Oil and Geopolitics: Worse to Come

T_Four weeks into the oil price collapse, US President Donald Trump has hinted at an imminent production cut among OPEC+ members, but we remain skeptical much will change before later this spring. T_In our opinion, we have yet to see the full extent of the ramifications of this macro shock on the global economy, financial markets and geopolitics. T_In the short term, downside risks apply to oil prices and emerging market (EM) bonds.

T_Global Macro

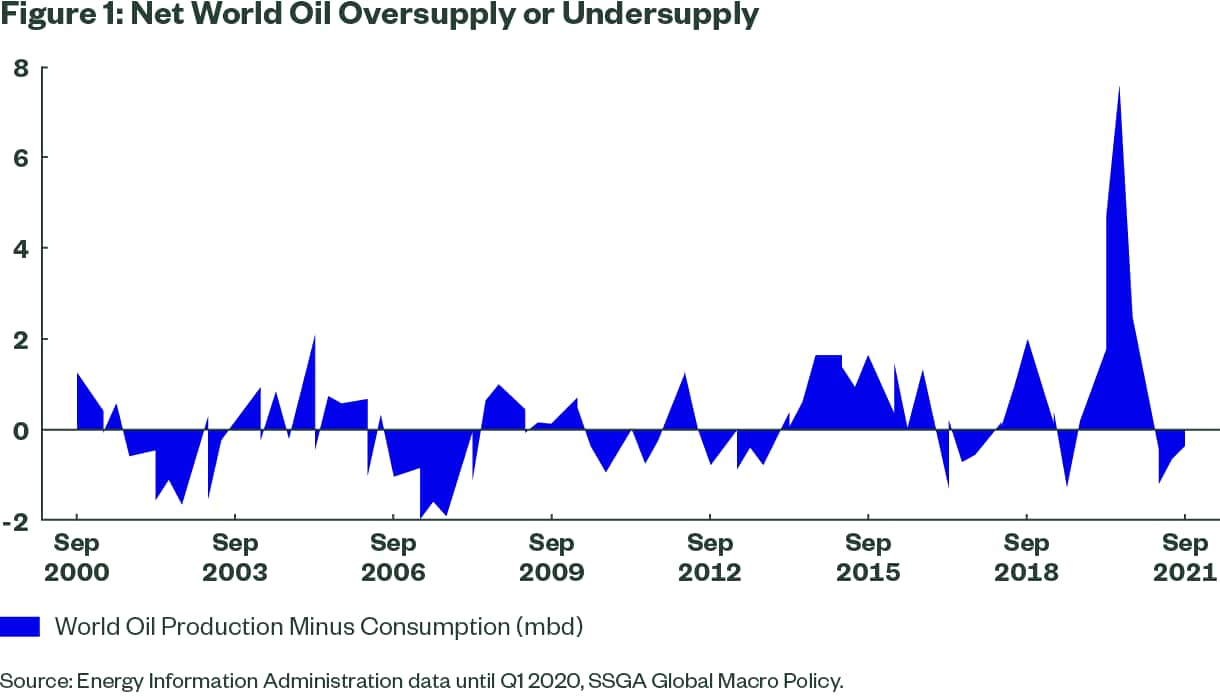

T_Notably, this is an unprecedented oil price shock with virtually no beneficiaries. T_Movements in the oil price typically generate a wealth transfer from producers to consumers or vice versa and are relatively speaking macroeconomically balanced from a global perspective. T_However, in this instance, the collapse in producer revenue is not matched by consumer gains as the public health measures restrict an increase in (or simply maintenance of) consumption. T_We forecast a record-breaking oversupply in Q2-Q3 of this year, and that includes relatively optimistic assumptions around the gradual lifting of lockdowns by early May (Figure 1). T_The rapid dissolution of this oversupply by spring 2021 assumes that as demand recovery sets in, supply cuts become accelerated.

T_Supply cuts will not only require intergovernmental agreement between oil producing governments but also US shale production declining substantially. T_During the oil downturn of 2015, it took 18 months for US production to decline by just one million barrels a day, but oil prices averaged US$45-50 during that period. T_The current price decline is greater and while US shale has improved its cost curve, the median producer’s break-even price is still near US$50. T_Above all, US shale production is also a function of US financial conditions, which remain tight despite massive policy support. T_A second crisis within a half-decade period will make it harder for credit spreads to normalize and for marginal producers to maintain production. T_Industry experts also expect a wave of consolidation across US shale. T_All in all, US production should come down gradually but meaningfully on account of these factors.

T_This will add an additional constraint on US growth as oil capex is closely tied to US manufacturing. T_The latter is likely to therefore undergo less of a V-shaped recovery compared with China and Europe’s manufacturing sector. T_Politically, this will be problematic for the re-election campaign of the president given that the swing states are disproportionately reliant on manufacturing (Wisconsin and Michigan rank No. 2 and No. 4, respectively, for highest share of manufacturing jobs as share of total employment, and Pennsylvania ranks No. 5 in terms of nominal manufacturing jobs) and represent the president’s electoral base.

T_Geopolitics

T_Considering a very competitive US presidential election and a fragile economy, President Trump could be tempted to divert attention from domestic policy failures. T_At the same time, Iran has been undergoing severe economic and social distress, with real GDP shrinking close to 10% in 2019 and oil exports at an all-time low of roughly 500,000 barrels a day (about 25% of pre-Trump sanctions levels). T_This dynamic had already been leading to increased confrontation, including the US assassination of Qassem Soleimani, the most senior Iranian military leader. T_Together with the botched response of shooting down a civilian airliner, COVID-19 has also dramatically escalated public animosity toward the regime. T_Following mass protests in late 2019, turnout in February’s parliamentary elections was at an all-time low. T_Worse, the virus originated in Qom (the capital of the regime’s ruling clerics) and transmitted widely among government officials, thus exposing the regime’s core base to allegations of public health mismanagement. T_All of this creates an enormous incentive to seek another round of confrontation with the United States (the US) given that the status quo is untenable for Tehran.

T_In this context, it does not help that other oil producers in the region will be unable to cope with oil prices sustaining at the current levels. T_Some are likely to experience severe unrest, including Iraq and certain North African countries. T_In light of the oversupply, there is little market risk from supply shortages, but Figure 2 illustrates that geopolitical events do correlate with major turning points in oil prices. T_Any large-scale violence or a renewed refugee crisis could be problematic as they could affect neighboring emerging markets or influence general risk appetite.

T_Sovereign Wealth and EM Funding

T_One certainty in the era of even lower oil prices is higher funding needs for all oil producers, including those with higher break-even fiscal profiles as well as large sovereign wealth funds (SWF). T_A common mistake is that SWFs are assumed to be major drivers of equity sell-offs, but in our previous research we could not find a single year where SWF net equity sales even reached 0.1% of global market capitalization. T_Even as SWFs will continue to fulfil their role as fiscal stabilizers, the macro effect of the depletion of their assets is negligible, though certain financial service providers may feel the drop in demand.

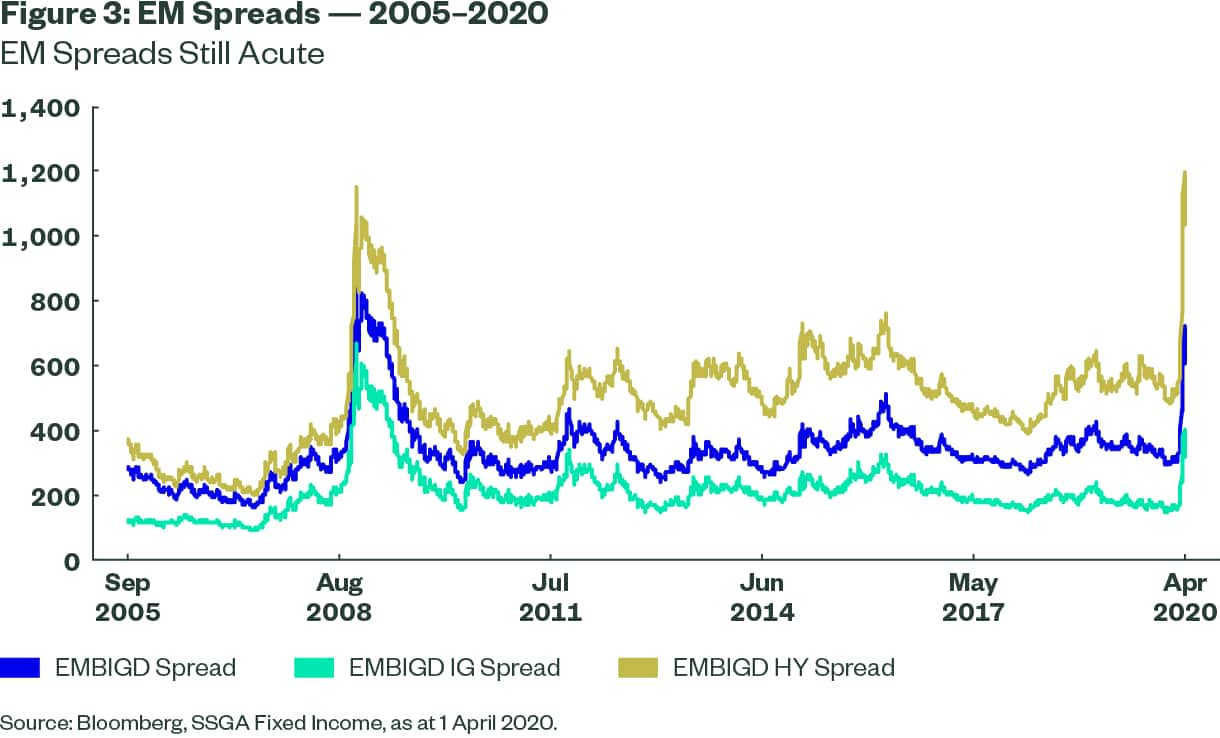

T_More importantly, there will remain a major funding gap for most oil sovereigns, including Gulf Cooperation Council members. T_These states will need to rely on global bond markets to fund their fiscal budgets, so a simultaneous rush of higher borrowing could continue to push up borrowing costs. T_In particular, given the large borrowing plans in the US, Europe and China, EM sovereigns will need to compete even harder than in 2015-2016 when high-grade sovereign paper was in short supply. T_Figure 3 illustrates the recent spike in EM spreads, and notably, roughly a third of the Emerging Markets Bond Global Index (EMBIG) is constituted by oil producers. T_Hence, their exposure to geopolitical tensions is likely to be more sensitive in 2020-2021 and will greatly affect their ability to provide fiscal support to their slowing economies.

T_Investment implications

T_The COVID-19 crisis has disrupted the supply-demand equilibrium in oil markets, which will not be restored until there is clarity on demand recovery. T_In the meantime, oil prices are likely to gyrate with disproportionate downside risks in the near term. T_That said, oil should experience a sharp rebound in the second half of 2020 with prices settling at about 25% lower than their pre-crisis levels by year-end.

T_SWF asset disposal is not market-relevant, but high borrowing needs should help keep yields up across oil producing EM borrowers. T_This could be exacerbated by a probable return of conventional geopolitical risks in the aftermath of the COVID-19 crisis, with repeated bouts of flight to safety and sustained dollar strength. T_However, the US election later this year holds the potential to be the catalyst to upend that trend.