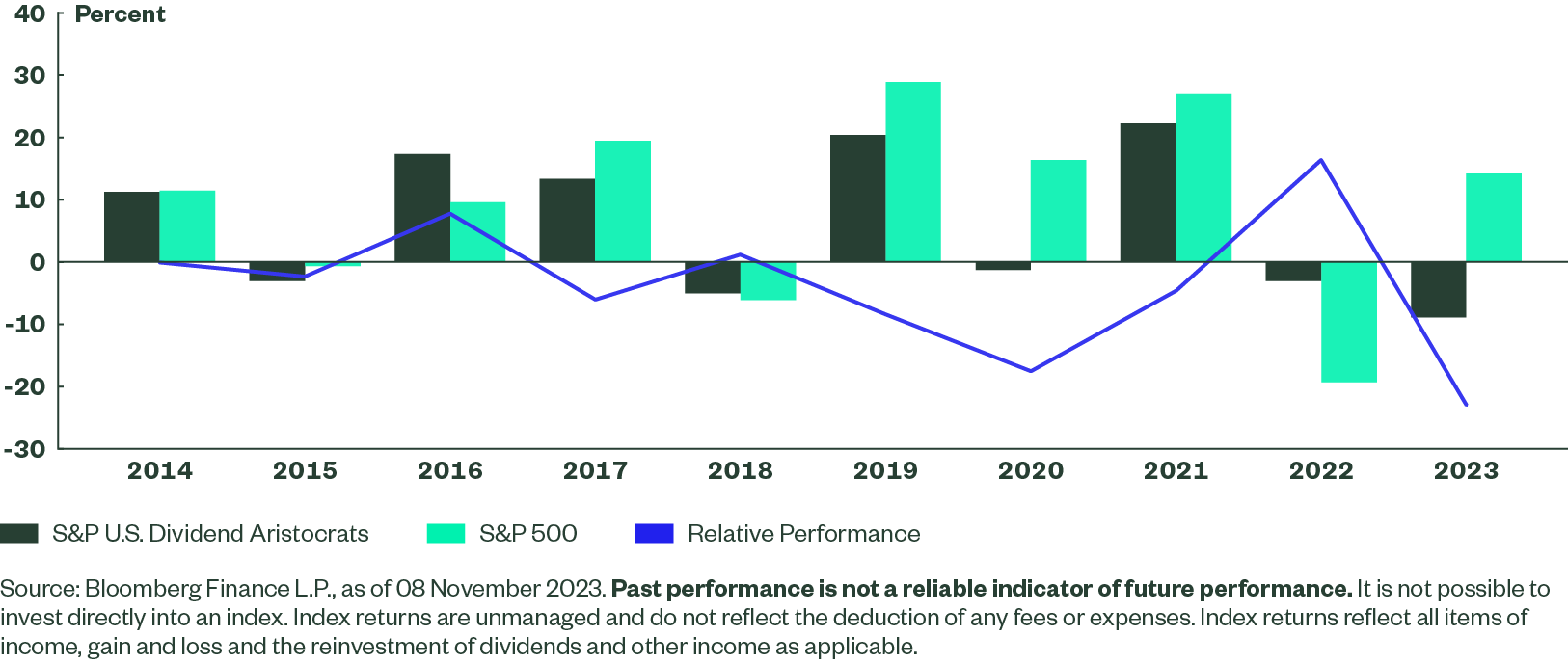

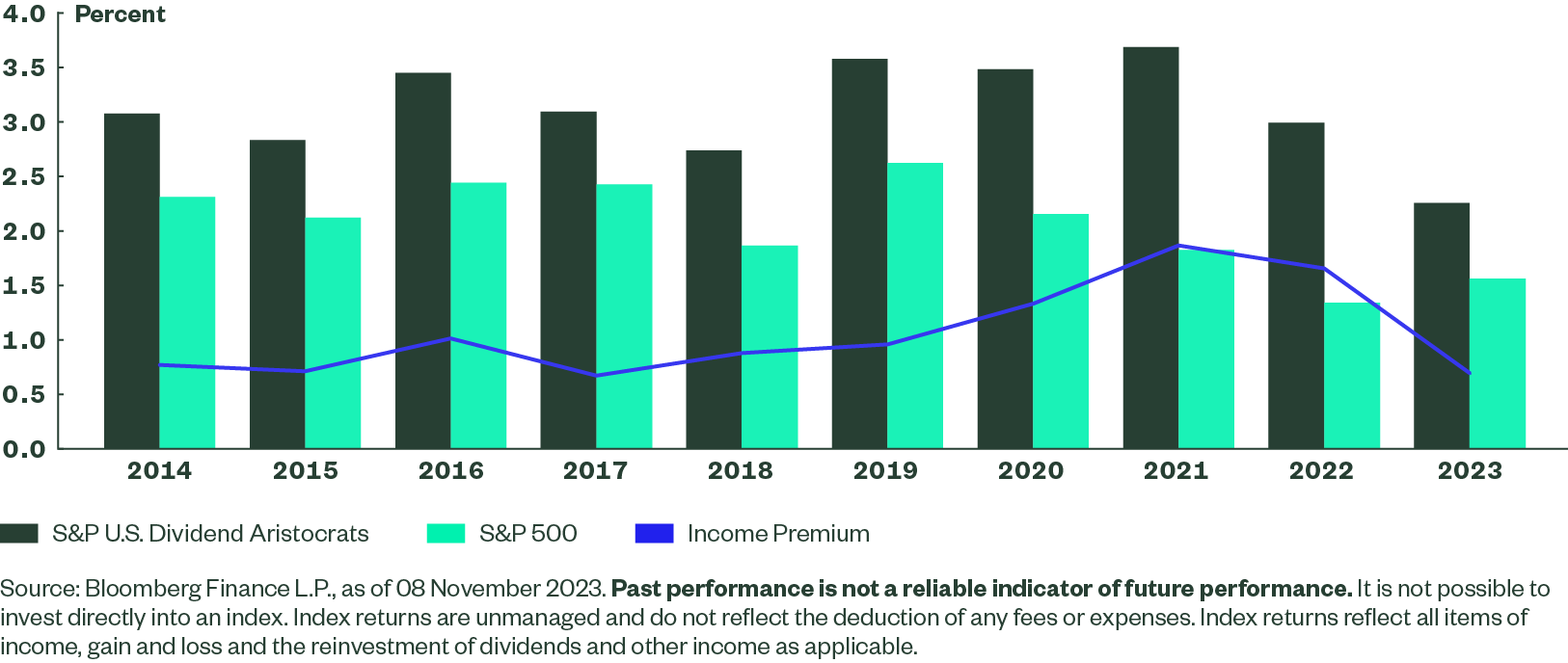

The premium price on earnings in growth sectors remains a cause for concern for investors in mega-cap US equities. Inflation data continues to moderate, but so too does the labour market, which was seen as a basis for the strong consumer. Investors could consider a stable dividend strategy in US equities as a cautious posture in the face of a potential recession. Dividend Aristocrats pick from a diversified base of quality regular cash dividends, combining dividend growth with dividend yield, to help investors navigate uncertainty by taking a more defensive posture. In the past five years, US equity prices have been quite volatile (Figure 3) due to interest rates, economic disruptions (e.g., global pandemic) and geopolitical concerns (e.g., Ukraine and more recently, the Middle East). The impact of an income premium derived from selecting companies with a long-term track record of dividend growth (Figure 4) remains a strong basis for the defensiveness of Dividend Aristocrats.

Figure 3: Capital Price Return (Past 10 Years)

Figure 4: Dividend Income Impact (Past 10 Years)

As we reach the terminal rate of this monetary cycle, we see earnings stability and downside protection of US Dividend Aristocrats starting to look more attractive. We see an opportunity in Q4 for investors to diversify away from US mega-cap stocks by considering a defensive “stable dividend” strategy in US equities, as a cautious approach to a potential recession in 2024. Investors seeking to remain long US equities, but fearful of these increasing risks, should consider a quality income Dividend Aristocrats strategy.

How to Access the Theme

Seeking exposure to US dividend aristocrats while also considering other factors?