Investment Implications of BOJ’s Great Normalization

In the world of negative rates, Japan was the last person standing. But after its meeting in March, the Bank of Japan decided to normalize its long-standing ultra-loose monetary policy. We look at the investment implications of this momentous decision.

From zero interest rate policy (ZIRP) to negative interest rate policy (NIRP), the Bank of Japan (BOJ) has made many complex policy maneuvers over the past 25 years. The BOJ’s decision to end NIRP and yield curve control (YCC) policy therefore could mark a historical shift from its long-standing unorthodox policy maneuvers toward a more normal policy stance. By ending ETF purchases, the BOJ has also signaled a strong intent toward further policy normalization. One of the immediate reasons for the BOJ’s decision could be tied to the fact that large Japanese companies have hiked wages averaging 5.28% this year, the largest in over three decades.

BOJ’s Key Policy Changes

- Ends NIRP and applies a uniform a 0.1% interest rate on all excess reserves

- The uncollateralized overnight call rate (call rate) is the new official short-term policy rate (0.0%-0.1%)

- Ends YCC policy and the inflation overshooting commitment

- Continues Japanese government bond (JGB) purchases

- Discontinues ETF and J-REIT purchases

- To gradually discontinue commercial paper and corporate bond purchase

It’s Curtains for NIRP

The central bank now uses the call rate as the short-term policy instrument, which has been guided to be in the range of 0.0%-0.1% versus -0.1%-0.1% previously. At the same time, the bank now will pay a uniform 0.1% interest rate on excess reserves, as it terminated the three-tiered system on its current account balances (Figure 1). The BOJ could foot this bill through dividends earned on its ETF holdings, which amounted to over ¥1 trillion last fiscal year.

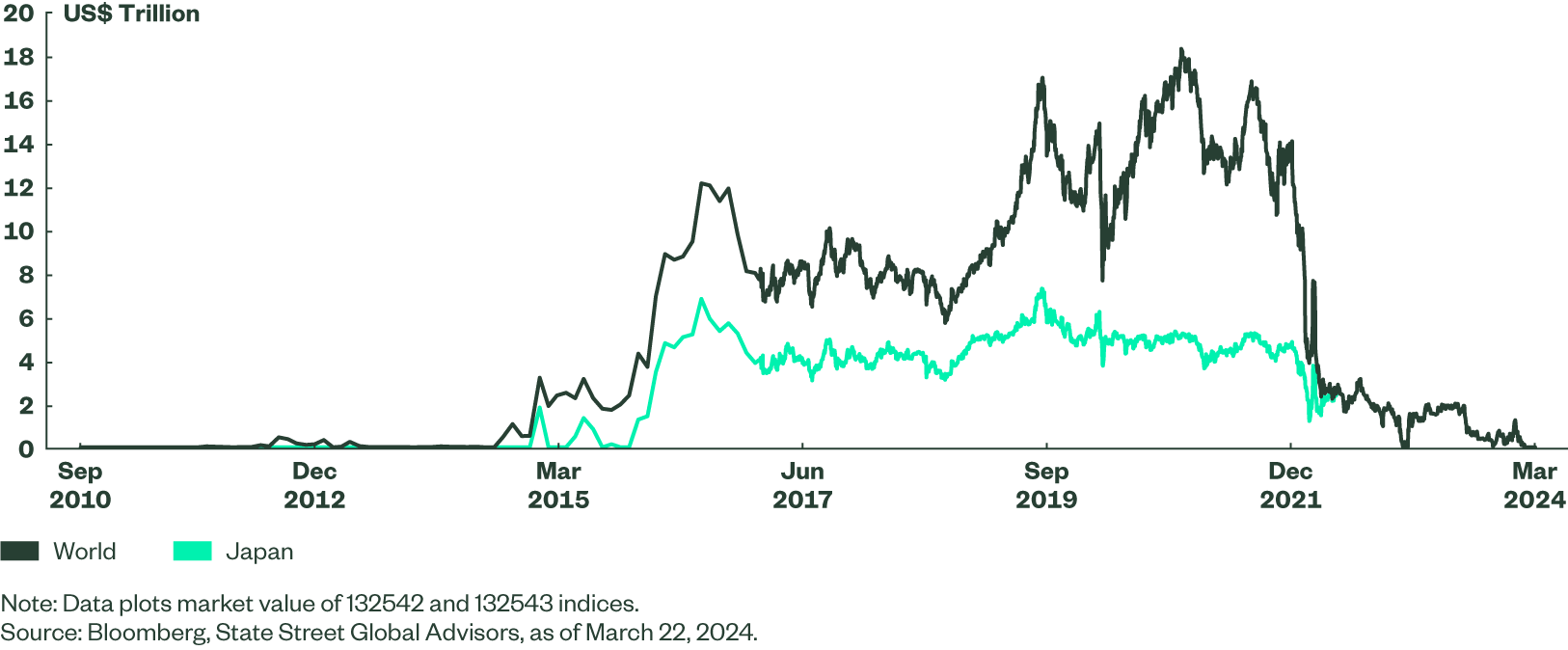

The day before the BOJ announced the end of NIRP, the yield on Japan’s one-month bill rose above zero percent for the first time since 2016. Japan has no negative-yielding debt anymore, compared with a peak of US$7.3 trillion worth of such debt in 2019. As such, there is no negative-yielding debt anymore globally either, which shows how historic the BOJ’s exit from negative rates is (Figure 2). This, however, begs the question: will there be a reversal again? It is difficult to forecast such extreme events, but if Japan and the global economy were to continue to grow well, it is hard to expect a reversal.

Figure 2: Negative Yielding Debt in the World

In this context, it is also worth noting that interest rates on most new deposits have been moving upward in Japan. Although the actual rise is relatively small, rates have risen well for deposit tenures of five years or more. For example, the deposit rate for ¥10 million for a tenure of 10 years has risen to 0.16% from 0.01% in October 2023 (Figure 3).

Quantitative Easing to Continue

After eight rounds of changes, the BOJ finally ended its YCC policy along with its inflation-overshooting commitment, a commitment through which the bank tried to expand its monetary base until inflation exceeded the 2% mark in a stable manner. Although the BOJ has maintained that it will continue to purchase Japanese government bonds (JGB) at the current pace of ¥6 trillion per month, Governor Kazuo Ueda has been telegraphing markets that the central bank will eventually reduce the scale of its JGB binge. We think this was a well-intended move to make sure that the policy change was interpreted correctly as the yield on the 10-year JGB declined to 0.69%.

The BOJ’s monetary policy is on a normalizing path, but by no means is it a straightforward path. The biggest obstacle before normalization is lack of domestic demand – real consumption has been declining in Japan even as it has been nominally rising due to price effects. However, a combination of sound wage growth and potential for lower prices could lift real income to positive territory this year. This should help to boost GDP growth and to sustain a virtuous cycle between wages and prices. We expect Japan’s GDP to grow by 1% and 1.3% in 2024 and 2025, respectively.

If the US and the world economy also grow at or above potential, we expect:

- The BOJ’s policy rate to rise to 0.25% by Q4 2024 and further to 0.75% in 2025

- The BOJ to taper its JGB purchases as early as this year and cautiously start off quantitative tightening by 2025

Outlook on Japanese Asset Classes

Given the macroeconomic context elaborated above, we provide our outlook on broad-level asset classes in Japan.

Outlook on the Equity Market

Given the BOJ’s calibrated transmission, the market had fully priced in the policy changes by the time of the BOJ meeting. The decision to end ETF purchases could still unsettle the equity market, but it is worth noting that the BOJ has been decreasing their ETF purchases in a sustained fashion (Figure 4). As such, we do not foresee this risk to fundamentally affect the equity market, as Japanese equities are supported by structural reforms and improving corporate governance.

A confluence of three favorable factors should maintain our bullish case for Japanese equities:

- Positive macroeconomic dynamics (wage growth, disinflation, among others)

- Ongoing governance reforms to increase capital efficiency and profit margins

- Better demand supply supported by increasing share buybacks and management buyouts as well as expanded tax exempt retail investment program in the form of Nippon Individual Savings Accounts (NISA)

Outlook on the Yen

We believe the yen is likely to appreciate by 10%-15% versus the US dollar over the next one to two years, driven primarily by compression in the US-Japan interest rate differential. The decision to exit NIRP is a step in that direction, but a 10-20 basis point rate increase is too small to have a material positive impact on the yen. Instead, we look to the potential for 150-200 basis points of easing by the US Federal Reserve and other major central banks by end 2025 to push the yen durably higher and achieve our expectation of a 10%-15% rally.

As opposed to our medium-term view, the short-term impact of the NIRP exit may induce further yen weakness. Investors looking to sell the yen to fund interest rate carry trades have been increasingly hesitant due to the risk of a short covering rally triggered by the NIRP exit and/or currency intervention (yen buying) by Japan’s Ministry of Finance.

Now that the NIRP exit has happened without triggering a positive yen shock, the risk of those carry trades is lower. Intervention risk still looms large, but it is less likely to be an issue unless the US dollar accelerates up to and through 155 versus the yen. Thus, we could see short-term speculative traders attempting to push the yen lower versus the US dollar until intervention appears to be a more imminent possibility.

Outlook on the Bond Market

In our view, there seems to be a slight hawkish undertone to the overall dovish interpretation of markets. The BOJ has shown a strong intent to further normalize its policy, as it plans to buy fewer JGBs in the second quarter. In the first quarter, ¥100-500 billion worth of JGBs maturing between five and ten years was slated to be purchased – this estimate has now been lowered to ¥100-200 billion. Furthermore, the Ministry of Finance’s latest market issuance plan of ¥171.0 trillion for FY 2024 is nearly a 12% decline from that of the last fiscal-year estimate.

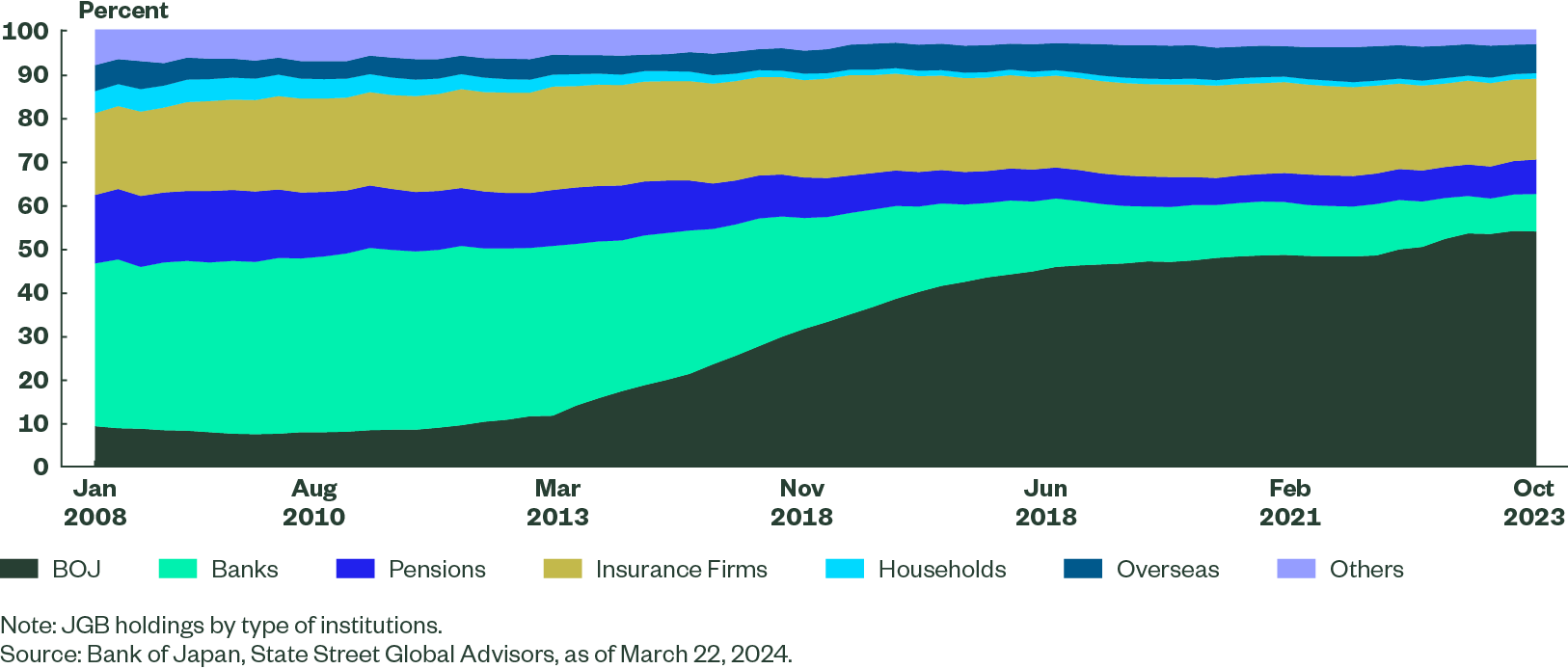

The bond market reaction to the BOJ announcement was largely muted, but with the end of YCC and decreased clarity in forward guidance, we are cautiously monitoring any developments at the long end of the curve. As the BOJ is likely to raise rates, albeit at a modest pace, and since this has yet to be fully discounted by the market, we expect upward pressure on JGB yields. Finally, financial institutions may consider using the reserves parked with the BOJ to purchase JGBs, which should help to supplant a part of the BOJ’s erstwhile purchases (Figure 5).

Figure 5: Domestic Institutions Could Improve Their JGB Holdings

The Last Word

All of the dynamics that we have illustrated above highlight the difficulty of normalizing the unorthodox monetary policy that the BOJ has been following for the past twenty-five years. Nonetheless, the BOJ has broken ground for a path toward the long-term normalization of its monetary policy without sending shockwaves across the global financial system. This in itself is a salutary moment worth our appreciation.