Hedging China bond exposures: strategic considerations for investors

This paper discusses the evolution of hedging strategies for managing RMB exposures. We focus on the transition from offshore non-deliverable forwards (NDFs) to onshore CNY instruments.

Key themes in RMB hedging

China’s bond market has rapidly evolved into a cornerstone of global fixed income investing and is no longer a discretionary allocation, but a structural one. Now the second-largest debt market globally after the U.S., China bonds offer scale, competitive yields and returns, as well as diversification benefits. However, with opportunity comes complexity—particularly in managing RMB currency risk.

This paper highlights the advantages and disadvantages of both onshore (CNY) and offshore (CNH) hedging options for investors. There are four key areas for investors to focus on:

- CNY trading growth: The increase in CNY trading volumes is attributed to better access, improved infrastructure, and the benefits of lower tracking errors when hedging in CNY compared to CNH. This trend is particularly significant during market stress.

- Evolution of hedging instruments: Initially, RMB exposure was primarily hedged using NDFs, which had limitations. The launch of the CNH market in 2010 introduced deliverable instruments, enhancing flexibility and market competitiveness.

- Onshore versus offshore hedging: Investors can now choose between onshore CNY and offshore CNH hedging instruments, each with unique benefits and challenges regarding cost, precision, and operational complexity.

- Regulatory considerations: Access to China’s bond market through Bond Connect and CIBM Direct has improved hedging strategies, with CIBM (China Interbank Bond Market) Direct providing broader access to onshore derivatives, thereby enhancing hedge precision.

Background: The rise of China bonds in global portfolios

In 2019, China was added to the Bloomberg Barclays Global Aggregate Bond Index, and then to the FTSE World Government Bond Index (WGBI) in 2021. These milestones marked a turning point in the internationalization of China’s bond market and significantly broadened foreign investor access.

Today, with over USD 25 trillion (RMB 185 trillion) in outstanding debt, China is home to the world’s second-largest bond market (Figure 1). Investors increasingly view China bonds as a strategic allocation, drawn by their historically low volatility, low correlation with other asset classes, and competitive long-term returns.

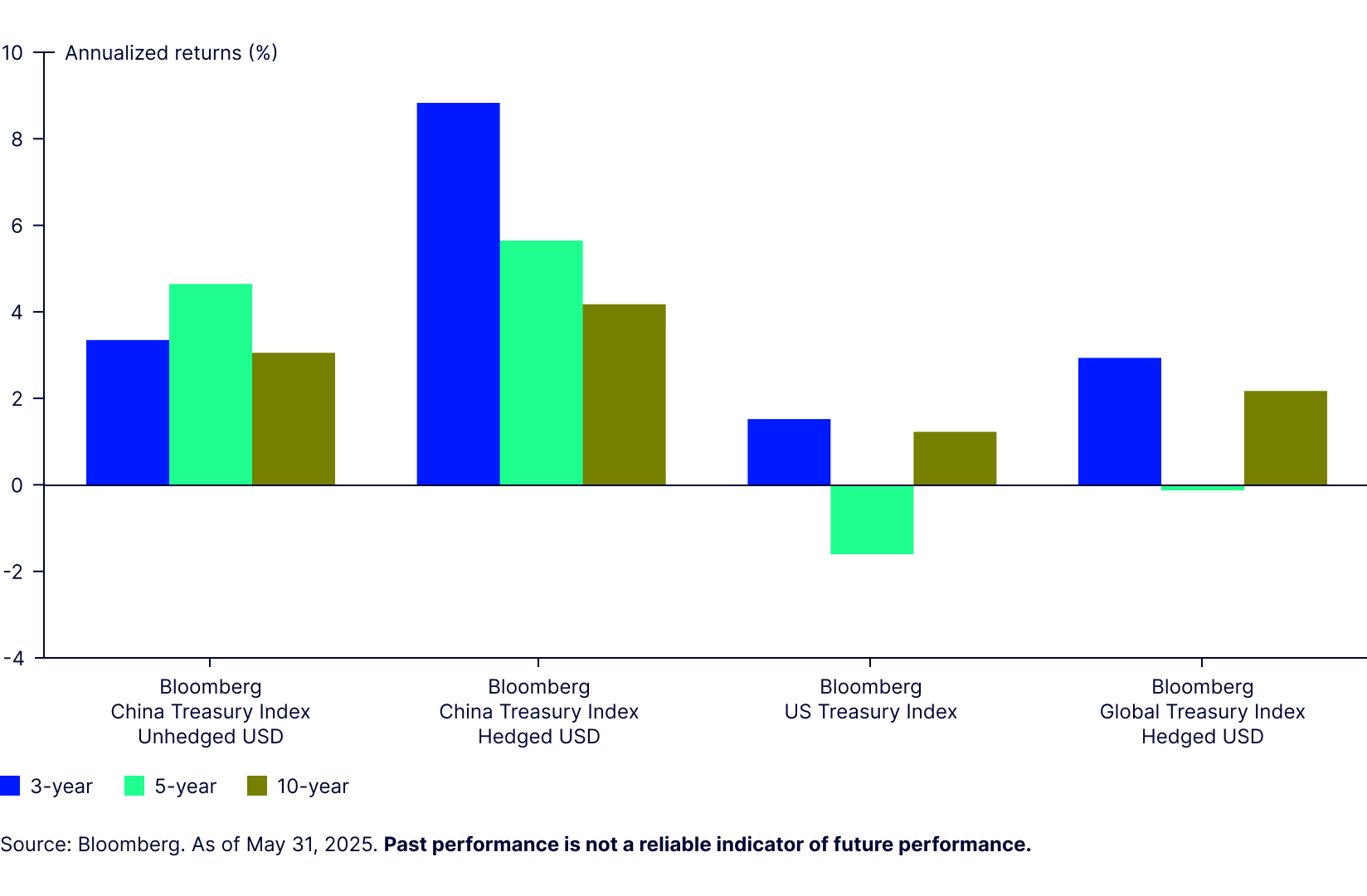

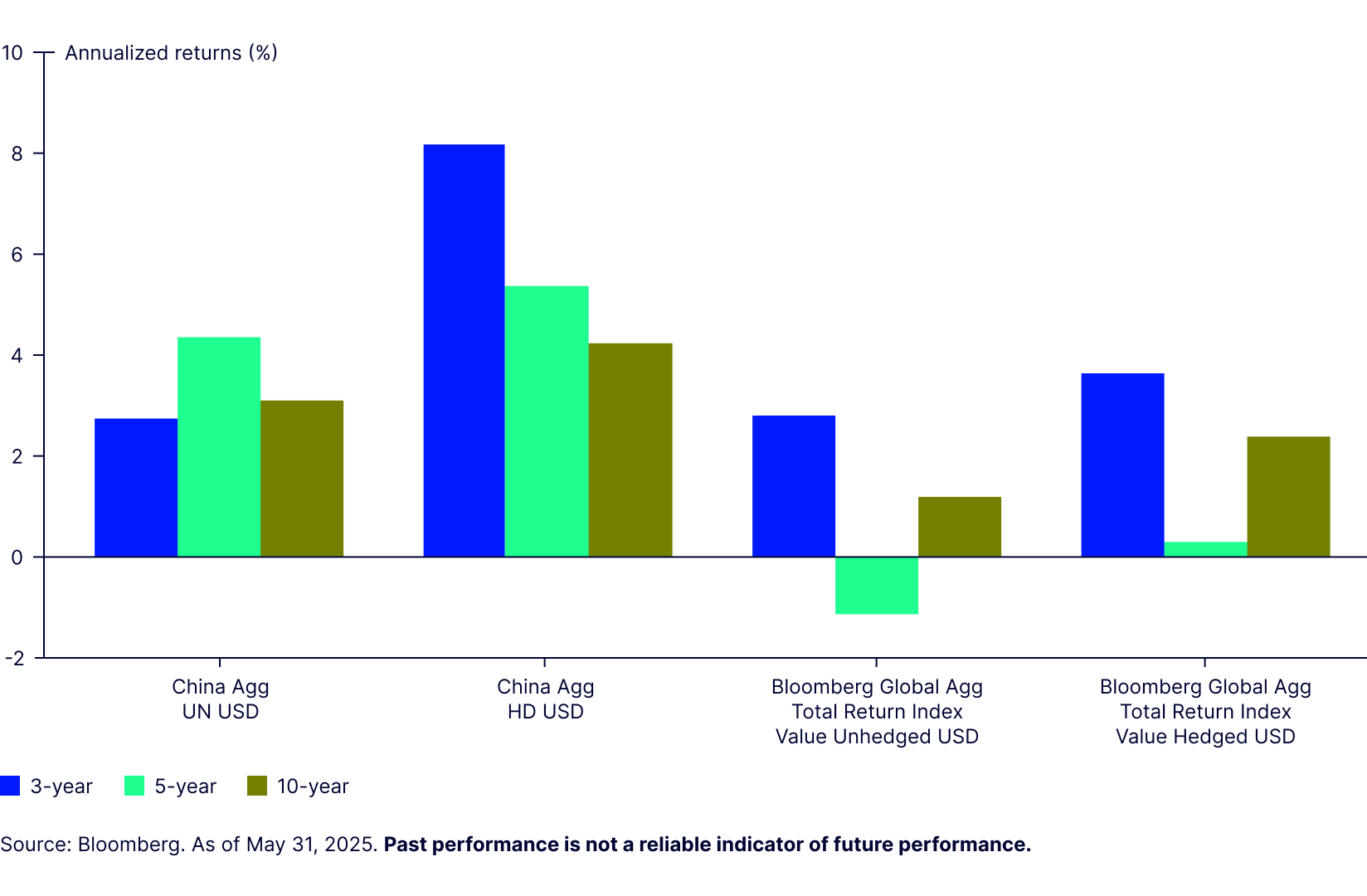

Alongside their strategic diversification benefits, China bonds have delivered consistently competitive returns. Over the past decade, both the Bloomberg China Treasury + Policy Bank Index and the Bloomberg China Aggregate Index have outperformed many major global benchmarks, including the FTSE World Government Bond Index and the Bloomberg Global Aggregate Treasury Index (Figure 2). These return profiles reinforce the case for including China Bonds in global fixed income portfolios and, where appropriate, for holding a dedicated allocation.

Why hedging matters

Historically, hedging has been beneficial for performance. Notably, the hedged versions of the China Aggregate Index and the China Treasury Index have delivered stronger results than the unhedged versions, outperfoming over 3-, 5-, and 10-year time periods (Figures 2 and 3). This delta underscores the value of currency management in enhancing performance.

Figure 2: Performance of China Treasury Bonds vs Global and US Treasury Bonds

Figure 3: Perfomance of China Agg vs the Global Agg

Managing currency risk

As allocations to China Bonds by global investors grow, so too do the hedging requirements that come with managing a hedged portfolio. Hedging renminbi (RMB) exposure remains a complex challenge. The RMB is still only partially convertible, interest rate policy is tightly managed by the People’s Bank of China (PBOC), and the onshore derivatives market—while evolving—continues to lack the depth and liquidity of developed markets.

A central complexity lies in the RMB’s dual structure: CNY refers to the onshore renminbi traded within mainland China, while CNH refers to the offshore version traded in international markets such as Hong Kong (see shaded box). Although both represent the same currency, they are governed by different regulatory regimes and can diverge in pricing and liquidity.

RMB, CNY, and CNH: Understanding the Alphabet Soup

RMB, or Renminbi, is the official name of China’s currency system. Within that system, two key denominations are used: CNY and CNH.

CNY refers to the onshore yuan, used within mainland China. It’s tightly regulated by the People’s Bank of China, and is the currency in which most domestic Chinese bonds — including government, policy bank, corporate, and Panda bonds (see below) — are issued and valued. These bonds are eligible for inclusion in major global indices like the Bloomberg Global Aggregate, provided they meet criteria for credit quality and liquidity.

Panda bonds are a special category of CNY-denominated bonds issued by foreign entities (such as governments, multinational corporations, or development banks) within mainland China. Despite being foreign issuers, these bonds are treated as local currency instruments and can be included in global bond indices if they meet standard inclusion criteria.

CNH, on the other hand, is the offshore version of the RMB, used outside mainland China in markets like Hong Kong. Bonds issued in CNH — known as Dim Sum bonds — are typically excluded from global aggregate indices and instead tracked in dedicated offshore RMB indices. These bonds are valued in CNH and reflect more market-driven pricing, as they are less subject to mainland regulatory controls.

In short: CNY bonds (including onshore and Panda bonds) are index-eligible and valued in CNY, while CNH bonds (Dim Sum) are tracked separately and valued in CNH. This distinction matters for investors seeking exposure to China’s fixed income market, as it affects currency risk, regulatory oversight, and index inclusion.

Progress in CNY hedging strategies

CNH has historically been easier to hedge due to its accessibility and deeper offshore derivatives market. However, as fixed income indices benchmark performance against CNY, and as allocations to China bonds have grown, so too has the impact of basis risk. This has led investors to explore CNY-based hedging options, despite the added regulatory and operational challenges—including limited instrument availability and stricter access requirements.

These structural features have created a nuanced risk environment where traditional hedging strategies may not always be viable or cost-effective. Encouragingly, the landscape has evolved significantly over the past decade, offering a broader—though still imperfect—range of instruments. One notable development is the steady rise in CNY trading volumes (Figure 4), which signals several factors that have smoothed the path for CNY hedging strategies:

- A transformation in market accessibility and investor behavior. The growth in volumes demonstrates the increasing internationalization of the renminbi, and the rise in investor engagement with Chinese financial markets. This trend underscores the rising demand for CNY-denominated assets and the expanding use of the currency in cross-border transactions and hedging strategies.

- A more functional market for managing FX risk. As foreign participation in China’s bond and financial markets has expanded, so too has the demand for effective currency hedging tools. In response, CNY liquidity has improved, access to forwards and swaps has broadened, and onshore derivatives infrastructure has seen incremental enhancements.

The CNY hedging performance differential

The growth in CNY trading volumes also reflects the market’s recognition of the potential performance advantages associated with onshore hedging. One of the key drivers behind this shift has been the lower tracking error observed when hedging in CNY versus CNH (Figure 5). As investors seek to align more closely with index benchmarks and reduce performance drag, the appeal of CNY-based hedging strategies has grown, particularly during periods of market stress when offshore pricing can diverge meaningfully from onshore rates. These performance dynamics have influenced investor behaviour.

Figure 5 illustrates the rolling one-year tracking error between CNHUSD and CNYUSD hedging strategies from April 2015 to April 2025. The data highlights periods—particularly around 2017 and 2020—in which CNH-based hedging diverged more significantly from benchmark performance. These fluctuations underscore the performance advantage of onshore CNY hedging in maintaining tighter alignment with index exposures.

Figure 6 shows the 3-month rolling excess returns of CNHUSD relative to CNYUSD from May 2015 to May 2025. While the series is volatile, it highlights the presence of basis risk between offshore and onshore hedging strategies. Although this basis tends to mean-revert over time, there are periods of prolonged under- or outperformance that can materially impact portfolio returns and tracking error. The extended underperformance of CNH-based hedging from 2023 to 2025 is reflective of this dynamic and has contributed to the increasing shift toward CNY-based hedging among performance-sensitive investors.

Finally, Figure 7 displays the distribution of monthly excess returns for CNHUSD relative to CNYUSD over the past decade. The skew toward negative excess return intervals—particularly the concentration in the -0.25% to 0% range—highlights the tendency for CNH-based hedging to underperform CNY on a month-to-month basis. While the average differences may appear modest, the frequency and persistence of small negative returns can compound over time, contributing to cumulative performance drag and reinforcing the rationale for shifting toward onshore hedging.

The evolution of currency hedging options

For investors managing RMB exposure, the evolution of hedging instruments has been just as important as market access itself. Up until the early 2010s, hedging RMB exposure was largely confined to NDFs traded offshore in USD. These instruments allowed investors to synthetically hedge RMB exposure without accessing the onshore market, but they came with drawbacks such as pricing inefficiencies due to capital controls, limited tenors and liquidity, as well as basis risk between NDF-implied rates and onshore spot rates.

In July 2010, the CNH (offshore RMB) market was formally launched by the PBOC and the Hong Kong Monetary Authority (HKMA), enabling RMB to be deliverable in Hong Kong. Offshore deliverable CNH forwards began trading, followed shortly thereafter by swaps and options, offering greater flexibility and transparency than the previously dominant NDFs.

By late 2013, CNH forwards had gained significant market share as liquidity improved and pricing became more competitive. This shift accelerated further after the PBOC’s August 2015 FX reform, which introduced a more market-driven RMB fixing mechanism and narrowed the pricing gap between CNH forwards and NDFs.

The next major evolution came with the introduction of direct access to China’s onshore bond and FX markets. CIBM Direct was launched in February 2016, allowing qualified foreign institutional investors to trade directly through onshore accounts. This marked a significant expansion beyond earlier access limited to central banks and sovereign institutions. Bond Connect followed shortly after in July 2017, offering a more streamlined, offshore-based route via Hong Kong infrastructure, eliminating the need for onshore registration and allowed foreign investors to trade onshore Chinese bonds through their existing offshore custodians and trading platforms.

Together, these access channels marked a turning point in the internationalization of China’s bond and derivatives markets. They enabled more precise and scalable hedging strategies for institutional portfolios including interest rate swaps (IRS) and cross currency swaps (CCS).

Comparing onshore versus offshore hedging

As China’s capital markets have opened, investors now face a critical choice between onshore (CNY) and offshore (CNH) hedging instruments. Each route offers distinct advantages and trade-offs in terms of cost, precision, accessibility, and operational complexity.

Onshore hedging (CNY):

Pros | Cons |

|---|---|

Tracking accuracy: Index providers benchmark using CNY. Therefore, onshore CNY hedging typically offers significantly lower tracking error compared to offshore CNH, ensuring closer alignment with actual bond exposures.

| Operational complexity: Requires local counterparty relationships, ISDA/CSA documentation, and familiarity with PBOC regulations. |

Market liquidity and accessibility: While offshore CNH markets historically offered easier access, improvements in market infrastructure now facilitate efficient access to onshore CNY derivatives.

| Capital controls: Repatriation and FX conversion rules can introduce friction.

|

Yield pickup: Onshore CNY may offer additional yield pickup due to interest rate differentials and lower frictional costs.

| Limited derivative depth: IRS and CCS markets are still developing so market depth can be a challenge for large investors.

|

Regulatory alignment: Instruments like CNY forwards and swaps are increasingly supported under Bond Connect and CIBM Direct. | Compliance: CNY is subject to PBOC oversight and capital controls, requiring compliance with SAFE regulations, including documentation of underlying exposure and transaction-level reporting. |

Offshore hedging (CNH):

Pros | Cons |

|---|---|

Ease of access: No need for onshore accounts or regulatory approvals.

| Basis risk: Offshore rates may diverge from onshore pricing, especially during periods of market stress or policy intervention.

|

Established infrastructure: NDFs and CNH forwards are widely traded and supported by global custodians and prime brokers.

| Higher cost: Wider bid-ask spreads and less favourable carry.

|

Operational simplicity: Requires minimal changes to investor workflows in China and is regulated by the HKMA, reducing regulatory complexity. | Limited tenors: Especially for NDFs, which are typically short dated.

|

Lower capital control risk: Settled offshore in USD or CNH. |

|

An additional consideration: regulatory and operational factors

While China has made significant strides in opening its bond and FX markets, regulatory and operational factors remain central to the execution of effective hedging strategies. Investors must navigate a complex multi-layered framework that governs market access, FX conversion, and derivative usage.

Foreign investors accessing China’s bond market primarily do so through two channels: Bond Connect and CIBM Direct. While both provide access to the China Interbank Bond Market, they differ in structure, execution mechanics, and critically, hedging flexibility.

Bond Connect is a trading link via Hong Kong, allowing offshore investors to trade onshore bonds without setting up a local entity. Settlement and custody are handled offshore, typically in Hong Kong.

A majority of Bond Connect investors hedge using CNH Forwards, which exposes them to basis risk between CNH and CNY. Investors can hedge RMB exposure using onshore CNY forwards and swaps, but only through designated Bond Connect market makers. Access to onshore IRS and CCS is limited. Also, FX transactions are subject to daily conversion limits and pre-trade disclosure requirements.

CIBM Direct allows qualified foreign institutional investors to access the interbank bond market directly from offshore, but with onshore account setup and regulatory registration.

This allows for broader access to onshore FX and derivatives markets, including Interest Rate Swaps (IRS), Cross Currency Swaps (CCS), and longer-tenor CNY forwards, providing greater flexibility in choosing counterparties and structuring bespoke hedges. FX conversions and hedging are more integrated with bond settlement flows, improving hedge precision. Most importantly, CNY is the currency of choice used for benchmarking major indices.

Our unique proposition

As China’s bond market continues to mature and integrate with global capital flows, the need for effective and nuanced hedging strategies has never been greater. Investors face an important set of challenges ranging from currency convertibility and interest rate policy to regulatory fragmentation and market access constraints. However, hedging matters greatly for investors, as properly managing currency risk can provide significant performance benefits for Chinese bondholders.

Ultimately, the optimal hedging approach depends on the investor’s objectives, risk tolerance, and operational capabilities. At State Street Investment Management, we are strategically positioned to deliver institutional-grade solutions across both onshore and offshore hedging capabilities. This dual approach differentiates our platform and provides investors with the strategic flexibility and operational precision necessary to navigate market fluctuations effectively.

To learn more about currency hedging in China bonds, please contact your State Street representative.