Navigating the Risk Return Trade-off in SAFI Portfolios

For investors in the Systematic Active Fixed Income (SAFI) space, a key objective is producing systematic alpha while controlling risk. In this article, we look at strategies for navigating that risk/return trade-off.

In Controlling Risk in SAFI Portfolios, we concluded that taking different (or off-benchmark) exposures to systematic risk factors and/or issuers in an attempt to improve relative portfolio performance can also increase the risk of underperformance. That’s why there are different types of portfolio strategies available for investors with different risk appetites.

Beta/Indexing/Passive Replication

In these strategies, portfolios are designed to closely track the returns of a benchmark index. This is typically done by structuring the portfolio to match all benchmark risk factor exposures as closely as possible, with a highly diversified issuer composition that carefully matches the benchmark exposures (at least for the largest benchmark positions). In equities, indexed portfolios may seek to match benchmark exposures exactly. For credit, however, a benchmark index could contain a large number of bonds, many of them illiquid. Passive replication may in that case use a stratified sampling approach to create a portfolio very similar to the benchmark without precisely replicating its bond-level composition. Indexed portfolios are not expected to outperform their benchmarks, but they are expected to track their returns with very low tracking error volatility (TEV).

Smart Beta

Standard benchmark indices are typically rules based and market weighted. This makes them highly transparent, but can also lead to inefficiencies, such as risk concentrations in large issuers or industries. Smart beta strategies, on the other hand, are designed with alternative sets of rules that aim to gain market exposure more efficiently, in line with client preferences. For example, a portfolio can be constructed that may:

- place limits on issuer concentrations

- delay forced selling of securities when their characteristics change, such as downgraded bonds

- reflect different liquidity requirements or turnover,

- or exhibit differences in characteristics such as quality, maturity and risk/return.

Investors may choose smart beta portfolios in anticipation of achieving better risk-adjusted performance than that of standard benchmarks, but any such result will be due mostly to the difference between the customized index and the standard one. A smart beta portfolio will typically be managed passively with respect to the customized smart beta index, and structured such that risks and returns closely track those of this alternative benchmark.

Fundamental Active

In traditional active management, investors seek to outperform the benchmark index. To that end, they give their managers discretion to express their views through active exposures to risk factors and issuers. Such portfolios typically express views on duration timing and sector rotation, in addition to issuer selection. The portfolio mandate will specify an investment policy that details the allowable risk limits and alpha targets, which can vary greatly from one mandate to another.

Systematic Active

In this paradigm, as in traditional fundamental active fixed income strategies, investors seek to outperform a benchmark index by taking active risk. However, rather than relying on manager discretion, systematic strategies follow a disciplined quantitative approach to selecting risk exposures relative to the index. Such portfolios take a large number of small active risk exposures, such as selecting securities, issuers or sectors deemed attractive by these models. These intended exposures have the potential to contribute to excess returns, while carefully controlling risk in all other dimensions. Systematic security selection strategies are expected to track their benchmarks more closely (i.e., with smaller TEV) than most fundamental active portfolios, with attractive risk-adjusted active performance.

The objective of systematic active strategies in fixed income is to outperform their benchmark indices, ideally over the full economic cycle. A second objective is to generate alpha that is competitive with fundamental active managers but with less TEV, resulting in attractive information ratios relative to those managers.

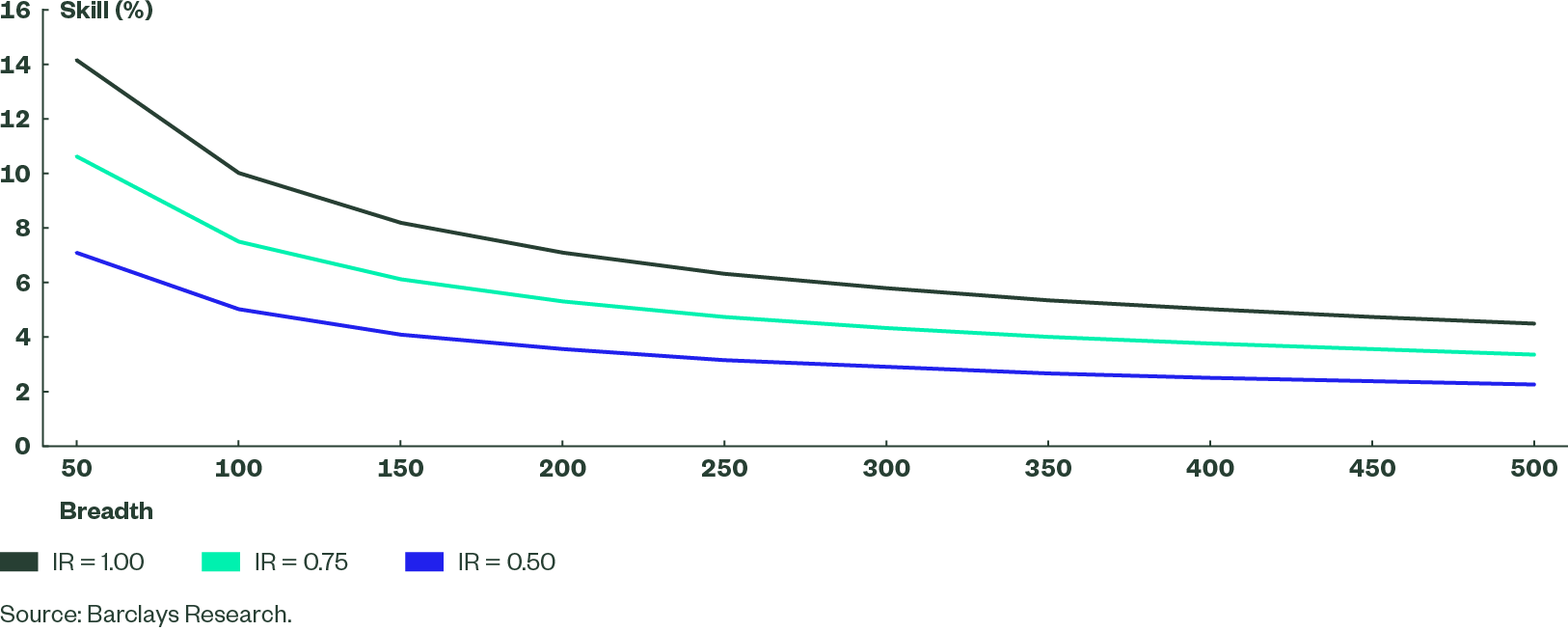

A systematic, data-driven approach can be taken to any risk dimension and used to set active exposures to rates, industries, countries, foreign exchange and the like. Some of these macro timing strategies have been found to be challenging to implement, as they tend to have lower breadth than security selection, so greater skill is needed to arrive at a similar information ratio, as illustrated in Figure 1.1 In many fundamental active funds, managers may carry a macro exposure to credit or duration that comprises a large portion of their portfolios’ overall risk relative to the benchmark. These exposures may help improve carry, but will likely increase portfolio TEV.

Figure 1: Skill Needed to Achieve a Given Information Ratio (IR), as a Function of Strategy Breadth

Setting Risk Limits

Our analysis shows that the greatest potential for achieving strategy breadth is found in the selection of specific bonds and issuers. Even after settling on a pure security selection strategy, different approaches can then be taken to setting risk limits and outperformance targets. Tight risk limits can be set, ensuring low volatility of tracking errors, and the desired outperformance will need to be achieved by consistently selecting bonds and/or issuers that outperform their risk-equivalent peers. This outperformance can be accomplished by selecting the securities that maximize the exposures to alpha factors while satisfying the constraints on risk factors.

However, if constraints are set too tight, such a strategy may be limited in the amount of alpha that it can generate. For example, if a strategy is run with risk controls that keep its tracking error volatility down to 25 basis points (bps) a year, even if it achieves an attractive information ratio of 1.0, its annual alpha will be only 25bps. For more ambitious alpha targets, it might be necessary to relax some of these constraints. In particular, a value strategy seeks to overweight bonds that trade at wider spreads than their peers. Such a strategy will be unable to generate much traction if we force portfolio spreads to match those of the benchmark. To leave room for a value tilt to be expressed, it therefore may be desirable to allow portfolio spreads to be wider on average than those of the benchmark. While this may seem to expose the portfolio to a systematic overweight to credit, this effect is found to be smaller in practice than might have been expected, as risk and valuation are related. Ben Dor et al. show that when a bond’s spread is found to be wide to fair value, its risk tends to be lower than that projected by the ‘duration times spread’ (DTS) approach.2

Rates derivatives such as Treasury futures or interest rate swaps can be a useful tool for managing interest rate risk in a systematic credit portfolio. Clearly, for portfolios that utilize active rates strategies, futures allow an easy way to layer a rates view on top of a credit portfolio, without requiring any changes to the portfolio itself. However, the flexibility they offer can be very valuable even to a portfolio based on a pure security selection approach. This is because in the absence of futures, the constraints designed to control rates exposures may interfere with credit selection.

Imagine that a number of issuers that are favored in terms of their alpha factor exposures have outstanding bonds only around the 5-year part of the curve. The need to match the benchmark’s exposure at this point on the curve may prevent the portfolio from buying all of these names and force it into less favored ones. However, if futures were allowed, the portfolio could choose the preferred issuer allocation, regardless of the positioning along the curve, and then apply a futures overlay to reposition the rates exposures along the curve to match the benchmark. Desclée and Polbennikov have emphasized the importance of derivatives in allowing separate management of rates and credit views and demonstrated that a “no derivatives” constraint can give rise to a marked drop in efficiency in active credit portfolios.3

The Bottom Line

There are different types of portfolio approaches available for investors with different risk appetites and different strategies – each with its pros and cons – for navigating the trade-off between risk and return. Systematic active strategies apply a disciplined quantitative approach to security selection and the determination of risk exposures relative to a benchmark index, offering the potential for competitive and differentiated excess returns while carefully controlling risk in all other dimensions.

More About SAFI

The data-driven insights in our Systematic Fixed Income strategies are informed by systematic signals delivered in the form of indices developed by the Barclays Quantitative Portfolio Strategy team, or QPS, which is well-recognized as an innovator in quantitative fixed income research. Their innovative signals and portfolio optimization methodologies form an important input to the process we, at State Street Global Advisors, use in the implementation and management of Systematic Active Fixed Income strategies.

Explore the State Street Global Advisors thought leadership series on Systematic Active Fixed Income investing to learn more about this innovative investment approach and its benefits.