USD Down, but Not Yet Out

The USD retraced 60% of its gains since mid-July in November on speculation that major central banks may be near the end of their monetary tightening cycles. However, we believe it is premature to anticipate a major USD bear market. Tactically, we have now turned negative on the SEK.

While the US dollar downside may persist for another 4–6 weeks, we hold firm to our view into 2024 that it is premature to anticipate a major US dollar bear market. The US dollar remains both a defensive and high-yield currency, while the US economy is outperforming—a very attractive trio of factors for the dollar.

Our base case—slower US growth against a backdrop of anemic growth in major economies outside the US—suggests that recession risk will remain a significant concern for investors, potentially leading to periods of greater equity volatility and intermittent US dollar rallies. Eventually, likely later in 2024 or maybe in 2025, we do see a dollar bear market, with the US losing much of its interest rate and growth advantage over the next 1–3 years, leading to a sustained dollar bear market. The unsustainably high combined US fiscal and current account deficits are expected to further pressure the dollar downward.

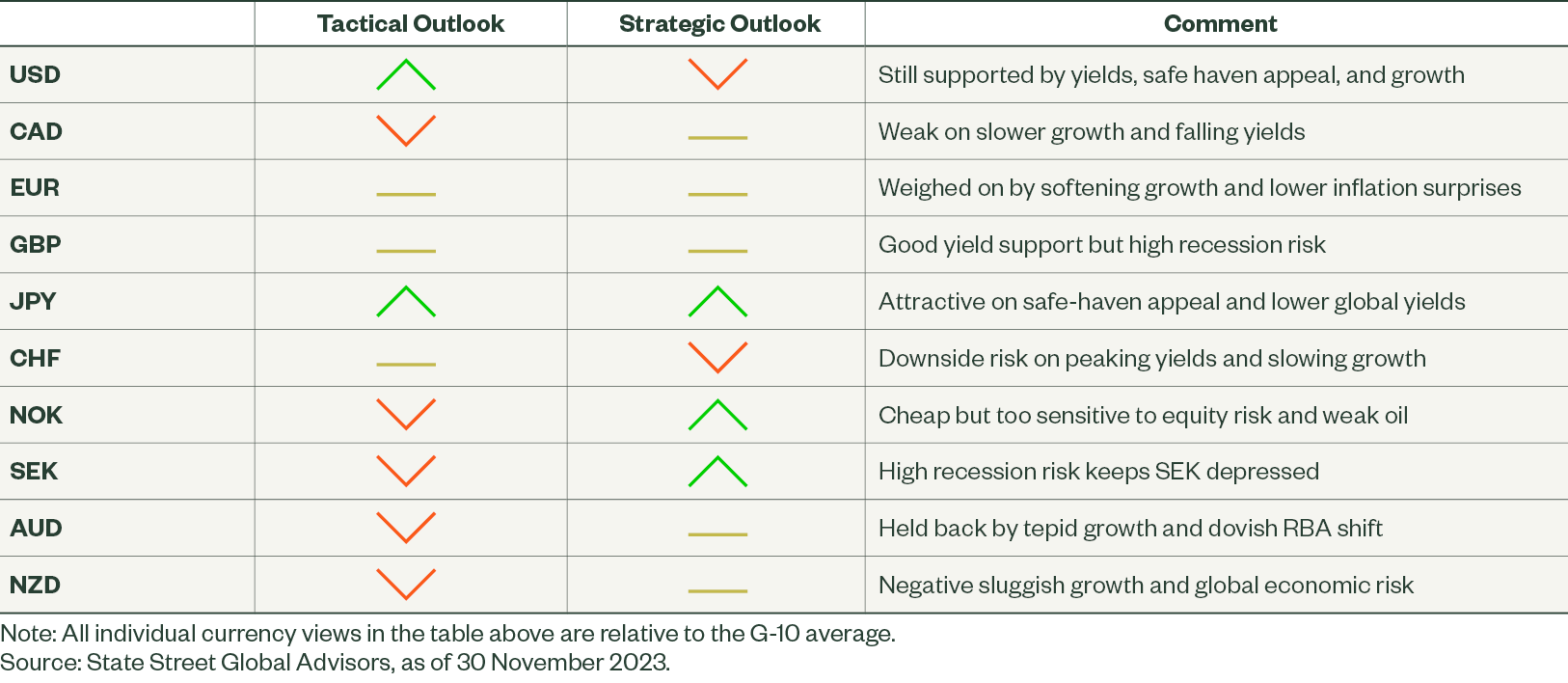

Figure 2: November 2023 Directional Outlook

As global yields normalize alongside slowing growth, the Japanese yen looks increasingly attractive. Our models suggest that we are in the very late stages of the yen bear market, with risks skewed clearly to the upside over the 6–12-month horizon.

Meanwhile, we expect weaker global growth, volatile risky asset performance, and geopolitical uncertainty to keep a lid on the cyclically sensitive Australian dollar, New Zealand dollar, British pound, Canadian dollar, and Norwegian krone, despite their cheap historical valuations. Within that group, the relative monetary policy outlook will likely determine their relative performance.

US Dollar (USD)

We have long held the view that the US dollar is likely to fall at least 10%–15% over the coming years, but it is currently in a noisy transitional phase from a bull to a bear market, characterized by protracted range-trading. December and early January tend to bring a positive risk/equity sentiment, which could lead to further upside in equity markets and downside for the US dollar, albeit with some intermittent corrections and at a much slower pace than in November.

However, sustained US dollar bear market does not appear imminent. The world is in a fragile place, while the US grows well above trend and offers high yields, and the US dollar tends to provide a good hedge for risky assets if we slide into recession. These factors provide strong support for the US dollar as we head into a highly uncertain 2024.

Canadian Dollar (CAD)

The Canadian dollar is now the lowest-ranked currency by our short- and medium-term models. Rapid deceleration in growth, alongside rising levels of unemployment and weak commodity prices, suggests further weakness for the Canadian dollar. Market expectations for Bank of Canada policy easing, which could be as soon as March next year, have risen, as they have for US Fed policy.

However, the more pronounced economic slowdown and equally rapid disinflation raise the risk of recession and an even earlier or more rapid monetary easing cycle in Canada. This risk appears to be underappreciated in the current market pricing and suggests scope for Canadian dollar weakness.

In the longer term, we believe Canadian growth will remain competitive and the Canadian dollar appears cheap in our estimates of fair value relative to the euro, the Swiss franc, and the US dollar, creating room for substantial upside.

Euro (EUR)

We maintain a neutral view on the euro against the G10 average and a negative view against the US dollar and the yen. Heightened global uncertainty and equity volatility over the next few months may help support the euro against higher-beta currencies, as will the ongoing weakness in commodity markets. Against the US dollar and other less cyclically sensitive currencies, we expect the euro to struggle, as they are likely to benefit more from global uncertainty than the euro. The combination of high European Union recession risk and softening European Central Bank (ECB) policy outlook is expected to weigh on the euro.

British Pound (GBP)

Our factor models remain neutral on the pound vs. the G10 average but are quite negative against the yen and US dollar. While stable for now, we see risks to the pound skewed lower as the economy teeters on the brink of recession, inflation and wages remain uncomfortably high, the central bank turns away from further rate increases, and the UK economy faces the constraints of high fiscal and current account deficits.

Our long-run valuation model has a more positive outlook for the pound. It is particularly cheap against the US dollar and Swiss franc. However, it is important to temper upside expectations as low productivity growth and high inflation are pushing fair value lower.

Fair value to the US dollar has fallen from 1.55 to 1.42 since May 2022. Breakeven inflation expectations and recent trend productivity differentials suggest that fair value will trend down to at least the mid-1.30s over the next few years, although, from current levels in the mid-1.20s, the pound is still materially cheap, even if fair value trends down to the 1.30s.

Japanese Yen (JPY)

Our models have shifted to a positive view on the yen relative to the G10 but retain a negative view vs. the US dollar, given high US interest rates and strong relative growth. Looking into 2024, we see risks skewed toward a broad yen recovery as yields peak and turn lower, while below-trend global growth creates an increasingly fragile environment for risky assets.

The uncertain timing of the turn in global yields and growth is an issue that requires patience and tolerance for additional near-term losses in long-yen positions. Intervention may also help to limit further yen downside, though it is less likely in the near term now that global yields have fallen and USD/JPY is off its highs. However, if the yen rises above 155 versus the US dollar, the risk of intervention is high.

Swiss Franc (CHF)

We hold a negative outlook on the Swiss franc over both the tactical and strategic horizons. It is the most expensive G10 currency per our estimates of long-run fair value; growth data continues to soften; inflation is rolling over. Aside from the yen, the franc has the lowest yields in the G10. The monetary policy outlook is also likely to shift in Q1.

The downtrend in inflation and soft growth data suggest a pivot by the Siss National Bank toward an easing bias, or at least ending currency intervention to support the franc. The December meeting may be a bit early to completely abandon its more vigilant inflation-fighting message, but we do expect more balanced language, which will ultimately turn more dovish next year. Such a shift is likely to provide a catalyst for the highly overvalued franc to begin a reversion toward our estimate of its longer-term fair value.

Norwegian Krone (NOK)

Our short- and medium-term models are negative on the krone due to falling oil prices, weaker equity markets, and disappointing growth data. On a positive note, inflation appears far too high for the Norges Bank to cut rates as early as the Fed and the ECB, which could be supportive for the currency. At least in December, equity markets tend to hold up well, providing room for the krone to partly catch up to the bullish equity environment.

Beyond that, we expect a general slowing of global growth led by the US, which will likely increase recession fear and result in periods of greater equity market volatility and subdued oil prices, both of which are consistent with a weaker krone. In the long term, the outlook is positive. The krone is historically cheap relative to our estimates of fair value and is supported by steady potential growth.

Swedish Krona (SEK)

We shift to a negative outlook on the krona in response to the weaker economic outlook, poor local equity market performance and weaker score in our short-term value model, which suggests that the krona’s strong performance in November was not justified by fundamentals and should reverse.

However, the ongoing Riksbank reserves hedging program may limit near-term downside. Eventually, though maybe not in the next several months, we expect Swedish and global inflation to be under control and the economy to begin a more durable recovery. Once that happens, the historically cheap krona has substantial room to enjoy a broad-based appreciation back toward its long-run fair value on a sustained basis.

Australian Dollar (AUD)

Our models continue to see medium-term risks tilted to the downside on weak commodity prices, sluggish economic growth, underperformance of Australian equity markets, and the overall fragility of the global growth outlook heading into 2024.

That said, we acknowledge the potential for the global risk sentiment and risky assets to stay well supported through year-end, which would lend further support for a stronger Australian dollar. We also expect a small improvement in Chinese growth following the recent fiscal and monetary stimulus.

In the longer term, the Australian dollar outlook is mixed. It is cheap vs. the US dollar, the British pound, the euro and the Swiss franc, and has room to appreciate, but it is expensive against the yen and the Scandinavian currencies. Here, the China story is less positive, as we see a structural downtrend in China growth, as well as a rotation toward domestic consumption and higher-value-added industries, which is likely to gradually reduce the growth rate of Australian commodity export demand.

New Zealand Dollar (NZD)

We remain pessimistic on the New Zealand dollar over the near term. Soft commodity prices, recession risk and the weak external balance—the current account is –7.5% of gross domestic product—more than offset any benefit of high yields, particularly now that the Reserve Bank of New Zealand has likely ended its tightening cycle. Any further relief from the pessimistic China growth theme is likely to prove temporary. We expect the China growth outlook to remain sluggish over the next few years.

In the longer term, our New Zealand dollar outlook is mixed. Our estimates of long-run fair value suggest that it is cheap vs. the US dollar and the Swiss franc, and has room to appreciate, but is expensive against the yen and the Scandinavian currencies.