Climate Stewardship

At State Street Global Advisors, we believe that managing climate-related risks and opportunities may be a key element in maximizing long-term value for our clients. Climate-risk management has been a theme of our Asset Stewardship Program for several years.

Our Approach to Climate Stewardship

We believe it is important to encourage the companies we invest in on behalf of our clients to consider material long-term risks and opportunities that can impact value creation and financial performance. We assess a range of material risk drivers, including those relating to ESG/sustainability factors, and seek to understand how companies address these risks and maintain sound governance and oversight practices.

At State Street Global Advisors, we believe that managing climate-related risks and opportunities may be a key element in maximizing long-term value for our clients. Our climate stewardship efforts are built around three pillars: proxy voting, company engagement, and thought leadership. Through our thought leadership, we provide both transparency to the market on our views and guidance for companies on our disclosure expectations. Through our engagements, we better understand how companies are effectively managing and disclosing climate-related risks and opportunities and encourage enhanced disclosure in line with our expectations. As our climate stewardship efforts evolve, we are committed to thoughtful engagement, maintaining our disciplined approach to proxy voting, and serving as pragmatic partners to companies.

Climate-related Voting

Director Elections

We have a longstanding commitment to enhance decision-useful disclosure on climate risk management and have encouraged our portfolio companies to report in accordance with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) since we first endorsed the framework in 2017. In 2022, we began taking voting action against directors of companies in the S&P 500, S&P/TSX Composite, FTSE 350, STOXX 600 and ASX 100 indices where the companies fail to provide sufficient disclosure regarding climate-related risks and opportunities in accordance with TCFD. In 2023, we expanded the universe of companies subject to this voting guideline to include the ASX 200, TOPIX 100, Hang Seng, and Straits Times indices. We voted against directors at over 130 companies in 2023 for lack of sufficient climate-related disclosure or oversight.

Our Environmental Voting Record

Voted against directors at 151 companies for lack of sufficient disclosure in line with TCFD per our voting guideline in 2022

Voted against directors at 132 companies for lack of sufficient disclosure in line with TCFD per our voting guideline in 2023

Supported 14% of environmental shareholder proposals in 2023 1

Source: State Street Global Advisors, as of December 31, 2023

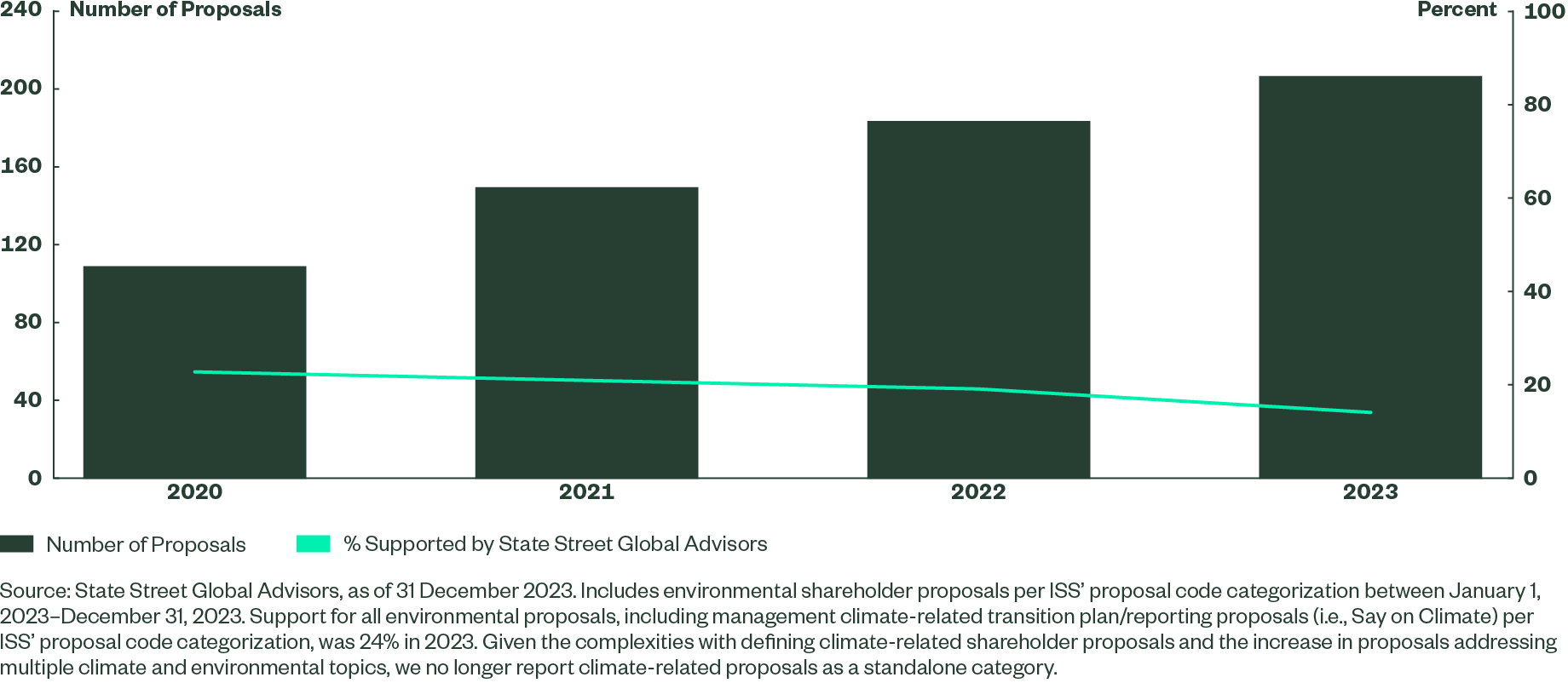

Environmental Proposals

We voted in favor of 14%2 of environmental shareholder proposals in 2023. As shown in the figure below, our support for environmental shareholder proposals decreased over the last two years. The decline in our support is attributed to several factors. There has been an increase in the number of environmental proposals; for example, we voted on 206 environmental proposals in 2023, compared to 183 in 2022. With this increase, the proposal topics, nature of proposals filed, and targeting of proposals have all evolved.

In recent years, there has been an evolution of proposals that use increasingly prescriptive language. Proposal language has moved from disclosure-focused to requesting changes to corporate practices or policies. For example, there has been an increase in proposals calling for the phasing out of a product or business line within a defined timeframe, increasing or decreasing investment in certain products, and decommissioning assets, which we generally do not support. In 2023, there was also continuation of proposals filed with companies where disclosures have improved. Proposals of the same climate topics were refiled with the same companies year over year, despite many companies providing enhanced disclosure and responsiveness to our engagements. Where we viewed enhanced disclosures to be in line with State Street Global Advisors’ expectations, we did not support these proposals. Further, an increasing number of proposals this season targeted emerging topics that are not yet well defined or for which consistent market expectations or frameworks are not yet widely available. Further information can be found in our Q2 2023 Stewardship Activity Report and in our voting bulletins.

Support for Global Environmental Shareholder Proposals Over Time

Climate-related Engagement

We conducted over 160 climate-related engagements in 2023. These included dialogues with boards, management, and other company representatives. Through our conversations, we aim to understand how companies are managing and overseeing climate-related risks and opportunities and financial planning processes. During engagement, we seek to foster constructive, long-term relationships with issuers.

Our engagement approach leverages the four dimensions of the TCFD Recommendations:

- Governance

- Strategy

- Risk Management

- Metrics and Targets

Engagement Campaigns

In the off-season, we conduct engagement campaigns that focus on a particular topic or a theme. The intended outcomes are to either help inform our views or to encourage improved disclosure on a particular topic. We initiate these meetings and drive the agenda according to the relevant campaign.

Climate Transition Plan Disclosure: We seek to understand and assess how companies are managing the climate-related risks and opportunities that are material to their business, including those presented by the transition to a lower-carbon economy. In 2022, we began conducting engagements with companies across sectors in our portfolio, including high emitters, to discuss their climate transition plans and share feedback on improving disclosure in line with our disclosure assessment criteria. We held 90 climate transition plan engagements in 2022 and 85 in 2023. As we continue to develop our climate stewardship efforts, we seek to enhance our engagement with companies in carbon-intensive industries.

Methane Emissions in the Oil and Gas Industry: In 2022, we initiated a series of engagements with more than 25 global companies across the upstream, midstream, and downstream oil and gas value chain to better understand efforts related to managing methane emissions. Through our engagements, we aimed to better understand each company’s strategy and encourage best practice disclosure on topics including methane detection and monitoring, methane and flaring emissions management, and methane measurement and quantification. We completed this campaign in 2023.

Social Risks related to Climate Transition Plans: Companies and investors are increasingly interested in understanding the potential social risks associated with the transition to a lower-carbon future. In 2022, we conducted a series of engagements with 24 companies in key sectors including Energy, Materials, and Utilities to understand best practices and disclosure trends on managing these risks and opportunities, including those associated with workforce transformation, customer affordability, stakeholder engagement, and supply chain management. These topics are often considered in how to achieve what many refer to as a “just transition,” which companies are beginning to address in their disclosures.

Financing Deforestation Risk: Addressing nature-related risk is a growing focus under our Asset Stewardship program. In 2021, we initiated a series of engagements to learn more about how our investee companies manage deforestation risk stemming from their supply chains. In 2022, we focused our engagement efforts on global banks that finance deforestation-related activities. We engaged over 20 banks on topics including financing decisions related to forest-dependent commodities, deforestation-related climate risk assessments, and the integration of deforestation considerations into companies’ long-term strategy.

Our Engagement Record

Environmental engagements in 2023

Climate-focused engagements in 2023

Climate-focused engagements to date

Source: State Street Global Advisors, as of December 31, 2023.