Macro Implications of the Banking Crisis

The macroeconomic effects of the current banking crisis may be evaluated along at least three different dimensions. What are those dimensions, and how can they enhance our current understanding of the crisis?

One of the major questions that has arisen in the aftermath of the ongoing banking sector turmoil is in relation to its macroeconomic implications. In our view, there are three implicit dimensions to the macro impact of the ongoing crisis: directionality, timing and magnitude. Directionality is the easiest to assess, timing much less so and magnitude is the hardest to get right.

Directionality of the Macro Impact

Directionality is the easiest to understand because the channels of influence are straightforward. Bank failures are, at their core, a failure of risk management, regardless of what specific form the original risk may take. In the aftermath of a crisis, risk management across the banking system—and even outside of it—tightens.

Consequently, credit standards become stricter and credit gets harder and more expensive to obtain. That, in turn, reduces demand for credit insofar as not all previously viable projects continue to remain so. Eventually, capital deployment and labor demand slow, growth decelerates, inflation softens and unemployment rises.

Timing of the Macro Impact

Policy measures that are deployed to contain a crisis have a huge role to play in determining the timing of the macro impact. In a sense, the two dimensions of timing and magnitude are related as the broader and deeper a hit, the sooner its effects will show up in data.

By contrast, the earlier it becomes apparent to market participants that they are dealing with a one-off event, the faster confidence is restored and undesirable behavioral changes minimized. Among lenders themselves, were lending standards rather lax at the onset? If so, tightening them could be an almost overnight phenomenon. But if new loan scrutiny was already high, there would be less need to go to extremes.

Alongside some of these considerations, the current starting point is reassuring, but along others, it is not. On the bright side, we were already approaching the end of the monetary tightening cycle, so bank funding costs seem unlikely to rise much further from here. Importantly, while aggregate bank deposits have been declining for three consecutive quarters, recent bank failures actually drove a surge in deposits at large banks, which could remain a relatively stable source of credit, at least in the near term.

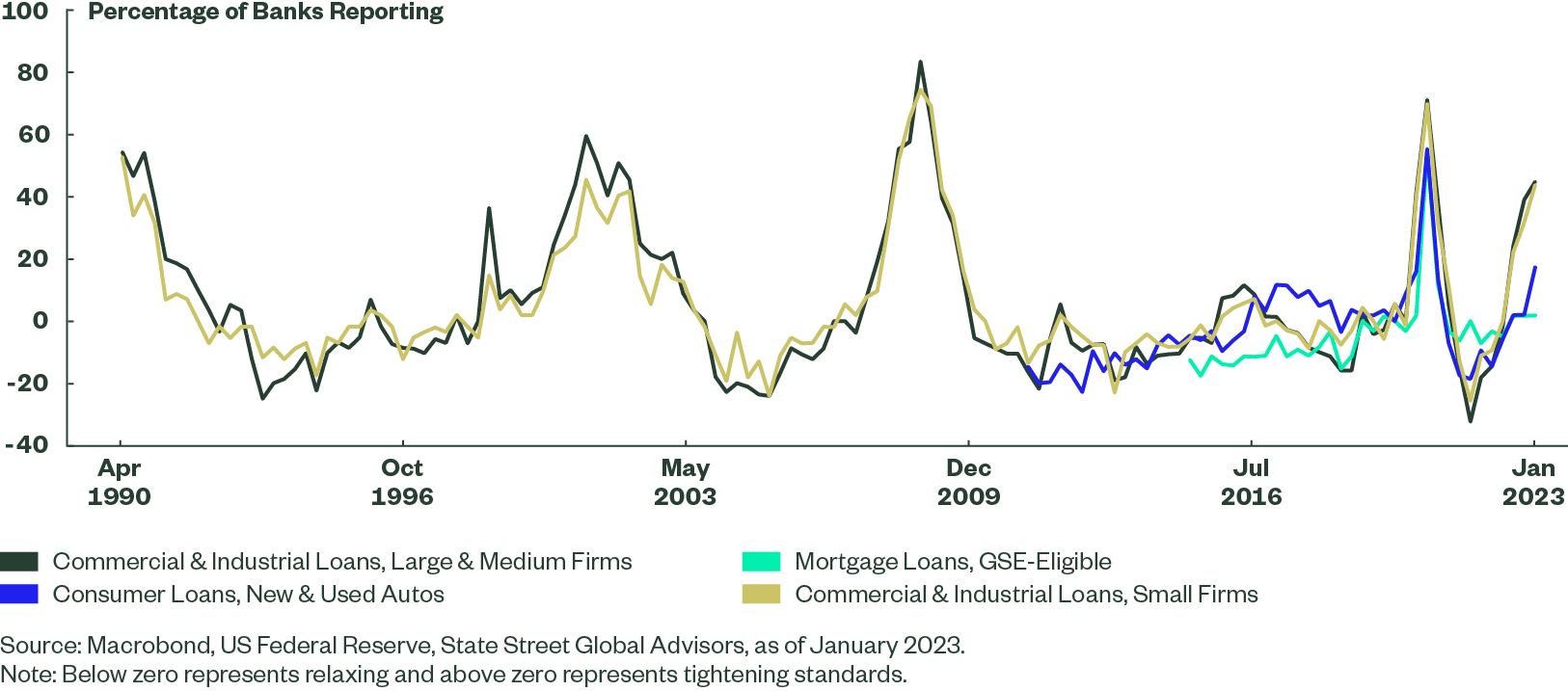

Secondly, credit standards across the banking system had already been tightened materially (Figure 1). By some measures, we are already two thirds of the way to prior cycle peaks in regard to restrictiveness of standards. Therefore, much of the hit might have already occurred in this respect.

Figure 1: US Banks Had Already Tightened Credit Standards Substantially

Crucially important, consumers’ debt servicing obligations are very low in the aggregate, suggesting some scope for absorbing higher borrowing costs without broad stress. This is true both relative to the US’s own history and also relative to that of other countries (Figure 2).

What is far less reassuring is that, despite high absolute levels of liquid assets, the non-financial business sector appears to be headed towards a credit crunch as short-term liabilities are exceeding short-term debt by a greater margin than during prior cycle bottoms (Figure 3).

Whether or not this implies an impending refinancing wave at much higher costs or a need to cut other spending to prioritize debt service, the implications for both profit margins and credit quality are negative. And, by association, so are the implications for future capital expenditures, labor demand and GDP growth.

Given robust household finances and an extremely strong starting point for the labor market, it might take until the third quarter before noticeable deterioration in aggregate employment numbers become visible. Since labor income is holding up and real wages are improving, consumer spending could similarly prove resilient for a few more months before evidence of momentum loss broadens. However, signs of stress in parts of the credit space could become apparent well before that.

Magnitude of the Macro Impact

Finally, we turn to the last question on magnitude. We think the biggest impact from the banking turmoil would be felt only later this year and mostly in 2024, when we no longer anticipate any improvement in growth performance. Our newly released forecasts now project annual growth of just 0.7% in 2024, down from 1.5% previously.

For a very long time we intentionally stayed out of the “recession is inevitable” camp—a view so far validated by incoming data. However, in light of recent events, it is becoming increasingly difficult to state with conviction that we would not witness at least a shallow recession by the end of 2024. Not all recession risks relate to recent events, however.

The exhaustion of household excess savings, the delayed effects of the US Federal Reserve’s (Fed) tightening and a less supportive fiscal backdrop were all forces that were already speaking to recession risks over that horizon. Banking sector troubles simply increase those risks and also have the potential to bring forward the realization of those risks.

We underscore that we anticipate material easing by the Fed: 50 basis points worth of cuts by the end of this year and a cumulative 200 basis points of cuts by the end of 2024. Without these, any downturn is likely to be considerably more severe.

In Summary

Every macroeconomic impact has at least three implicit dimensions. As far as the directionality of the current crisis is concerned, lower growth and further disinflation cannot be ruled out. Timing, which is more difficult to assess, could be fairly rapid but not immediate – we expect a time frame of several months. Magnitude is quite hard to get right, but in our assessment the annual GDP growth should be off by at least a few tenths of a percent.

Our Take on the Credit Suisse Crisis

Credit Suisse-UBS, AT1

Credit Suisse-UBS, AT1

European banks, we believe, are well positioned to regain their momentum on the back of strong balance sheets that are supporting increasing capital returns to shareholders.

Our Take on the SVB Debacle

SVB, Signature Bank, Etc.

SVB, Signature Bank, Etc.

The fallout of SVB and the subsequent failure of Signature Bank warn us of non-linear events that could precipitate in the context of the higher-for-longer environment.