Energy Transition and Decarbonization: Is Asia Prepared?

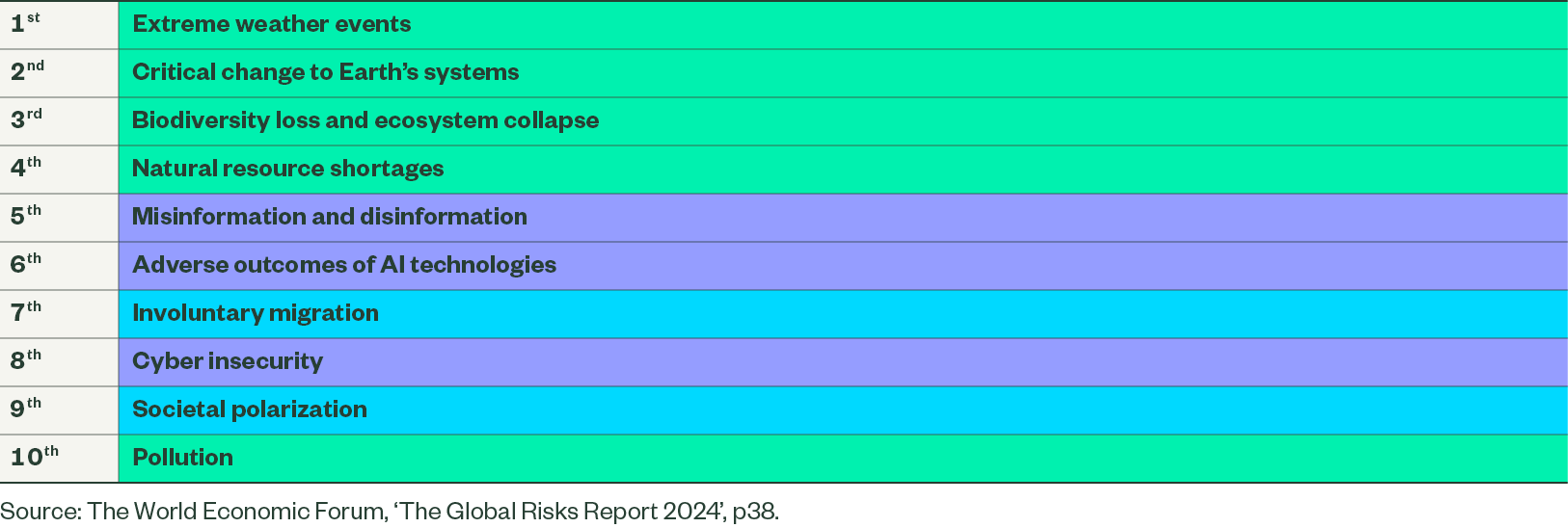

Climate change has the potential to disrupt economies worldwide and challenge companies across sectors and geographies, to varying degrees. As highlighted by the World Economic Forum’s ‘Global Risks Report 2024’, failure to mitigate climate change and adapt remains a serious risk. As shown in Figure 1 below, around half of the top 10 global risks are related to environmental issues and climate change.

Figure 1: Global Risks Ranked by Severity Over the long term (10 Years)

The United Nations' 28th Conference of Parties (COP28) emphasized the importance of enhancing global efforts to strengthen resilience to climate change including global consensus on adaptation targets.1 The global impact of climate change has already been felt across countries and industries, with each region facing its own unique challenges and opportunities.

Some Asian countries may face higher climate adaptation challenges as they are likely to be more vulnerable to the physical impacts of climate change. Based on our analysis of ISS and MSCI research, Thailand, Malaysia and Indonesia may face higher physical climate change risks. In addition to the physical damage associated with climate change, such as loss of life and livelihood, and danger to society and communities, there may be risks for investors from a portfolio management perspective. During the 2011 floods in Thailand, for example, companies experienced major disruptions to their supply chains, posing financial risks to investors.

Many Asian governments have made net zero commitments in an effort to mitigate the effects of climate change. For instance, Singapore and South Korea have committed to net zero emissions by 2050, China by 2060, and Thailand and India by 2065 and 2070, respectively.2 Some regulators in Asia have increasingly aligned their disclosure expectations for companies with recommendations from the Task Force on Climate-related Financial Disclosures (TCFD). The Monetary Authority of Singapore (MAS) and the Securities and Future Commission (SFC) in Hong Kong have likewise introduced disclosure rules on environmental and climate risks for fund managers.

More broadly and from a global perspective, the issuance of global reporting standards on sustainability and climate change by the International Sustainability Standards Board (ISSB) will likely see further interoperability of reporting standards in the future based on these standards.3

To help mitigate climate change and facilitate energy transition, taxonomies have been developed across Asian countries to support sustainable investment activities. China pioneered its first Green Bond Endorsed Projects Catalogue in 2015 and has worked closely with the EU to develop Common Ground Taxonomy (CGT) in recent years. Using a three-tier ‘traffic light’ and Energy Transition Mechanism respectively, both the Association of Southeast Asian Nations’ (ASEAN) and Asian Development Bank’s (ADB) taxonomies included mechanisms to support transition finance.4

As highlighted in a recent ADB report, transition finance is increasingly recognized as a necessary component for effectively addressing climate change, especially in emerging markets where energy demand is growing and power generation and industry is carbon-intensive.5 In Asia’s case, there needs to be a fine balance between the growing energy needs of industries, an emerging middle class, and energy transition.

Climate change is complex and requires investors to employ multifaceted approaches. In addition to working with pure play ‘green’ companies, reducing emissions also requires working with the highest-emitting industries, as some of the best know-how regarding emissions reduction exists within these high emitting companies.6 This will likely facilitate real economy emission reduction and ultimately, support the Paris Agreement goals.

To achieve real economy decarbonization, investors may consider engagement with carbon-intensive sectors to be crucial. Globally, many investors have been engaging with high carbon-intensive companies and encourage these companies to enhance their climate disclosure and align themselves with TCFD recommendations.

In addition to targeting real economy emission reduction, investors have expressed their desire to achieve portfolio decarbonization, and a growing number of investors in Asia, as well as globally, have set decarbonization targets in the past two years. For many large investors, which are near-permanent holders of capital, achieving decarbonization target and at the same time building a low tracking error portfolio to the benchmark is also desirable. Portfolio optimization is often more preferable to simply screening out carbon-intensive industries, in order to manage the tracking error to the benchmark and follow a more inclusive approach in portfolio construction. Portfolio optimization can also help investors address climate mitigation and adaptation in a portfolio context, and achieve a range of climate objectives such as reducing carbon intensity, fossil fuel revenue and reserves, increasing green revenue and green bond allocation (in the case of fixed income portfolio) as well as targeting a range of forward looking climate objectives such as Implied Temperature Rise (ITR), and Carbon Risk Rating which seek to reduce portfolio exposure to physical and transition risks.

The development and adoption of green and transition taxonomies in Asia and globally will likely further support companies to align their activities and enable sustainable growth. Asia’s fast population and economic growth, and potentially keener vulnerability to the physical impacts of climate change, are at the centre of energy and climate transition discussions today, and now is the time for investors to take action.