Liquid Real Assets: Cost-Effective Inflation Protection

Real assets can be a valuable source of diversification when combined with broad equities and nominal bonds. Addition of real assets to a portfolio could lead to reduced drawdowns compared to market cap equity.

Despite inflation moderating around the globe, we see a structural shift to a new norm of higher inflation. In this note, we discuss what liquid real assets are and how their characteristics can help protect capital in this new inflation environment. Understanding the drivers of real asset returns can help intelligently combine exposures to generate attractive portfolio characteristics, such as reduced drawdowns, risk-adjusted returns and diversification.

What Are Liquid Real Assets? How Can They Protect From Inflation?

Real assets are valued based on their utility or physical properties. Many also require a large capital investment and long periods of illiquidity to gain exposure and pick up premiums. Liquid real assets are at the more accessible end of the real asset spectrum.

Many real assets share common characteristics, with either direct linkages to inflation (for example, in legal contracts) or second-order links to inflation through supply/demand dynamics, or even how the assets are financed.

Contractual arrangements in some real estate sectors such as hotels and self-storage have short-term leases, with owners being able to mark to market rents more often. So during periods of high inflation, being able to increase rents regularly benefits the investor. Longer-term real estate contracts, in sectors like offices, may require tenants to pay for the office space as well as the expenses that go along with maintenance, etc., irrespective of whether they use it or not. This helps protect the real value of cash flows.

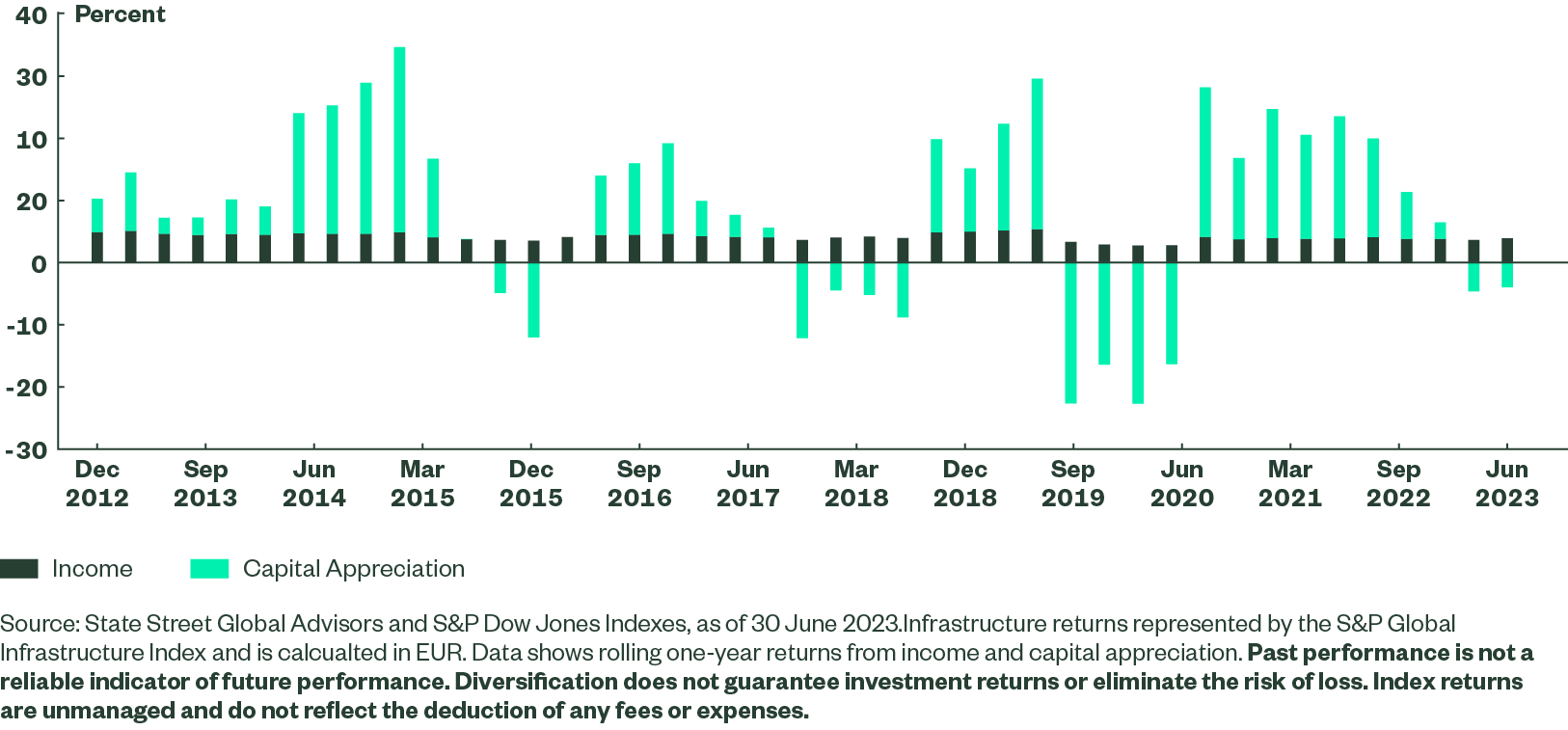

Infrastructure assets tend to be long-term leases and their income streams often have rate escalators in their contracts tied to inflation. This means that they can charge customers price increases in line with inflation. A toll road is a good example. The large proportion of income in the total return of infrastructure helps generate attractive returns, even when inflation is stable or declining.

Figure 1: Global Infrastructure Returns %, Rolling 4-quarter returns from income and capital appreciation

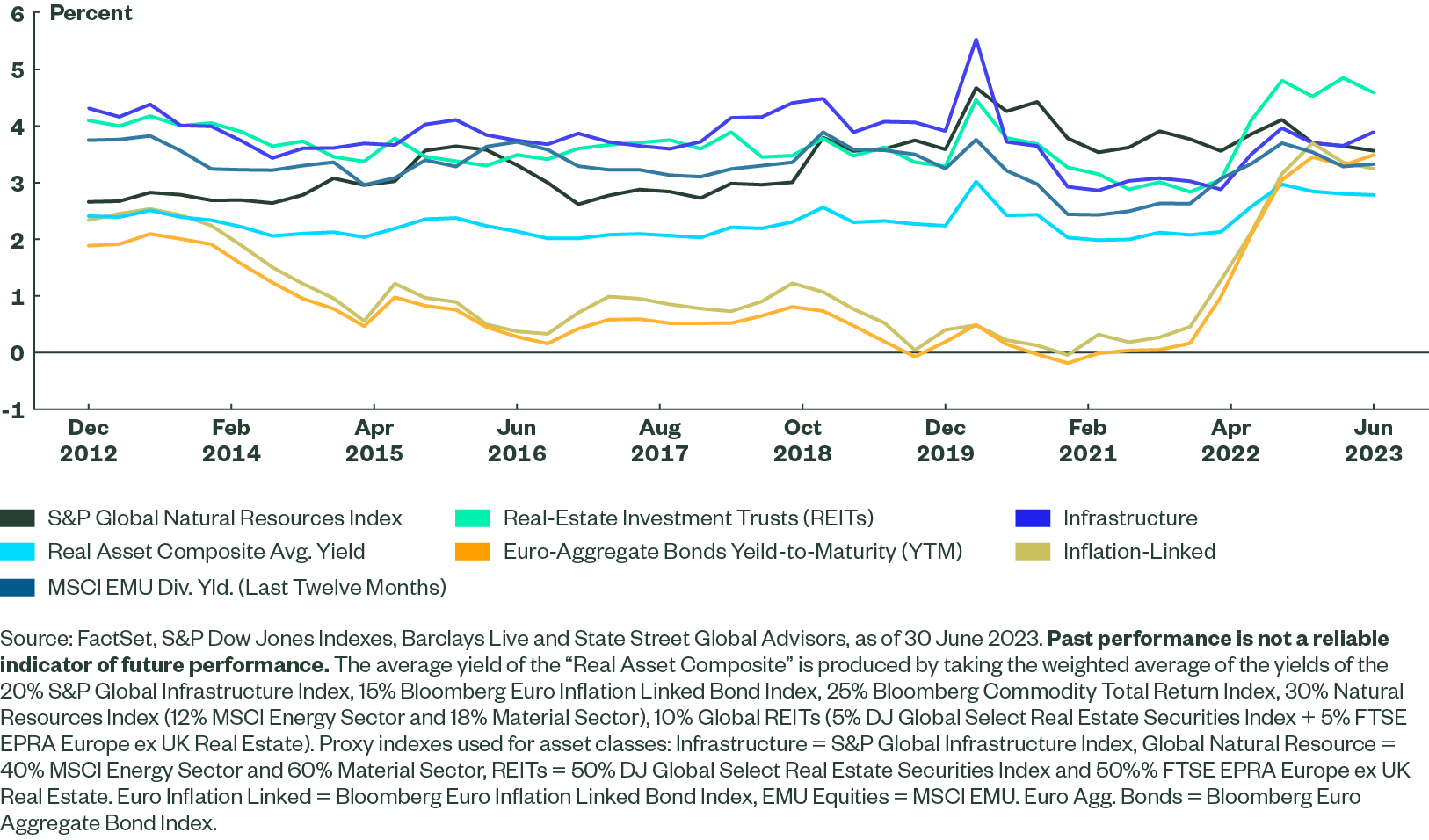

It is not just infrastructure. As we can see in Figure 2, many real assets provide a healthy yield compared to the equity market. Supply and demand dynamics (e.g., commodities), or even the hurdles to entering a market (e.g., infrastructure assets), can all benefit real assets in times of high growth and inflationary environments. Many real assets are also leveraged with long-term fixed rate debt, which tends to do well in inflationary environments as debt gets paid down with inflated currency, supercharging their returns.

Figure 2: Historical Yields (%) of Real Asset Components and Benchmark

Long-Run Inflation Likely to be Higher

We believe there is a structural shift toward a higher-inflation environment. Inflation is often modelled as having a permanent component and a transitory component. The permanent component is driven by forces such as wage costs, productivity gains and demographics, whereas the transitory component can be driven by surges in energy costs, weather-related shortages or one-time effects resulting from fiscal measures such as tax holidays.

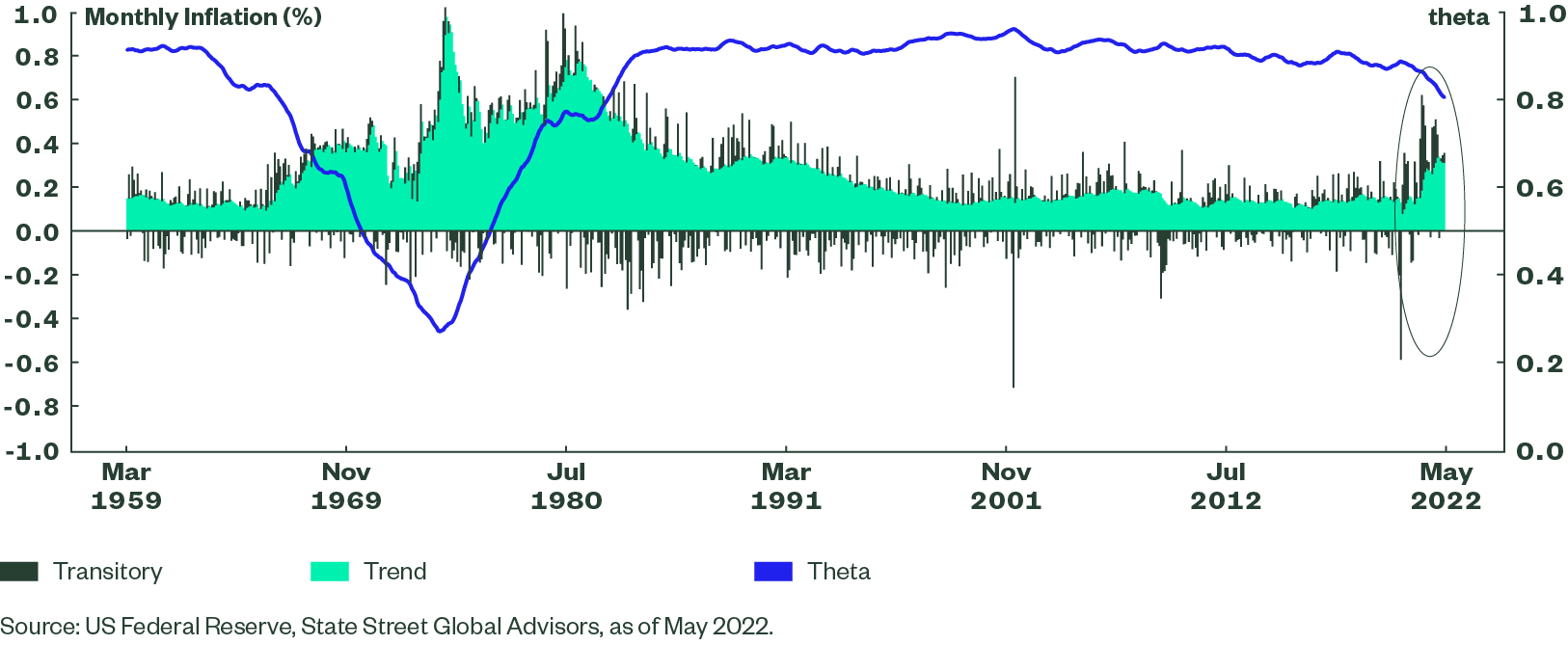

In their latest research paper “Are We Entering a New Era of Higher Inflation?” State Street’s Ramu Thiagarajan, Senior Investment Advisor, and Hanbin Im, Global Macro Researcher, conclude that the recent rise in inflation has not been driven by transitory shocks, but by a steady rise in the spillover of these transitory shocks into the permanent component of inflation, meaning that long-run inflation is likely to be higher.

It is an important shift as it counters the view that transitory shocks dissipate, and certainly differs from the behavior of prior transitory shocks. The 1970s were a period with low theta values. Low theta values indicate that transitory shocks impact the long-run level of inflation and, as a result, have attained a certain “permanence.” As such, inflationary shocks became more permanent and needed strong monetary action. It took several quarters for inflation to abate, and several years before the permanent component receded to levels of prior years.

Theta is a measure of persistence. A higher theta indicates transitory shocks remain transitory and have no effect on the long-run level (permanent component) of inflation. A lower theta indicates that the transitory shocks impact the long-run level of inflation and, as a result, have attained “permanence.”

Inflation eats away at nominal asset returns over time. As such, investors need to protect and factor this into their strategic asset allocation decisions. A liquid real assets strategy provides an effective solution that not only protects against inflation with a solid income, but provides diversification and downside protection compared to pure equity risk.

Figure 3: Decomposition of Core Personal Consumption Expenditures (PCE) Inflation from March 1959 to May 2022

Real Assets – Inflation-Hedging Efficacy

Understanding how asset classes perform across different inflation regimes can help investors to build appropriate protection into their strategic asset allocation.

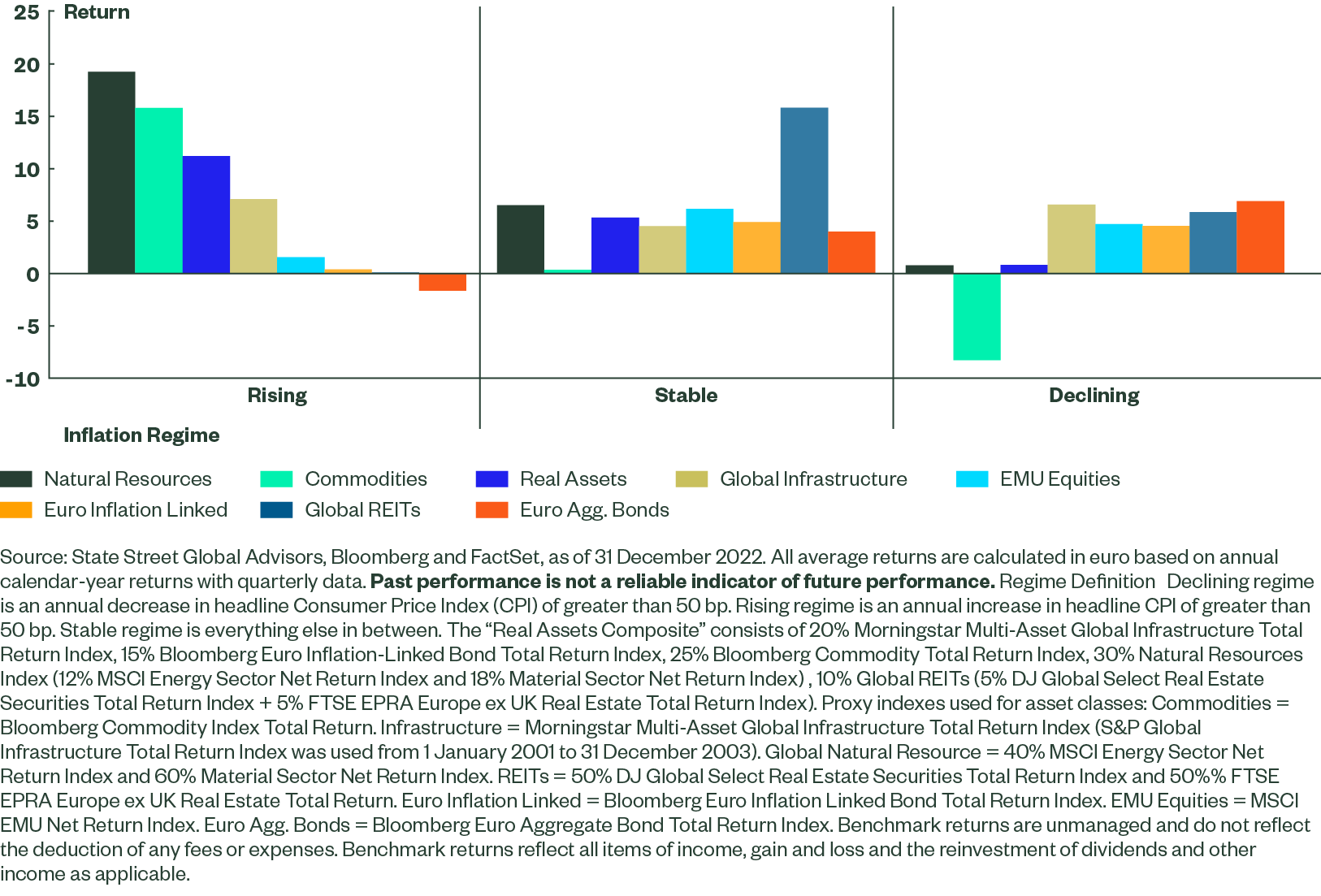

Figure 4 shows the quarterly real asset returns over the last 22 years for three discrete inflation regimes: rising, stable and declining. It is important to note that this is a directional measure, rather than indicating the level of inflation. For example, a declining inflationary regime can still be experiencing high inflation.

Figure 4 shows us that real assets provided attractive returns not only in rising inflationary regimes, but also during stable regimes. Even in declining regimes, many real assets may generate attractive returns compared to equities.

Understanding these nuances can help us construct a portfolio. Commodities and natural resources are very efficient protections against unexpected and rising inflation. Real estate investment trusts (REITs) and infrastructure also performed well in stable regimes, and even in declining inflationary environments.

Combing the exposures carefully, being aware of drivers and risks, resulted in a strategy that not only helped protection from inflation (driven by commodities and natural resources), but also reduced the opportunity cost, or premium for providing an inflation protection (REITs and infrastructure), when inflation is declining.

When we couple these real assets with exposures like inflation-linked debt and potentially floating rate notes, this could help provide an element of capital protection.

Figure 4: Average Return Versus Inflation Regimes (2001–2022)

Real Asset Strategies – Bringing It Together

An inflation-resilient portfolio has to be built with a diversified allocation to assets that exhibit high inflation beta, our preferred measure of inflation-hedging efficacy, on a leading basis. Clear inflation linkages to return outcomes is also key, in our view. We use our proprietary long-term asset class forecasts, while paying particular attention to tail risk.

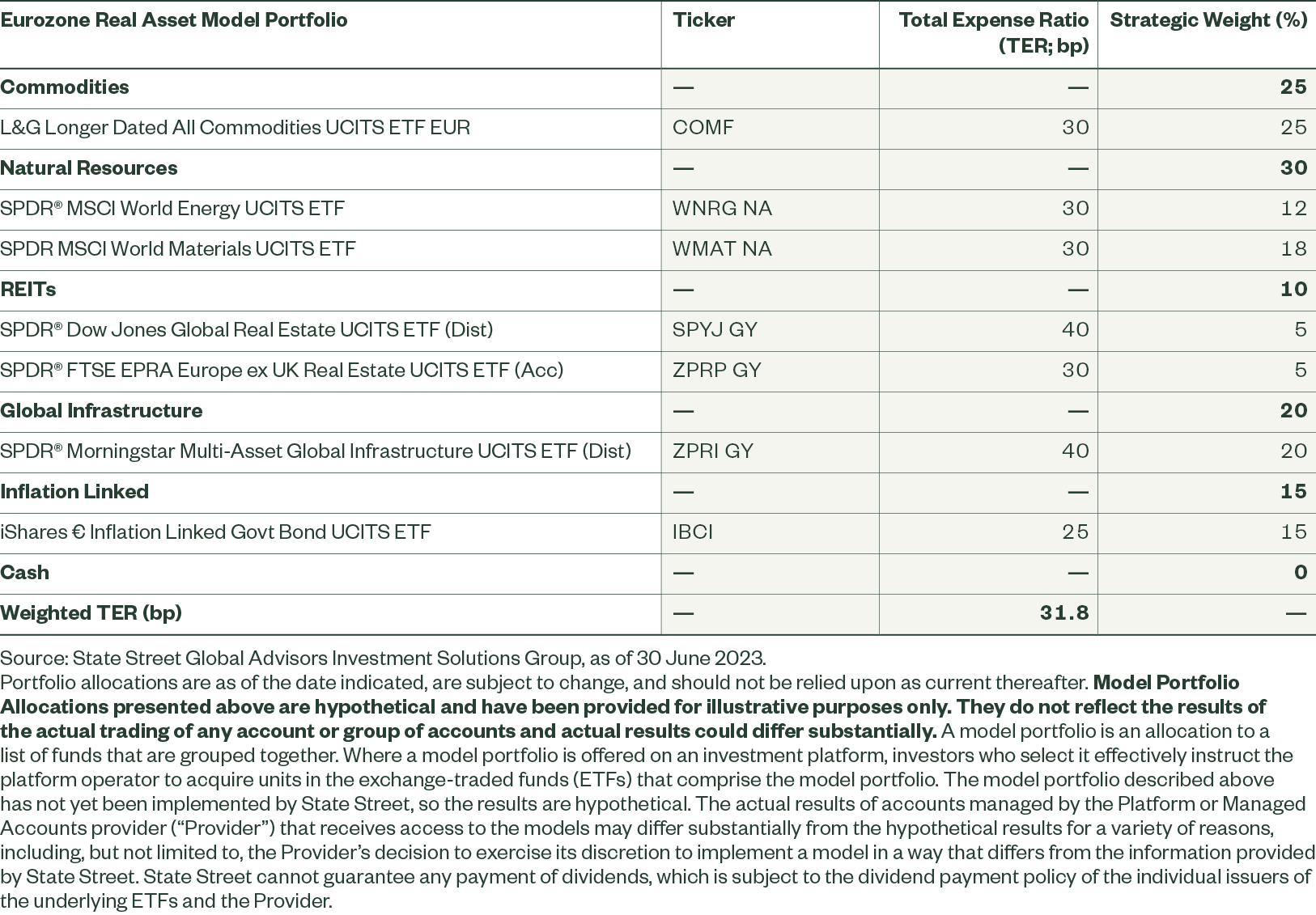

Figure 5: Eurozone Real Asset Model Portfolio

While some investors allocate to gold, the lack of income and direct inflation linkages driving returns deter us from taking large positions, preferring to allocate capital to other areas, although it can be a good diversifier to consider. We also avoid cryptocurrencies for the same reason, compounded by a lack of history. While crypto’s limited and predictable supply gives it the semblance of being a real asset, showing promise, when looking at realized and surprise inflation, it does, however, experience huge volatility driven by regulatory, security and political risk. Inversely, weighting crypto exposure to its volatility can be a solution; however, we steer clear, for the time being.

Diversification Benefits

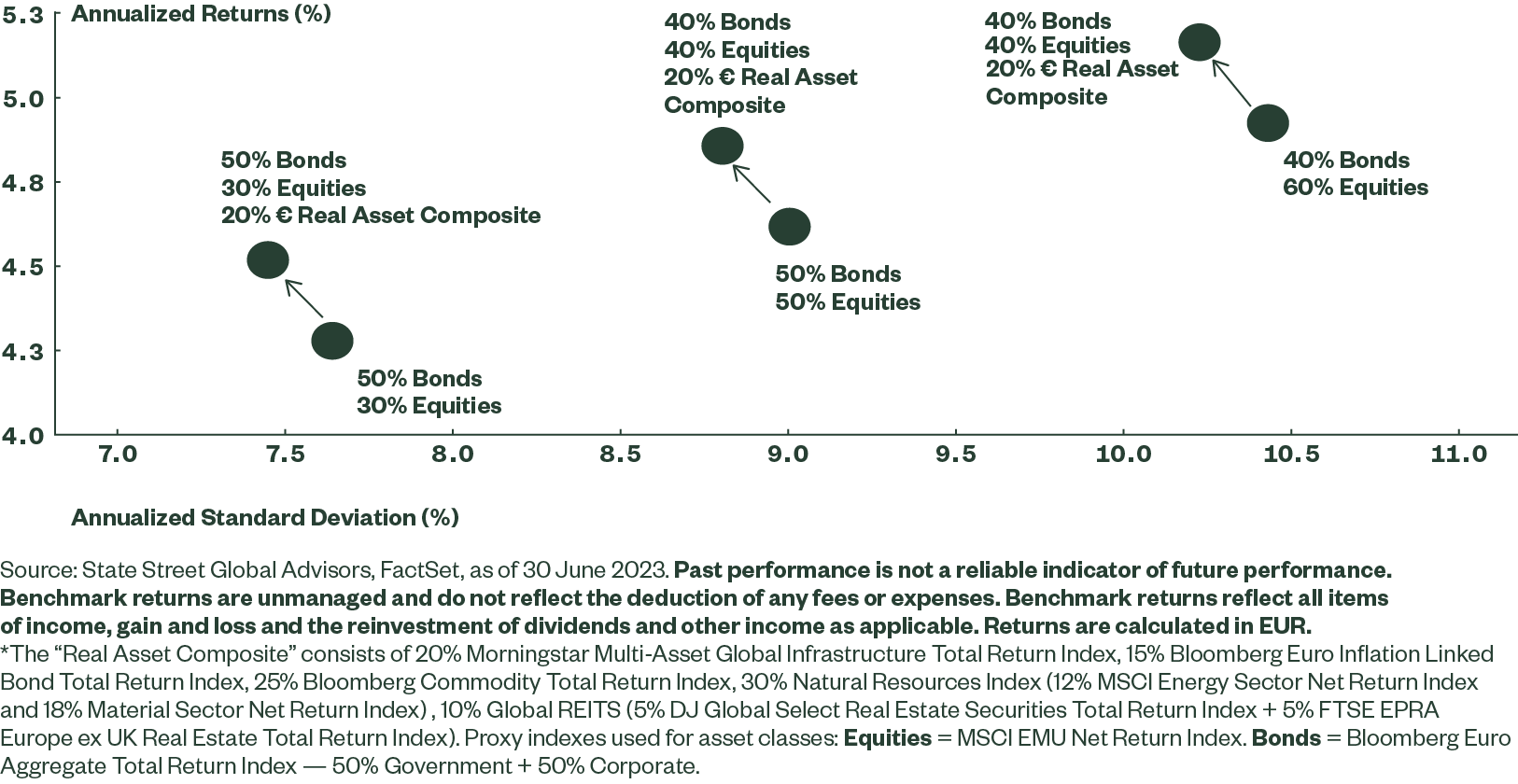

Real assets can be a valuable source of diversification when combined with broad equities and nominal bonds, shifting the efficient frontier up and to the left.

Figure 6: Annualized Volatility and Returns Since December 2003

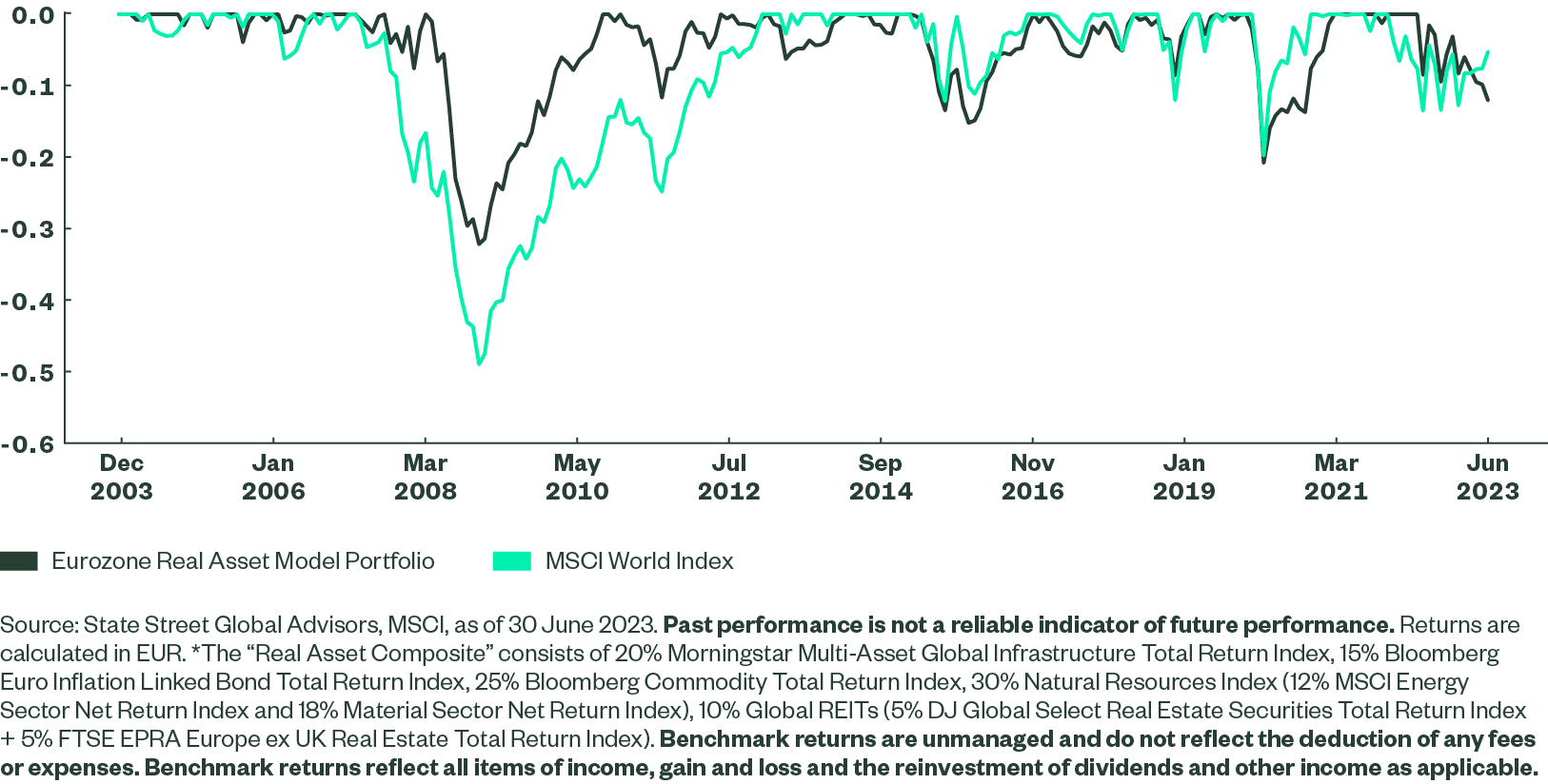

A real assets strategy can also have drawdown benefits compared to market cap equity exposure, as we show below.

Figure 7: Monthly Drawdowns Since December 2003

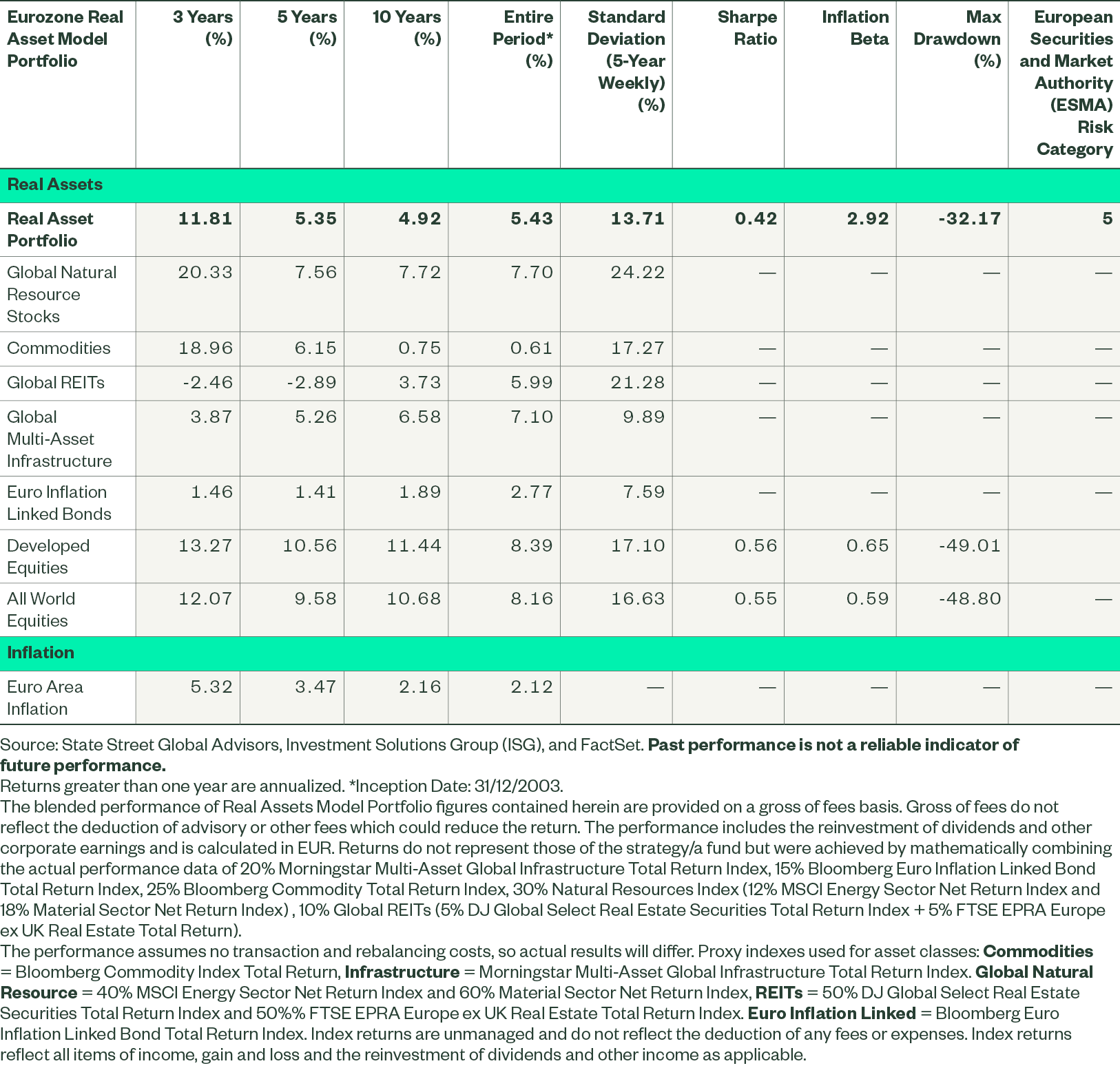

Real Asset Strategies at State Street

State Street’s Investment Solutions Group manages real assets through both strategic and tactical asset allocation strategies, utilizing passive liquid building blocks. Figure 8 below shows details of the Eurozone Real Asset Model Portfolio.

Figure 8: Historical Annualized Model Portfolio Returns/Standard Deviation Through June 2023:

Conclusion

We believe:

- There is a structural shift toward higher inflation

- Real assets share common characteristics that help protect against inflation

- Understanding these drivers and intelligently combining exposures in a portfolio can protect capital from inflation

- The efficient frontier shift demonstrates good diversification potential

- Addition of real assets to a portfolio could lead to reduced drawdowns compared to market cap equity

- Addition of real assets could generate attractive risk-adjusted returns

State Street Global Advisors’ Investment Solutions Group works closely with a broad array of clients to find both strategic and tactical asset allocation solutions in the liquid real asset space. Currently, State Street manages in excess of USD 8 bn in liquid real asset strategies.