A Big Moment for US Small & Mid Caps?

- US small and mid cap equities look well suited for the current macroeconomic environment, given their relatively undemanding valuations, rebound potential and domestic profile.

- While US small and mid caps are more cyclical than large caps, and thus more volatile, smaller companies have performed favourably in past recessionary periods and may now present an opportunity.

- Download our full report for further analysis.

Small and Mid Caps: What Are They?

The most important element of the definition of small and mid caps is market capitalization. The Russell 2000 Index, which is one of the most popular small cap exposures, aims to include the smallest 2000 stocks out of the Russell 3000 universe. The median market cap of constituents within the index is $927 million, or well within the traditional band of $300 million to $2 billion one would expect for small cap companies.

Similarly, the median market cap of stocks within the S&P MidCap 400 Index, which is a well known US mid cap exposure in the US, is $4.9 billion, again within the typical band of $2 to $10 billion for mid cap companies. The ranking method used by both index providers is relatively simple, yet at the same time important as they allow investors to maintain exposure toward small and mid cap companies in an otherwise highly concentrated US equity market.

There are misconceptions, particularly about small cap companies, as some investors believe they are predominantly start-ups. In the US, there will be certainly be a share of companies early in their life cycle, such as in the biotech or software industries, reflecting the innovative start-up culture. But the median market cap in the small cap index is close to $1 billion, suggesting a wide breadth of maturity of businesses.

Can the Size Premia Return?

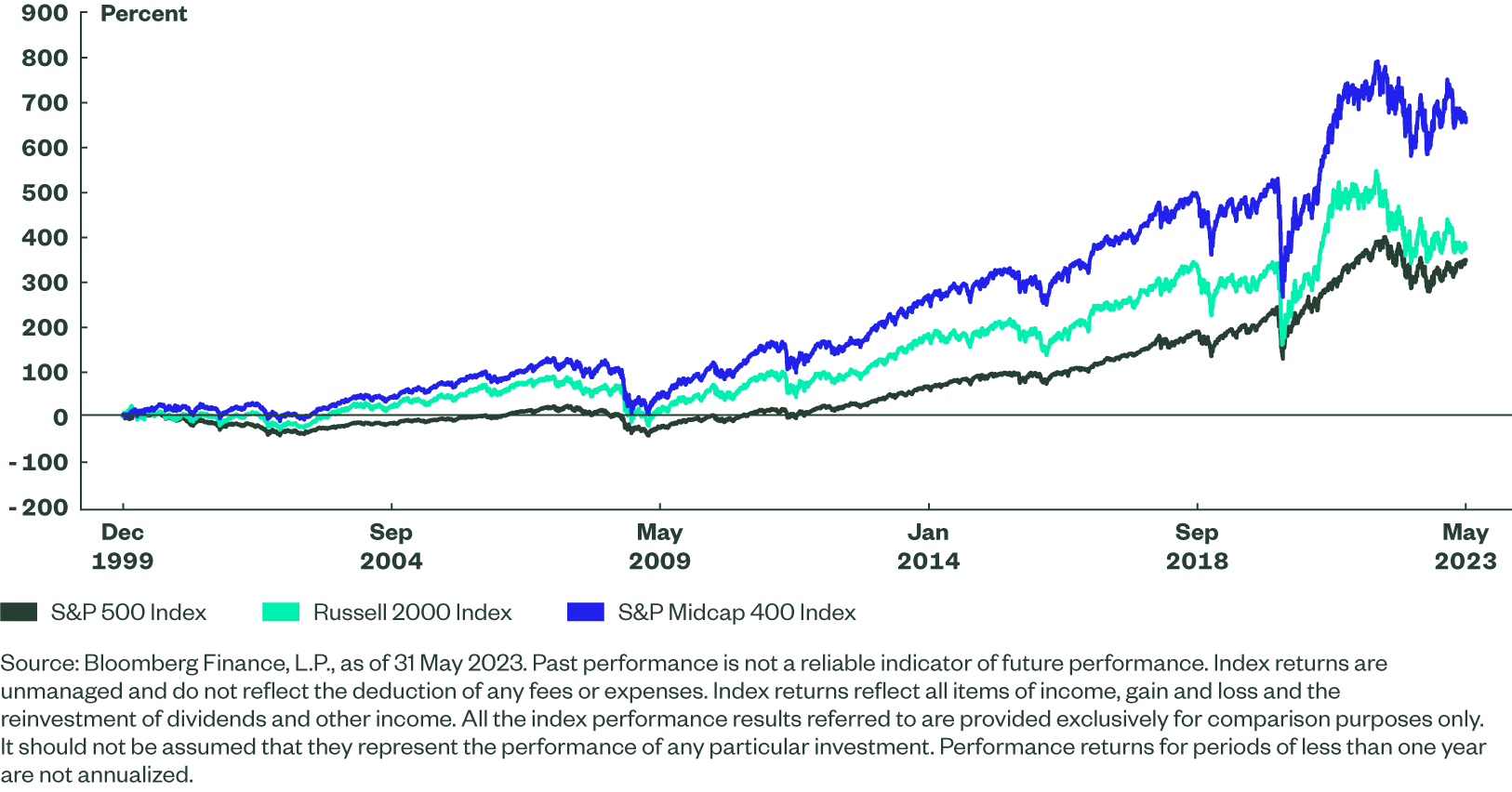

Looking at long-term performance, both small and mid cap companies have enjoyed size premia. Mid caps have fared particularly well, delivering double the return of the S&P 500 since the beginning of the year 2000. Small cap companies have outperformed their large cap cousins over the longer run, as documented by Eugene Fama and Kenneth French.1

Naturally, the size premia depend on the chosen time horizon and macroeconomic backdrop. Size premia disappeared over the past five to six years, as S&P 500 returns were driven by the rise of tech giants and FAANGs, which were supported not only by the promise of continuous growth but also by extremely low interest rates. Most recently, in 2023, after a brief rally in January, small and mid caps once again underperformed as a regional banking crisis and debt ceiling issues weighed on the growth outlook and brought yields down. These challenges again benefitted the S&P 500 relative to smaller cap companies.

Figure 1: Cumulative Performance Since the Beginning of 2000

Is It Worth Investing in Small and Mid Caps Around Recessions?

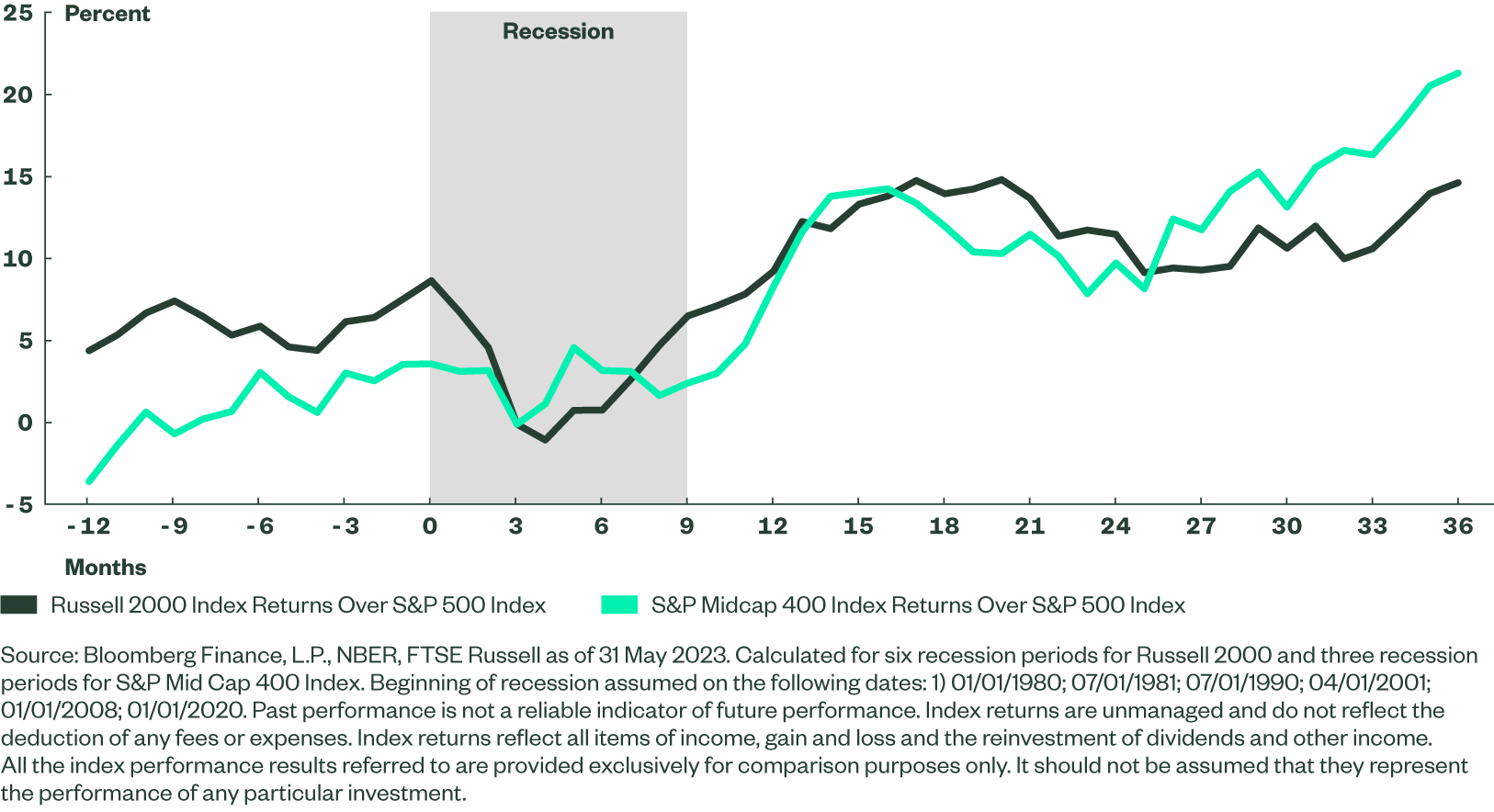

Global growth is slowing and the US economy is no exception as the impact of tighter policy becomes clear. The broad expectation is that recession in the US is not inevitable but quite probable, with consensus suggesting a 65% probability of recession later this year and -0.5% growth in Q3 and Q4.2 If a recession materializes, it will likely be shallow and relatively short. In any case, the US economy should bottom out over the next few months. For that reason, we examined how small and mid cap equities have performed on a relative basis versus large caps during past recessionary periods. We have based our analysis on the past six recessions, spanning 45 years, for the Russell 2000 Index and past three recessions, or 25 years, for the S&P MidCap 400 Index.

Historically, on average the best time to invest in small and mid caps was approximately three to four months into the recession and to hold these exposures for the next one to three years. This timeline would bring the strongest returns relative to investing in large caps.

At first glance, it may sound counterintuitive that investing in smaller, more risky companies during the slowdown can yield such results. However, markets are not exactly the economy and investors understandably always look forward, trying to price in the economic outlook, assess risks and opportunities, and position accordingly. On the one hand, investing too early may bring pain coming from cracks in the economy, but investing too late may result in missing a rally as markets can move quickly once the skies clear, risks become known, and investors position accordingly.

Initially, the rebound in small caps in particular has historically been preceded by the outperformance of large caps in the beginning of the recession as investors took a more defensive posture. Interestingly, in the current cycle this may be exactly what we have observed since February.

The regional banking crisis and the debt ceiling issues justified volatility but both challenges were resolved in an elegant manner. The regional banking crisis was answered with a guarantee on the deposits of distressed banks and, more recently, debt ceiling disputes were resolved before 5 June, preventing spillover of negative consequences into the real economy. In this environment, the key risk is that high interest rates break something – but we may not know what it would be in advance. Smaller, more domestically oriented companies are naturally sensitive to such challenges, as we observed over the past several months.

For that reason, the resolution of the regional banking crisis and debt ceiling issues are pivotal. Resolving these challenges helped not only to mitigate current risks but also to demonstrate that if new headwinds appear, the US government or another US institution will act responsibly. This may also turn out to be a catalyst that could allow small and mid caps to start outperforming larger stocks, as observed during past recessions. Looking at performance in early June, the initial signs are encouraging.

Figure 2: Average Returns of US Small and Mid Cap Equities Over S&P 500 During Past Recessions

Labour Market is the Key

We are in the period of slowing growth with potential technical recession followed by a rather gradual recovery. The positive element is that disinflationary forces are in motion, with supply chain pressures easing significantly. Headline CPI fell to 4.0%, the lowest reading since March 2021. Interest rates may have peaked but, in any case, we will need to wait at least several months before the Fed starts cutting rates.

What is arguably the most important element of the US economy for the small and mid cap story is the remarkably strong US consumer. Interest rates have been rising for more than a year and monetary policy has worked – inflation is moderating. This outcome was achieved without destroying the labour market, which is as strong as ever, and unemployment sits at 3.7%, which is one of the lowest readings since 1969.

The extremely low unemployment is not the only sign of consumer resilience in the US. Job openings recently surged to 10.1 million (or well above estimates), PCE has been robust at +0.4% and wage inflation is +0.3%; these are signs of a resilient US consumer.

Against tight monetary policy and economic slowdown, the resilient US consumer is pivotal to small and mid cap companies. Of note, 82% of revenue for companies within the Russell 2000 and 76% of revenue for companies within the S&P MidCap 400 is generated within the US. Forthat reason, the resilience of the labour market is important for smaller companies to thrive, even during periods of economic slowdown.