New Horizons: LDI Strategies for the Future

- Last year’s gilt crisis brought the potential weaknesses of existing pooled LDI fund structures to the fore and the industry is considering how to respond.

- One solution being explored is moving to segregated structures — once deemed too expensive for smaller schemes.

- There is another way: SSGA’s innovative suite of pooled Target Leverage Funds (TLFs) gives smaller schemes many of the benefits of segregated approaches.

- TLFs allow schemes to leverage both their growth and LDI assets, and maximise capital and collateral efficiency whilst maintaining asset allocation flexibility.

- The Fund range bases leverage targets and rebalancing bands on each client’s individual holdings.

Why Reassess?

Now that the dust has begun to settle from last year’s gilt crisis, trustees and consultants are rightly asking whether there are longer-term structural changes they could make to their liability-driven investment (LDI) portfolio management which would benefit schemes and members, and help to prevent some of the more commonly experienced challenges.

The gilt crisis — sparked by a loss in confidence in the UK’s fiscal sustainability following the September mini-budget — saw long-dated gilt yields move at unprecedented speed and scale. The initial sell-off triggered widespread collateral calls for many defined benefit (DB) pension scheme’s leveraged LDI portfolios, and led to forced selling.

Initial responses to the crisis have focused on the reduction of leverage levels and a shortening of capital call windows within pooled LDI funds. At the scheme level, more collateral is being held ready to meet potential calls and trustees, in partnership with their consultants, are working on improved liquidity risk management processes to ensure they are operationally ready to meet collateral calls more quickly.

State Street’s TLF solution already exceeds the minimum liquidity buffers of 250 bps that the Bank of England’s Financial Policy Committee recommended on 29 March 2023. Furthermore our capital call window has already been reduced to 5 business days from October 2022 and hence is aligned with the FPC’s judgement that pension schemes should be expected to deliver collateral within 5 business days.

The Role of Pooled Funds

As Sarah Breeden, Executive Director for Financial Stability at the Bank of England pointed out in a speech in November,1 pooled LDI funds had a greater role to play in the amplification of market moves. But despite being labelled as one of the contributors to the crisis, pooled LDI funds remain in common use amongst UK pensions schemes and when viewed over an extended time horizon, have enabled schemed of all sizes to effectively hedge their interest rate and inflation risks. So, does the crisis signal the end of LDI pooled funds, or merely the beginning of a new wave of pooled fund innovation?

Segregated LDI Accounts are run for one pension scheme only. Such structures allow full flexibility for clients to implement their required hedging portfolio with complete customisation of restrictions and objectives — including eligible assets, counterparty diversification, bespoke legal documentation with counterparty banks, and a quick instruction process through which to implement trades and amend investment objectives. One of the prerequisites for a segregated account is that schemes have their own custody arrangements in place, and this cost can be too prohibitive for some schemes. Single investor pooled funds also exist but they retain most of the costs of a segregated LDI mandate, making them costly for small-to-medium size pension schemes.

Multi-Investor Pooled Funds have the benefits of delegated governance, regulated fund structures and avoiding the need for the scheme to appoint a custodian. Furthermore, unlike segregated accounts, pension schemes have limited liability in the face of losses. Leverage is managed within rebalancing bands on a fund-level basis, so all clients get capital calls and distributions at the same time.

How Did We Get Here?

Historically, LDI as a strategy — buying assets that hedge the moves in a scheme’s liabilities — was originally only available to schemes via segregated accounts. Later innovation led to the creation of more cost-effective pooled LDI funds that managed the assets of many pension schemes together.

During last year’s volatile times, leveraged LDI managers had to balance the need to maintain LDI exposure against the need to maintain solvency. Where there was visibility and certainty on the arrival of collateral, LDI exposures could be maintained. This was more challenging when operating pooled funds, due to requirements that all clients be treated fairly and a dependency on all clients meeting their obligations on time and in full.

Depending on the structures in place, some LDI managers were obliged to wait until all clients provided cash before capital calls could be met. Furthermore, depending on the pooled fund structures in place, at the time of the crisis even if one client had enough cash to meet capital calls quickly, in order to treat all clients fairly LDI managers may have been obliged to wait for other clients to provide their portion of the cash. In an extremely fast-moving market, this meant hedges may have been cut to maintain the funds’ solvency.

The other weakness of existing pooled funds that the gilt crisis brought to the fore is the need to diversify the use of leverage across a portfolio; in a nutshell to move from 100% reliance on the gilt market. Traditionally it has been the LDI portfolio where schemes have taken leverage, in the form of gilt repo or swaps — this is particularly true for pooled fund clients. However leverage can also be obtained in the growth portfolio. During last year’s gilt crisis, UK and other developed equity markets did not see the extreme volatility that gilt markets did. As a result, clients obtaining leverage in equity markets would not have seen rises in leverage of the magnitude that many LDI clients did, and therefore would not have experienced similar collateral calls.

Our Solution

One of the avenues being explored by some pooled LDI fund investors is to move into segregated accounts. However, that isn’t the only solution available and may be too expensive for smaller and mid-sized schemes. We believe that there is a better way.

We have deep experience implementing LDI portfolios for our clients using both segregated and pooled structures. We designed a new pooled fund range to bring some of the benefits of segregated LDI to the pooled fund market. Our Target Leverage Funds (TLFs) improve the risk management within leveraged pooled funds, and allow clients to diversify their leverage if they want to do so. In 2021, our innovative fund design won us recognition and the award of LDI Manager of the Year in the Professional Pensions Awards.

Advantages

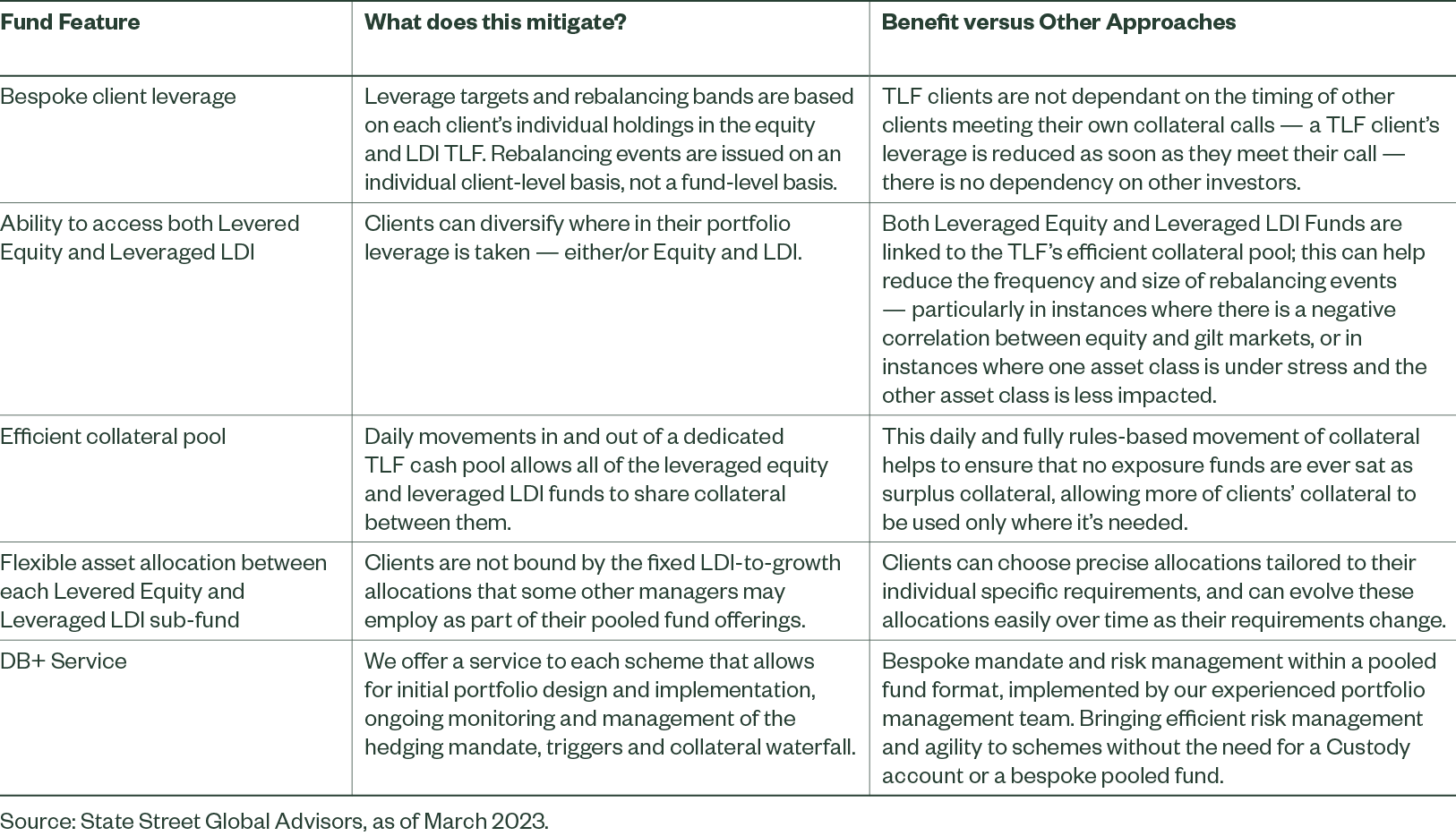

With TLFs, leverage targets and rebalancing bands are based on each client’s individual holdings. This means that rebalancing events (capital calls and distribution) are issued on an individual client-level basis, not on a fund-level basis. The implication is that a client’s leverage falls as soon as they meet a capital call; there is no dependence on other investors also meeting their capital calls. For clients who can access collateral quickly to meet a capital call, this reduces the likelihood of seeing a forced reduction in hedging exposure.

The TLFs allow exposures to both levered Equity and LDI allowing clients to diversify where leverage is taken in their portfolio. This can help reduce the frequency and size of rebalancing events — particularly in instances where there is negative correlation between equity and gilt markets, or in instances where one asset class is under stress whereas the other asset class is less impacted. Excess/surplus collateral is shared for each client allocation on a daily basis, akin to the collateral management offered to segregated clients.