Calmer times ahead for Global Aggregate?

Despite the diversified nature of global aggregate strategies performance has been challenging. However, the back-up in yields should see the risk versus reward trade-off improve.

A more stable backdrop for bonds

It has been a turbulent year for fixed income investors but with the top to Federal Reserve interest rates seemingly in place, the hope is things may become a little calmer. Any strategies with a meaningful amount of duration struggled over the summer as the bear-steepening in the US Treasury curve proved a significant drag on performance. Global Aggregate was no exception, with the index returns only recently edging back into positive territory for the year1 . After two successive years of negative returns for most fixed income markets, this was not how most investors had seen 2023 panning out.

There may, however, be reasons for optimism. Broader benchmark strategies such as Global Aggregate typically have an appeal going into year end and in times of uncertainty when being far from benchmark represents too much of a risk. The better yield now offered by the global aggregate strategy should provide market participants with some protection. It has a yield-to-worst of just over 4%2 , this is off the recent highs of just above 4.40% but remains at its highest level since late 2008.

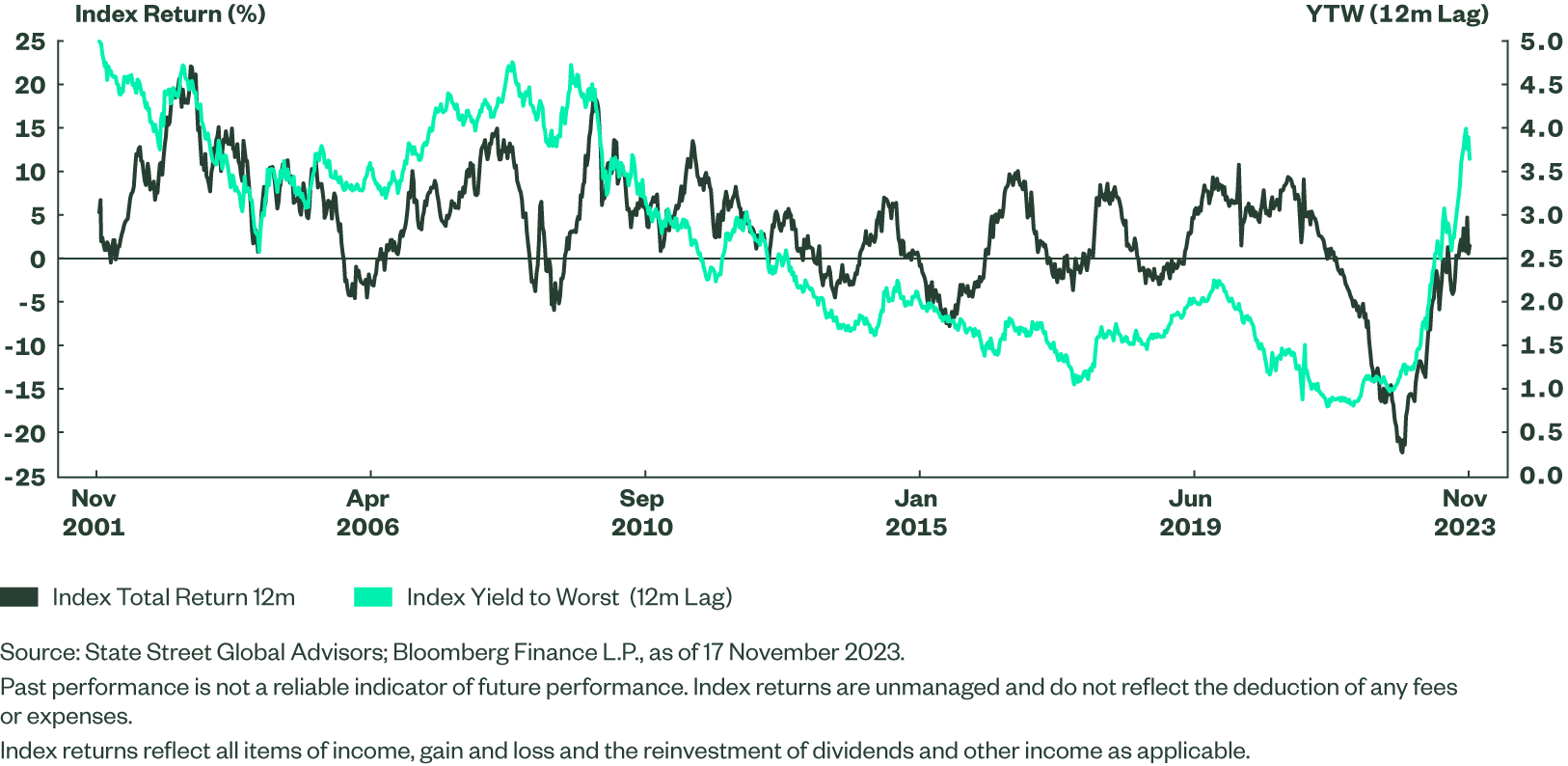

The historically higher yield is an advantage if the higher for longer mantra on central bank rates turns out to be true and the market remains rangebound. There is also some evidence that returns from holding a strategy are influenced by the purchase yield. Figure 1 shows the yield-to-worst on the Bloomberg Global Aggregate Index with a 12-month lag against the index return over the past 12-months. The correlation over the 22 year period shown is a modest 54%, but importantly, over the 207 weeks during that period when the initial yield-to-worst was 4% or above, in only 12 cases were the returns from the index over the following 12-months negative.

Shorter duration, higher yield helps risk/reward trade-off

Another consequence of the Summer sell-off was that it resulted in shorter durations for many bonds. The Bloomberg Global Aggregate Index currently has an Option Adjusted Duration of close to 6.5 years, over 1 year shorter than the highs seen in 2021. This lower sensitivity to interest rate moves, coupled with the higher yield, helps the risk/reward trade-off around big market moves. Dividing the yield by the duration of the index gives a rough rule of thumb on how far yields need to rise in order for the price losses on the index to offset the yield gained from holding the index bonds. In this case the ‘breakeven’ point on the Bloomberg Global Aggregate Index has rise to 0.62%, the highest since 2009.

There is also an a-symmetry to the returns. Modelling a parallel shift in yields on Bloomberg for the Global Aggregate index suggests a shift lower of 200bp in all of the curves within the Global Aggregate exposure would generate total returns of +13.9%. Conversely, if all of the yields rose by 200bp, returns would be -10.7%3.

The risk within Aggregate strategies is that not everything moves in parallel. The Global Treasury component (54%) has been the key drag on returns over the first 10 months of the year, but there are clearly risks that, if the economic activity data slows too far, then credit spreads may start to widen. While this is a risk, the Option Adjusted Spread to swaps for the Bloomberg Global Aggregate Index is already wider than it reached in 2016, the start of the previous Fed tightening cycle. So there is something of a slowdown already priced into the index. It did get wider in 2020, but that reflected the market pricing of a near complete shutdown of many parts of the global economy.

For those not wishing to take such a geographically broad view on bond markets there are more targeted strategies such as US Aggregate and Euro Aggregate. These focus on a similar broad cross-section of types of bond as Global Aggregate but are constrained to issuance in one currency. The high yields on offer from US Treasuries makes US Aggregate particularly interesting. The index has a yield-to worst of 5.2% and a duration of 6.1, implying a ‘breakeven’ in the event of a sell-off of around 85bp.

Figure 1: Yield to worst a year prior to returns for the Bloomberg Global Aggregate Index