A Time for Sentiment

Sentiment, a core theme in our investment model, soared in January, marking its strongest monthly return since mid-2020 COVID disruptions. We delve into Sentiment and its close cousin Momentum to understand driving factors and gauge extreme performance periods.

Sentiment in January and Over the Long Term

The Systematic Equity – Active (SE-A) team has four core themes that we deploy in our proprietary ‘alpha’ model that we use to systematically assess future return expectations for approximately 19,000 stocks on a daily basis. The four themes we analyze consistently are: Sentiment, Value, Quality, and Catalyst.

The SE-A Sentiment theme pulls together direct and indirect measures that capture the evolution of companies’ operating environments and the market’s appreciation of them. As such, it is reflective of both the broader macroeconomic and investment environment, as well as of corporate idiosyncrasies that drive returns for stocks.

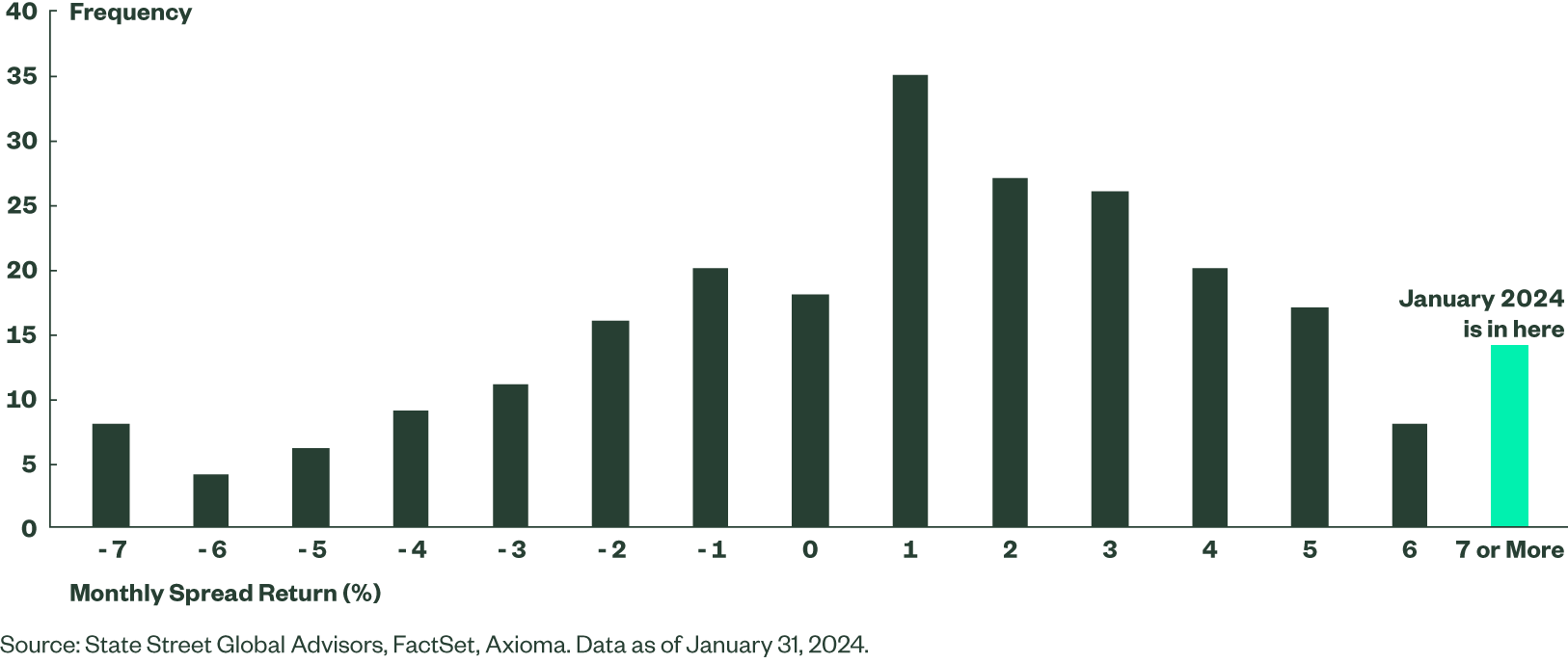

Sentiment delivered an outsized spread return1 in January of 7% in our Large Cap Developed Market universe, buoying active performance across our suite of strategies. Although not an all-time high, January’s return was still significantly larger than average. Our Sentiment theme is considerably more nuanced and refined than a traditional Price Momentum factor as it is designed for capturing alpha, rather than as broad factor exposure. Though different, the two factors do share some parallel characteristics. Similar to Sentiment, the Momentum factor’s high positive spread return in January also falls in the tails of the distribution.

Figure 1: Frequency Distribution of Monthly Returns for Medium-Term Momentum Factor

Sentiment Exposure in Extremes

Prior peaks in Sentiment performance came in July 2020, November 2011, and in 2008 during the buildup of the Global Financial Crisis (GFC). By contrast, the weakest performance came in March and April 2009 as investors saw a way out of the GFC and in November 2020 as the surprising efficacy of COVID vaccines paved a path out of the COVID crisis.

As Sentiment and Momentum latch on to prevailing market themes their exposures to other themes and risk factors, particularly in extreme periods, provide insights into what is driving markets at a given time.

To test our hypothesis, we analyzed the 10 most extreme positive months and the 10 most extreme negative months for Momentum returns over the past 20 years. In those periods, we compared average factor correlations with the 20-year average correlations and the observation for January. We were careful not to confuse causation and correlation, and therefore we observe:

- Across many risk factors, exposures are not significantly different between extreme months and the long-term averages.

- Extreme months tend to have a slightly more negative exposure to Valuation (i.e. Momentum points to more expensive names).

- Momentum in extreme months has tended to show significant bias towards low risk names; January, by contrast, trended toward the long-term average.

- Commodity exposures have also appeared stretched in other extreme months. January appears to show a notable deviation from these other periods, especially in oil and gold exposures.

In prior extreme periods, Momentum has tilted towards areas of the market that benefit from disinflation. In January, for example, it had a positive tilt towards US inflation, presumably as the inflationary spike of last year was still working its way out of the factor. - In general, Momentum crash months tend to have more exaggerated exposure to risk factors than in other periods, while January looked closer to the long-term average.

Finally, we looked at the average three-month spread return for Momentum following an extreme up or down month. For extreme positive months, the factor gave back a little of the strong returns, delivering -1.1% over the next three months. For extreme negative returns, the average subsequent three months returned -6.6%, a figure heavily skewed by returns in February and March 2009 amid the significant rotation from the GFC. If we ignore that period, the average would be -1.9%, not dissimilar to the positive months.

The Bottom Line

Momentum and Sentiment factors performed very strongly in January, but not anomalously so. Digging into exposures of Momentum to other risk factors, we determine that January’s results in many ways look more similar to the long-term average as compared to other extreme performance months. We also find that extreme one-month performance tends not to repeat itself over the subsequent three months.

While Momentum and Sentiment share some similarities, we explicitly use our diversified, nuanced Sentiment measure in our investment process. The additional diversification in our measure helps mitigate the effects of some of the extreme returns, particularly on the downside. In the 10 most extreme negative months for Momentum over the past 20 years, the Momentum factor generated returns of -12.4% on average, while our Sentiment measure fell -8.4%.

By combining Sentiment measures with other themes, such as Value, Quality, and Catalyst signals, we can strengthen portfolio returns with diversification, thereby limiting the effects of extreme short-term returns while still benefitting from the strong, long-term performance of Sentiment.