Unlocking Opportunities in the Forgotten 493 Stocks

The S&P 500 Index returned a handsome 26% in 2023, with the Magnificent 7 responsible for 62% of that gain.1 However, excluding the Magnificent 7, the S&P 500 grew 9.8%. This could spur concern about the state of fundamentals and valuations in the all-but-forgotten 493 non-Mag-7 names. We explain why we think equity investors can find attractive opportunities in the other 493 stocks amid a healthy economic backdrop and improved sentiment.

US Company Fundamentals Remain Solid

Despite a challenging environment post-COVID, the operational performance of large US corporations is stable, and credit profiles remain healthy.

Profitability

Higher inflation and global supply chain constraints initially created a decline in the demand for goods and services during the pandemic. Still, companies were not only able to maintain, but also improve, their net margins because they were able to raise prices and pass higher costs to their customers. Average year-over-year growth in consumer spending has risen to 9.37%2 as of January 2024 versus 4.58%3 pre-COVID driven by pent-up demand, low unemployment levels and higher household savings, which supported companies’ top lines despite higher prices. In addition, companies haven’t seen a spike in interest costs despite higher rates because of debt refinancing at lower rates during the COVID period. (The rise in rates could have eroded net margin.)

Furthermore, in the face of recession concerns, the US led cutting-edge technological advancements in AI that drove investor exuberance, continuing the pattern of US exceptionalism, or the divergence in US performance versus that of the rest of the world. Figures 1 and 2 show that margins and return on equity (ROE) in the MSCI US Index were better than the same metrics for the MSCI World ex USA over the last decade. The S&P 500 outperformed the latter by 7.21% CAGR over that period.4

This positive momentum is also seen in the fourth quarter of 2023. Earning figures were better than expected, with 73% of S&P 500 companies reporting a positive EPS surprise and 64% of S&P 500 companies reporting a positive revenue surprise.5

Balance Sheets

As mentioned above, despite the Fed’s swift tightening cycle, company profits were largely shielded from increased interest expense. Most US corporations used the early days of the pandemic to lock in ultra-low interest rates with long maturity profiles (leading to the current weighted average maturity of 9.7 years for S&P 500 companies),6 pushing out maturity walls (Figure 3). More than 70% of the debt outstanding for S&P 500 companies is fixed rate debt,7 curbing any increase in interest burden.

The current Debt/Equity of S&P 500 companies (86.12%)8 is below the long-term average of 93.76%.9 The cash position of these companies (32.28%)10 is also in a solid shape — well above the long-term average of 27%11 (Figure 4). Corporates tapped credit markets in 2020, taking advantage of lower rates, and they used the issuance proceeds to buy back shares. However, during the same period, dividend payouts were muted, leaving the companies with better cash balances. Strong liquidity positions help support companies’ resilience in the event of economic distress.

Could the Rally Broaden?

The recent post-GTC conference rise in the stock price of Nvidia, a company that continues to reap the benefits of a customer base hungry for AI hardware, is exhibit A that the transformative tech juggernaut hasn’t let up. Momentum and AI demand could continue to be tailwinds for growth stocks, but we think equities could see strong performance from names beyond the Magnificent 7 over the rest of 2024.

Beyond the Magnificent 7

At this point in the cycle, it is imperative for investors to consider quality in their stock selection, and the stocks outside the Magnificent 7 may offer a better price/quality mix.

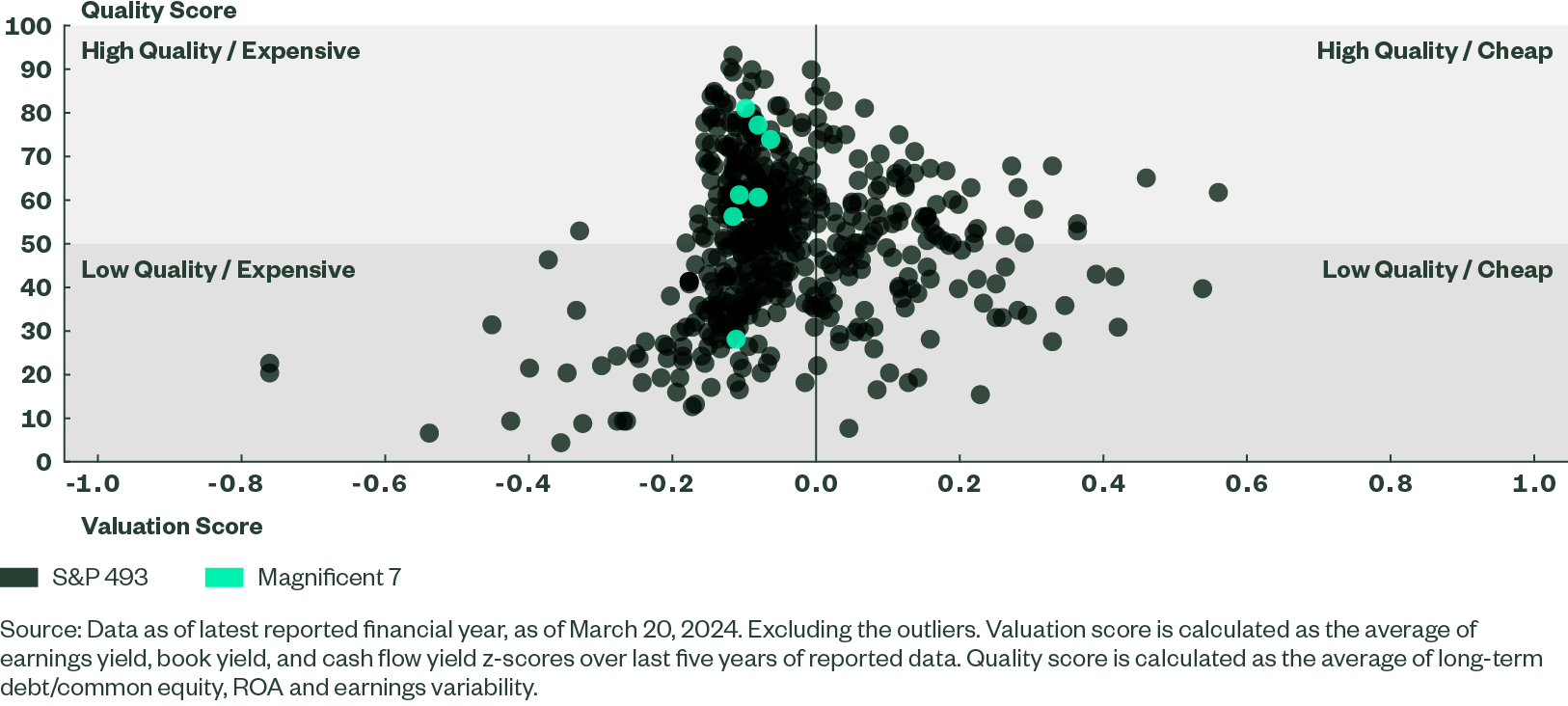

Figure 5 shows the Magnificent 7 and remaining 493 stocks across the quality/valuation spectrum. A number of non-Mag-7 companies have high quality scores and are trading at discounted valuations. By contrast, the Magnificent 7 companies tend to lean more expensive with varying levels of quality. See Calculations section for definitions of quality score and valuation score.

Figure 5: Opportunities for Higher Quality, More Discounted Stocks Can Potentially Be Found Outside the Mag 7

Sifting Out the Names with Favorable Quality/Valuation Characteristics

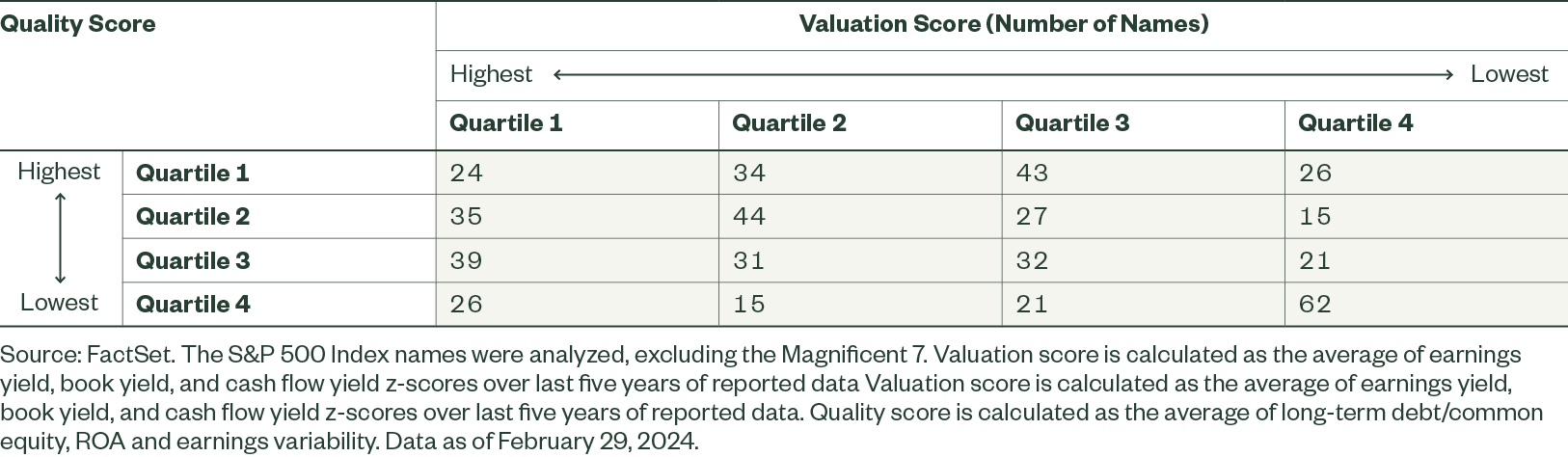

Taking the analysis further, we divided the 493 universe into quartiles of quality score and valuation score and identified 137 companies that fall into the top two quartiles of our quality/valuation matrix (i.e., companies that are above median in quality and below median in valuation). Results are shown in Figure 6. Together, the stocks make up around 18.3% of the S&P 500 by weight.12

Figure 6: A Quality and Valuation Matrix Helps Uncover Opportunities

Figure 7 shows the sector distribution of the 137 companies mentioned. Similar to the distribution of the full list of 493 names, these 137 companies are concentrated in four sectors: IT, Health Care, Financials, and Industrials. When measuring by market cap, 40% of these companies fall in the top half of the S&P 500 Index, and the remaining 60% are in the bottom half.13

Breaking down the sectors further, the 137 companies are concentrated in industries such as Capital Goods (Industrials), Health Care Equipment and Services, Pharmaceuticals Biotechnology and Life Sciences (Health Care), and Technology Hardware and Equipment (IT) (Figure 8). As a result, these industries may be worth considering when searching for diversification and value outside the Magnificent 7.

The Bottom Line

Within the forgotten 493, we have identified segments of the market that are favorably positioned across the quality/valuation continuum. This subset of companies has reported higher average ROE (24.91) than the S&P 500 (19.77)14 during 2023, and 76% of these companies have beaten their Q4 2023 earnings targets.15 In addition, allocations outside the Magnificent 7 can help investors diversify away some of the concentration risk inherent in the market cap index, and can allow investors to benefit from any weakness in the Magnificent 7 that then sends capital flows into the remainder of the index.

The S&P 500 has carried its performance momentum from last year into 2024, riding a wave of positive economic data and the resilience of US corporations to deliver value. However, uncertainties around tightening liquidity and restrictive monetary policy remain as risks to the market. Therefore, we believe that quality metrics remain crucial for long-term investors.