Zooming Out: A Comprehensive Approach to Defining Economic Cycles

Theoretically, asset prices represent future cash flows discounted to the present. The macroeconomic environment will influence future projections of these fixed or variable cash flows, and/or the discount rates and, therefore, will ultimately affect asset prices. However, it is important that investors evaluate the macroeconomy with enough historical data to form a complete, holistic view of asset class performance. To accomplish this, we believe one should look at performance across a wide range of economic regimes.

Looking Beyond the Immediate

Market participants tend to (narrowly) focus on the current environment, or the next likely environment. For example, there were many articles focusing on inflationary regimes a year ago. Then, with the disinflationary trend more established in developed economies, focus has turned to asset class prospects during recessions. We believe looking solely at growth or inflation is too narrow. For instance, when attempting to take insights from historical growth data, there is a scarcity of historical periods officially defined as a “recession.” Instead, we consider four regimes based on the rates of change in both growth and inflation (see Figure 1). These regimes can assist us in analyzing the performance of active and passive investment styles in different economic environments.

Figure 1: Our Four Proprietary Regimes Can Be Used to Analyse Equity Performance in Distinguishable Markets

In keeping with existing literature,1 to characterize economic growth, we use the month-over-month change in a chosen leading indicator of growth that is more timely than the official gross domestic product (GDP) numbers. To measure changes in inflation, we use the most recent three-month average consumer price index (CPI) year-over-year minus the 36-month average. This calculation can also act as a proxy for inflation surprise, with the three-month average making allowances for noise in monthly readings, and the longer period a proxy for inflation expectations.

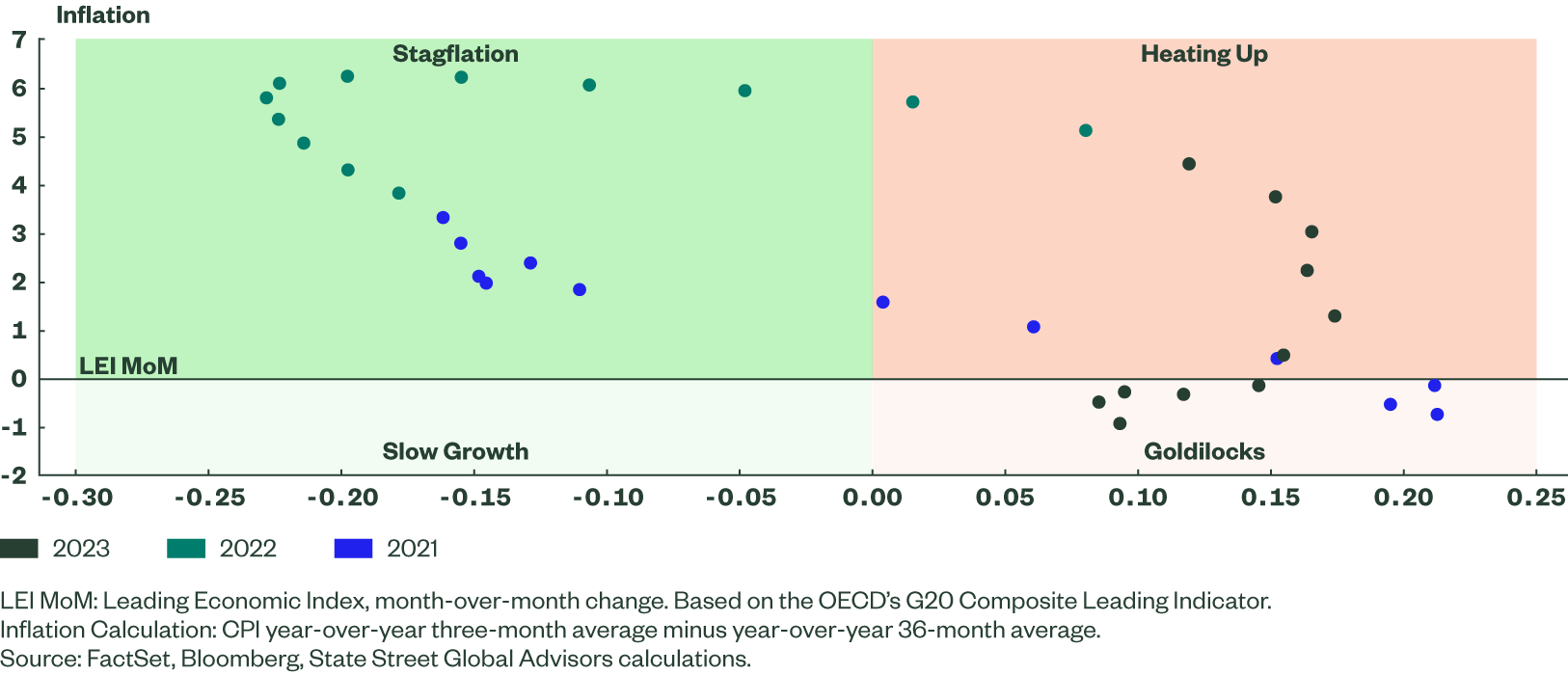

To be more precise, we constructed a global version of our regime classifier using the Organization for Economic Co-operation and Development (OECD’s) G20 Composite Leading Indicator (CLI) and OECD CPI Series.

Recent Economic Movements

Figure 2 is a scatter plot of our measures of economic growth and inflation overlaid onto the four quadrants. Under the global regime, we were in Stagflation starting in July 2021, then moved to Heating Up at the end of 2022 as the environment transitioned from falling growth to rising. Finally, more recently we have moved into Goldilocks territory. Should growth continue to decelerate and disinflation continue, we believe the next move may be into the Slow Growth regime.

Figure 2: The Global Economic Growth Profile Has Shifted From Stagflation To Goldilocks

Performance Across Regimes

We examined the average monthly returns of the MSCI Emerging Markets Index and the MSCI World index under the four different regimes. Using all available data for the benchmarks, we see both indices have on average had positive returns in positive growth regimes (Goldilocks and Heating Up). On the other hand, Stagflation has historically been bad for equity returns, especially in emerging markets (EM). Slow Growth has been marginally positive for developed markets (DM), and negative for EM. These trends are illustrated by Figure 3.

We compared the data in Figure 3 with MSCI Emerging Markets Index and MSCI World Index performance in traditional economic cycles. We found that for the MSCI World Index and the MSCI Emerging Markets Index, the average returns over recessionary periods were -5.12% and -12.92%, respectively. These results compare most closely to the Stagflation regime in Figure 3.

The Bottom Line

The ability to parse historical periods into the four regimes in Figure 3 allows us to better analyze the way markets respond to various macroeconomic environments. By looking at the current environment with a broader lens, we can better manage the risks of the market backdrop and improve our outlook for global market returns.

In The Case for Active Investing in Equities, we use the four regimes to compare the performance of systematic active and fundamental active equity funds to give a sense of when a particular active style may have a competitive edge in a particular macroeconomic regime.