Q2 2024 Bond Compass

Rate cuts on the horizon, reinvestment risk, and tight credit spreads will present challenges — and opportunities — as the economy moves toward a soft landing.

Quick Links

Fixed Income Trends

Investor Sentiment: US Bond Demand Strong

Explore bond investor trends across tens of thousands of fixed income portfolios.

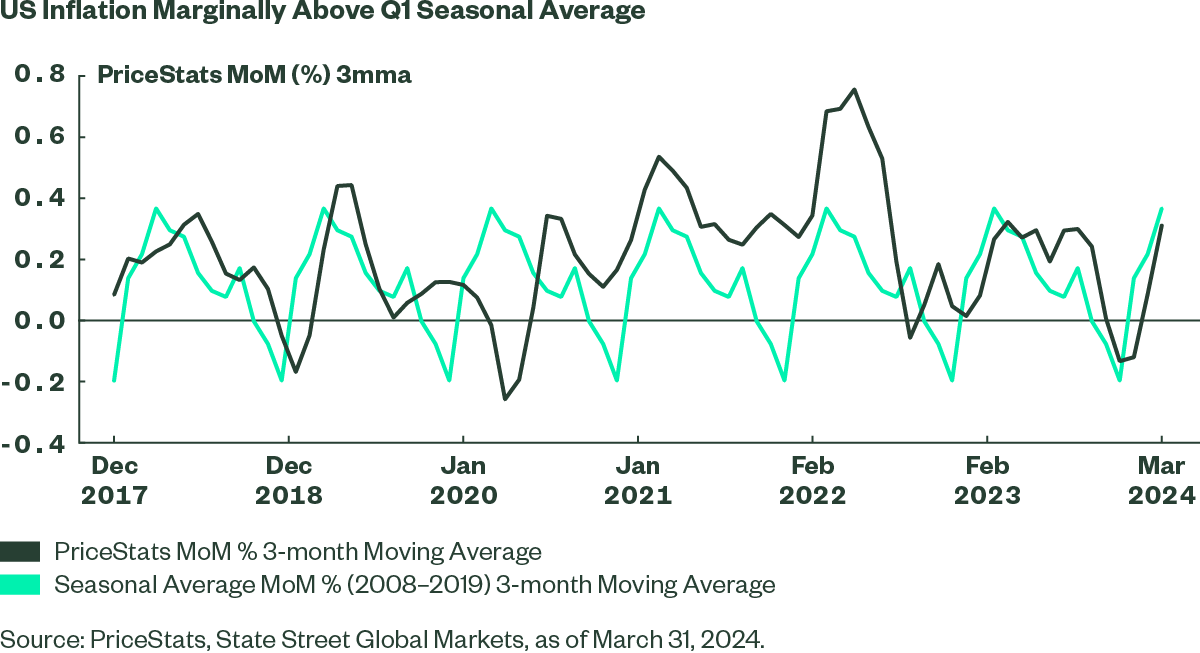

PriceStats: Will Benign Inflation Continue?

Gain insight into inflation trends based on analysis of millions of items sold online around the globe.

A Look at Short Duration Emerging Markets Hard Currency

Emerging market hard currency debt has performed better than local currency year to date. We review the economic backdrop and performance drivers along with potential risks.

More Fixed Income Insights and Research

Fixed Income ETFs: Fact vs. Fiction

This report identifies and analyses the 8 most common misconceptions around fixed income ETFs.

The Defensive Qualities of High Yield

High real yields and short durations make high yield bonds appealing. Structural changes in the market have added to the resilience of a high yield strategy.

Convertible Bond Indices: An Overview

Convertible bonds are debt securities that combine features of both debt and equity.

Our Expertise

We are a leader in fixed income investing.

in fixed income assets 1

of bond investing

fixed income index strategies

About the Bond Compass

Our most comprehensive quarterly report on fixed income flows and holdings includes analysis of investor trends across $10 trillion of assets,2 plus SPDR® fixed income ETF implementation ideas for the upcoming quarter.