Midyear 2023 Global Market Outlook: Preparing for a Path Less Certain

Heightened liquidity risk and softening growth prospects demand vigilance from investors. Persistent uncertainty and recession risks warrant cautious portfolio positioning.

Given the macroeconomic and market events of the last few months, our market outlook has been sharpened as we look toward the rest of 2023 and beyond. In this midyear addendum to our 2023 Global Market Outlook (published in December), we expand on the factors shaping our macroeconomic outlook and asset class views, anchoring our themes around key topics we are hearing from clients. Our purpose is to help investors navigate uncertainty and build resilient portfolios amid a challenging investment climate.

We believe global growth will remain fragile through the remainder of this year and in 2024. Against this backdrop, our high-level takeaways for investors include the following:

- Watch fixed income as it may present better return potential than equities

- Exercise caution and emphasize quality when considering risk assets

- Note how China’s reopening is steering the country into a new normal

- Look at short-term bonds for income opportunities

- Stay poised for the US dollar softening, a tailwind for unhedged non-US assets

- Consider a downside protection strategy

Macroeconomic Outlook: From Liquidity Flood to Liquidity Squeeze

— Simona M Mocuta, Chief Economist

The overarching theme for both the global real economy and the financial markets for the past few months — and even looking forward into the rest of 2023 — has been the tectonic shift from a world of abundant (we may even call it excessive) liquidity to one where liquidity in all its various forms is now being drained at an unprecedented speed and intensity. One need not be a die-hard monetarist to believe that the surge in money supply following the initial COVID-19 shock had something to do with the intensity of the subsequent inflation surge. Evidently, other factors such as supply constraints played a key role themselves, but their inflationary impact would not have been nearly as pronounced if not for the liquidity-driven surge in demand.

Looking forward, the relevant question is what comes next? Overall, nothing easy or pleasant is usually associated with episodes of liquidity withdrawal as intense as the one that the global economy is now experiencing (see Figure 1). Consequently, we would argue that — aside from inflation — nothing really gets better from here on the macroeconomic side in the near term. Our projection is that global growth slows, though a US recession still remains a more compelling argument for 2024 than for 2023. For 2023, we now forecast growth of around 1% in the United States, and only incrementally lower in the eurozone.

Disinflation deepens and broadens going forward. Disinflation is the one silver lining in the outlook. It is also the key factor that can establish a floor under the growth deceleration by allowing the much-anticipated monetary policy pivot toward lower rates to actually begin in the United States at the end of 2023, and to broaden and accelerate globally in 2024. Against this downside protection mechanism, fading reopening effects in China, intensifying fiscal headwinds in the United States, and the delayed impact of higher interest rates keep global growth low and risks to growth elevated in 2024.

Given the vital role disinflation plays in limiting an approaching economic slowdown, it is worth discussing the inflation outlook in greater detail. We consider the inflation debate along three dimensions: cyclical momentum, medium-term equilibrium levels, and inflation volatility. The first is truly what our disinflation call is anchored on: Following the post-COVID surge, the next stage in the cyclical inflation journey is lower. Reaching 2% (or close enough that the difference will not matter) in 2024 is not such an impossible hurdle as the general opinion seems to imply. Not in a world where price competition likely reemerges as backlogs shrink, demand slows, and base effects work in one’s favor. We believe that the inflation surge of the past year incorporated a fair amount of opportunistic price increases that made the inflation spike not only high in amplitude but also broad-based. Part of our more constructive view on inflation embeds an anticipation that as the demand-supply imbalance shifts from not enough to too much supply, those behaviors will simultaneously correct.

We share the belief that the medium-term equilibrium level for inflation over the next 10 years will be higher than it was in the 10 years before COVID when both globalization and deleveraging were in force. However, we are not convinced that it will be necessarily higher than the rate that prevailed in the 2000–08 period (when only globalization was in play). Globally, the green transition and deglobalization are inflationary forces, yet technology, demographics, and debt levels all suggest powerful disinflationary forces remain. Admittedly, deleveraging may now be more of a factor on the public side given the surge in fiscal stimulus and public debt levels post-pandemic. However, there are many economies — for example, Canada and Australia — where household finances appear stretched thin. Even in the United States, we suspect there is a correction coming for consumer spending following the abandon of the transfer-fed frenzy of 2021–22. China, too, is no longer in a position to deploy debt to fuel growth. Hence, we would argue that the shift in the equilibrium inflation rate is a sub-one percentage point move. Implicitly, this means that following more than a decade of sub-target inflation, we may well be entering a period where modestly above-target inflation is sustained for more than a decade.

Finally, inflation volatility may be the part of the medium-term inflation story that is most troubling to us. The combination of the green transition, deglobalization, and intensifying geopolitical risk speaks to an environment of more frequent potential shocks, with associated spikes and subsequent sharp declines in inflation whose timing is increasingly difficult and nearly impossible to predict. Such an environment would require ongoing and fairly dramatic adjustments to both business planning and investment portfolio allocations to navigate successfully. Indeed, a high volatility inflation scenario might present more challenges than sustained but steady 3% inflation.

Fixed Income and Equity Outlook: Proceed With Caution

— Altaf Kassam, CFA, EMEA Head of Investment Strategy and Research

— Matt Nest, CFA, Head of Active Global Fixed Income

Fixed Income: Better Positioned to Perform Than Equities

Value has been building in bonds over the last couple of years. The timing of when to take the plunge and buy bonds often rests on a shift in sentiment. With developments through the first months of 2023 — including banking sector turbulence, debt ceiling concerns, and associated political wrangling — interest rate momentum has clearly shifted and implies lower rates are here to stay. Furthermore, tighter lending standards should accelerate the slowdown in growth and inflation that had already begun to materialize and bring forward the timeline for a federal funds rate cut. The primary cyclical trends investors should expect over the next six to 12 months are lower rates, steeper curves, and wider spreads. The rest of the world is playing catch-up so we favor exposures in the United States versus Europe or Japan.

Overall, we find more opportunity in fixed income than we have for several quarters. Adding duration makes sense, and our focus is on intermediate maturities as the path and timing of Federal Reserve policy remains highly uncertain and long bonds do not offer as much value. We maintain a cautious stance toward credit, owning higher quality, lower beta instruments, and a preference for investment grade over high yield. Although credit spreads are wider than at the beginning of 2021, the possibility of a hard landing, and concerns about tighter credit conditions stemming from high rates and recent events within the US banking industry, could have considerable implications for lower-rated companies seeking to raise capital — a pickup in defaults seems likely. Should this happen, we would look to capitalize on cheaper valuations as the sector would look more attractive on a risk/reward basis.

Equity: Cautiously Optimistic, With a Preference for Europe

Equities have had a broadly positive run in 2023, notwithstanding the banking sector crisis that pressured markets in March. Equity performance has been supported by lower market rates, which have partially offset weaker corporate earnings. However, we do not see the rally in equities being able to sustain itself through the remainder of 2023. The US equity market advance has been led by a narrow group of mega-cap stocks that benefited from the drop in rates and earnings that beat lowered expectations. For the rest of the year, we expect earnings to soften further. We have concerns about worsening fundamentals, weaker demand as financial conditions tighten, and elevated margin pressures driven by still high levels of inflation. We have a more constructive view on European equities, where we favor an overweight allocation. European earnings and sales expectations continue to surprise on the upside, and the region’s markets offer a significant discount to US equities. We also believe that a modest inflationary environment is beneficial for value assets, and Europe has a relatively greater proportion of these within market indexes.

We anticipate volatility over the balance of 2023 into early 2024 as the economy digests tighter credit conditions, anemic growth, and geopolitical tensions. With valuations still high, there is less room for sustained equity appreciation in our view. We believe equities will outperform when investors have confidence that economic growth will return to trend levels — such outperformance tends to come six to nine months ahead of trend growth being achieved. However, driven by positive momentum and light investor positioning, we have been tactical buyers of equity, and our allocations reflect that short-term positioning. We will maintain a close eye on allocations as we continue to monitor macroeconomic factors — the pace of disinflation, the response of central banks, and the extent of economic slowdown.

While emerging market (EM) equity valuations remain attractive and quality factors are now positive, we believe poor price momentum and weak sentiment dent the overall outlook. With the US dollar’s expected retreat from the highs of 2022 proving slower than anticipated and earnings expectations lower than those for the United States and Europe, we retain a guarded stance. There are reasons to be optimistic on China. The country’s reopening and the commitment by the People’s Bank of China and the Chinese government to use monetary and fiscal policy to achieve a 5% growth rate present an offset to mixed prospects elsewhere in the EM universe. Our preference, however, is to stay on the sidelines until we are more confident in Chinese growth targets, while also keeping an eye on the delicate US-China relationship.

China: Heading to a New Normal

— Elliot Hentov, PhD, Head of Macro Policy Research

— Laura Ostrander, Emerging Market Equity Portfolio Manager and Macro Strategist

The overall theme for China is one of gradual normalization as the country adapts to a landscape without COVID-era restrictions. The recovery appears likely to fall short of other countries’ reopening experiences, while future trend growth rates will also likely be lower than China’s pre-COVID track record.

Both organic growth prospects and economic policy are supportive of the near-term outlook. In contrast to previous cycles, China’s recovery is consumption-led. Even so, household and business confidence, and that of foreign investors, remains relatively lackluster. Retail sales and mobility numbers for the first quarter look strong, although the type of post-lockdown “revenge” spending of many forecasts did not materialize. Household cash levels remain high but lag the excess savings dynamic in the United States through the pandemic. Structural problems in China’s property sector undermine confidence in a key investment asset of Chinese households. Furthermore, weak employment figures have dampened confidence in job security and income prospects. These drivers explain why the rebound in consumption is more a normalization from the zero-COVID period than a sustainable boom.

A similar situation is unfolding on the policy side, where the response is supportive but restrained. Hence, we will not see the type of past Chinese economic growth that fueled global demand for commodities, especially industrial metals and other capital goods imports, that in turn lifted global growth. This time, policymakers are calibrating a different response, prioritizing a reduced reliance on other countries for critical technologies. Meanwhile, government intervention has been necessary to maintain housing price stability, while authorities are still pursuing a strategy of deleveraging and reducing local governments’ budgetary dependency on property sales. Thus, one traditional growth driver is unlikely to return in the medium term, resulting in lower trend growth. Demographic decline is also a growth-inhibiting factor, particularly with regard to the size of the labor force. This leads us to expect real GDP growth of 5% in 2023 to slow thereafter (see Figure 2).

Geopolitical, political, and regulatory developments could upend any of these forecasts. We agree with the broad consensus that geopolitical tensions are structurally worsening between China and the United States, but we expect relative calm to prevail for the remainder of 2023. This could change heading into 2024, and peacemaking efforts in Ukraine, as well as presidential elections in Taiwan and the United States, could repeatedly trigger event risk.

A comparable perspective can be applied to domestic regulatory risk. Structural spillovers from geopolitical competition remain factors, as are the overarching strategic goals of China’s government. We are thus reticent to declare the recent shift in the regulatory environment as something permanent — increased regulatory intervention may be needed should economic and market exuberance return. Hence, we remain skeptical of a small subset of the Chinese market where certain business models do not seem well aligned with either domestic politics or global geopolitics.

Investment Implications

Chinese Equities: As China’s cyclical, reopening-driven recovery gains momentum and inflation remains low, policymakers have flexibility to provide economic stimulus as needed. We see upside for both multiples and earnings for China equities. Consumer sectors should benefit most from the consumption-led recovery, while efforts to localize supply chains should lift select technology names. Policymakers are likely to limit further downside to the property sector, but uncertainty is likely to limit near-term upside.

Chinese Government Debt: We like the carry in currency-hedged 5-to-10-year Chinese government debt but see little value in outright unhedged positions. Chinese yields are toward the lower end of their 10-year range, whereas the yields of most other large economies are at the higher end. The steady fall in inflation suggests yields should remain depressed. There is little incentive for yield-seeking investors to flock to China.

Better growth is unlikely to translate into materially higher yields in 2023 or higher inflation. Policymakers seem keen to see how far this recovery can go and likely believe that it is broadly working given the Shanghai Stock Exchange Composite Index’s recent gains. Improving growth and the desire to limit overly exuberant credit creation are also likely to keep policy rates from falling much further. We expect the government to continue to favor more targeted stimulus measures, for more demand-side policies are needed, not monetary easing.

As growth dynamics normalize and labor markets improve, inflation is likely to gradually recover — something reflected in the upward sloping yield curve. This provides opportunity for overseas investors to capture that extra yield via currency-hedged positions in the 5-to-10-year portion of the curve. For long-term investors, Chinese government bonds may make sense given their lower risk profiles and as a diversifier due to their lower correlations to other developed market fixed income assets.

Seeking Income Opportunities

— Matthew Bartolini, CFA, CAIA, Head of SPDR Americas Research

— Will Goldthwait, Portfolio Strategist

Predictability of returns is highly valued among investors, particularly during periods of heightened volatility. Until the banking-led market turbulence in March, cyclical trends favored adding duration and reducing credit exposures against the backdrop of rising policy rates. Income-seeking investors should prepare their portfolios as peak policy tightness nears — preserving liquidity and exercising patience in identifying entry points.

Against that backdrop, investors should hold more cash (high yields and dry powder for investing in other assets), mortgage-backed securities, and dividend-yielding stocks. The higher yields on offer in the US fixed income space, especially within short-term fixed income, represent an opportunity for income-seeking investors to reassess portfolio exposures. In terms of short-term strategies, balancing duration risk and credit risk will be important. Right now, duration looks cheap at the shorter end of the curve, and we favor adding some additional risk from that perspective.

The Federal Reserve Board (Fed) is nearing the end of its policy tightening — indeed, we believe it is close to a pause. The Fed’s policy aggressiveness and uncertainty for the policy path ahead have increased bond volatility, however. Implied volatility levels are averaging near the historical 90th percentile,1 and realized volatility is at 35-year highs.2 A preference for lesser volatility from bond portfolios is taking on greater importance.

Even if this current hiking cycle is ending, the Fed’s actions so far have created above-average income opportunities within short duration markets — the most sensitive to Fed policy. For example, the current environment makes 1-to-3 year US investment grade corporate bonds — now yielding about 5%, more than 230 basis points above their 20-year average — particularly attractive.3

While rates have risen for 1-to-3 year investment-grade corporate bonds, duration has remained steady at 1.89 years, on par with its 20-year average.4 As shown in Figure 3, no other credit maturity band experienced such a significant improvement in this yield versus the rate risk ratio. And with credit spreads near their long-term average, the extra yield does not come from outsized credit risk.

Given this profile, and how the 1-to-3 year investment grade segment has an index-weighted average rating of A3/BAA1,5 it represents a high-quality value opportunity to pick up a yield on par with the US equity market earnings yield of 5.4%.6

Among other higher-yielding balanced risk opportunities, an active ultra-short strategy can access attractive segments such as securitized credits, like asset-backed securities, mortgage-backed securities (MBS), and commercial MBS all at once. In the context of weak earnings sentiment, the investment grade market may be more ideal for finding income opportunities at a reasonable risk.

Beyond an active strategy, an imbedded mortgage bias may enhance credit quality, as those securities are backed by the federal government. It also may be a method for defensively extending duration while earning a higher yield than Treasurys. Mortgage-backed securities are also likely to face less extension risk if the Fed cuts rates.

The maturity focus of an ultra-short strategy as well as its short-term credit position, its income potential, and its lower volatility profile relative to the broader market, may allow investors to strike a better balance between risk and return within bonds. Owning high-quality, uncorrelated assets like MBS can also help defend portfolios against losses during periods of rate and equity volatility.

Elsewhere, we believe investors should bias portfolios toward higher-quality assets or companies with high cash flow yield; these companies have the greatest ability to fund their growth and potentially expand shareholder payout via dividends and buybacks. And despite leading economic indicators flashing warning signs of a recession, history shows that dividend-paying firms have typically retained their dividend policies amid economic downturns.

The median decline in dividends paid by S&P 500 companies in the past 12 US recessions since World War II was just 1%.7 And there was no decline in four of those recessions (1974, 1980, 1981, and 1990) when inflation was above 5%. Given that dividend payments are more stable than stock price movements, high-quality dividend-paying firms may provide an income cushion for total return.

Is the Tide Turning for the US Dollar?

— Aaron R. Hurd, FRM, Senior Portfolio Manager

— Altaf Kassam, CFA, EMEA Head of Investment Strategy and Research

We believe the US dollar (USD) is in transition from a bull market to a bear market, but the transition will be inconsistent, and volatile, and may take the better part of a year.

The USD was supercharged in 2022 by a combination of rising relative yields and its appeal as a safe haven destination amid falling equity markets, rising recession risk, and high geopolitical tension. By our estimates, the USD peaked in September 2022 at 29% above fair value relative to an MSCI World ex USA Index currency basket. That overvaluation is down to 20%, as of April 2023, with plenty of room to decline further as the factors justifying an expensive USD are reversing.

The US interest rate advantage is nearly the same as in late 2018, yet the USD is now almost twice as expensive as it was in 2018 relative to our estimate of fair value. That US rate advantage will likely narrow as the Fed shifts to cut rates amid slowing growth, while in Europe, where growth and core inflation have surprised on the upside, the likes of the European Central Bank and Bank of England continue to tighten and then remain on hold for longer.

Chinese growth is also beginning to show considerable improvement after the country’s reopening from COVID lockdowns. Relatively weaker US growth and the stabilization of equity markets at levels well above their 2022 lows (at least for now) also temper the safe haven demand for the USD.

However, despite these negative forces, we believe it is too soon for a significant, broad-based dollar depreciation. We see risks of a near-term rebound in short-term US interest rates and continued bouts of USD safe haven demand driven by elevated global recession risk in late 2023 into 2024.

Our rationale for higher short-term rates partly stems from our view that market expectations of Fed rate cuts by September appear too aggressive. US economic growth is clearly decelerating, but the consumer remains resilient amid historically high employment. Meanwhile, balance sheets are robust (room to borrow), and there is still some excess savings from the pandemic fiscal stimulus. Moreover, the Fed’s commitment to vanquishing inflation likely makes it reluctant to cut rates unless the US economy is falling off a cliff. Of course, recent US bank failures remind us that cliffs do exist. However, a hard landing for the US economy would likely hit global growth and risk sentiment, reviving the safe haven demand for the USD even if the Fed were to cut rates significantly this year.

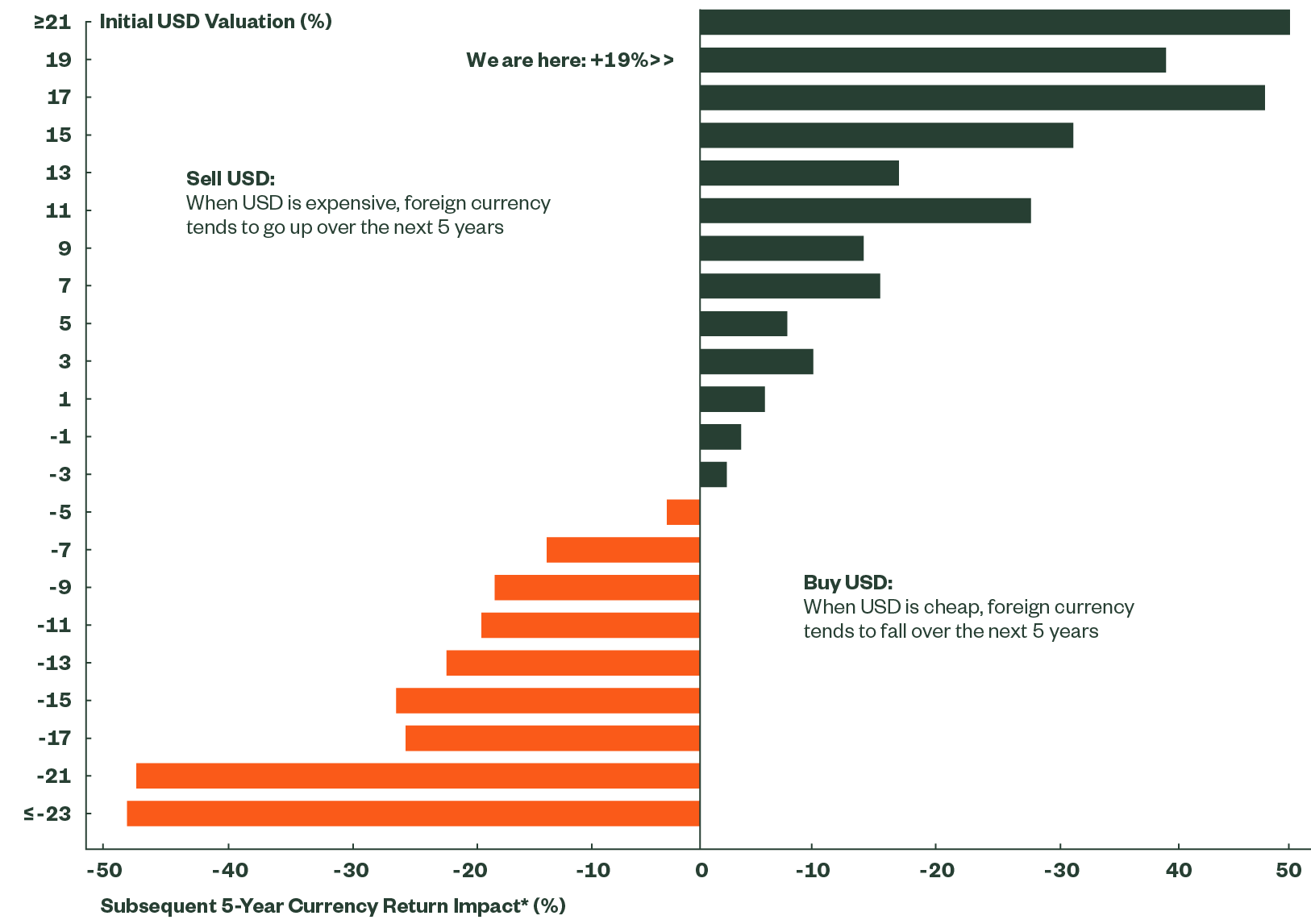

The current optimistic view on growth outside the United States may be overdone. EU and UK growth have beaten dismal expectations so far in 2023, helping drive the euro, British pound, and Swiss franc higher versus the dollar (see Figure 4). We are at levels that have historically led to steep USD losses and foreign exchange gains. However, high core inflation and additional monetary tightening should weigh on growth in Europe over the second half of 2023, while China’s growth surge from the post-COVID reopening is likely to revert to a more sustainable rate later this year.

Figure 4: US Dollar Valuation and Currency Impact

Source: State Street Global Advisors and Bloomberg Finance L.P. as of April 30, 2023. *Current return of MSCI World ex-US over the next five years.

Overall, we see the next big sustained USD move to be lower, providing a tailwind for unhedged non-US asset returns relative to US assets. Investors with a multi-year horizon should consider underweight USD positions. Over the next six to nine months, elevated risks of a severe economic slowdown suggest adopting a defensive expression of short USD that is focused more on long euro and Japanese yen. The latter could provide the best protection in a global hard landing scenario, potentially significant disruption from the US debt ceiling issue, or in the event of a geopolitical shock. More cyclically sensitive currencies such as the Australian dollar, Norwegian krone, and Canadian dollar, which also have lower interest rates than the US dollar, are likely to remain soft until the extent of the global slowdown is clearer. However, we then expect these currencies to lead gains versus the USD. If deciding to overweight cyclically sensitive currencies, we suggest focusing on those with both high nominal and real yields such as in Latin America and perhaps Eastern Europe if inflation begins to roll over.

Equity Considerations

We view the outlook for equities through the following primary lenses: fundamentals, valuations/discount rates, and positioning.

Fundamentals have been strained globally in 2023, and we expect a slowdown to intensify across both developed and developing economies. Earnings in the United States have surprised slightly in 2023 but face continued headwinds from a strong dollar. European earnings revisions have outpaced the experience elsewhere. The global outlook, ex-China, shows deceleration almost everywhere.

Valuations of developed markets ex-US equities are still within or around their bottom quintiles despite their strong performance in 2023. Valuations of US assets remain relatively expensive. Historically, appealing price levels have not been enough (by themselves) to attract significant flows, given the high profitability differential and innovation advantage of US companies.

Positioning is where we see an upside for non-US assets. European equities currently trade at a deep discount to US equities notwithstanding a euro rally. Other economies are significant long-term investors in USD-denominated assets — institutional owners have the highest overweight to the United States in approximately 25 years, while having sizable underweights to emerging markets across a similar time frame. We do not think this trend will persist in the long term, but a catalyst will be required to encourage investors to make allocations outside of the US safe haven currency.

Downside Protection: An Approach for All Cycles

— Hélène Veltman, PhD, Senior Investment Strategist, EMEA

— Kishore L Karunakaran, Global Head of Portfolio Strategy, Active Quantitative Equity

Uncertainty has been a regular companion of financial markets in recent times. The market volatility that typically flows from uncertainty underpins the argument that investors should consider downside protection approaches for their portfolios to best weather volatile markets.

Since the beginning of 2023, financial markets have been beset by an array of uncertainties. And lurking in the background is the worry that a nasty surprise could deliver a hefty blow to investors. The market wobble in March on the back of banking sector turmoil presented evidence of markets’ vulnerability to shocks, and the potential for other unforeseen events to rattle portfolio foundations should not be discounted. In thinking about portfolios that can withstand turbulent markets, it is worth revisiting the question of volatility itself. The easy monetary policy that helped keep a lid on volatility for large parts of the post-Global Financial Crisis period has given way to central banks’ focus on tackling inflation and normalizing their balance sheets. With the banks’ policymakers appearing considerably less disposed to backstopping markets, the risk is that volatility comes roaring back — knowing how, when, and in what form will be crucial.

Amid this backdrop, how should investors be looking at their portfolios? It has long been our view that investors should consider downside protection strategies in all market cycles, not just those marked by heightened volatility (when it is often too late). In fact, data on the US S&P 500 going back almost a century reveals that the stock market has historically produced positive quarterly returns after a previous drawdown (see Figure 5).

| Range | Quarterly Return (%) | Subsequent Quarterly Return (%) | # Observations |

|---|---|---|---|

| Less than -20% | -26.6 | 9.7 | 9 |

| -20% to -10% | -14.3 | 4.9 | 31 |

| -10% to -5% | -7.1 | -0.4 | 31 |

| -5% to 0% | -2.1 | -0.4 | 69 |

| 0% to 5% | 2.7 | 2.3 | 97 |

| 5% to 10% | 7.2 | 1.6 | 90 |

| 10% to 20% | 13.0 | 3.7 | 47 |

| Greater than 20% | 41.3 | 2.4 | 7 |

Source: State Street Global Advisors and Bloomberg as of March 31, 2023. Based on the S&P 500 price return data between December 31, 1927, and March 31, 2023. Past performance is not a reliable indicator of future performance. Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain, and loss and the reinvestment of dividends and other income as applicable.

Some investors may need the higher expected returns afforded by equities but worry about their risk in the context of a projected slowdown in growth. However, simply diversifying global equity with fixed income, for example, does not do enough to limit tail risk. One possible solution may be to remain invested in equity for the time being, yet combined with some form of downside protection, or alternatively move into a low volatility equity strategy.

Among the downside risk management approaches that investors could consider are:

| Managed Volatility Equity and Active Defensive Equity |

|

|---|---|

| Regime-Based Asset Allocation |

|

| Target Volatility Triggers |

|

| Managed Target Protection |

|

A low volatility equity allocation helps to smooth an equity portfolio’s volatility profile. Such strategies typically have volatility and size factor exposures as well as other diversification in the form of exposure to cap-weighted indexes or active management. For investors with a focus on risk management and who wish to manage against a risk budget, a volatility-targeting approach may be more appropriate. For investors who wish to manage against a protection level, the managed target protection strategy can be a suitable solution.

Ultimately, a big question for investors is whether the longstanding and steady upward climb in markets prior to the most recent drawdown will give way to episodic downward slides or a more prolonged slide. How investors protect against that downside should form a fundamental part of their thinking.