Currency Moves Sensible, But Overextended

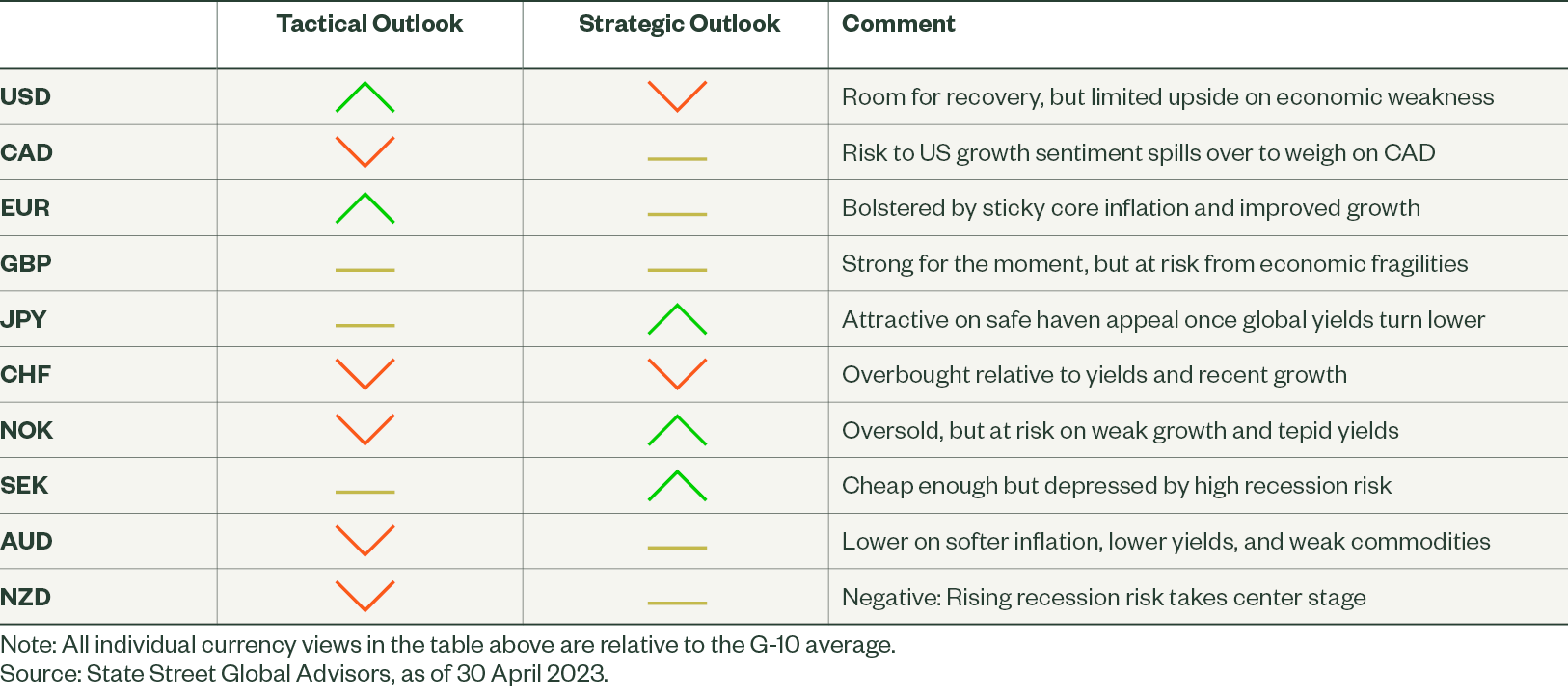

Fading fears of a banking crisis helped global yields rise in April. But the massive global monetary tightening will eventually work to slow credit and demand over the next several quarters. We are tactically positive on the USD, EUR and JPY, but are negative on the CHF, NOK, CAD, NZD and AUD.

The US led the post-pandemic recovery and monetary tightening cycle, and is likely to lead a global slowdown and rate-cutting cycle through 2024. It may be tempting to think of a relative US weakness and a lower US dollar, but restrictive monetary tightening has been global, and the rest of the world is likely to follow the US.

This will make for a bumpy ride, skewing global yields, equity markets, and credit risks to the downside. More defensive currencies such as the yen and the euro are likely winners, while more cyclically sensitive currencies, such as the Australian dollar, the New Zealand dollar, and the Norwegian krone might suffer. The US dollar is stuck in the middle, losing yield and growth support, but bolstered by its role as the preeminent safe haven.

Figure 2: April 2023 Directional Outlook

US Dollar (USD)

We believe the US dollar is in transition from a bull market to a bear market, but the transition will be inconsistent, volatile, and may take the better part of a year. To the detriment of the US dollar, the US economy is slowing, the US Federal Reserve (Fed) pivot is imminent, and the next big move in yields is likely lower. However, US yields and growth may move lower first; we do not see this as a permanent detachment. We expect other major economies to weaken over H2 2023, preserving some US dollar upside risks this year, despite our bearish longer-term view.

Canadian Dollar (CAD)

Our models are negative on the Canadian dollar on weaker commodity price trends, poor relative local equity market performance, and expectations of a deeper economic slowdown. Also, Canada and the Canadian dollar are heavily exposed to the weakening US growth outlook. However, recent economic data in Canada has been surprisingly resilient and the immediate impact of lower US yields benefits the Canadian dollar against both the US dollar and the more cyclically sensitive Australian dollar, New Zealand dollar, and Norwegian krone.

Euro (EUR)

We are positive on the euro on an improving economic outlook, attractive equity performance, and continued European Central Bank (ECB) monetary tightening, while the Fed and a number of other G10 central banks have stopped, or will soon stop, tightening policy. The euro is also likely to benefit from its relatively low correlation to global equity volatility, which makes it less sensitive to the hard-landing risk. As the euro trends higher, we caution that the ECB policy tightening is likely to reintroduce recession fears later this year and limit gains.

British Pound (GBP)

Winter is over, but the British pound is a bit over its skis after its recent gains. The economy has surprised to the upside; nominal monetary policy rates are high and rising; and the pound is still well below our estimates of fair value. But further pound gains will be hard to sustain given the low absolute growth levels in the UK, further negative credit impulses from additional monetary tightening, negative real wage growth, Brexit-related damage to long-term potential growth, a chronic current account deficit, and the pound’s historically higher sensitivity to global growth and equity market shocks.

Japanese Yen (JPY)

We see risk of further yen depreciation in the coming weeks as reduced fear of a widespread banking crisis, higher global yields, and a patient Bank of Japan weigh on the currency. Beyond that and into 2024, downside risks to global growth and our expectation of falling global yields should trigger a strong rally in the deeply undervalued yen. We also believe that the yen provides an excellent risk hedge to protect against a global hard landing, the US debt ceiling crisis, or additional bank failures.

Swiss Franc (CHF)

The franc is extremely expensive in our long-run fair value estimates and now appears overbought in the short term. Its recent strength does not make fundamental sense as inflation is beginning to roll over, while growth is clearly decelerating, and Swiss yields are falling relative to the G10. We see downside risks to the franc, though the Swiss National Bank has a strong incentive to intervene to limit weakness until it sees inflation decline more aggressively.

Norwegian Krone (NOK)

We remain negative on the Norwegian krone over the near term on weak/volatile oil prices, weaker economic growth, and poor local equity market performance. That said, the krone’s dramatic decline over the past six months looks overdone. Any pickup in oil prices, a hawkish surprise from the Norges Bank, or other positive catalyst will likely trigger a material, though likely temporary, short-term rally.

In the longer term, the Norwegian krone is historically cheap relative to our estimates of fair value and supported by steady potential growth. Thus, we expect strong gains eventually, but reiterate that the Norwegian krone faces a tough near-term environment.

Swedish Krona (SEK)

The Swedish recession risk looms large, but we have only a slight negative tactical view on the Swedish krona as it has already priced in a fair amount of bad news, is supported by a stronger euro, and local equity markets have performed well.

In the long term, the outlook is much more positive. The krona remains among the cheapest currencies in the G10 according to our fair value estimates. Eventually, Swedish and global inflation will be under control and the Swedish and regional economies will begin a more durable recovery. Once that happens, the krona has substantial room to appreciate on a sustained basis.

Australian Dollar (AUD)

Weak/choppy commodity prices, slowing consumer activity, negative real wage growth, rising equity market risk, and a cautious Reserve Bank of Australia present meaningful headwinds for the Australian dollar in the near term. To be fair, the Australian dollar , at the low end of recent ranges, already reflects many of these risks and we think that, as the improved Chinese growth begins to show up in the data, it may help to limit further Australian dollar downside. That said, we do not think that Chinese growth will be enough to warrant significant outright Australian dollar strength because it is likely to be concentrated in domestic services.

In the longer term, the Australian dollar outlook is mixed. It is cheap vs. the US dollar and the Swiss franc and has room to appreciate but expensive against the British pound, the Japanese yen, and the Scandinavian currencies.

New Zealand Dollar (NZD)

We are negative on the New Zealand dollar in the near term. Rising recession risk and the record low current account more than offset any benefit of high yields. In fact, markets viewed the higher-than-expected 0.5% Reserve Bank of New Zealand rate hike in April negatively for the New Zealand dollar as it hastens the economic slowdown.

In the longer term, our New Zealand dollar outlook is mixed. Our estimates of long-run fair value suggest that it is cheap vs. the US dollar and the Swiss franc, and has room to appreciate, but is fairly valued vs. the Canadian dollar and the euro, and expensive against the Australian dollar, the British pound, the Japanese yen, and the Scandinavian currencies.

Click Download for a more detailed report.