Time to Play Defense in the Bond Proxy Sectors?

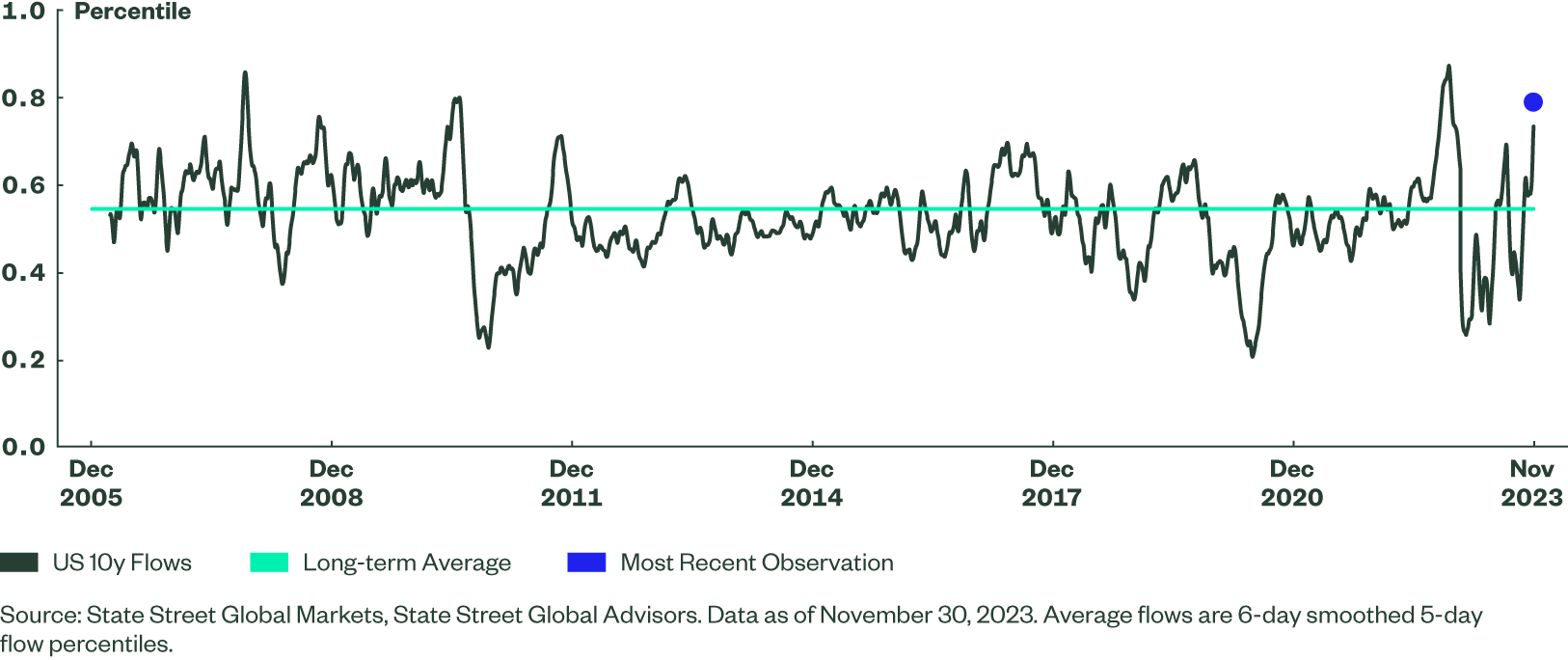

As the market narrative rotated in November from “higher for longer” to a soft landing, bond yields fell significantly and equities soared. Yet historically high yields have renewed interest in bonds, and institutional flows are now back well above their long-term averages. This month we look into the equity cousins, or the “bond proxy” sectors that so far have been left behind in the 2023 equity market rally.

Renewed Interest in Long-Duration Bonds

November was a month characterized by a rally in everything. As the narrative rotated from “higher for longer” to a soft landing, bonds rallied, equities rallied and risk-on sentiment prevailed. With tempting yields still on offer and expectations shifting towards earlier rate cuts from the Federal Reserve Board (Fed) next year, institutional investors added duration and flows into 10-year Treasuries, as measured by our colleagues at State Street Global Markets, that are now well above the long-term average.

Figure 1: Institutional Flows into US 10-Year Treasuries

No Love yet for the Bond Proxies

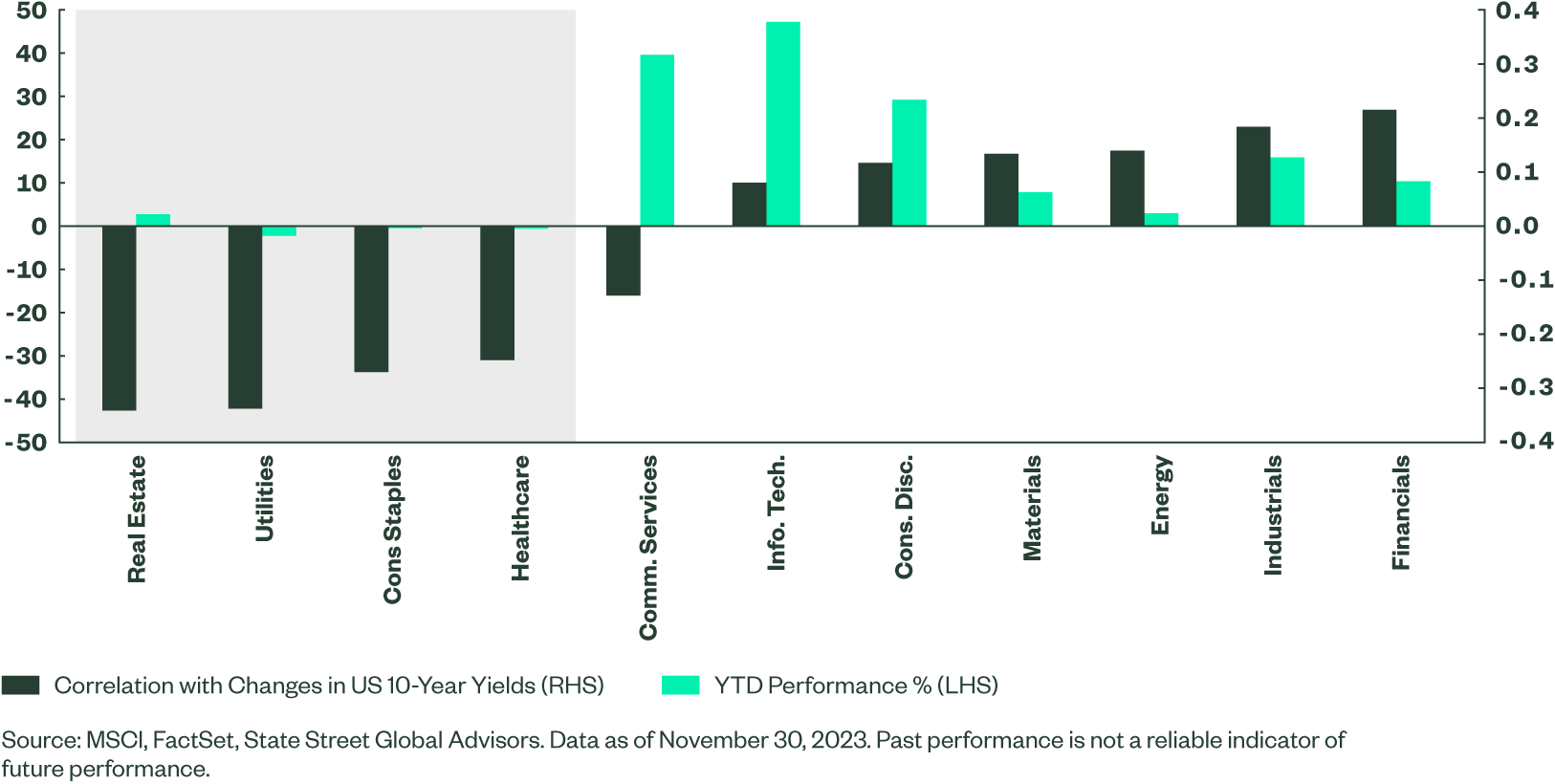

In equity markets, the biggest laggards so far in 2023 have been more defensive sectors, such as Utilities, Real Estate, Consumer Staples and Healthcare. These sectors have often been seen as equity market proxies for bonds and have traditionally been associated with high and relatively stable dividend yields and an inverse relationships to bond yields. Therefore, these sectors underperform as yields rise and vice versa.

Since bond yields hit their nadir in April 2020 the “bond proxy” sectors of the equity market have underperformed notably, delivering an average 26% return against 61% for the MSCI World Index and 97% for the high-flying Information Technology sector. This relative underperformance accelerated this year, with the defensive group delivering on average -0.1% to the end of November, compared to a 18.8% rise for the World Index. While the focus should not be only on interest rates and bond yields, there has been a strong relationship between the sectors with the most historically negative correlation to changes in bond yield and the weakest performers year-to-date.1

Figure 2: YTD Performance, and Long-term Excess Return Correlation with Changes in Bond Yields

Valuations and Volatility

As we head into 2024, however, the defensive characteristics of these bond proxy sectors may become more attractive. The outlook for equities is likely to be more challenging than this year. Slowing economic growth, continued liquidity withdrawal, and attractive yields in bond markets are likely to prove headwinds to equities, especially at the riskier end of the spectrum.

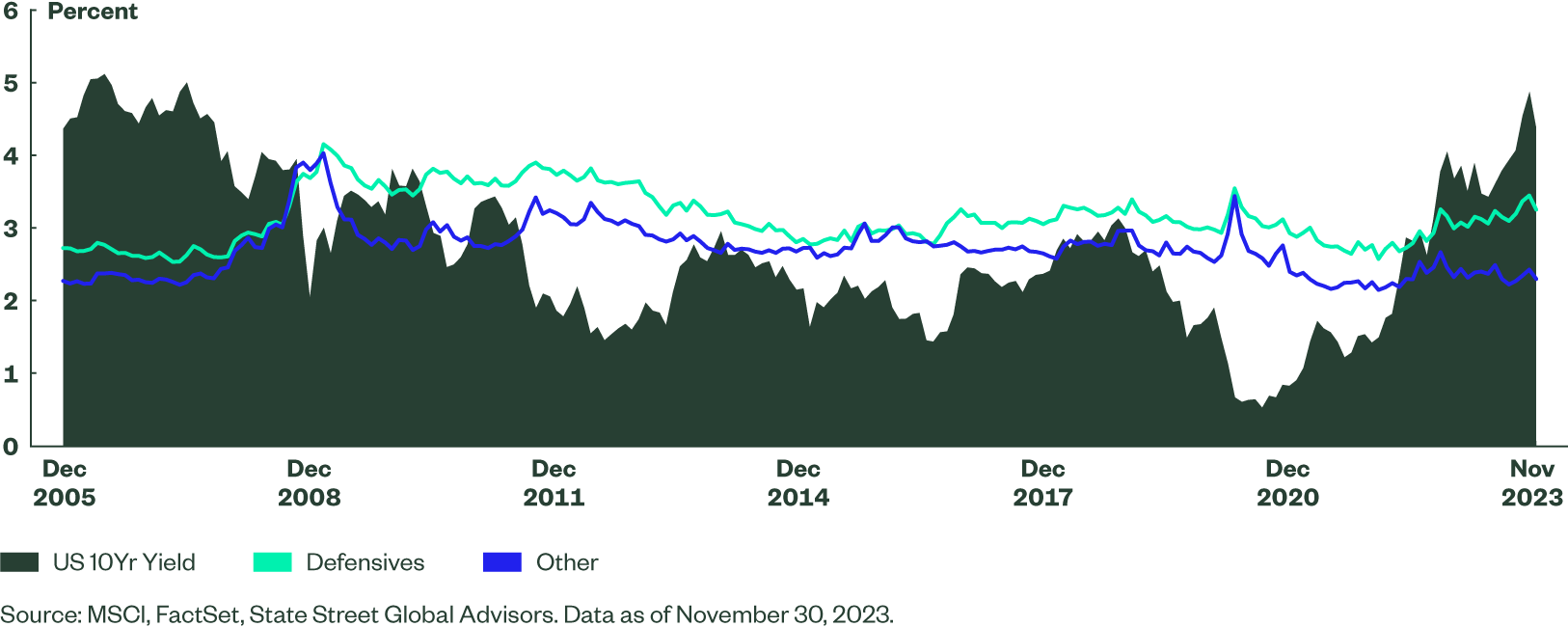

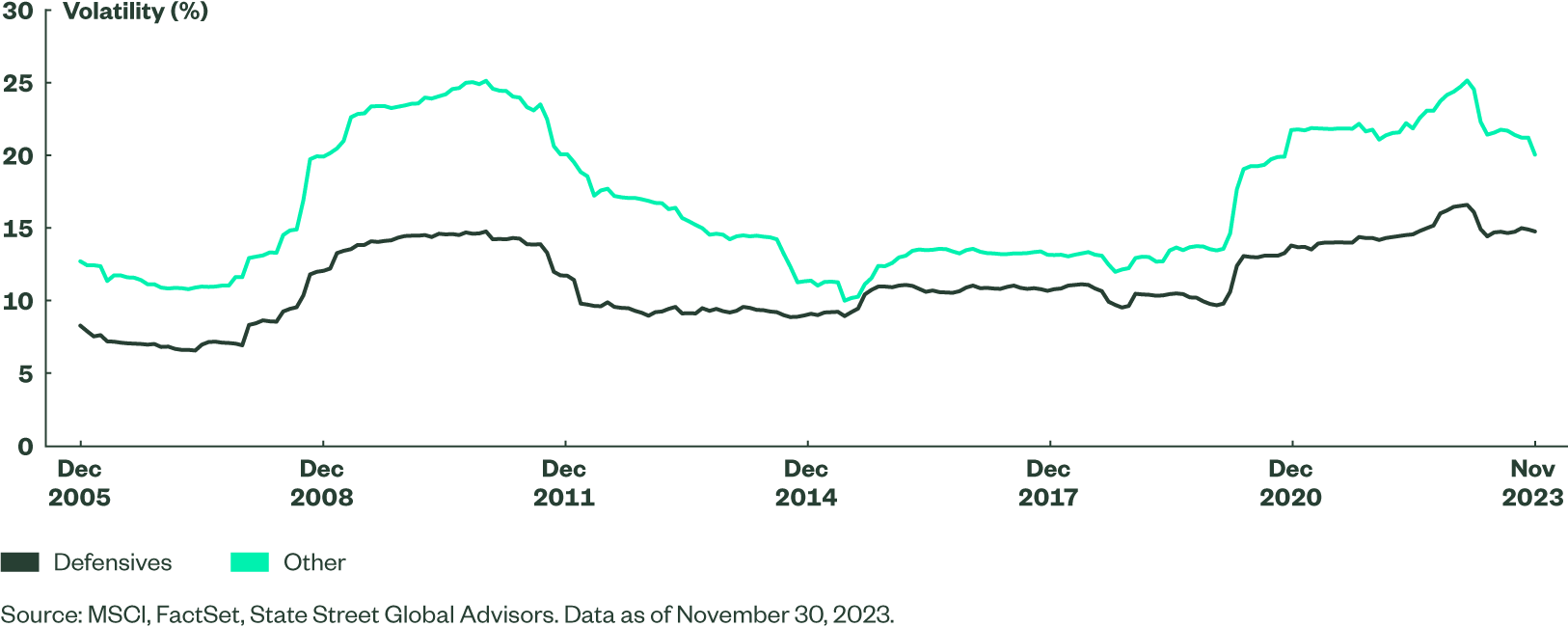

Equity markets no longer command a yield premium to sovereigns, which lessens the appeal of dividend yield strategies themselves. However, the defensive sectors have maintained a yield advantage over the rest of the equity market, coupled with lower volatility which suggests they may still be a safer place to hide if volatility picks up and equity markets stall.

Figure 3: Average Dividend Yields for Defensive Sectors vs. Rest of the Market and US 10 Year Bond Yields

Figure 4: Average Return Volatility Defensive Sectors vs. Rest of the Market

The Bottom Line

Defensive sectors, or the “bond proxy,” have been out of favor in the most recent leg of the equity bull market. However, those characteristics that have made these sectors mainstays in minimum volatility indices and defensive equity strategies may now be more important than ever as we move through 2024.

While we do not know the exact course that economies and equity markets will take over the next year, we believe it is likely that volatility will pick up as information on the evolving macroeconomic and market dynamics becomes available and the narrative adjusts. Institutional investors are already voting with their feet and moving allocations to fixed income markets. Within equity markets, higher quality, higher yielding, and more defensive areas may finally garner attention as attractive places to hunker down and weather the storm.