Identifying Sustainable Outcome Investments

This third article in our series on Sustainable Outcome Investing examines methods for identifying investments that aim to generate sustainable outcomes.

The first two articles in our series on Sustainable Outcome Investing (SOI) introduce the sustainable investing spectrum of capital and clarify SOI’s position within it. The previous articles also define SOI and explain its relevance for investors seeking alignment with specific sustainable outcomes.

This article addresses the identification of sustainable outcome investments. Three concepts form the foundation of this identification framework: asset contribution, theory of change, and alignment with the UN Sustainable Development Goals (SDGs).

Asset contribution

Asset contribution refers to identifying assets whose products and services intend to contribute to sustainable outcomes. This identification process employs a range of key performance indicators (KPIs) that are linked to companies’ products and services.

Revenue from products and services aiming to contribute to a sustainable outcome is a prevalent KPI used to identify and measure outcomes, as it can be obtained or derived from data reported by companies. The framework includes two revenue KPIs: the percentage of revenue deemed to contribute to sustainable outcomes relative to a company’s total business, and the absolute amount of such revenue generated. The latter allows for the incorporation of outcomes created by larger companies that might be obscured if assessed only as a percentage of the overall business.

Where available, the framework also includes capital expenditure invested in products and services aiming to contribute to sustainable outcomes, such as renewable energy capital expenditure.

Our research indicates registered patents can serve as another KPI for identifying sustainable outcome investments. Patents can serve as a proxy measure for innovation and provide a forward-looking method for aligning innovations with sustainable outcomes. This metric can help identify companies supporting early-stage innovation with potential for future revenue growth from activities that aim to generate sustainable outcomes, even if that revenue may be below pre-defined thresholds currently.

Product-specific outcome measures are another category of KPIs in the framework. These include metrics such as renewable energy generated, which help identify and measure the tangible outputs and outcomes from a company’s products and services.

The framework also incorporates criteria to assess where a company may undermine the achievement of a sustainable outcome, even when identified as contributing to outcomes through its products and services. Companies identified with such undermining activities are not classified as sustainable outcome investments under this framework. This consideration of negative asset contribution is designed to reflect the full scope of a company’s attributes to a given sustainable outcome.

Theory of change application

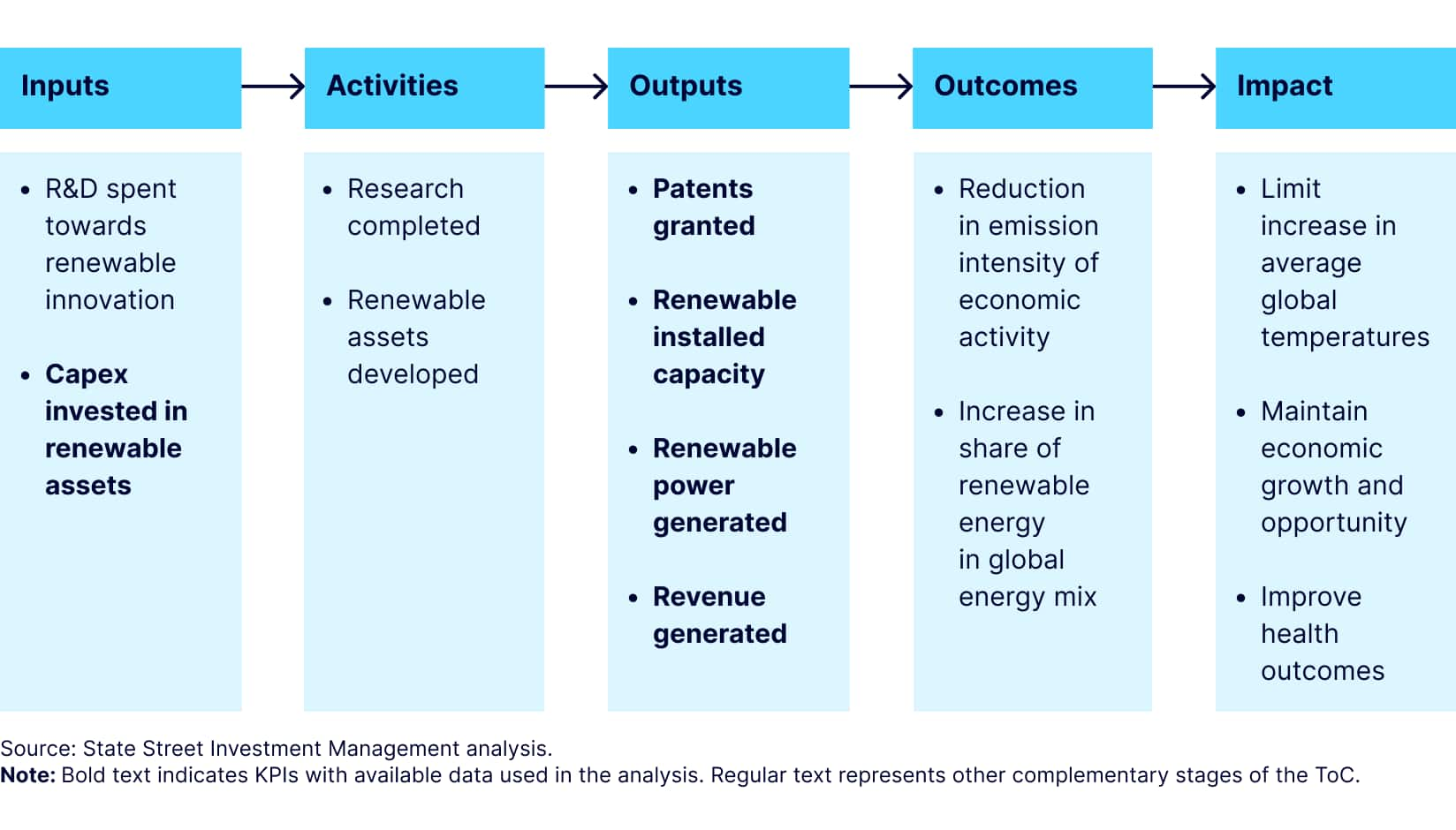

As discussed in the previous article in this series, a theory of change (ToC) provides a methodology for mapping how company activities can lead to sustainable outcomes. A ToC can be used to articulate how companies, identified via the framework’s KPIs, contribute to a stated sustainable objective. To facilitate this linkage, each KPI used in the framework is mapped to a specific step in the ToC logic chain.

For example, Figure 1 illustrates how several KPIs (shown in bold) align with a ToC that outlines the assumed pathway through which developing affordable clean energy could reduce pollution and help mitigate the effects of rising global temperatures.

Figure 1: Mapping KPIs to the Theory of Change for SDG 7

SDG alignment

A third concept underpinning the framework is alignment with the UN SDGs, which involves linking the KPIs used to identify asset contribution to the SDGs and their underlying targets. Within this framework, each KPI is aligned with sustainable outcomes, and each criterion identifying activities that may undermine them, has been mapped to the SDGs using an evidence-based approach. For example, the ToC and KPIs shown in Figure 1 correspond to SDG 7: Affordable and Clean Energy. This mapping can serve to validate the use of these KPIs and to facilitate the implementation of targeted SDG alignment for specific objectives.

Conclusion

This article outlines a framework for identifying sustainable outcome investments, designed for investors targeting such outcomes alongside a financial return. The framework employs KPIs for identifying contributions and criteria for identifying exclusions, mapping them to specific SDGs through a theory of change.

This process is designed to facilitate both the identification of assets contributing to a sustainable outcome objective for portfolio construction and the measurement of those outcomes. As such, the SOI framework provides a structured approach for investors seeking to identify and measure contributions to sustainable outcomes within their investments.