Equities Pared in Favor of the Agg

Each month, the State Street Global Advisors’ Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) that can be used to help guide near-term investment decisions for client portfolios. By focusing on asset allocation, the ISG team seeks to exploit macro inefficiencies in the market, providing State Street clients with a tool that not only generates alpha, but also generates alpha that is distinct (i.e., uncorrelated) from stock picking and other traditional types of active management. Here we report on the team’s most recent TAA discussion.

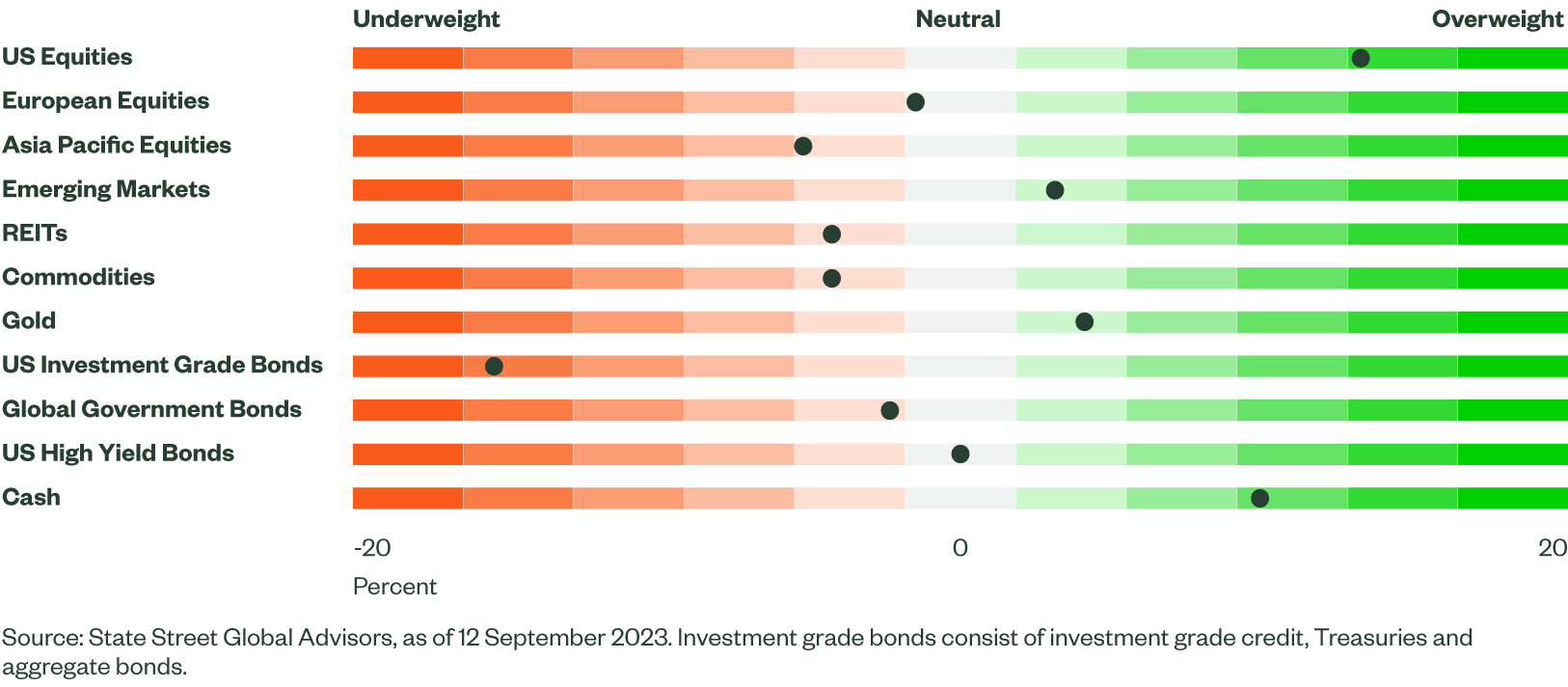

Figure 1: Asset Class Views Summary

Macro Backdrop

Following a synchronized monetary policy tightening cycle, we are experiencing desynchronized growth among regions.

In Europe, due to weak household consumption, the final reading on the eurozone’s Q2 GDP points to a softer trajectory over the April-June period. Purchasing Managers Indices (PMI) can help gauge underlying momentum – while the European manufacturing PMI has remained firmly in contraction, services recently fell below the 50 threshold for the first time this year, suggesting further weakness ahead. The European Commission just released fresh forecasts, lowering expectations from +1.1% GDP growth in 2023 to 0.8%, with Germany expected to experience a prolonged recession.

In China, the lack of strong policy response to support demand has stunted sentiment, keeping consumption lower. China’s property sector remains in trouble and estimates for growth have dropped. In Japan, real GDP was revised lower, but was still strong at 4.8% and above a healthy Q1 print. Consumption activity in Japan has firmed and should be supported in Q4 by increasing wages.

The United States (US) continues to outpace on the back of residual fiscal policy (CHIPS and IRA Acts) and durable consumers. US consumers have been aided by built up savings and with a high percentage locked into low fixed-rate mortgages and low debt to disposable income ratios, they are less sensitive to higher rates than has historically been the case. The labor market continues to exhibit signs of cooling but remains strong with positive demand for labor and claims, both initial and continuing, generally trending lower.

We have yet to see cracks in the housing sector that point to significant trouble ahead, with new and existing home prices appearing to bottom despite higher rates. With most homeowners locked into mortgage rates sub 5%, additional supply will need to come from new construction. Housing permits have moved higher while housing starts jumped in July and look like nearing a bottom, potentially providing a boost to economic growth moving forward. The US looks poised to outperform growth expectations for the third quarter in a row.

Overall, several factors will eventually chip away at economies, and we continue to expect global growth to slow to a more muted pace in 2024.

Directional Trades and Risk Positioning

Investors navigated a number of broad narratives over the first half of August ranging from strong growth optimism to Fitch downgrading US debt, Moody’s downgrading some midsize banks and increasing debt issuance from the US Treasury.

Implied volatility on equity spiked into a normal risk regime while our risky debt measure marched up from a euphoria regime to a low-risk environment, pushing our Market Regime Indicator (MRI) towards the upper end of a low-risk regime. As the month progressed, softer labor data and a downward Q2 US GDP revision calmed investors with all three factors moving lower, pushing MRI into euphoria.

While this environment can still support equities, it typically suggests investors have become a little too complacent and equities could correct lower. Against that backdrop, we reduced our equity overweight, investing the proceeds into aggregate bonds.

Relative Value Trades and Positioning

Within equities, our forecast for European equities continued to deteriorate. While valuation measures are still attractive for the region, sentiments and analysts expectations for both earnings and sales weakened further while macroeconomic indicators and price moment are less supportive.

With this decline, we reduced our exposure to Europe, now an underweight, placing the proceeds into emerging market equities. After lagging most of 2022, our forecast for emerging markets continues to improve. Quality factors, which measure balance sheet health, remain robust and valuations have softened, but remain attractive.

Elsewhere, price momentum has turned positive and sentiment indicators have become less of a drag. And with light positioning and bearish sentiment, given weakness in Chinese economic activity, any modest improvements may lift EM equities out of doldrums.

Within fixed income, our outlook continues to be poor. On balance, the views expressed by our fixed income model suggest a higher level of interest rates, a steeper curve and wider credit spreads (both investment grade and high yield). As a result, we sold non-US government bonds, initiating an underweight, with proceeds deployed to cash.

Finally, at the sector level, we maintained an allocation to consumer discretionary, but rotated out of consumer staples and communication services into energy and industrials. Our forecast for consumer discretionary improved and the sector ranks well across all factors except valuation. Improvements across macroeconomy and sentiment, both earnings and sales, kept the sector atop our rankings.

Our expectations for consumer staples weakened on the back of lower sentiment indicators with analysts downgrading expectations on weaker sales and earnings. After receiving a boost from the AI driven rally, our communications forecast, while still positive, softened as price momentum, valuations and sentiment indicators have become less of a tailwind.

The energy sector has ridden the rapid increase in energy prices up our rankings. Short-term price momentum is robust while earnings estimate upgrades have now turned positive and support the sector.

Elsewhere, our evaluation of balance sheet health is advantageous. Rounding out the top sectors is industrials, which are buoyed by positive sentiment and improved price momentum.

Click here for our latest quarterly MRI report.

To see sample Tactical Asset Allocations and learn more about how TAA is used in portfolio construction, please contact your State Street relationship manager.