Smart Beta ETFs What’s Trending in Smart Beta?

Get our latest views in this quarter's Smart Beta Compass

What is Smart Beta?

Sitting between active and index strategies, smart beta represents an evolution in index investing and an opportunity for investors. Rather than simply weighting stocks by market cap, these indices are constructed to identify and exploit specific factors.

Investors can capture these exposures by utilizing the SPDR range of Smart Beta ETFs, which has funds offering exposure to the value, volatility and quality dividend factors.

Dividend ETF provider in Europe by AUM 1

Top 3 Smart Beta ETF provider in Europe by AUM 2

Expertise in Smart Beta strategies since 2005

Why Smart Beta?

- Smart Beta ETFs can help investors achieve targeted outcomes through factor-based investing.

- Factor investing seeks to systematically identify and exploit specific drivers of risk and return, aiming to deliver a premium above the traditional market-cap benchmarks.

- ETFs can be used to track a specific factor index to deliver diversified, transparent and cost-efficient3 access to smart beta.

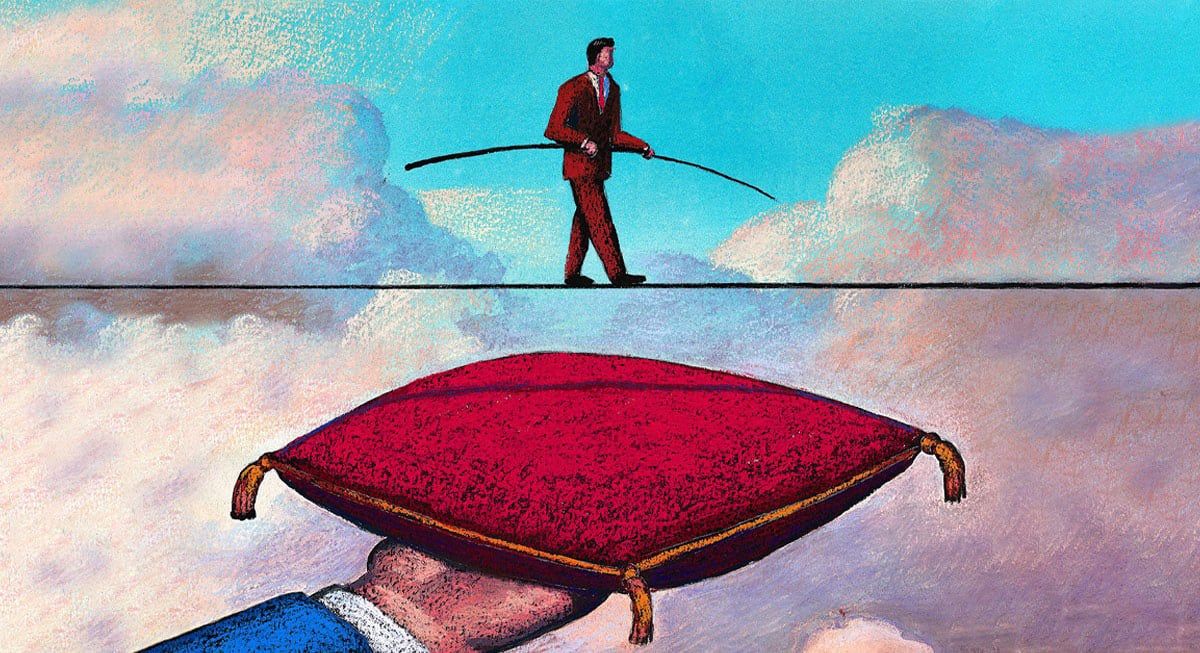

In uncertain times, it may be a good idea to adopt a defensive posture while staying fully invested in the equity markets. This can be achieved through a low volatility strategy.

The SPDR low volatility ETFs track indices that are weighted according to the volatility of the underlying stocks rather than their market capitalisation, which provides a measure of protection against market downturns.

We believe these ETFs could generate higher returns than cap-weighted strategies over the long term, exploiting the so-called 'low volatility anomaly'.

Moreover, a low volatility strategy may be particularly suited to those investors who are not required to adhere to any particular benchmarks and who wish to take cover from heightened market volatility.

Value Investing for the Long Term

Academic evidence has shown the outperformance of companies with lower valuations over the long run on a risk-adjusted basis, as documented by studies such as Fama-French.4

The SPDR range of value ETFs is based on indices that emphasise metrics such as sales, book value and earnings to provide a comprehensive measure of value.

Investors looking for specific exposure to value companies can select from US and Europe. Additionally, SPDR offers ETFs that emphasise both value and smaller-sized companies to suit those investors with specific allocation preferences.

Related Products and Content

Commitment to Quality Dividends

Yield + Track Record = SPDR Dividend Aristocrats

Companies that consistently pay higher dividends often possess sound fundamentals, such as lower debt and stable earnings. When seeking dividend yield, these are important characteristics, as they can insulate a company from a sudden market downturn.

The SPDR Dividend Aristocrats ETFs are weighted according to the highest yielding dividend stocks, with a filter to emphasise those companies that have sustained or increased dividends over time.

The SPDR Dividend Aristocrat Range includes Global, US, Pan Asia, European and UK exposures, with ESG screened strategies available for the Global, US and European ETFs.

More Information

Questions?

We are Here to Help

Fund information

View our SPDR fund range