Sector Equity Compass Q4 2025 Sectors in Focus

Sectors in Focus by region:

| US | Europe | World | |

|---|---|---|---|

| Info Technology | |||

| Health Care | |||

| Financials | |||

| Industrials |

Health Care: Balancing innovation and value

Rapid innovation and demographics are driving investor interest in Health Care, but President Trump’s pharma policies have introduced volatility. Tariff delays and new drug agreements may mark a turning point.

Innovation and growth

- Next-generation treatments: Promising results for oral GLP-1 candidates and novel biologics to combat obesity and diabetes. Regulatory approvals could be expedited given the strong patient outcomes reported. Eli Lilly and Novo Nordisk lead the pack.

- Preventative care: Diagnostics, telemedicine, and home healthcare services all promote proactive health management. Roche and Illumina are advancing AI-powered diagnostics and precision medicine.

- Digital health: The integration of electronic records with machine-learning applications. Continuous health monitoring is improving disease management and driving earlier diagnoses.

- MedTech: Robotics and wearable devices are enabling precise, minimally invasive procedures. AI use is a significant part of this progress. Medtronic and Siemens Healthineers are notable providers.

- Personalised medicine: Advances in DNA sequencing advances are tailoring treatments based on genetic profiles, especially in oncology and rare diseases.

Trump’s prescription makes pharma queasy

President Trump’s policies and proposals — including a Section 232 investigation into potential national security threats related to pharmaceutical imports—have unsettled the sector. The report is expected by year end. Other presidential moves include emergency Pharma sector tariffs to accelerate progress on trade deals and drive corporate commitments to increase US manufacturing, and an executive order to reduce drug prices, insisting on most-favoured-nation pricing equal to the lowest price paid in relatively wealthy countries.

The importance of medicines to voters, and the risk of supply shortages, legal challenges, political opposition, and significant lobbying all lead us to discount the worst-case scenarios.

Trump’s tariffs preceded very recent news of companies, starting with Pfizer, increasing opening more US facilities and selling at lower prices. Sector share prices have reacted positively to this, so far

Undervalued. Under-owned.

Valuations currently offer a rare opportunity to gain exposure to long-term structural growth, at a discount. US Health Care’s 30% discount to the S&P 500 is double the norm.

A clear deep-value rotation, and an earnings-sentiment improvement, drove a performance surge in August. This improved relative strength momentum is reflected in SPDR’s Sector Momentum Map [link] for the US, European and World sectors.

Access Health Care sector in US, Europe, World:

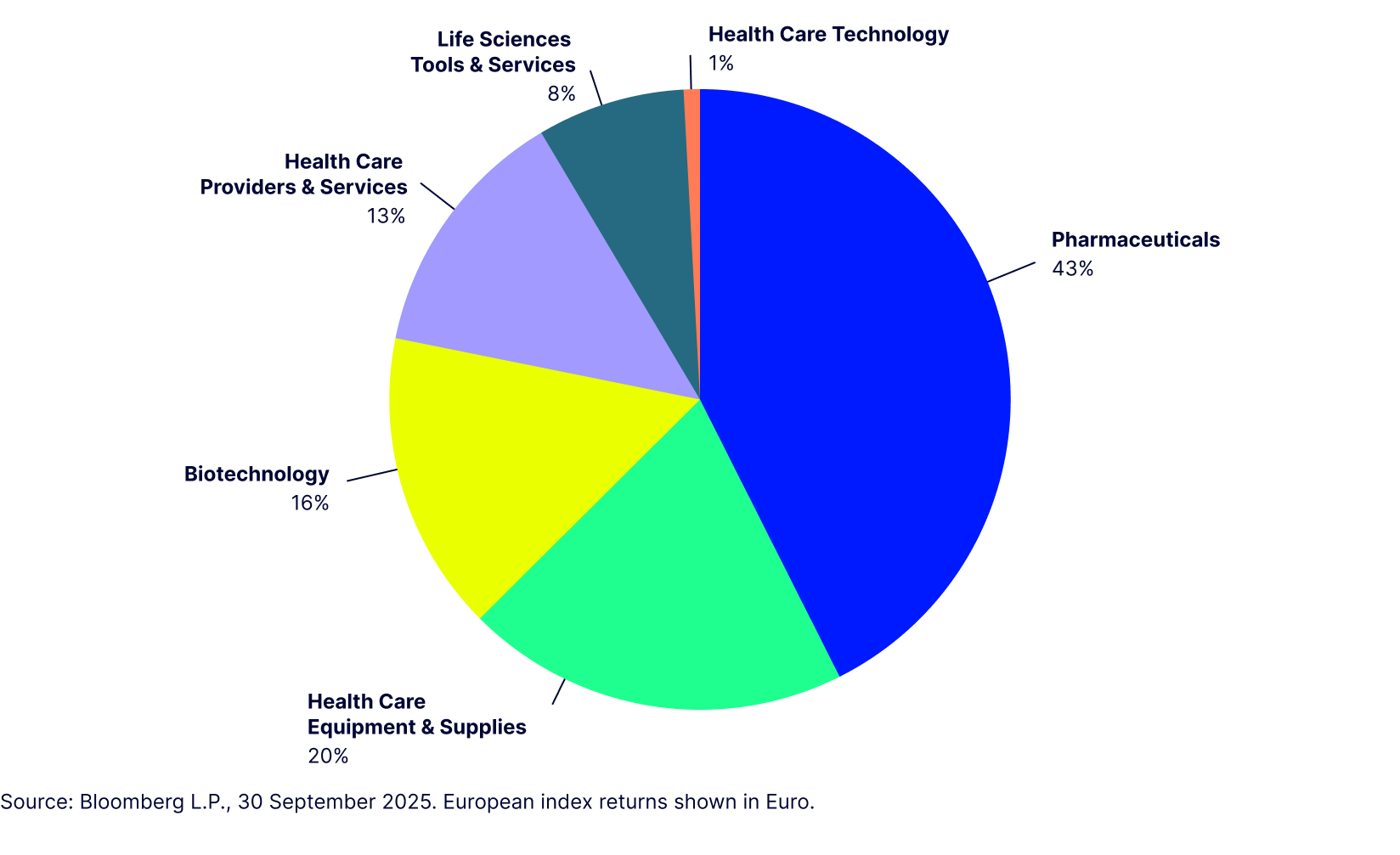

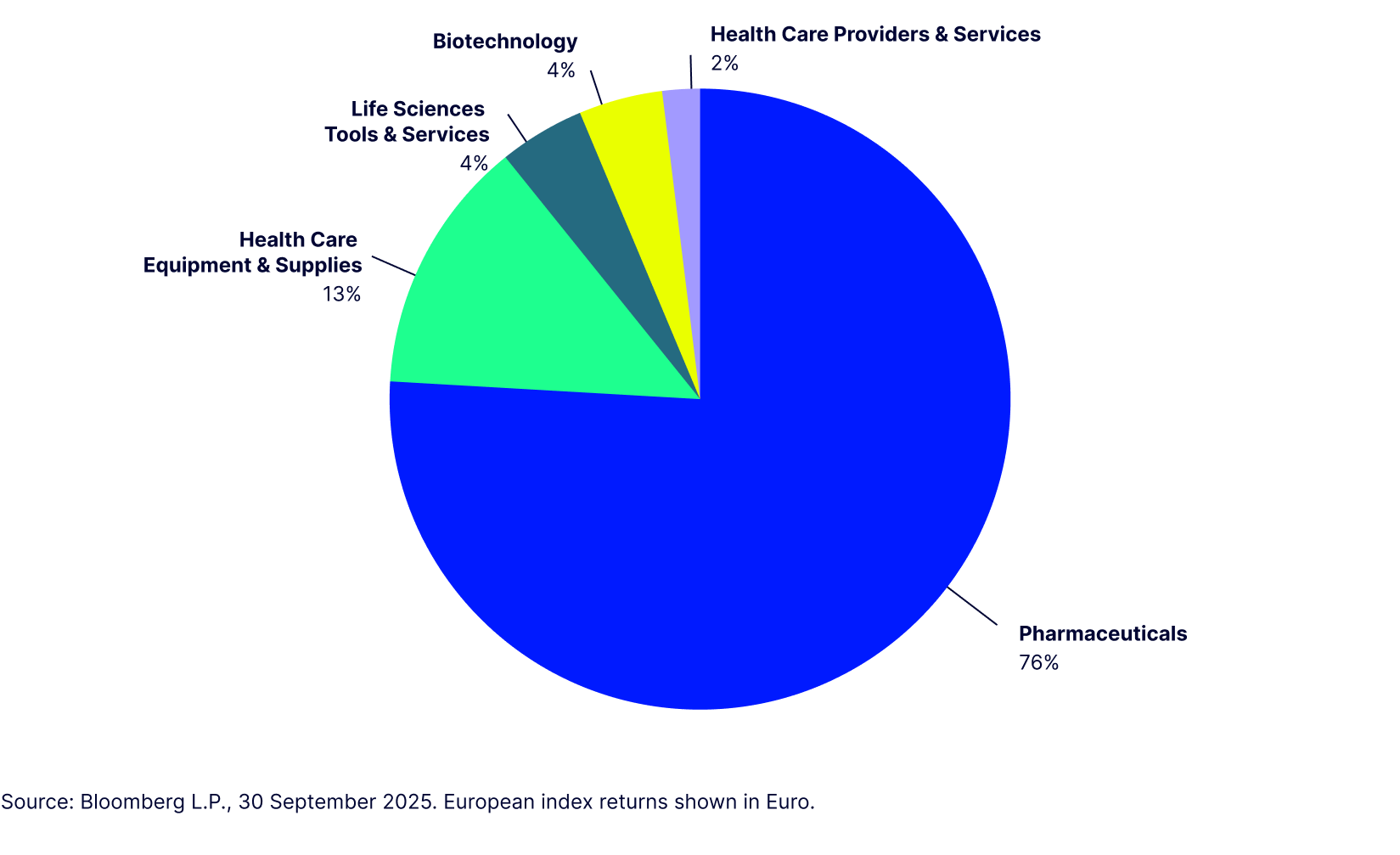

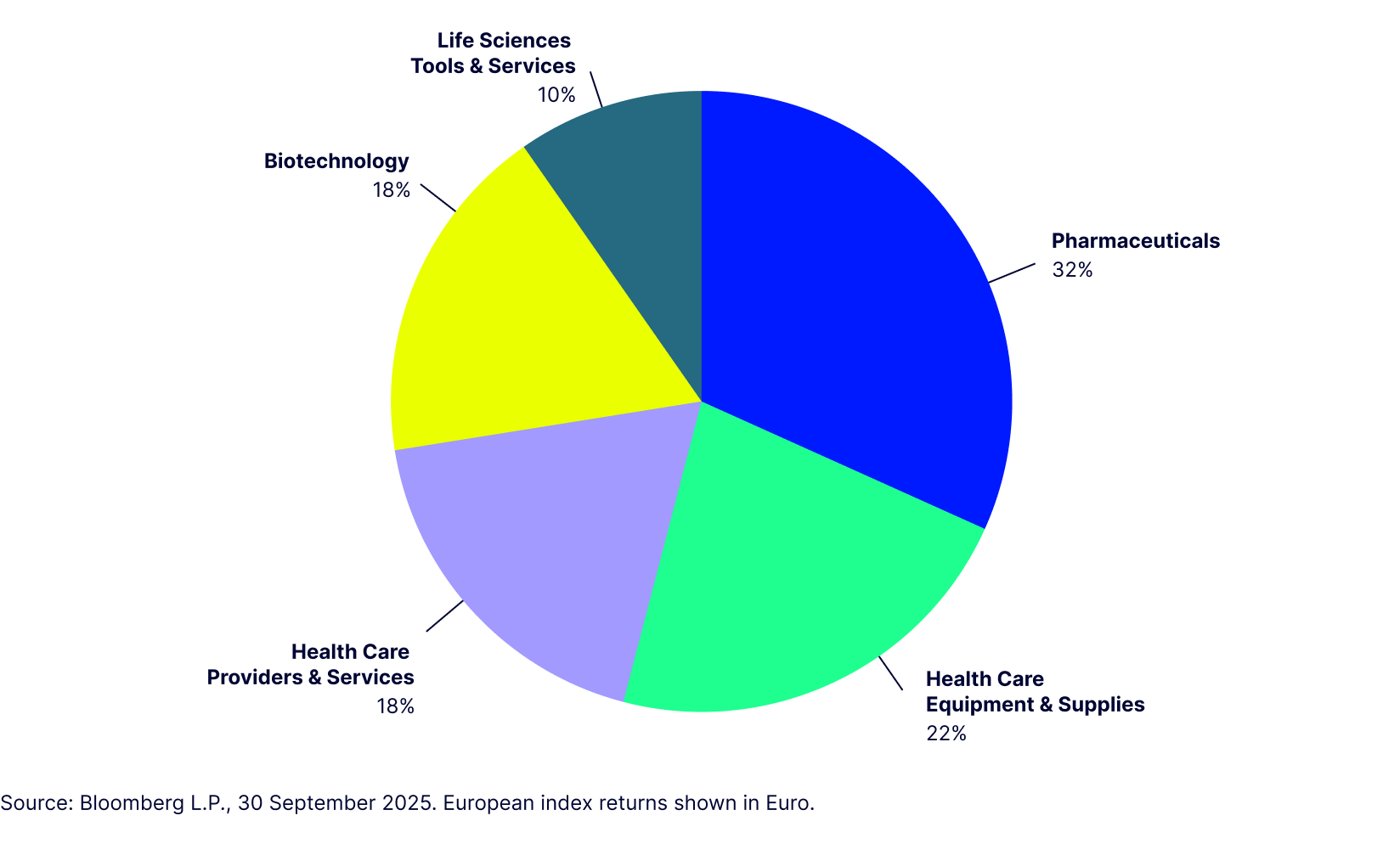

Figure 1: Health Care innovation extends across subsectors

Information Technology: Navigating AI acceleration

The IT sector remains a leader in structural growth and innovation. Many advantages—AI, cloud computing, and cybersecurity—are well understood but resilient demand may provide downside protection in Q4.

Momentum drivers

- More than MSCI World Technology 50 stocks made double-digit share price percentage gains in Q3. Beyond the Magnificent 7, Broadcom, Palantir and Oracle helped raise index performance. AI remains a major driver. Prospects are shifting from generative AI to agentic AI and autonomous systems capable of complex decision-making.

- This narrow focus leaves room for other stocks in the sector to perform. AI-linked chipmakers (including NVIDIA) have surged, but non-AI semiconductor firms, serving autos, industrials, and consumer electronics, have lagged due to oversupply. These companies may rebound as inventories normalise and demand stabilises.

Key factors for Q4

- Earnings: Q3 reporting season will be pivotal. Mega-cap company guidance will set the tone for sector sentiment. Strong results are required to reinforce the bullish AI narrative and justify recent valuations.

- Hyperscaler hype: The huge capital commitments to datacentres have dominated headlines in recent months. Investors want to see monetisation of the cloud infrastructure.

- Regulation: More scrutiny from US and EU regulators remains a risk, but also a potential catalyst. Companies that demonstrate compliance leadership may attract premium valuations and institutional support.

- Cybersecurity: Data breaches and stricter regulations (like the EU Cyber Resilience Act) are driving enterprise IT budgets toward compliance and security. This benefits software and IT service providers with strong governance offerings.

Defensive qualities

- IT infrastructure systems underpin core operations in healthcare, finance, and supply chains, keeping budgets resilient even in downturns. This reflects confidence in long-term demand and supports revenue visibility.

- Recurring revenue models provide stability to earnings and cashflow. The exemplar is the subscription-based services which power much of Apple’s revenue.

We believe a wise best approach to mitigate volatility in US exposures is to barbell a sector holding of IT with Health Care. By combining with a relatively lowly correlated sector, the volatility of returns is much reduced, providing downside protection.

How to access the sector

US Financials: Earnings, buybacks, deregulation

The sector benefits from macroeconomic tailwinds, valuation support, and sector-specific catalysts. Financials, especially Banks, are a quintessential domestic cyclical which would benefit from a soft landing.

Fund flow data also shows the investor demand for value and cyclicals sectors, and Financials have captured a meaningful share.

- Good news on interest rates and margins: The Fed’s recent signals suggest a downward interest rate path with potential for modest cuts this year and in early 2026. Lower-rate volatility favours banks and diversified financials. Loan growth remains resilient, and credit quality exceeded expectations, reducing concerns around default rates.

We expect the US Treasury yield curve to remain steep, supported by persistent inflation, which helps banks’ net interest income margins. - Strong capital positions boost shareholder value: US financials have demonstrated robust capital discipline. Recent stress tests show that major banks are well-capitalised. JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Goldman Sachs and Morgan Stanley have announced aggressive buyback programs and dividend hikes.

- Fundamentally attractive: The S&P Financials index trades at a discount to the S&P 500 on both forward earnings and price-to-book metrics. This valuation gap is historically wide and offers latitude for investors. Earnings growth is expected to accelerate in Q4, so the sector presents an attractive risk-reward profile, especially compared with more richly valued sectors. AI-driven productivity gains across financial industries in the longer term, will help navigate high levels of regulation and complexity. The sector (via investment banks) is benefiting from elevated M&A activity. Insurers and financials services providers, such as BlackRock and Prudential Financial, are leveraged to the strength of the equity and fixed income markets.

- Regulatory clarity: this has stabilized after mid-year uncertainty. We expect a loosening of capital requirements and liquidity buffers. The sector is ripe for consolidation, particularly among regional banks and asset managers, and may get a friendlier reception in the Trump era. This should allow improved efficiencies.

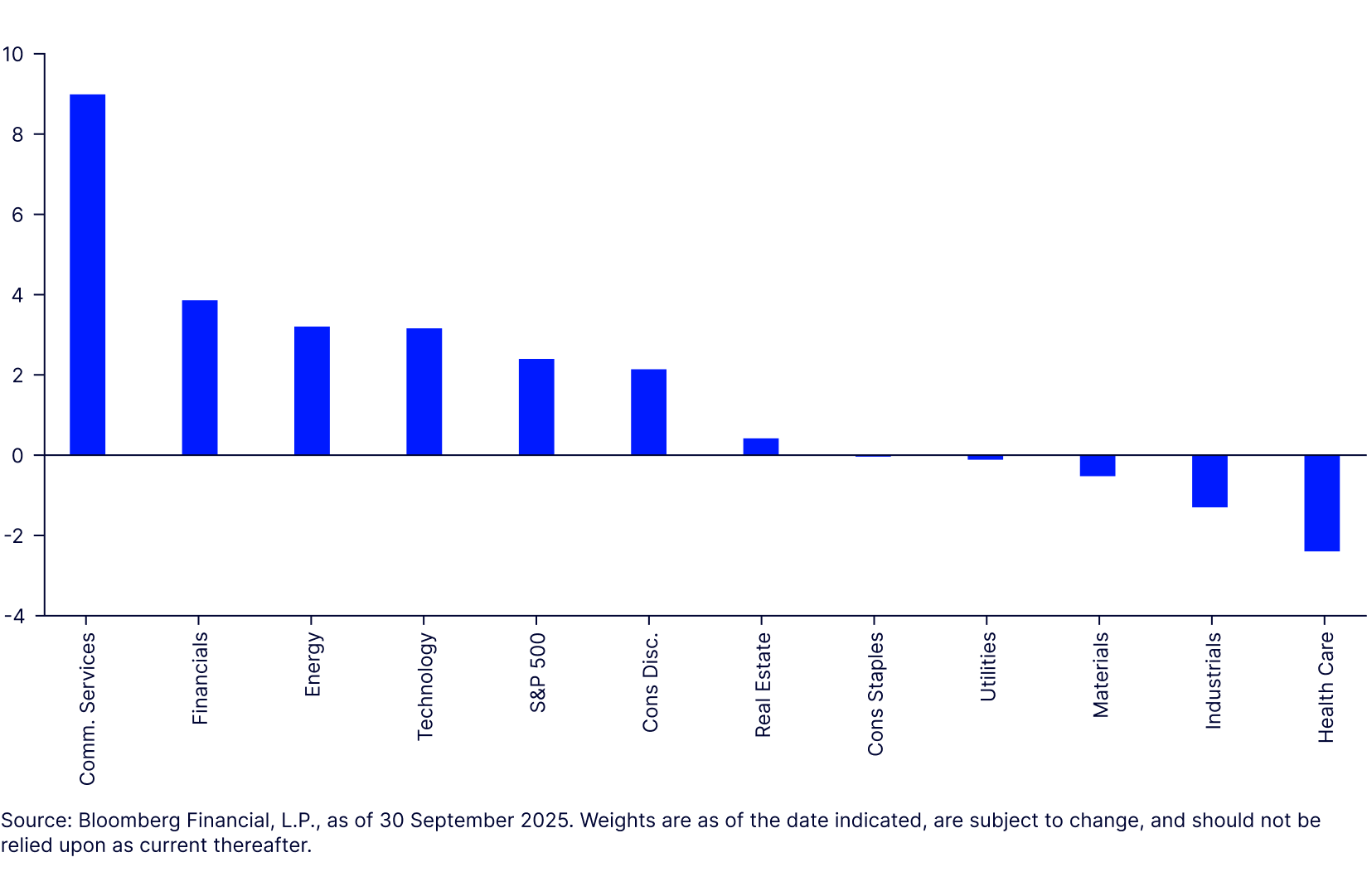

Figure 3: Financials has amongst the best EPS revisions for US sectors over previous 3 months (%)

How to access the sector:

European and world Industrials: Power move

MSCI Europe Industrials has been a favourite of ours over the past year, justified by strong returns, outperforming the broader European market. As of end September, the sector had delivered 23%, driven by defence stocks and other structural growth themes. We expect investor appetite for Industrials to continue.

Growth drivers

- Defence: the most discussed sector year to date. We expect European companies to raise earnings forecasts as countries raise NATO commitments. This will also benefit US names like RTX (Raytheon Technologies), in MSCI World Industrials, given its advanced technologies in aerospace, AI, and cybersecurity.

- Datacentres: continued capex commitments support optimism. Electrical equipment is used in server rooms, datacentre infrastructure management, and power supply. Schneider Electric is a market leader, supplying an extensive range of cooling products, generators, and transformers. ABB, Siemens, and Eaton should also benefit.

- Digitalisation and automation: Investment in digital transformation, robotics and AI-driven manufacturing is boosting productivity and creating new revenue streams for leading industrial companies. Siemens and ABB are leaders because of smart-factory investment, and energy and green efficiency.

- Green transition and electrification: Industrials are at the heart of Europe’s energy transition, supplying equipment and services for renewable energy, grid modernisation, and electrification of transport and industry, all tailwinds for capital goods and engineering firms. Schneider is a pure play on electrification, energy efficiency, and smart grid solutions.

- Reshoring: The sector is benefiting from supply-chain relocalisation, driving new orders and capital expenditure, especially in automation, electrification, and advanced manufacturing.

Cyclical gains in a soft landing

We expect the sector to benefit from the easing global policy cycle, improving financing conditions are good to capital-intensive projects. Resilient domestic enterprise demand is shown in strong order books, especially for specialist software and analytics.

Airbus and others are supported by a constructive market in aerospace, with rising demand for modern aircraft to support growing global travel. Rolls-Royce is aligned to the recovery in long-haul travel and engine aftermarket services. The company also has an attractive story in defence and power systems.

Global portfolio of themes

US companies account for 51% of market cap in the World sector, including General Electric (now predominantly aerospace) and its demerged energy business, GE Vernova. Both benefit from demand in jet engines and grid modernisation, and exposure to AI-driven industrial automation and renewables.

Caterpillar offers exposure to positive US industrial dynamics spurred by economic strength; supported by infrastructure spending and mining demand. Uber—best known for its taxi business—has logistics and mobility platforms increasingly integrated with industrial supply chains, and autonomous delivery services.

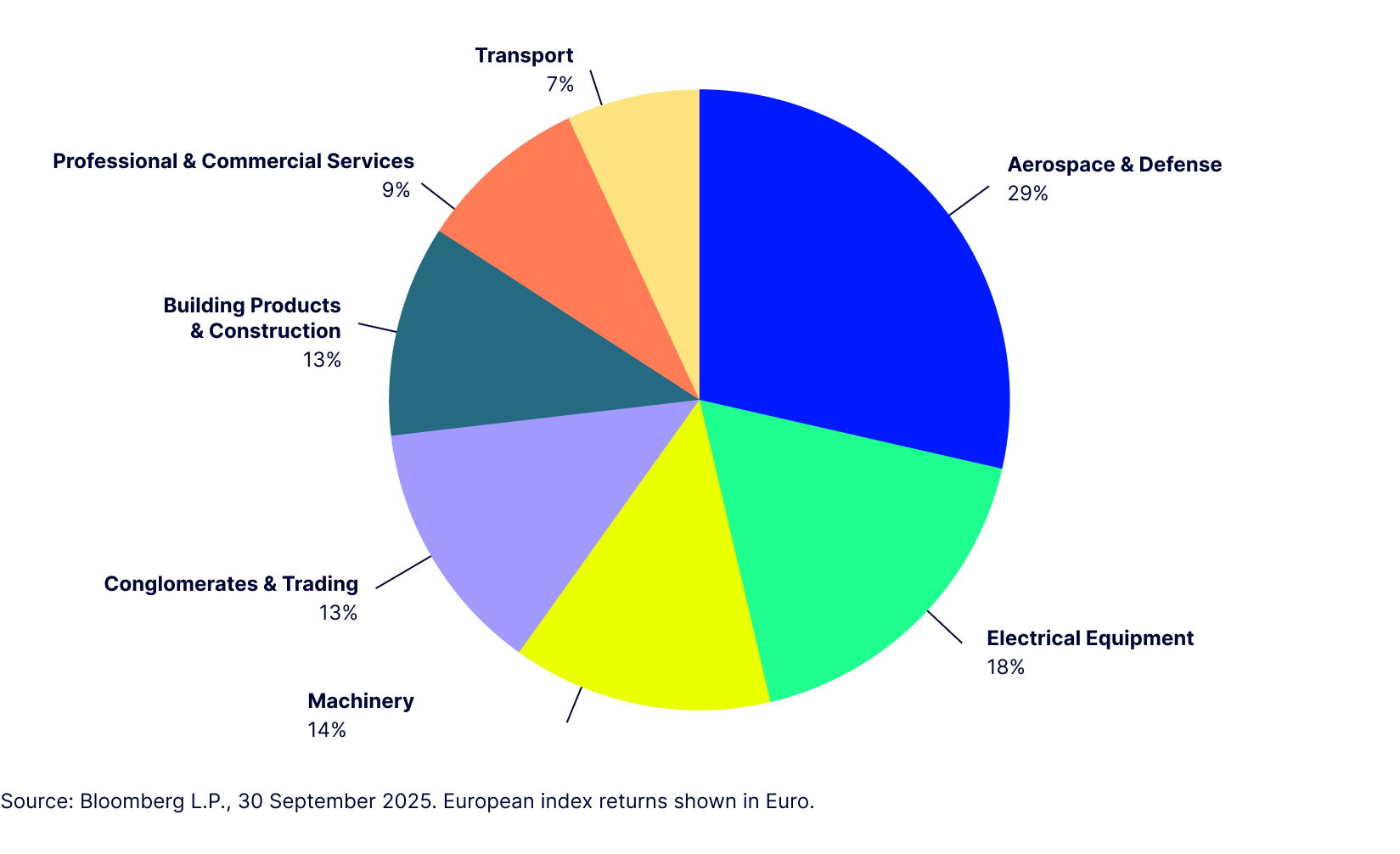

Figure 4: Structural growth trends support majority of MSCI Europe Industrials industries (% of market cap)

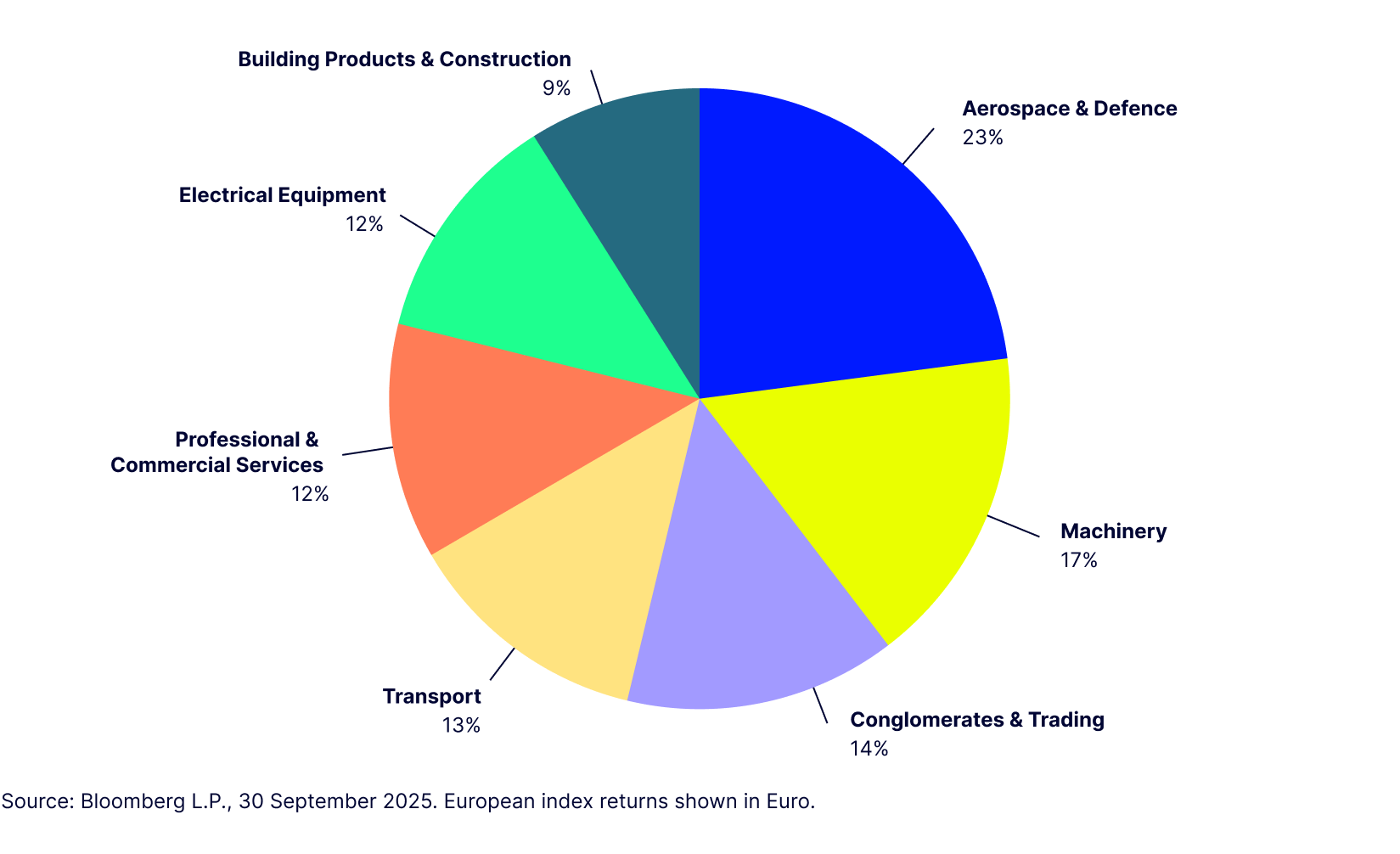

Structural growth trends support majority of MSCI World Industrials (% of market cap)

How to access the sector:

All the companies mentioned are held in SPDR’s sector ETFs