Correction at the Long End of the Bond Curve

Risks over weaker growth and the potential for China to act as a disinflationary force are likely to remain a consideration for central banks in the coming quarters. If growth does continue to slow and there are no supply digestion issues, then investors are likely to shift out along the curve to make the most of the long duration and convexity profile provided by long-dated bonds.

The latest leg higher in bond yields, topping those levels seen in October 2022, has come as something of a surprise to investors, with markets becoming detached from central bank rate expectations. While the Bank of England (BoE) is seen having more rate hikes to come, markets are now pricing only residual risk of additional tightening from both the Federal Reserve (Fed) and the European Central Bank (ECB). Despite this, yields at the long end of the curve, in particular, pushed higher and the curve steepened. Looking at a 20-year history of the US Treasury curve suggests these “bear steepening” moves are relatively rare. In months when the 5-year Treasury yield increased, only 33 of those, or less than 14%, were accompanied by a steeper 10- to 30-year spread.

It is perhaps not such a surprise to see rising yields around the 10-year part of the curve. In the Q2 Bond Compass, we explicitly noted the richness of the belly of the curve, which was seen as the result of an overly aggressive pricing by markets of “imminent” central bank cuts. With growth only gradually showing signs of slowing, the market is reluctantly acknowledging that aggressive cuts may not materialise.

Unanticipated, however, was the disinversion at the very long end of the curve. There have been several drivers:

- Higher real yields: Long-dated real yields have been gradually rising all year in the US, European and UK markets, but the move accelerated in August with the US 30-year real yield pushing above 2% for the first time since 2011. This is seen as a proxy for growth expectations and, with predictions of a US recession having been continuously rolled further into the future, there may be some reasons to hope that a soft landing will be engineered.

- Higher inflation expectations: Inflation breakevens (the difference between the above mentioned real yield and the yield on the nominal bond) rose between June and August for the US and European markets. This is potentially an acknowledgement that central banks may be willing to tolerate higher levels of inflation. For Europe, long-end breakevens have been increasing all year, as weak growth is seen as making central bankers cautious on raising rates. Interestingly, in the UK – where inflation has been very high – breakevens are little changed.

- Concerns over supply and demand: A key catalyst for the up-move in yields was the US Treasury Refunding announcement on 2 August. This substantial package of issuance raised questions over who was going to buy it, now that central banks are sellers of bonds also. The summer is not a time when big asset allocation decisions are made and the dealer community is typically reluctant to warehouse risk for any length of time. A yield concession was then required to absorb the supply.

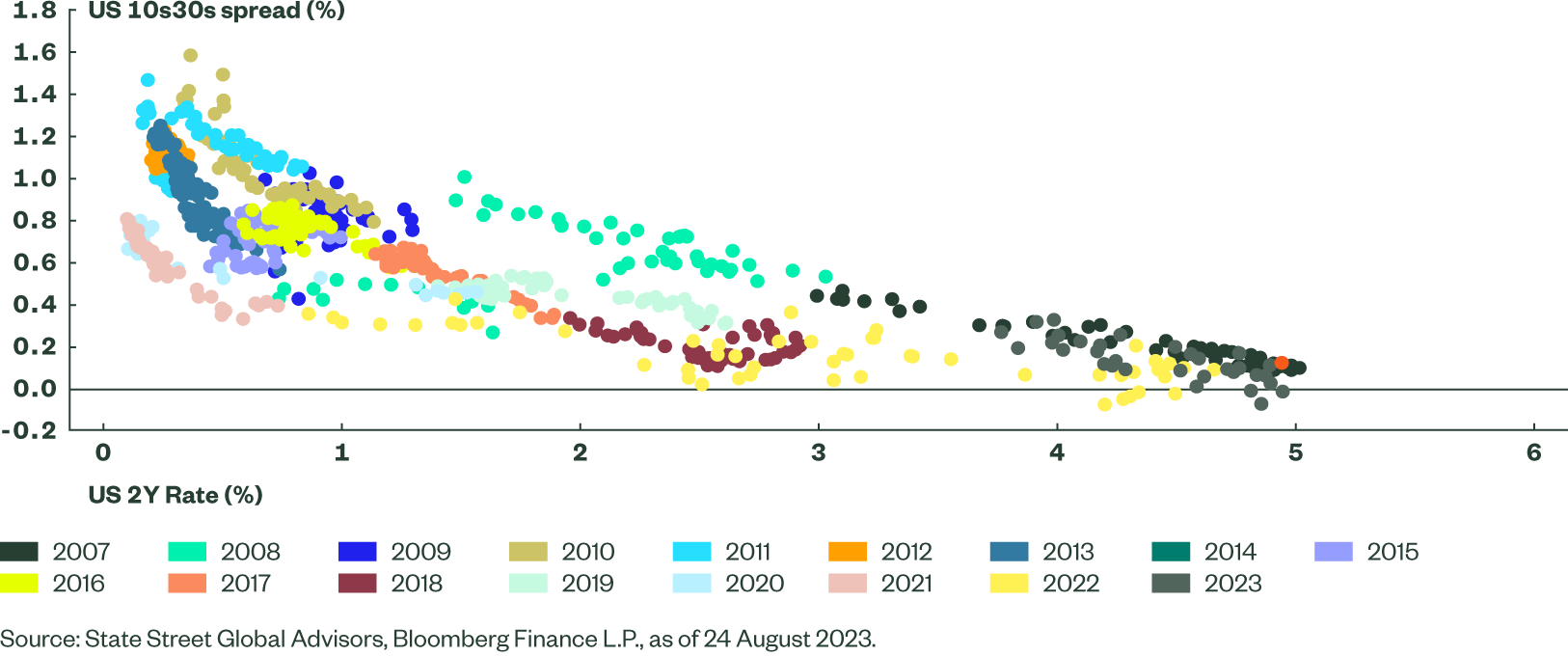

There is no doubt that issuance pressures could continue to exert an influence on the longer end of the curve. Many nations are running large budget deficits and the downgrade to US ratings by Fitch would not have been helpful for long bonds. However, a long-term plot of the 10- to 30-year spread against the short end of the curve suggests current levels of steepness for the US curve are consistent with levels last seen when short rates were at similar levels in 2007 (see Figure 1). In broad terms, this hints that much of the negative term premium associated with central bank buying since the Global Financial Crisis has been unwound.

Figure 1: US 10- to 30-Year Treasury Spread vs. 2-Year Broadly Consistent with 2007 Levels

Immediate issuance concerns may ease as markets get back to business and higher yields draw in buyers. Those pension funds that are incentivised to match long-term liabilities with assets have seen their position markedly improve over the past 2 years and may now be inclined to lock in these better solvency ratios. This is especially the case for the UK, where outright 30-year gilt yields are at their highest since 2007 (aside from the spike in October 2022).

In addition, fears of a recession have not gone away, with policy lags meaning monetary tightening is still feeding through to the economy. Risks over weaker growth and the potential for China to act as a disinflationary force are likely to remain a consideration for central banks in the coming quarters. If growth does continue to slow and there are no supply digestion issues, then investors are likely to shift out along the curve to make the most of the long duration and convexity profile provided by long-dated bonds.

How to Access this Theme