An Introduction to Systematic Active Fixed Income

State Street Global Advisors is introducing a suite of fixed income strategies that take a data-driven, systematic approach to generating excess return over a standard fixed income benchmark. We are collaborating with the Barclays Quantitative Portfolio Strategy team (QPS), an organization that has long been recognized as a market leader in fixed income quantitative research. Systematic fixed income portfolios can offer several benefits:

- Alpha generation driven by exposure to quantitative signals

- Diversification derived from signals that exhibit low correlation with traditional, active fundamental credit strategies

- Fee reduction due to lower costs in the portfolio construction process

- Compelling risk-return on a standalone basis

- The combination of portfolio construction skills from State Street Global Advisors and data insights from Barclays QPS

In this piece, we discuss why “now” for systematic active fixed income, how our collaboration with Barclays QPS came about and what our existing capabilities can offer in this space.

Why Now?

To start with, the trading environment for fixed income has become much more transparent and efficient, largely driven by the rise of electronic trading networks (ETNs). Rich information about individual bonds, their pricing, liquidity, risk characteristics—most of the data that could influence security returns—is now readily available.

In the past, the fixed income market was inefficient, opaque, and rife with opportunities for mispricings. Traders could generate alpha by spotting obvious security mispricing, homing their execution skills, or leveraging their broker-dealer relationships. Today, with the growth of ETNs, portfolio trading and exchange traded funds (ETFs), much of the incremental alpha available from trading inefficiencies has been squeezed out. It makes sense for us to help our clients explore opportunities in systematic approaches that are looking to generate alpha another way. Specifically, systematic approaches thrive on the availability of data and market transparency.

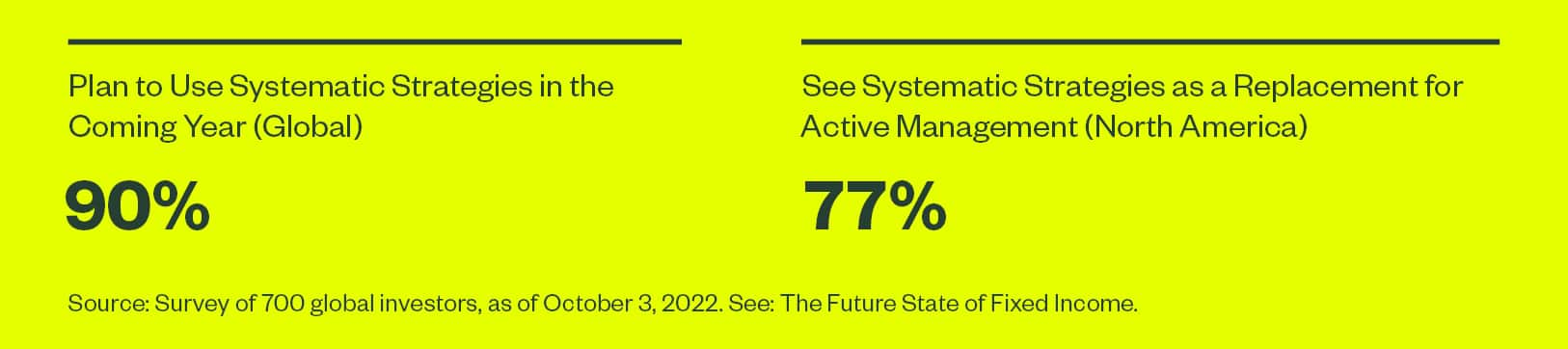

We also note that interest in fixed income systematic strategies is growing among investors (Figure 1), and larger investors are driving demand for systematic fixed income strategies.

Figure 1: Investor Demand Is Rising

State Street Global Advisors and Barclays QPS: A History of Collaboration

Our exclusive collaboration with Barclays QPS is an exciting way for clients to access this opportunity because it pairs our leadership in portfolio construction and implementation with QPS’ excellence in quantitative research. We have closely liaised with QPS for over two decades, as our position as a large index manager has allowed us to interact with them about constructing fixed income indices, as well as engage with them on index developments. We have been using QPS’ index expertise since we began managing fixed income in 1995. Barclays QPS has 14 analysts, most of them PhDs, who have an average tenure of 18 years.

Each day, Barclays QPS provides us with comprehensive quantitative issue-level signals through custom systematic strategy indices that are put through a risk-controlled optimization process with the aim to maximize the portfolio signal and ultimately generate alpha. This process allows us to take advantage of data from both equity and fixed income markets to identify superior risk/return opportunities.

Leveraging Our Indexing Capabilities

We believe that systematic active fixed income is aligned with our heritage in Indexed Fixed Income. In Building a Portfolio: A Closer Look at Our Process, we discussed sampling, which is a major part of the construction of both indexing and systematic strategies. Sampling, or selecting alternative bonds in an optimized portfolio that have similar risk exposure but better liquidity and pricing requires deep skill and experience that we have garnered as an index manager of over $500 billion in fixed income index AUM.

Investor Considerations

In this new, highly efficient, and more transparent bond market, we think that investors should look closely at their traditional, fundamental active corporate bond exposure. A systematic approach to credit selection casts a wider net when seeking opportunities, as it evaluates the entire security universe when considering opportunities versus their more focused fundamental research-driven one. This suits a trading environment that is tilted toward electronic and basket trading and allows clients to benefit from scale efficiencies.