Fundamental Growth and Core Equity Pursuing Quality, Sustainable Growth and Reasonable Valuation

We are laser-focused on finding quality companies that can deliver growth that is stronger and more enduring than the market’s expectations.

These companies are rare, so when we find them we pursue them with confidence and conviction—but we never abandon our valuation discipline.

Our Expertise

billion In AUM

Actively managed strategies including global, US, international, China and EM, Innovation, and Climate Transition

Investment professionals across six countries

Average tenure in years of portfolio managers

Average years of experience for research analysts

Year we launched our first fund

Information as of December 31, 2023.

Our Strategies

We have 11 actively managed strategies including global, US, international, China and emerging markets

Why Us?

Investing Like Owners, Not Traders

- Long-term perspective united by a common philosophy

- Low turnover

- Fiduciary mindset

Seasoned Team With A Singular Focus

- Time- and market-tested track records

- Long-tenure with a collaborative culture

- Interests aligned with clients’ objectives

Robust Investment Process

- Deep fundamental research conducted globally

- Rigorous and disciplined process enhances repeatability of results

- Proprietary Confidence Quotient (CQ) framework

High-Conviction Portfolios

- Concentrated portfolios

- Belief that high-conviction portfolios will lead to greater alpha

Boutique With Backing

- Focused independent investment process

- Support of global investment firm

The Three Pillars of Our Philosophy

We invest confidently at the intersection of sustainable growth, quality and reasonable valuations.

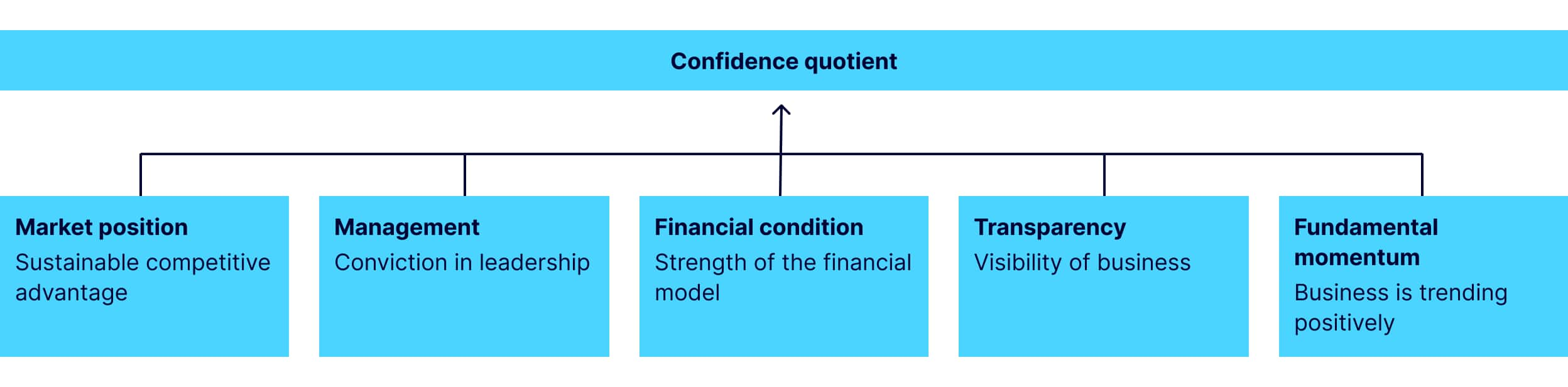

Our analysis of quality is forward-looking, focusing on qualitative attributes that lead to sustainable growth. The Confidence Quotient (CQ) is our proprietary analytical framework that quantifies how we think about quality.

We believe that the power of long-term, compounding growth is underappreciated by the market and offers unrecognized investment opportunity. Our extended investment horizon is a crucial part of how we generate alpha.

We don’t chase growth at any price. We insist on a valuation that is justified by the firm’s growth potential. Our valuation discipline creates a growth margin of safety.

Quantifying Our Confidence

CQ provides structure to how our team evaluates quality, bringing rigor, measurability and consistency to the process of assessing five elements of quality that we score and track over time. Each element of CQ is backed by a detailed scorecard that provides a framework for determining our confidence in the company’s quality.

Research Process

Our disciplined, repeatable process focuses our attention on the most compelling opportunities.

Idea Generation

Drawing on the domain expertise of our analysts and input from portfolio managers, we identify companies for further analysis. Our quantitative scoring tool reflects our investment philosophy and augments our analysts’ judgment.

Fundamental Due Diligence

We seek to develop deep conviction in a select group of companies. In addition to our proprietary financial modeling, we use the Confidence Quotient to bring rigor to our assessment of quality.

Research Portfolio

We invest in our highest-conviction ideas through live research portfolios. These serve as powerful communication tools and capture the track records of each analyst, creating accountability that enhances the alignment of our interests with our clients' long-term objectives.

Portfolio Integration

From the research portfolios, our portfolio managers generate ideas for integration into the final portfolios. Our proprietary dashboards provide advanced analytics from our research team that guide the portfolio integration.

Our Leadership Team

Hiring a fundamental active manager involves a belief in the people as much as the process. Our impressive performance reflects the caliber and stability of our team—and our shared commitment to our fundamental, high-conviction investment philosophy.

We are passionate about investing in sustainable growth through active management. Email us for more Information.