Overweight in High Yield Extended

Each month, the SSGA Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) to guide near-term investment decisions for client portfolios. Here we report on the team’s most recent discussion.

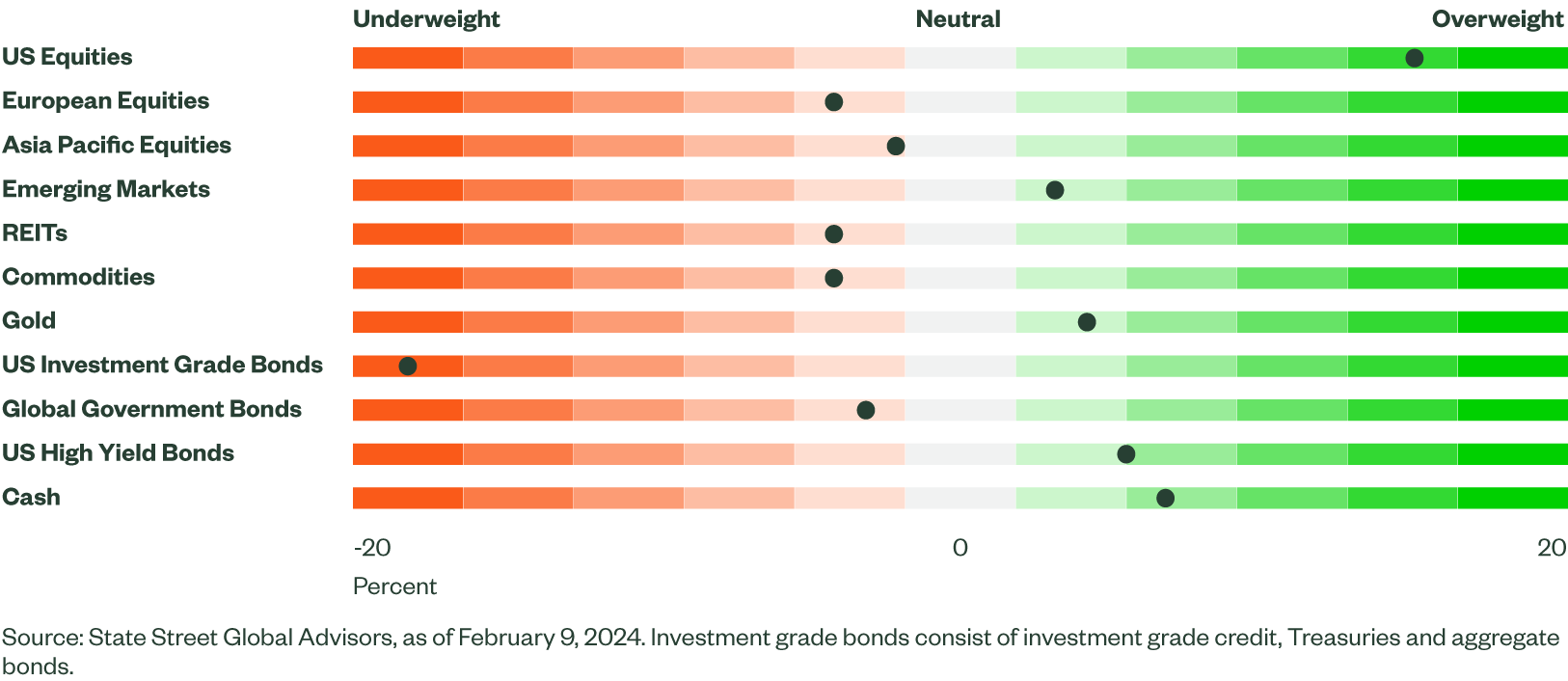

Figure 1: Asset Class Views Summary

Macro Backdrop

Whether you view the economy through a glass half-full or glass half-empty perspective, recent data prints provided something for everyone. We received more evidence that a recession will be avoided and that rate cuts, a key component of the soft-landing narrative, are likely further away than anticipated.

After a stronger-than-expected fourth quarter GDP print in the United States (US) of +3.3% QoQ vs +2.0% expected, the Atlanta GDPNow is tracking at 3.4% for Q1, pointing to further momentum in the economy. Manufacturing activity appeared to have bottomed, with purchasing managers’ indices (PMI) moving higher in the US and the eurozone while stabilizing in China and Japan. Service activity remained solid with global PMI readings generally remaining firm and expansionary. In the US, both measures outpaced expectations with rising new orders. However, prices paid measures in each survey also increased and highlighted potential challenges to hitting the US Fed’s inflation target.

Signals from consumers and the labor market were mixed. While jobs data was strong, the January ADP employment report underwhelmed and layoffs jumped in January. Additionally, while average hourly earnings rose for two consecutive months, the Fed’s preferred Employment Cost Index (ECI) continued to ease, although both remain elevated. Strong December retail sales and improving confidence signaled a healthy consumer, but the percent of credit card and auto loan delinquencies hitting 30+ and 90+ days rose.

The rise in December CPI numbers, both headline and core, was expected given the rise in energy, but goods inflation was flat after previously falling and core service inflation remained hot. However, the personal consumption expenditures price index (PCE) continued to ease and producer prices came in below expectations with headline unexpectedly declining. While disinflationary pressures remained intact, central banks continued to push back against rate cuts citing the need for more confidence on inflation moving forward.

In aggregate, economic data pointed toward a firm economy with signs of cooling, which we forecast to continue. The higher interest rate environment should continue to moderate economic growth. Besides, ongoing geopolitical tensions threaten to alter the disinflation trend and could hamper economic growth. However, a potential tax relief bill, aimed at expanding child tax credit and the Tax Cuts and Jobs Act business incentives, could provide some support. All eyes will be on the Fed over the next few months for clues on when the central bank will start reducing rates.

Directional Trades and Risk Positioning

The elation experienced over the final two months of 2023 carried into 2024 with investor risk appetite remaining strong as evidenced by our Market Regime Indicator (MRI), which stabilized in low risk, a regime that is typically favorable for risk assets. Strong job reports, stellar US retail sales and sticky service inflation readings challenged expectations for a Fed rate in March. January’s FOMC meeting resulted in no change to rates while Chairman Jerome Powell dashed hopes for a March cut.

Investors have been tested in 2024 but appeared laser focused on the eventual Fed rate cuts and a soft landing for the US economy. After falling into a euphoric regime in December, our risky debt spread measure remained benign. Implied volatility on currencies spiked to begin January but receded throughout the month and finished in a low-risk regime. Implied volatility on equities rose from very low levels, but still appeared favorable, residing in a low-risk regime.

Our quantitative forecast for equities strengthened with sentiment indicators, both earnings and sales, improving. Elsewhere, balance sheets still appeared healthy and price momentum was firm. We do not make any changes to our equity allocation and continue to hold a sizable overweight.

Within fixed income, our outlook deteriorates further with our model anticipating higher interest rates. Our momentum indicator suggests the recent rise in yields could continue while strong nominal GDP and better manufacturing activity imply yields should continue to rise. From a shape perspective, our model is predicting a modest steepening of the yield curve due to lower inflation expectations and relatively low leading economic indicators.

Despite the forecast for higher interest rates, our model is constructive on high yield bonds, as it expects spreads to tighten further. While rates have risen recently, they remain lower than the levels reached last October, suggesting better funding conditions. Additionally, positive equity momentum and favorable seasonality buoy our outlook for high yield.

Against that backdrop, we increase our exposure to high yield bonds using proceeds from the sale of aggregate bonds.

Relative Value Trades and Positioning

Within equity, we did not execute any trades and maintain our overweight to US and emerging market equities. The US is our top ranked region across all factors except value. Improvements in price momentum and analysts’ expectations for both sales and earnings reinforce our positive outlook. Our analysis of emerging markets yields a firm outlook, with the region exhibiting strong markings across all factors except sentiment. Prospects for Pacific equities improved due to strong sentiment indicators and better macroeconomic factors, but valuations are unattractive and balance sheet health is poor. Valuations for Europe are attractive, but sentiment indicators continue to weaken and price momentum remains neutral.

Given our outlook for higher Treasury yields and tighter high yield spreads, we make small adjustments to our fixed income positioning. We sold US aggregate bonds with proceeds deployed to high yield bonds and cash. From a positioning perspective, we now hold healthy overweight positions to both cash and high yield with corresponding underweight positions to US aggregate bonds and non-US government bonds.

Finally at the sector level, our model favors more growth-oriented sectors. We maintain our allocation to technology while rotating out of energy and into communication services. Elsewhere, we remove our allocation to industrials in favor of financials. While valuations for technology are unfavorable, the sector ranks near the top in every other factor. In particular, price momentum is robust while sentiment is excellent. Communication services ranks well across all factors except macroeconomics, with sturdy sentiment indicators, healthy balance sheets and robust price momentum anchoring the sector near the top of our rankings. Financials have moved up our rankings due to better expectations for earnings and sales along with increased price momentum. Our expectations for energy are still positive, but declining price momentum and weaker sentiment push the sector down our rankings. Finally, sentiment has turned negative for industrials while balance sheets are poor and valuations are unappealing.

Click here for our latest quarterly MRI report.

To see sample Tactical Asset Allocations and learn more about how TAA is used in portfolio construction, please contact your State Street relationship manager.