US IG Credit – Sticking Close to Benchmark

The State Street Global Advisor’s approach to Corporate ESG ETFs has been to develop indices that have similar risk characteristics to the broader market weighted benchmarks. An attribution on the performance of the Bloomberg SASB U.S. Corporate ESG Ex-Controversies Select Index against the market weighted parent index suggests some benefits from lower levels of volatility, with both sector and security selection supporting the performance of the Bloomberg SASB index during times of stress. This should provide confidence that the strategy is suitable for use as a core building block for benchmark-aware ESG investors.

ESG Investing for Benchmark Aware Investors

SPDR ETFs offer a slightly different approach to ESG investing through the tracking of the Bloomberg SASB Corporate ESG ex-controversy Select family of indices. The market weighted Bloomberg index initially goes through a screening process to remove controversial issuers. The index is then optimised with the dual objectives of favouring those issuers with a high ESG score (State Street Global Advisor’s own R-Factor methodology) while at the same time trying to align the characteristics of the new Bloomberg SASB index with those of the parent index. More details on how this family of indices is constructed can be found in our SPDR Bloomberg SASB overview.

The flagship Bloomberg SASB U.S. Corporate ESG Ex-Controversies Select Index has delivered a remarkably consistent performance versus the parent market weighted index over the last 5 years (see Figure 1). Returns in the 1, 3 and 5 years to the end of January 2024 have been just slightly above those of the Bloomberg US Corporate index while volatility over the longer run has been lower. This results in a slightly higher Sharpe ratio for the ESG index and should give investors some confidence that this strategy is suitable for use as a core building block for benchmark-aware ESG investors.

Figure 1: Returns and volatility of the Bloomberg SASB US Corporate ESG Ex-Controversies Select Index versus the parent index

| Annualised Return (%) | Annualised Volatility (%) | Sharpe ratio | ||||

|---|---|---|---|---|---|---|

| 31/01/2024 | Bloomberg SASB US Corporate ESG Ex-Controversies Select Index | Bloomberg US Corporate Index | Bloomberg SASB US Corporate ESG Ex-Controversies Select Index | Bloomberg US Corporate Index | Bloomberg SASB US Corporate ESG Ex-Controversies Select Index | Bloomberg US Corporate Index |

| Last 1 year | 4.22% | 4.16% | 9.61% | 9.63% | 0.43 | 0.42 |

| Last 3 years | -2.90% | -2.92% | 9.28% | 9.25% | -0.29 | -0.29 |

| Last 5 years | 2.34% | 2.12% | 8.64% | 8.88% | 0.3 | 0.26 |

Source: State Street Global Advisors 31 January 2024

Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income as applicable.

Understanding the Drivers of Returns

While the top level performance of the Bloomberg SASB US Corporate ESG Ex-Controversies Select Index looks similar to the market weighted index, it is important to understand how the index screening and optimisation processes affect performance. To better understand what is going on ‘under the hood’ of the ESG index we have run quarterly hybrid performance attributions on data since Q4 2019 to see how it has performed.1 This is a testing period of history that has seen more than its fair share of volatility, with the Covid crisis, the invasion of Ukraine, Silicon Valley Bank run and an aggressive Federal Reserve tightening cycle.

The attribution is split into its standard components: yield curve, sector and security allocations as a means to try to ascertain the key sources of returns driving the relative performance of the Bloomberg SASB US Corporate ESG Ex-Controversies Select Index versus its parent.

The Yield Curve or Duration as a Driver

One of the constraints within the index optimisation run by Bloomberg is the Option Adjusted Duration which must be within 0.15 years of the parent index. In theory therefore, duration positioning should have a limited impact on the SASB index performance versus the market weighted one. There have, however, been some meaningful swings with an underperformance (negative bar in Figure 2) of the Bloomberg SASB US Corporate ESG Ex-Controversies Select Index against its parent index in Q1 2021 of 8.9bp. The following quarter most of that underperformance reversed (+7.9bp). Q2 2022 also saw a material underperformance of 6.6bp while the final quarter of 2023 saw the SASB ESG strategy outperform. In aggregate, duration mis-matches have been a small drag on performance of the Bloomberg SASB ESG index of around 0.5bp per quarter.

Unsurprisingly, several of these larger swings in relative performance have coincided with broader moves in market yields. There is some limited evidence of directionality, for instance, Q1 2021 saw a big upswing in the yield on US credit from its all-time lows at the end of 2020, which resulted in a negative drag from duration positioning. Likewise, the big rise in yields in 2022 resulted in 4 quarters of outperformance by the market weighted index strategy. Conversely, the big rally in rates in Q4 2023 saw the SASB index outperform by 4.6bp. This suggests that there is a tendency, albeit weak, for the duration component of the Bloomberg SASB index to outperform in an environment where rates are heading lower.

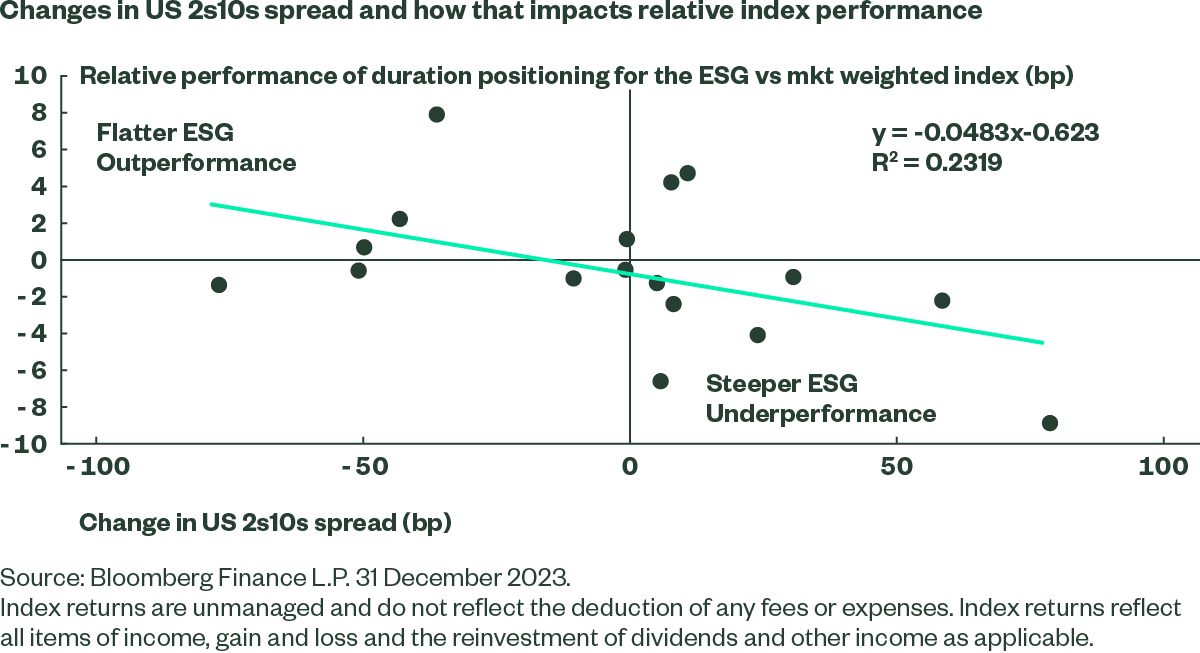

Looking at the US curve slope (2s10s in US Treasuries) regressed against the relative performance of the Bloomberg SASB ESG index something similar can be seen. The Bloomberg SASB ESG index has had a tendency to perform slightly better than its market weighted counterpart due to its duration positioning when the curve is flattening (Figure 3). Combining these two observations, an environment where the curve is bull flattening has typically been more constructive for the Bloomberg SASB ESG index from a duration positioning perspective.

Figure 3

Sector Allocations

The Sector asset allocation element of the attribution should provide information on how sector mismatches between the Bloomberg SASB ESG index and the market weighted parent drives their relative performance. The optimisation process for the ESG index does ensure some sector alignment but this constraint is only at Bloomberg level 2 (Financials, Industrials and Utilities) with each sector needing to be within 200bp of the weight of the parent index. This allows for a materially different exposure at the Level 3 breakdown as can be seen from Figure 4 which shows the over and under weights that the Bloomberg SASB ESG index has to the Bloomberg US corporate index.

Over the whole period in question the attribution suggests that there has been a marginal outperformance for the Bloomberg SASB index of 0.7bp per quarter that has been derived from sector allocations. However, the excess returns have a standard deviation of 18.5bp highlighting the meaningful divergences in performance that can occur over a single quarter. Figure 5 shows the maximum outperformance that has occurred due to differing asset allocation was 68bp in Q1 2020 as Covid hit the credit market. The breakdown by sector illustrates that the underweight at the time to Energy (-4%), Insurance (-2.3%) and Transport (-2.1%) coupled with an overweight to Tech (+5.4%) were the key sectors driving the stronger performance of the ESG index.

That outperformance of the Bloomberg SASB ESG index then unwound over the following 4 quarters as intervention from the Fed supported the less liquid, lower quality areas of the US credit market. This hints at a more defensive allocation than the standard market weighted index. However, each crisis has different drivers and, while neither the invasion of Ukraine nor the troubles in US banking have produced anywhere near the same magnitude of out or under performance, in Q1 2023 (the Silicon Valley Bank failure) the Bloomberg SASB ESG index overweight to REITs acted as a drag on its relative performance.

Security Selection

The attribution suggests that Security Selection has had an even greater bearing on relative returns than asset allocation. It has provided a significant contribution to the outperformance of the Bloomberg SASB ESG index of +4.4bp, on average, per quarter since Q4 2019.

As is evident from Figure 6, security selection during the Covid crisis was the key driver of the significant outperformance of the Bloomberg SASB ESG index versus its market weighted counterpart (+86.7bp in Q1 2020). The lower weight towards Energy and the type of Energy providers selected for inclusion in the Bloomberg SASB ESG index accounted for 76.5bp of the outperformance.

Most of the outperformance as a result of security selection was given back in the following quarter (-75.7bp), but since those wild swings security selection has provided a 4.5bp uplift to the performance of the Bloomberg SASB ESG index versus its parent. Much of this has come through during crisis times. The invasion of Ukraine saw the Bloomberg SASB ESG index outperform by 7.6bp and the US banking wobbles by 13.0bp.

Not all market backdrops will favour those securities with a stronger ESG profile. The Bloomberg SASB ESG index had a challenging time in Q3 2022 as the bear flattening of the US yield curve weighed on the banking sector. At the same time, Tech and Communications sectors were suffering from their association with long duration assets. However, security selection has contributed to performance since then with an outperformance by the ESG index up until Q4 2023 when the dramatic fall in yields boosted returns from a broader range of securities. The aggressive tightening in credit spreads seen during this period typically helps lower rated, less liquid bond issues the most. An analysis of the performance of these two indices and how that interacts with the changes in the Option Adjusted Spread suggests that credit spread tightening is associated with an outperformance by the market weighted index.2 As the old adage goes: the rising tide floats all boats.

Conclusions

This attribution suggests that there have been some stabilising effect on returns from the use of ESG screening for the Bloomberg SASB US Corporate ESG Ex-Controversies Select index. In particular, during the Covid crisis in Q1 2020, the substantial negative index returns seen in investment grade credit were partially offset by the strong positive contributions from both the asset allocation and security selection of the Bloomberg SASB ESG index. Conversely, the lower returns for the Bloomberg SASB ESG index than for the parent index during the aggressive Q2 2020 credit rebound will have contributed to lower levels of volatility. Subsequent crises have been less dramatic but the Bloomberg SASB ESG index has posted higher returns than the Bloomberg US Corporate index of 11.9bp in Q1 2022 (Ukraine) and 5.3bp in Q1 2023 (Silicon Valley Bank), despite the drag on performance from higher exposure to REITs.

Netting out the the duration, sector and security allocation effects suggests little conclusive evidence that either the overall direction of the US Treasury market or the curve slope has a significant bearing on relative returns. There is, however, some evidence that a widening in credit OAS spreads leads to a better performance from the Bloomberg SASB US Corporate ESG Ex-Controversies Select index, also underlining its defensive attributes.