Expectations of Near-Term Multiple Rate Cuts Are Premature, Data Suggests

- Since early May, the markets have been signaling a higher chance for a rate cut at the June 19th meeting of the Federal Reserve Bank due to rising US-China trade tensions.

- This article will examine if recent macroeconomic conditions have changed and warrant a change in expectations for a rate cut.

Since US-China trade tensions began re-escalating in early May, market participants’ views of likely Fed policy for the remainder of the year have shifted dramatically. As of June 12, there was a 20% market implied probability of a rate cut at the June 19 meeting and an 80% chance of a cut in late July. Contrast this with two months ago, when investors saw virtually no chance of a June cut and only a 10% possibility of one in July. Moreover, this is just the beginning, as multiple rate cuts are now priced in over the next 12 months. It may be hard to believe (but we assure you it’s true) that as recently as February, the Federal Open Market Committee (FOMC) itself was still penciling in two rate hikes for this year.

What Does the Data Say?

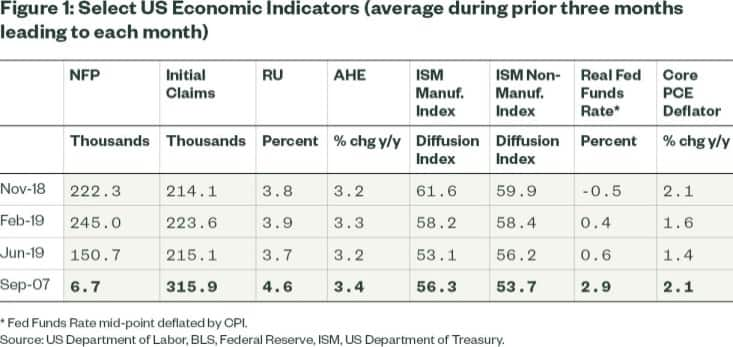

A natural question under these circumstances is whether changes in macroeconomic fundamentals over the last few months warrant this drastic shift in rate expectations. Given the Fed’s dual mandate, we investigate several variables relating to both employment and inflation performance. A summary table is presented below, comparing recent performance to conditions prevailing in September 2007, the last time the Fed initiated an easing cycle.

Employment and Growth Numbers Provide No Basis for Near-Term Cuts

In aggregate, current employment and growth data provides no basis for the Fed to pre-emptively ease policy. While the pace of job creation has slowed noticeably, on average, over the last several months, it remains above levels necessary to keep the unemployment rate stable. Initial unemployment claims remain low and job openings are close to record highs.

Admittedly, labor market indicators are among the slower-moving signals as to the health of the economy. But in today’s context, where many risks on the horizon relate to unpredictable (and easily reversible) policy actions such as tariffs, perhaps there is particular value in looking beyond the noise and considering some of these more stable data sets. After all, the manufacturing/industrial sector is by nature more prone to up and down cycles, but these do not always translate into broader economic weakness—as happened in 2016.

We value employment data because employment provides household income stability and household income stability engenders consumption stability. Remember: if the consumer and services hold, the economy holds. It is also interesting to note signs of revival in the housing sector, including the recent spike in mortgage refinancing applications: not only should this free up cash for those able to refinance, but data trends suggest housing could be a stabilizing force in this latter part of the cycle, rather than a contributor to its demise.

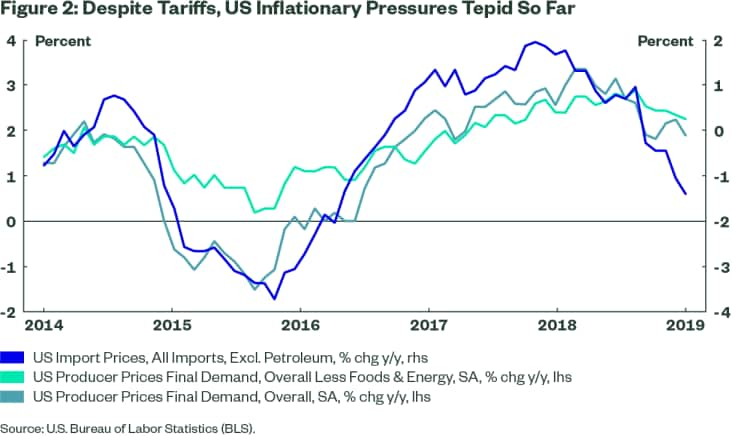

“Inflation” Argument Remains Weak

Recent inflation data could perhaps be seen as providing circumstantial support for a more accommodating stance. In a recent speech to the New York Economic Club, Fed Vice-Chair Clarida noted that “the range of plausible estimates for u* [the natural level of unemployment] may extend to 4% or even below” and that “indicators suggest that longer-term inflation expectations sit at the low end of a range that I consider consistent with our price-stability mandate.”

However, we view an inflation-based argument as a “slower moving” argument compared with a “meaningful shock” argument (since such a shock threatens to tank the economy in short order and therefore demands a quick policy response). Indeed, as a first order response, we believe that the implication of Clarida’s speech is that the Fed’s current “patient pause” can be extended further, even in a best-case macro scenario, rather than that rate cuts are urgently needed right now.

Recent inflation data presents an interesting conundrum for the Fed. There is the obvious challenge that, having described the current inflation softness as “temporary”, responding to it by cutting rates would imply the weakness is actually persistent. One would at the very least expect the Fed to clarify its views before acting.

The other tricky aspect is that low inflation in the context of solid wage gains (most measures of wage inflation are close to cyclical highs) boosts real incomes, supporting household consumption and further undermining any growth-related arguments for such a cut. Indeed, US wage inflation is robust and measures of worker confidence are high. The share of voluntary job leavers relative to the unemployed population remains near its cycle high, as is the labor differential in the Michigan consumer confidence survey. The Atlanta Fed wage rigidity index is at a cycle low, all of which suggest that wage inflationary pressures continue to build.

Moreover, the labor force participation rate has actually relapsed recently, somewhat challenging the Fed’s lately embraced assumption (underpinning their staff forecasts) that “projected employment gains would manifest in smaller-than-usual downward pressure on the unemployment rate and in larger-than-usual upward pressure on the labor force participation rate”.

The combination of all the above should, under normal circumstances, prompt the Fed to consider tightening, not easing. Admittedly, these are not normal circumstances (given the possibility of a serious shock from trade, late-cycle dynamics, etc.), but is the Fed ready to fully discard the Phillips curve (a model that describes the inverse relationship between unemployment and wage inflation) as an indicator of where rates should be? And, even if such wage inflation does not translate into broad-based inflation because of productivity gains (a possibility articulated by Clarida), that would imply a higher potential growth rate, which then undermines the rate cutting argument from a different angle.

Complications of Cutting Rates While Reducing the Balance Sheet

Finally, either a July or a September rate cut would present the additional (and unusual) complication of the Fed cutting interest rates while still reducing its balance sheet, the latter being directionally a tightening action. Our sense is that any really bad news on the trade front (such as expanding tariffs to all imports from China) would overshadow worries over such an apparent contradiction—and in fact could cause the Fed to end runoffs sooner—but that, absent such developments, the Fed has one more reason to hold fire for now.

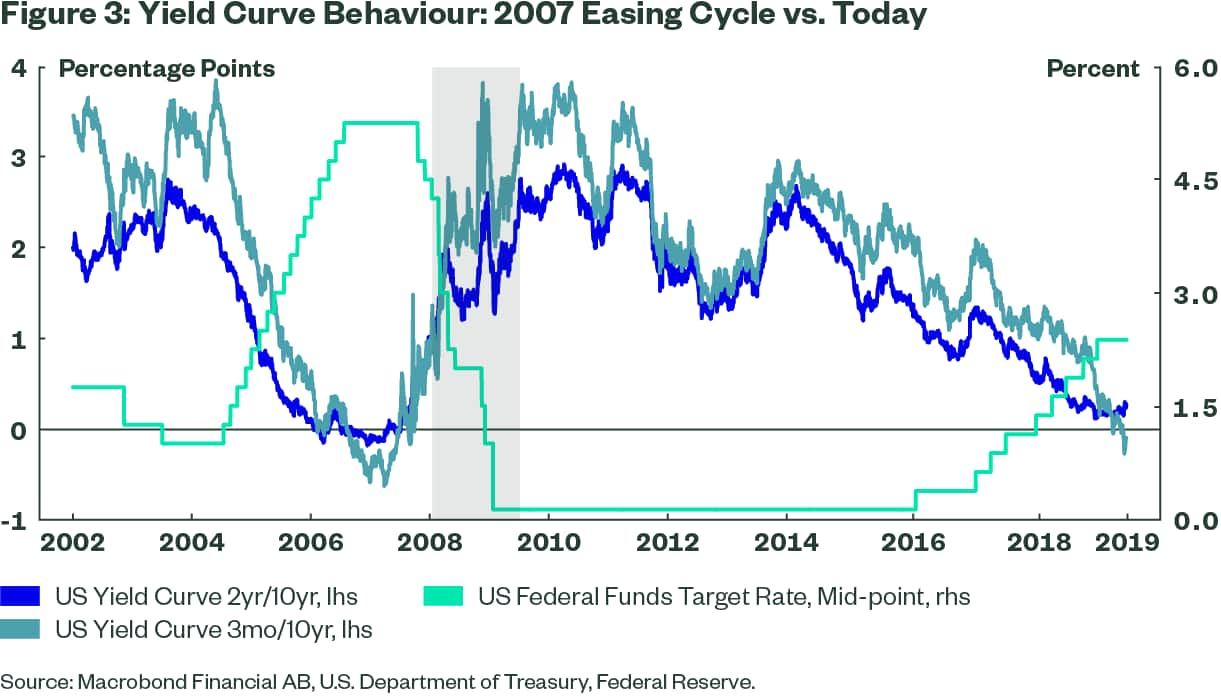

What Does The Yield Curve Say?

This leaves the yield curve as another possible reason for the Fed to pre-emptively cut. Parts of the yield curve have indeed inverted recently, but we are doubtful that this is sufficient justification in and of itself for a near-term rate cut. Certainly, the Fed may wish to be more pre-emptive than usual given the proximity of rates to historically low levels, but it is unclear whether cutting now would create more policy space down the line or could actually limit that space by creating a situation where the Fed cuts, the data subsequently improves, yet the Fed is then reluctant to walk back the cut(s). It is also interesting to note that the entire curve was inverted for a year or so before the Fed actually began easing in 2007. By the time they cut, the inversion had actually corrected. Even if “this time is different” we can’t help but wonder if it’s really that different!

Conclusion

Recent Fed communications have made it clear that the Fed stands ready to act if necessary. Such a stance is commendable and puts a floor under markets for now. Moreover, Chair Powell’s promise that the FOMC stands ready to “act as appropriate” to sustain the expansion seems credible precisely because the Fed actually has considerably more policy space than any of the other major central banks. However, it is still an open question as to whether acting right away to reduce rates is necessary. The markets seem convinced that the answer is yes. We tend to side with the data, which seems to suggest that the answer is no. This is especially so given that the macro outlook is exceedingly dependent on the outcome of trade negotiations between US and China. The G20 meeting at the end of June could provide some clarity one way or another, and we will reassess our interpretation at that point, but for now, market pricing of multiple rate cuts appears premature.