Cautiously Optimistic: The Story of ETF Flows in H1 2023

Looking at flows for EMEA-domiciled ETFs during the first half of the year, it’s apparent that investors found places to put their money. Amid uneven markets and risk-off sentiment, we did see relatively robust flows into fixed income while China reopening triggered exceptionally strong flows into emerging market equities. This equity category, with inflows of more than $15 billion year to date, has already surpassed its 2022 haul by c. $3.5 billion.1

Uneven Markets Lead to Meek but Positive Flows for Europe and US

From both a performance and flows perspective, we saw turbulence and volatility during the first half of 2023. The year started well as, after a disastrous 2022, tailwinds in the global economy finally began to appear, with disinflation gathering pace, China ending its zero-COVID policy, and Europe managing to avoid an energy crisis.

As such, markets rallied and Europe was initially the strongest beneficiary of that upward move. By the end of February, the continent had enjoyed $3.6 billion of net inflows at the expense of the US, which saw negative net flows of $3.6 billion.

However, as we progressed through the year, the global economy endured the regional banking crisis and debt ceiling issues, which brought growth expectations down – even though both challenges were largely resolved. With general slowdown and a re-energized AI theme, the above-mentioned Europe/US flow pattern reversed somewhat. So, on a net basis year to date, these two regions have gathered a mere $2.7 billion and $1.9 billion, respectively.

Fixed Income Shines on Relative Basis Against Strong Equity Flows

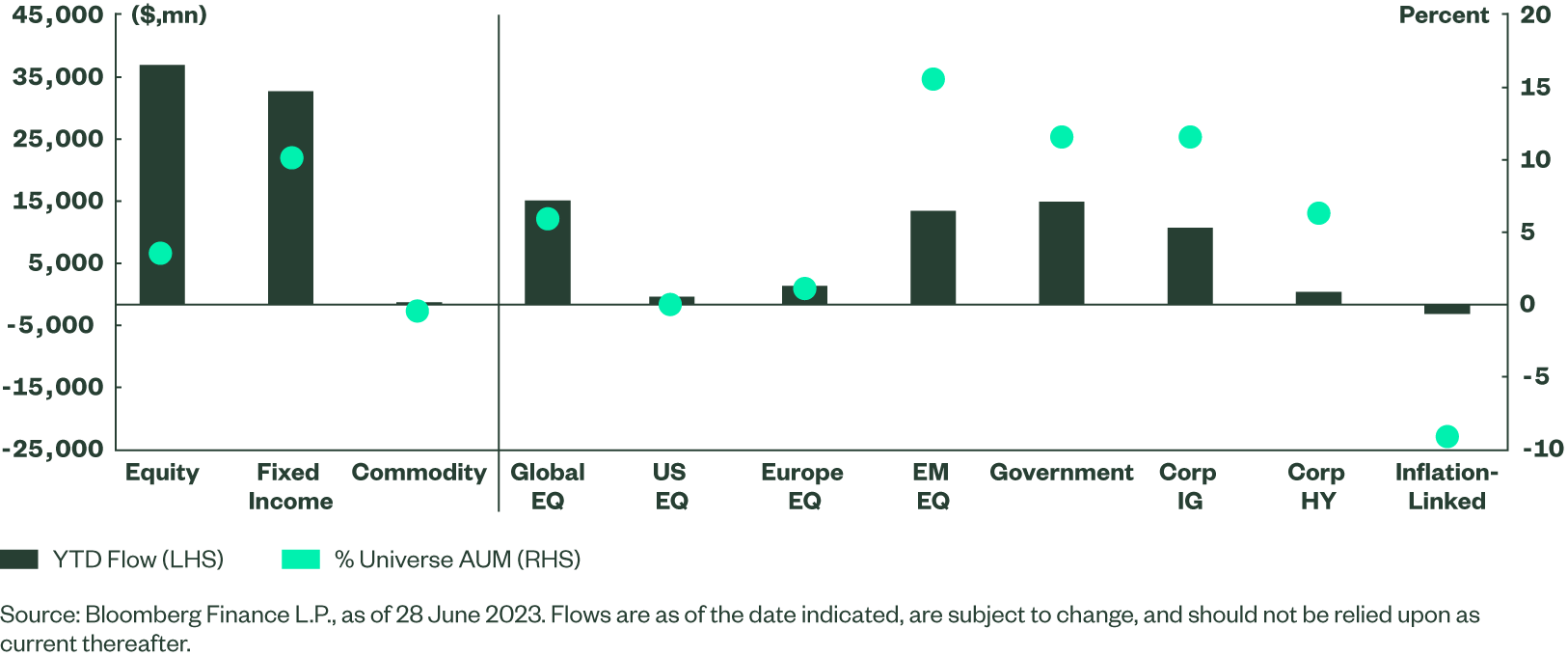

Disinflation broadened and deepened through the first half of the year, providing an all but ideal environment for fixed income exposures to shine. With yields at levels unseen since the Global Financial Crisis, fixed income has posted $34.6 billion of net inflows year to date. On an absolute basis this is less than the $38.8 billion gained by equity but, looking at the relative size, fixed income flows exceeded 10% of its universe AUM from the beginning of the year while equities added only 4%.

Within fixed income, investors aware of risks stemming from a higher interest rate environment favoured lower risk exposures, such as EMU government debt or US Treasuries, over emerging market debt. Similarly, within the corporate debt segment, there was a preference for investment grade, which attracted $12.4 billion, over high yield, which took in $1.9 billion during the first half of the year.

Factors: Value on Back Foot but Dividend Income in Demand

Value exposures have suffered heavy net outflows of $1.8 billion year to date as the economic slowdown, regional banking crisis and debt ceiling disputes spooked investors. On the other hand, as rates remain elevated, investors have seemingly been searching for higher yielding but more stable stocks and hence dividend ETFs have gained $971 million. Small caps have enjoyed net inflows of $777 million, of which more than a half was captured in June as the debt ceiling resolution improved investor sentiment.

Sectors: Artificial Intelligence Drives Real Flows

Sector flows have been extremely muted on balance, with $284 million of net new assets overall. However, beneath the surface, there were significant moves as the AI theme helped drive flows into the technology and consumer discretionary segments, which gathered $841 million and $687 million, respectively. Energy has continued to be unloved, losing $1.6 billion as global demand slows down, while health care saw $953 million of net outflows in the first half of the year.

The Standout: Emerging Market Equities

Emerging market equities stood out in the H1 2023 flows picture, taking in $15.1 billion of net inflows on the back of China reopening. The performance of emerging market stocks was clearly disappointing. However, given robust expected economic growth in emerging markets and stagnating developed market economies, along with potential US dollar weakening and relatively attractive emerging market valuations, we see the potential to catch up with developed markets.

YTD EMEA-Listed ETF Flows