Explore Funds

Insights

Testing Resilience in 2024

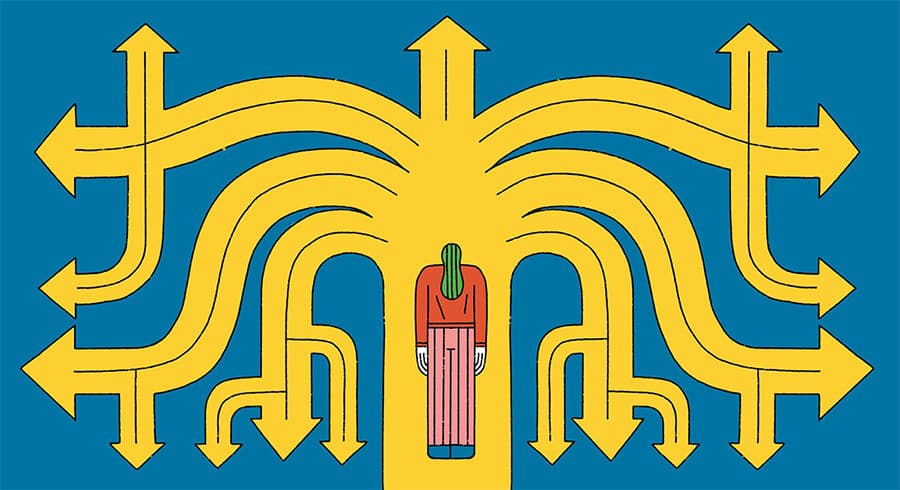

As the economy shifts from policy-supported resilience to durable organic growth, risks are skewed to the downside. How can you invest for the challenges ahead? Get our 2024 ETF Market Outlook.

Investment Ideas

What Can Gold Do For You?

Risk management. Capital appreciation. Wealth preservation. How do gold’s investment characteristics help it play multiple roles in an investor’s portfolio — in good times and bad?

Choose Bond ETFs to Pursue Income

Interest rate risk and inflation challenge today’s portfolios. Learn how the unique traits of bond ETFs — liquidity, transparency, and lower costs — can help.

Build a Low-Cost Core Portfolio

Low-cost ETFs can help investors build efficient and diversified core portfolios designed to achieve their investment goals across the risk spectrum — for less.

ETF Model Portfolios Powered by Institutional Expertise

Deliver institutional-caliber portfolio management to clients, while focusing on what really matters — growing your business and building relationships. State Street’s ETF Model Portfolios pursue a range of investment outcomes across a variety of risk profiles.

Sign Up for Latest Insights

Stay on top of market trends and opportunities. Get new insights and investment ideas delivered to you.