Thinking It Through: The Changing Shape of the Yield Curve and Fixed Income Positioning

In recent months, the US Treasury curve has “bear steepened,” meaning that long-end yields have risen more than short-end yields. This bear steepening differs from the “bear flattening” that has characterized the latest Federal Reserve (Fed) tightening cycle. Notably, bear steepening is a rare phenomenon when the curve is inverted. The curve’s movement has served as a catalyst for investors to look closely at the long end and how it can impact global markets.

In this piece, we consider what the bear steepening means for investors, why it happened and how investors can take advantage.

Our Thesis

Since mid-2022, the Treasury curve has been inverted, as aggressive Fed rate hikes have led to expectations of a recession/hard-landing while inflation expectations have remained well anchored. This backdrop spawned a sharp rise in short-end yields, making sovereign debt an attractive option for both total return potential and hedge properties (see: A Window of Opportunity for Income-Focused Asset Allocation). However, with the recent bear steepening (Figure 1), 10-year Treasury yields have also risen above the 5% milestone rate, and investors have started debating where the peak in long-end yields truly lies. The question becomes: Is now the right time to add duration?

While many variables impact the future level and shape of the yield curve, with US Treasuries now offering an attractive yield of 5%, the opportunity to lock-in these historically competitive returns for the next 5, 10 or 30 years with minimal risk of principal loss looks quite compelling. Looking forward, we believe the curve could “bull steepen,” and our analysis shows that this could bode well for investors with both short- and long-end fixed income allocations (Figure 4). We think adding duration is worth considering at this time.

Why the Curve Bear Steepened

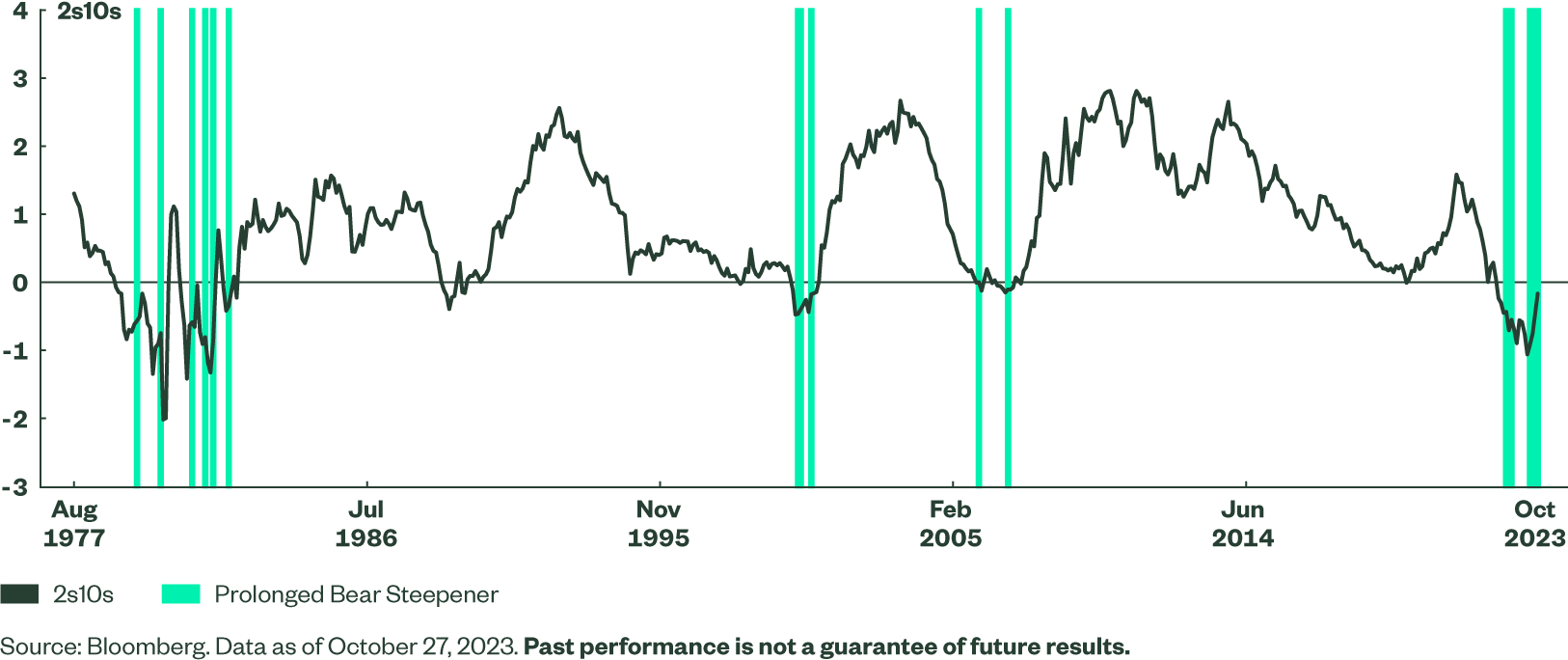

The recent bear steepening of the curve has taken many market participants by surprise, as it rarely occurs when the yield curve is inverted (Figure 2). Typically, bear steepening happens when markets upwardly revise their expectations for growth and inflation—a situation we would expect to see during the early stages of an economic cycle. Given that we are 18 months into one of the most aggressive Fed tightening cycles in history, the “bear” nature of the steepening move is unusual and worth inspecting in greater detail.

Figure 2: Less than 20% of Prior Inverted Curve Periods Have Coincided with Bear Steepeners

We can cite several factors for this yield curve behavior:

- The continued resilience of the US economy has led markets to begin accepting that yields may stay higher for a longer period.

- A rise in the term premium, or the gap between long-term yields in the market and long-term yields calculated by the future path of short-term interest rates, is occurring for a wide range of reasons, such as changing investor preferences (see Our Thoughts on the Term Premium).

- A heavy slate of Treasury supply is on its way over the next 18 months, all while the Fed continues to shrink its balance sheet. The Fed is also expected to continue quantitative tightening at a pace of US$75 billion/month till mid-2024, at minimum.

Finding Opportunity in Higher Long-Term Rates

The last leg of the Treasury selloff presents a rare opportunity to lock in high yields while enhancing a portfolio’s hedging properties. We believe that higher long-term rates are likely to add to the existing tighter conditions prompted by the hawkish Fed moves, and eventually, the soaring rates will weigh heavily on the growth and inflation outlook. Once this happens, the Fed may pull back from tightening, resulting in a “bull steepening” in markets in coming months.

To observe the impact of a bull steepening on both equity and fixed income markets, we used the BarraOne1 platform to perform a scenario analysis based on a variety of yield curve shocks. Figure 3 shows the bull steepening cases we observed, while Figure 4 shows potential outcomes.

Figure 3: Hypothetical Yield Curve Shocks

| Bull Steepening (Shocks in bps) | Case #1 | Case #2 | Case #3 | Case #4 |

| 2Y | -25 | -75 | -200 | -300 |

| 10Y | -12.5 | -37.5 | -100 | -150 |

Source: State Street Global Advisors, as of September 29, 2023. See footnote 1 for details on model.

On balance, fixed income allocators could benefit from the curve moving from a bear steepener to a bull steepener. By contrast, on the equity side, in our view, the start of Fed rate cuts would likely coincide with a slowdown in economic growth, which would be a headwind for equities. A heuristic 60/40 portfolio proxied with the S&P 500 Index and the Bloomberg US Aggregate Index (the Agg) could undergo a scenario in which the fixed income allocation performs well, while the equity allocation struggles.

Additionally, as illustrated by the four cases in Figures 3 and 4, the magnitude of interest rate moves has an exponentially inverse effect on the two asset classes; e.g., investors taking on more duration benefited more from the bull steepening.

The analysis in Figure 4 implies that (1) liability-driven investors may seek to further derisk from equity to fixed income; or (2) fixed income investors may want to consider deploying their dry powder, which has been earning upwards of 5% in cash, to longer-term bonds earning higher yields; or (3) equity investors may consider higher-quality aspects of the market that provide better structural growth or defensive characteristics.

Allocation Takeaways

We believe that investors would be well served to consider adding duration. For the reasons outlined in Our Thoughts on the Term Premium, we do not see a long-term case for yields to trade higher structurally. In addition, with long-end yields now surpassing 5%, rate risks are adequately priced in our view (i.e., investors are being compensated to own duration risk).

For instance, with the Agg now yielding in the mid 5% range and its yield per unit of duration now back to its long-term average, the Index offers a balanced breakeven ratio that has not been seen since 2009. This means that, for the first time since 2009, the Agg’s subsequent one-year total return could be positive even if yields rise another 100 basis points (bps) (Figure 5).3

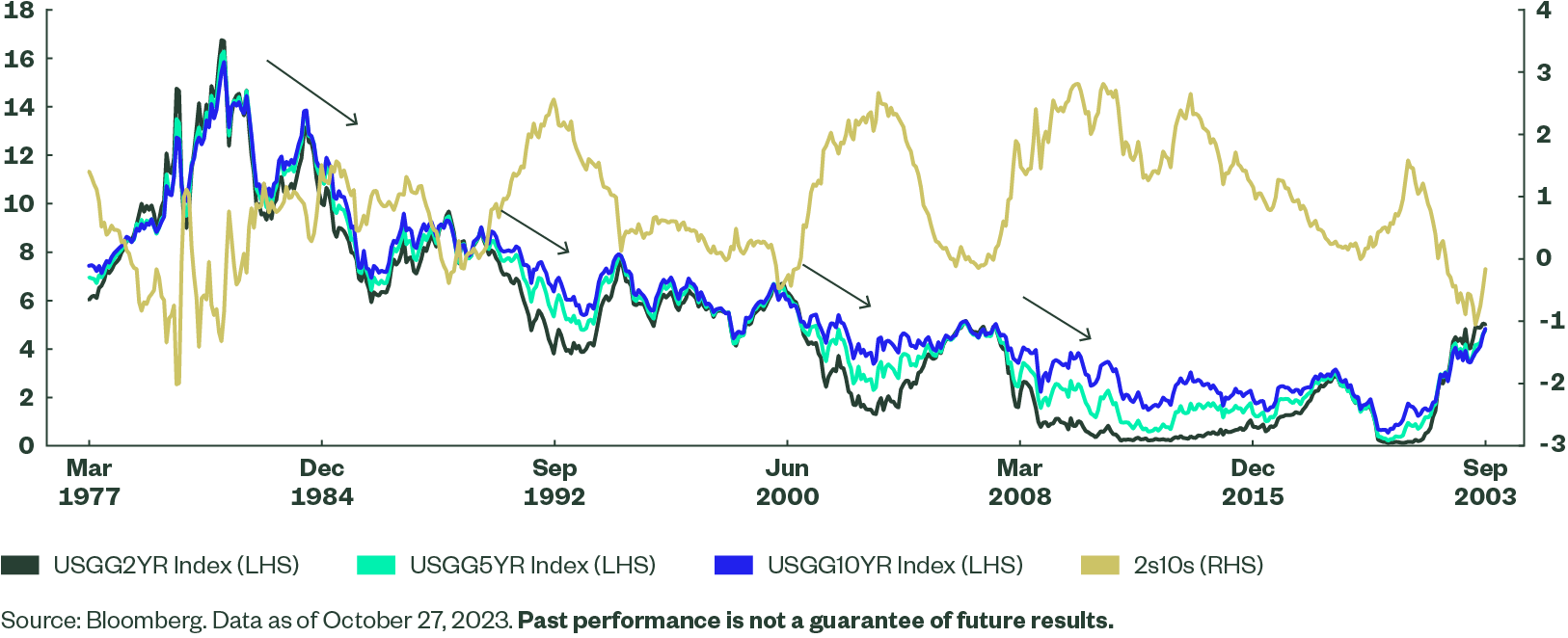

Beyond our perspective that the Fed’s actions and the term premium will help tamp down further sharp rises in long-end yields, we also note that historically, the deepest 2s10s inversions have coincided with a peak in yields (Figure 6). Short-end yields have usually led the way in retreating lower, which adds conviction to our bull steepening view. As the curve bull steepens and the carry becomes positive, the long end should become even more attractive for several market participants such as banks. So far, banks have preferred parking their excess liquidity in overnight reverse repo facilities over long-end government bonds which should change once the carry becomes postive.

Figure 6 - Deeply Inverted 2s10s Curves Have Occurred Alongside Peak Yields

Conclusion

In a low growth macroeconomic environment, with consideration given to structural forces keeping inflation anchored, we believe that markets are now offering a very compelling opportunity for asset allocators to take advantage of the recent rise in long-end yields by adding duration to their portfolio. Investors adding duration could also benefit from the potential bull steepening that could occur in the next several months.

Today’s market is less favorable for risk-seeking investors given deteriorating economic conditions. In general, we don’t believe investors need to reach for return in order to achieve their stated return objectives, especially when fixed income now provides a substantial amount of income. In this environment, we favor the higher quality aspects of government bonds relative to credit, and find spread risk less attractive. By adding duration to a fixed income allocation, investors could harness the diversification of high-quality fixed income, at a time when rates are still elevated, but could potentially drop in 2024 should the Fed need to further engineer a soft landing.