2024 US Election – Big or Small Macro Policy Shift Coming?

With President Joe Biden and former president Donald Trump emerging as the presumed nominees, it is an opportune time to examine the respective policy stances and what an election victory for either candidate would mean for the United States economy. We focus on the macroeconomic policy implications in this article.

In the inaugural piece of our US Election series, (2024 US Presidential Election Preview), we laid out the election in a historical context and highlighted how economic indicators have until relatively recently acted as strong predictors of election outcomes. That correlation has not been as solid in recent electoral cycles.

The current macroeconomic backdrop is more supportive of the incumbent than opinion polls currently suggest. However, the Senate looks highly likely to flip Republican, whereas the House is trending slightly Democratic. This matters for analyzing the potential macroeconomic policy shifts post-November, given that the outcomes of three potential scenarios – the status quo, a Trump presidency and split Congress, or even a Republican sweep – all remain live possibilities at this stage.

The status quo would mean policy continuity with recurring battles over the debt ceiling, and likely similar negotiation results, i.e. a neutral fiscal impulse (though debt dynamics are organically worsening – more on that below). A return of Trump to the White House, even with a split Congress, would likely deliver larger policy changes in non-fiscal areas, so it is worth focusing on the most significant policy themes through a macroeconomic lens.

A Split Congress Has Material Implications for Industrial Policy, Trade, and Immigration

The centerpiece policy of the Biden administration is aimed at bolstering public investment in domestic manufacturing, especially in renewable energy and semiconductor related industries. Post-election, the Inflation Reduction Act (IRA) would remain law, although a Trump administration could curtail or maintain the interpretation of the IRA provisions which dictate public subsidies and tax incentives. We would not expect a substantial change in the government’s application of the IRA given that the majority of funds have flowed to Republican-led states and Trump shares the reindustrialization objectives associated with the Act. The major policy difference would likely be around the level of support for the fossil fuel industry without negating the bulk of the IRA provisions.

On the trade front, Biden has continued his predecessor’s policies; indeed, he has actually increased restrictions on bilateral US-China trade. Nonetheless, Trump has vowed to go further and impose tariffs of up to 60% on Chinese imports and has floated a 10% across-the-board tariff on all imports. As we learned from the 2018-2019 trade wars, tariffs typically result in retaliatory action, and thus the overall net effect is an expectation of lower growth and higher inflation. However, given that the US remains a relatively closed economy, the magnitude of these shifts would be modest, with reasonable estimates forecasting a decline in real US GDP growth of roughly 0.3%.1 Had it not been for the pandemic experience, we would be reasonably confident that this represented an upper bound, but we now know that businesses have tested pricing power and would respond quickly to pass cost changes on to end consumers. Therefore, trade measures could support a renewed wave of inflation, but only in conjunction with other inflationary forces. Figure 1 reflects the trajectory of import prices over the past decade and shows that the impact of the 2018-2019 trade dispute was a modest temporary increase in consumer goods prices.

Immigration is a macro topic in 2024 precisely because of its potential impact in a tight labor market and the policy divergence between the candidates is significant. During his first term, Trump enacted policies that marginally lowered legal immigration against a backdrop of an improving labor market. At the same time, the number of illegal entries began rising. Figure 2 illustrates the scale of the increase in immigration under the Biden administration, which is especially apparent after the pandemic-specific restrictions were lifted in 2022. In total, the inflow of migrants in 2023 was double that of 2019, equating to an extra two million individuals.

The migration-inflation connection is more complicated than simply a function of labor supply. Most immigrants seek quick entry to the work force, so the persistence of ultra-low unemployment rates would imply that labor markets would be much tighter absent immigration, and by extension, inflation would be higher too. At the same time, rapid immigration increases demand for core goods and services, notably housing which has an inelastic supply, so this also has an inflationary element, at least in the near term. It is the balance of these supply-demand dynamics that needs to be restored.

Neither candidate has a coherent policy platform to address this challenge, although Trump’s positions point to more labor supply constraints, and therefore, perhaps imply a ‘higher for longer’ rates environment.

Fiscal Picture Is Dire and Could Turn Worse

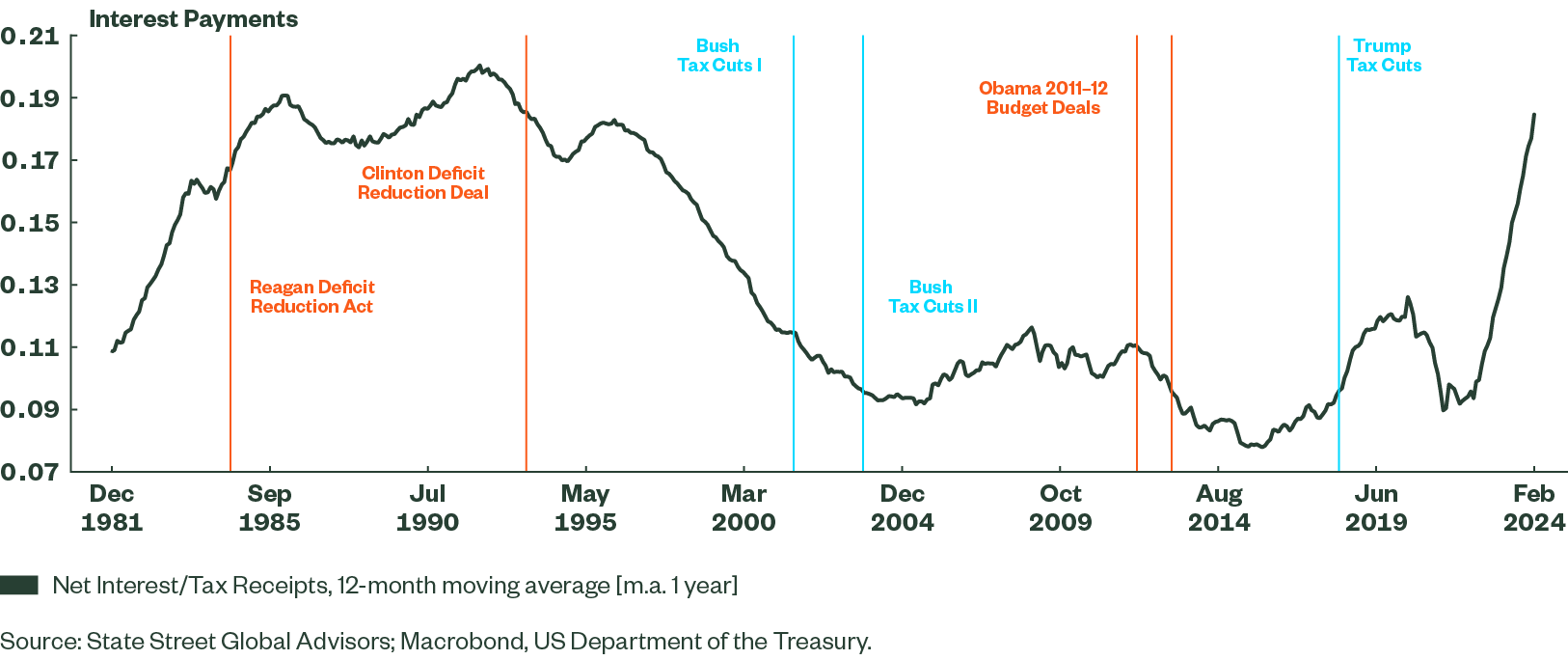

The US fiscal outlook has declined over the past year and is on an unsustainable trajectory. Figure 3 shows that higher rates are supported by the worsening fiscal profile and, in turn, feeds it further. It also underlines that meaningful shifts in fiscal policy usually only occur under unified governments — and only the Republican party could conceivably control all branches of the federal government after the election. Hence, it is worth considering what the fiscal path would look like.

Figure 3: Federal Interest Payments as Share of Revenues 1980-2024

One reason for the deterioration of the ratio in Figure 3 is that following Trump’s unfunded fiscal expansion in the 2018-2020 years, the Biden administration did not raise taxation to the extent expected prior to his election. Instead, spending grew substantially to finance the pandemic recovery and other policy initiatives without offsetting growth in revenues. The next president will have to act on the expiry of the 2017 tax reform by the end of 2025, with most individual income taxes resetting to pre-2017 levels. History suggests consumers increase preventive savings in advance of such tax changes so this could slow consumption growth during 2025 if fears of broad-based tax increases become prevalent.

Republican control of Congress and the presidency would almost certainly avoid such a tax increase. While overall state-level public finances stabilized, the general government primary balance (deficit before interest payments) is still running at -2.2% of GDP. In the absence of a tax increase, this implies a growing debt burden and higher debt servicing costs given America’s trend growth rate.

Consequences of Shifting Debt Dynamics

For a reserve currency such as the US dollar, there will never be a lack of demand for safe assets. Bond vigilantes may succeed in raising the term premium to reflect long-term debt concerns, but the greater problem is in the mechanics of higher debt servicing costs. As the average maturity of US Treasury funding hovers between five and six years, more than half of the current outstanding stock will be refinancing at higher levels. Rising debt servicing costs alongside further increases in issuance add to pressure on higher rates. Together, these forces could result in indirect crowding out of private investment, as well as curtailing public expenditure due to interest payments taking up more of the budget.

Figure 4 presents the growth in interest payments relative to defense expenditure and shows how debt payments will begin to surpass core budget priorities. Given that we do not foresee revenue raising measures to succeed (only imaginable under a Democratic sweep which we view as implausible), the political challenge for the next administration will be to decide where to restrict spending growth. Under Biden, we imagine the budget and debt ceiling negotiations to repeatedly generate cuts in discretionary and defense budgets. A Trump presidency may consider changes to entitlement spending, particularly in the healthcare-related parts of the US budget (e.g. Medicaid and Medicare).

There are a small number of technical choices that could support long-term fiscal sustainability without being overly politically sensitive. We would place raising the contribution limits on social security, as well as age qualifications in categories that could emerge from budget or debt ceiling negotiations.

The Bottom Line

What are the investment implications that investors should consider during this election year? Overall, we believe the macroeconomic policy divergence between the two parties is less this year than in the prior two presidential elections in 2016 or 2020. However, the areas subject to change are most closely wedded to inflation and rates – which have been the dominant investment drivers of the post-pandemic period. Long-term rates are clearly settling at higher levels, yet certain policy choices could increase them further. As the situation currently stands, there are no serious policy proposals that would do the opposite.2