What to Ask Your Index Manager

Over the past decade, investor adoption of index-based strategies has soared. To meet the demand, asset managers have formulated new low-cost offerings, driving the competition up and investment management fees down. This dynamic has amplified the emphasis on fees as the key selection criterion for both managers and funds. While fees may be an obvious dimension for evaluation, it offers a limited picture of investor value. Here we will suggest three alternative factors that index investors should consider:

- Fund performance

- Size and scale of the manager

- Vehicle offerings

Ask your investment manager to share details on these three elements of their index investing solution:

Why Does Performance of an Index Fund Matter?

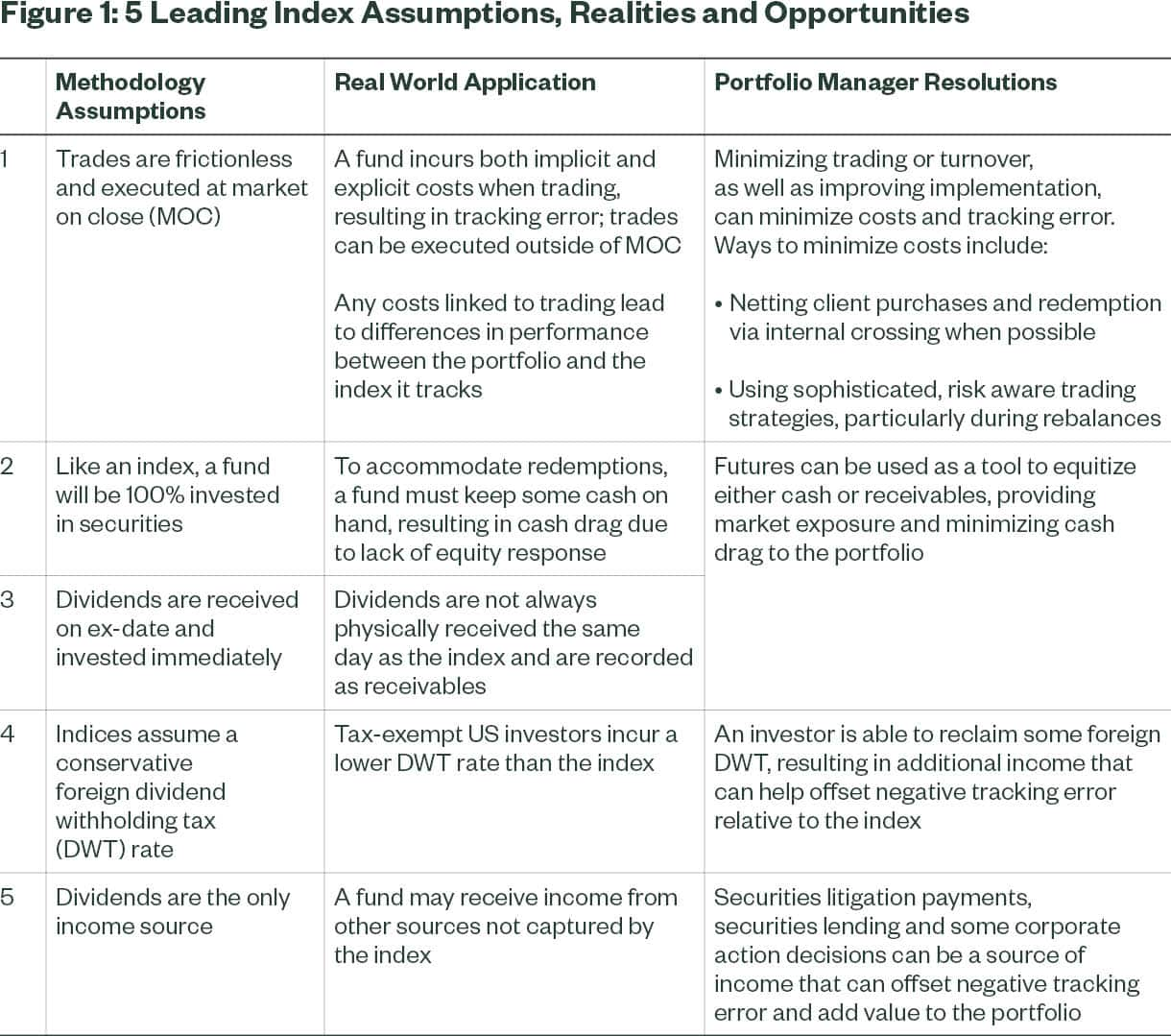

Delivering index returns is often thought to be a relatively easy undertaking that any manager can accomplish. However, there are a number of embedded index assumptions that make this task more challenging than meets the eye. Figure 1 describes several notable index assumptions, the realities and potential approaches a manager might undertake to reduce tracking error.

Given these assumptions are known, fund performance will deviate in some way from its respective index. For this reason, it’s pragmatic for a manager to assign expected tolerance bands as a form of performance measurement. This is a critical step in the portfolio construction process, as it helps establish performance expectations. If the performance differential between the fund and its respective index substantially deviates from its tolerance bands over time, the investor may be incurring an additional cost (i.e., negative tracking error) or potentially taking on unintended risk in the case of significant outperformance. That said, it’s critical that an index manager finds the right balance of minimizing tracking error and risk when overcoming these variables.

Why Is Size Important?

Size supports scalability and provides breadth and depth from a product perspective. A substantial index asset base may serve as an indicator of an asset manager’s commitment to the index style, helping to pave the way for innovations in process improvements, technology, new product development or enhancements to existing strategies.

A common complaint of index funds is “passive ownership.” Index funds innately must buy or sell a company in accordance with an index, regardless of the company’s governance practices. To combat this issue and ensure that company policies are supportive of long-term shareholder values, large managers like State Street can help to influence the market via proxy voting and active stewardship engagement. Our program is highly focused on transparency and measurable momentum. Our stewardship program is anchored in three distinct pillars of ESG and their intersections. We regularly identify thematic focus areas that guide our proxy voting and engagement efforts. One of our focus areas is gender diversity, and since the launch of our Fearless Girl campaign in 2017, 1,027 Companies (approximately 50%) have now added a female director to their board globally.1

Furthermore, size may potentially help a manager better track a respective index, particularly if the index is broad and has a large number of constituents. For example, the popular MSCI ACWI ex US IMI Index, which covers developed ex US and emerging markets, has over 6,500 constituents presenting challenges from a replication standpoint in a small fund. So ideally a larger asset base may be able to more easily replicate the index, as it can hold more stocks in the index. In addition, sizable funds with a diverse client base can often accommodate larger contributions or redemptions. This can potentially lead to less turnover, assuming the manager invests in futures or utilizes an internal crossing network, whereby contra investors’ flows can be netted against one another.

And finally, size can translate into more effective implementation. This is particularly meaningful in the DC arena, which encompasses millions of investors and countless transactions. In this context, a large fund manager may be able to more easily absorb money movement with less impact to fund performance. In practice, this means a large fund can potentially accept substantial cash contributions without having to immediately buy securities to house the assets. Instead, managers can buy or sell futures to reduce transactions costs. More importantly, a manager with a large and diverse client base will likely have more contra flows that can be netted against one another, assuming the manager has established a robust internal crossing mechanism. This process can provide substantial savings to plans and participants, often in excess of the management fee of a fund.

What Is the Most Appropriate Vehicle for an Index Fund and Why Does It Matter?

Index funds are offered to US-based institutional investors in several structures, including mutual funds, pooled trusts like collective investment trusts (CITs), exchange-traded funds and separately managed accounts. Depending on factors such as the investor’s tax status or legal structure, investment time horizon, liquidity and need for customization, one vehicle may be more suitable than another for certain investors. For the purposes of this section, we’ll focus on the differences between mutual funds and CITs, which are pooled funds regulated by the US Office of the Comptroller of the Currency and often the most suitable index vehicle for large-scale, tax-exempt entities such as defined contribution plans.

Mutual funds remain the primary default index fund vehicle option, accounting for 57% of DC holdings.2 Popularity may be due to the perception of “portability,” participant familiarity and ability to access publicly available information. However, for CIT-eligible 401(k) plans, approximately 43% or $3 trillion of the $6.9 trillion held in (k) plans is invested in collected investment trusts – and the concentration is growing.3 We believe this is because CITs offer a number of advantages over a mutual fund. Some of those advantages include:

- Ability to cross and reduce transaction costs

Given their unique structure, CITs can cross either at the individual security or unit level via an internal trading network (if supported by the manager), resulting in a significant cost savings, as the manager is able to avoid going out to the open market to trade. Figure 2 highlights the cost savings that State Street Global Advisors and our respective clients have received as a result of using an internal crossing network.

Figure 2: Internal Crossing: A Powerful Source of Cost Savings & Liquidity4

|

Total Value |

In-Kind/ Internal Crossing/ Unit Crossing |

Estimated Cost Savings |

Transaction Cost Savings |

US Market Case Study |

$224.0 Billion |

87% of the total |

0.03% of the total |

$58.5 Million |

Non-US Developed Case Study (2020-2022) |

$34.6 Billion |

85% of the total |

0.15% of the total |

$44.2 Million |

Emerging Markets Case Study (2020-2022) |

$23.0 Billion |

62% of the total |

0.25% of the total |

$35.6 Million |

Note: Note: Availability of internal crossing at State Street Global Advisors may be affected by your asset class, vehicle type, jurisdiction or other factors.

- More favorable tax treatment

All underlying CIT investors are tax-exempt ERISA plans. For this reason, a CIT is able to reclaim a greater share of foreign dividend withholding taxes (DWT) than a mutual fund, which can include taxable investors as well. In some markets, a mutual fund is taxed at an additional 15% relative to a CIT. Based on our findings, an investor was eligible to reclaim an additional 14 basis points (bps) in DWT in a CIT versus a mutual fund benchmarked against the MSCI ACWI ex US IMI Index.5

- Increased flexibility in pricing

Unlike a mutual fund that has stated expense ratios, CIT pricing can be customized to the client relationship.

- Securities lending program potential

Investors know that even incremental investment gains can make a difference. In the case of securities lending, a well-managed program can provide between 0.2 and 13.2 bps6 of additional return on US equities, warranting consideration. As part of this review, sponsors and their advisors should consider the additional risks associated with a securities lending program as well as return and cost assessments to determine the program that is right for them. For additional information, read our Securities Lending in US DC Funds executive summary and whitepaper.

It’s worth noting that not all CITs are the same, and can vary by manager. For that reason, investors should discuss with their managers:

- How onboarding and contracting is executed,

- Whether the manager has or maintains a crossing program and

- What historical estimated transaction cost savings they’ve earned for specific CIT strategies.

Figure 3: The State Street Advantage

Against the criteria detailed here, State Street delivers:

Fund Performance |

|

Size and Scale |

|

Vehicle Offering |

State Street offers a wide range of investment vehicles, including CITs, which provide a unique set of benefits:

|

Source: State Street Global Advisors.

Note on internal crossing specific to “Vehicle Offering” section: Availability of internal crossing at State Street Global Advisors may be affected by your asset class, vehicle type, jurisdiction or other factors.

Beyond Fees

Given the attention paid to fees over the past few years, selecting an index manager has become somewhat of a “passive” process. Today, fees have settled to record lows and investors are now looking for alternative ways to evaluate index funds. Performance, size and scale, and the index vehicle are meaningful dimensions to incorporate into the due diligence process and will most likely offer a new and fresh perspective on the index marketplace. Choosing the right index manager matters — and asking better questions will help separate the rigorous from the regular.