Why the AI CapEx cycle may have more staying power than you think

Recent headlines caution that the AI-driven capital expenditure (CapEx) surge—especially in data centers—may be overextended. Some even suggest that without this data center buildout, the US economy would be teetering on recession.

We see things differently. A more constructive lens suggests the AI CapEx cycle is still in its early stages, historically a phase that supports sustained valuation premiums. In our view, sluggishness in other construction segments reflects the digestion of prior buildouts and elevated interest rates, not poor underlying potential. Limited resources are simply being rationally redirected to higher-return opportunities like data centers.

Explosive growth in AI infrastructure

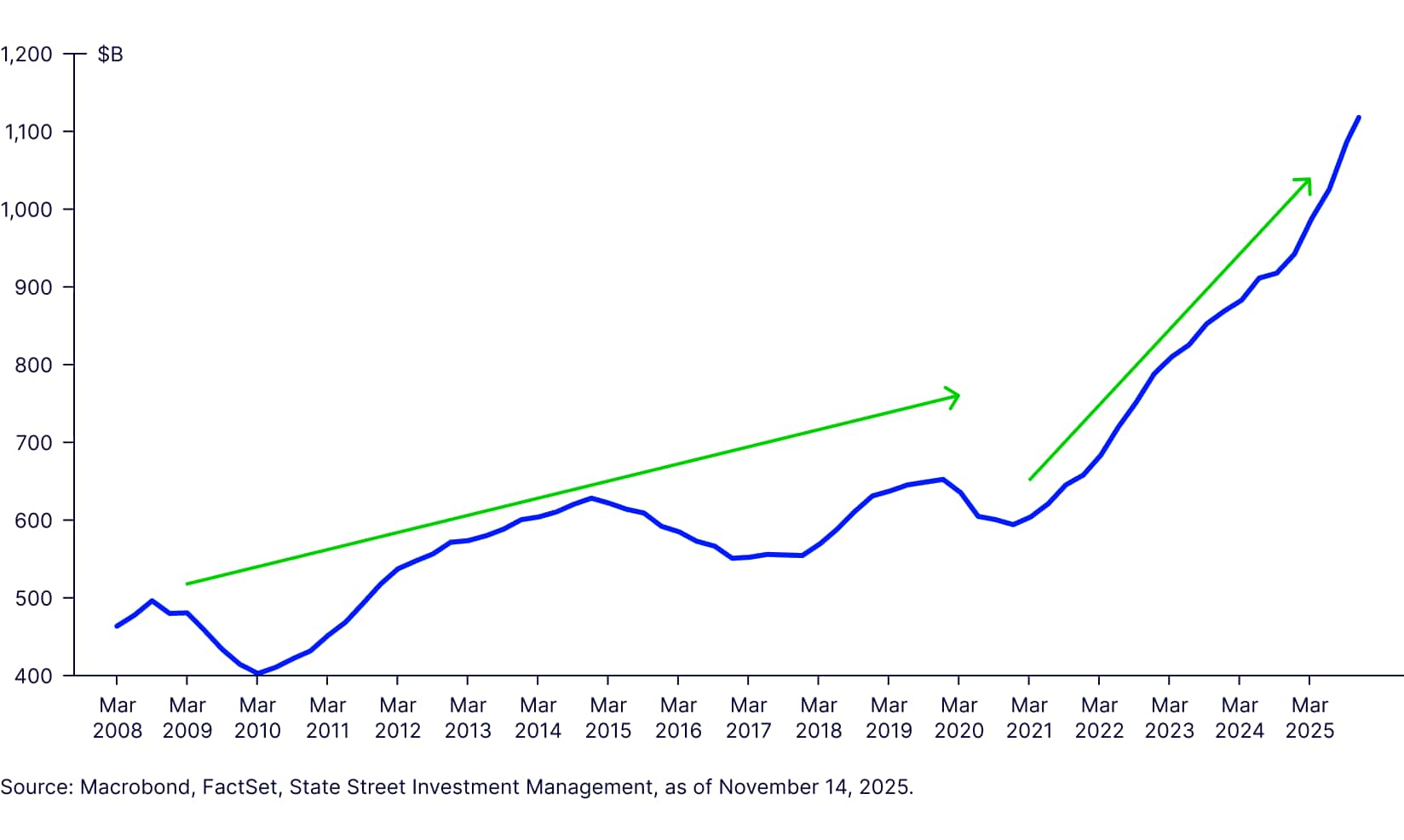

The US data center boom is visible everywhere, from company reports (Figure 1) to macro Census Bureau data (Figure 2). Capital spending by S&P 500® firms has nearly doubled since 2021, marking a clear inflection point.

Figure 1: S&P 500 CapEx has nearly doubled since 2021

The Census Bureau’s value in place data tells the same story: data centers are on track to surpass the entire general office construction market this year, a striking shift driven by remote work’s structural impact on office demand (Figure 2). And, with company pledges pointing to continued investment, there is no slowdown in sight.

Though Census Bureau data may lag company-reported figures, it has the great benefit of internal consistency and cross-segment comparability. That context is critical for understanding the relative size of data center construction versus other segments.

Is it too much, too soon?

You may be tempted to say yes, since the numbers look aggressive in isolation. But in context, they’re proportionate. While rapidly expanding, data center construction remains a small portion of overall US construction activity (Figure 3). Even if annualized spend were to double or triple over the next two years, the surge in data center buildout would still be comparable to what we’ve seen recently in other segments, like manufacturing structures, where investors seem far less concerned about overreach.

Today, data center construction value put in place is also roughly on par with the well-established healthcare construction segment (Figure 3). Given AI infrastructure is a “new genre,” high activity “flow” makes sense as the industry builds the “stock” needed to meet surging data-processing demand.

Bottlenecks ahead: Labor and power

Labor may be the key constraint to data center buildout plans. Overall construction employment has grown steadily since the post-Global Financial Crisis (GFC) lows of the early 2010s, but the pace has slowed markedly relative to the initial post-Covid rebound (Figure 4). Limited labor capacity is being diverted to the highest priority segment: data centers.

Labor shortages could intensify in 2026, which may require changing immigration restrictions—perhaps a “carveout” or temporary sector-specific waiver. This is a growing risk, especially if lower interest rates revive residential construction activity and competition for workers intensifies.

The likeliest “next-stage” bottleneck is power availability. A data center without power grid connectivity is a stranded or non-operational asset. While there are valid investor questions about AI profitability, a lack of power is the surest path to no profit at all.

The success of AI investment depends on a coordinated ecosystem supported by policy, including on the regulatory/permitting front. Earlier this year, President Trump stated that “from this day forward, it will be a policy of the United States to do whatever it takes to lead the world in artificial intelligence.” There is, indeed, much to do. Recent public private-partnerships signal an “all hands on deck” approach, reinforcing why concerns that AI CapEx is overextended may be misplaced.

Earnings resilience beyond tech

Absent the CapEx Supercycle, US equities still look healthy. In Q3 2025, eight of 11 sectors in the S&P 500 outperformed earnings expectations, with Financials, Utilities, and Real Estate all besting predictions (Figure 5). And, it’s not just the AI-driven Mega Caps delivering earnings growth either—the S&P 500 Equal Weighted Index has moved steadily higher too.

This isn’t just a tech story. Companies in other sectors are defending margins and producing solid earnings results. That said, companies and sectors that are aligned with the buildout of the AI ecosystem—from Utilities to Industrials—may have lots of room to run still.

Utilities: From defensive to strategic?

Utilities, in our view, are no longer just defensive plays. Trading at a 19x NTM P/E with a 2.83% dividend yield, they’re evolving into strategic growth platforms, powered by AI’s relentless demand for electricity.

Hybrid utilities—those blending the stability of regulated operations with exposure to high-growth infrastructure—are leading this transformation. The surge in power demand from hyperscalers and AI-driven data centers is forcing utilities to accelerate grid expansion, transmission upgrades, and generation capacity.

For these utilities, regulated frameworks help ensure cost recovery and rate-base growth, while massive CapEx tied to data center infrastructure unlocks incremental earnings potential. And, recent dividend hikes signal confidence in sustained EPS growth fueled by industrial load expansion. For investors, this can translate to bond-like stability plus potential upside from digital infrastructure growth, a rare combination that may deliver inflation-protected cash flows and structural earnings acceleration.

Moreover, the scale of investment is staggering—over $1 trillion dollars in US grid infrastructure by 2029. That creates potential spillover opportunities in private credit, infrastructure, and real estate, which are increasingly financing behind-the-meter generation, battery storage, and transmission projects.

The bottom line is, the data-center-driven AI CapEx cycle isn’t just reshaping tech, it’s creating spillover opportunities and redefining sector opportunities, including utilities as engines of structural growth. Investors may want to take note.

Explore more of our latest macroeconomic perspectives and market insights.