Investor Sentiment in Flux: Financial Hope vs. Economic Worry

- ETF owners are more likely to be optimistic about their financial future than investors who do not own ETFs.

- Less than 25% of investors think that the S&P 500® Index will be down at the end of 2023.

- In the US, pessimism about the country’s 12-month economic outlook has increased more than 50% over the past three years.

Investors Show Signs of Personal Financial Optimism

Investors who have ETFs in their investment portfolios are more likely to be optimistic about their financial future (81%) than investors who do not (71%).

Figure 1: Personal Financial Outlook Over the Next Year

An ETF Ownership Comparison

Approximately three-quarters of investors are optimistic about their financial future over the next 12 months. More investors in EMEA report being optimistic than those in the US and APAC.

More Millennials than Gen X and Baby Boomers are optimistic about their financial future. In particular, Baby Boomers in EMEA are less likely to be optimistic about their financial future compared to Baby Boomers in the US and APAC.

Investors Have Bullish Predictions for the S&P 500®

Nearly half of investors who own ETFs think the returns of the S&P 500® Index will be up by the end of 2023, which is significantly greater than those who do not own ETFs.

The majority of investors surveyed, regardless of one’s region or ownership of ETFs, think the S&P 500® returns will be up or flat by the end of 2023. Less than 25% of investors think it will be down.

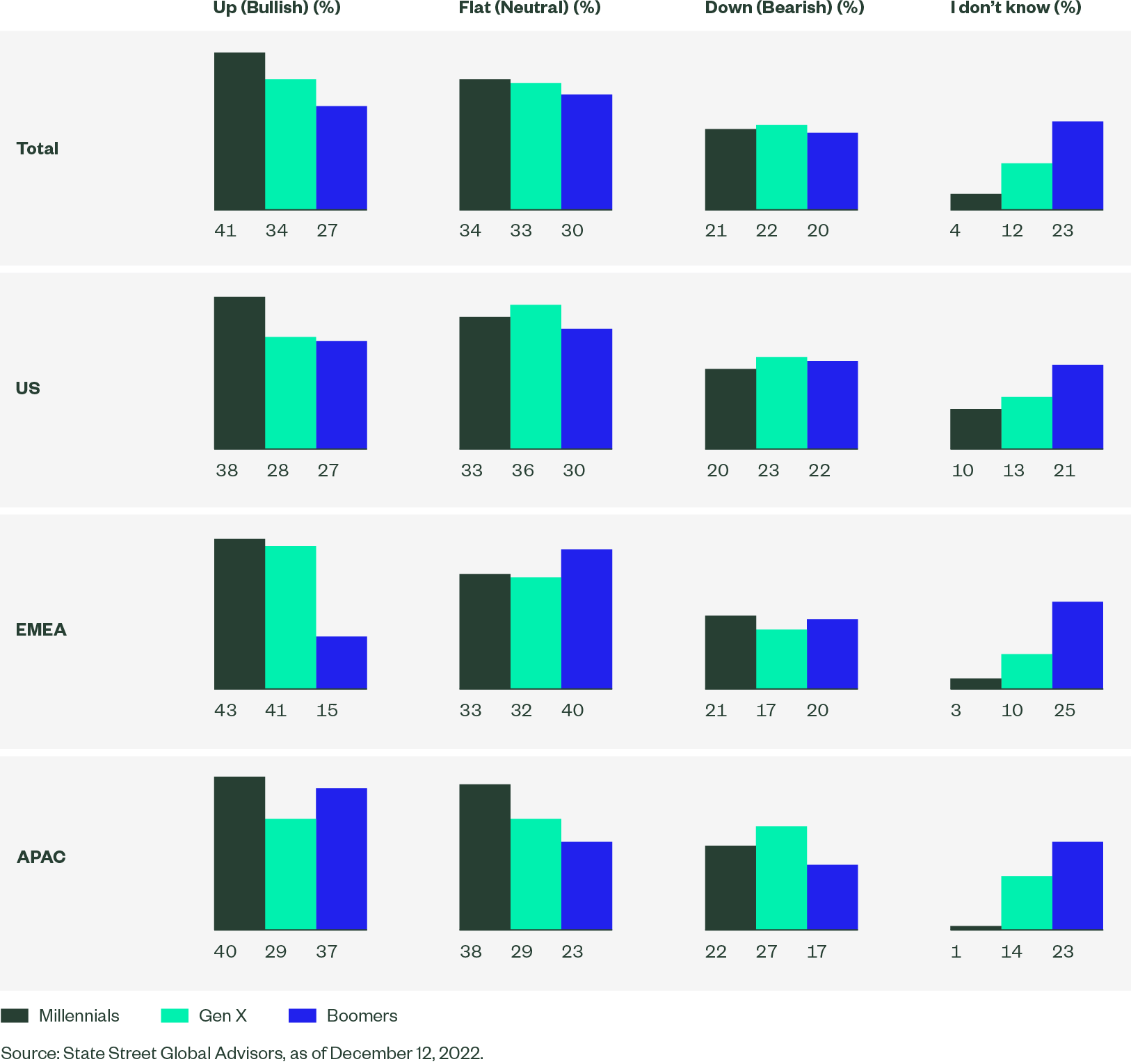

Of the generations surveyed, Millennials are the most likely to think the S&P 500® returns will be up, followed by Gen X, and then Baby Boomers.

Figure 6: Expectations for S&P 500® Returns at the End of 2023

A Generational Comparison by Region

But There’s Growing Pessimism for Countries’ Economies

Around the globe, nearly as many investors are pessimistic (32%) about their respective country’s economic outlook in the next 12 months as are optimistic (39%).

In the US, pessimism about the country’s 12-month economic outlook has increased more than 50% over the past three years. In addition, investors in the US are likely to be more pessimistic and less optimistic about the country’s economic outlook than investors in EMEA and APAC.

Figure 8: Investors’ Sentiment Regarding Their Country’s Economy

A US Trend and Regional Comparison

Generationally, more Millennials are optimistic about their country’s economic outlook than Gen X and Baby Boomers.

- In the US, Millennials and Baby Boomers are more likely to be optimistic than Gen X.

- In EMEA and APAC, Millennials and Gen X are more likely to be optimistic than Baby Boomers.

The rising pessimism toward countries’ economies could be directly correlated to the unsettling nature of today’s volatility, as well as the other uncertainties that global markets are experiencing.

In the volatile market environment, what are the realities individual investors are experiencing?

About the Survey

State Street Global Advisors, in partnership with Prodege and A2B, conducted a study surveying more than 1,000 individual investors. Read more about the details.