Defined Contribution

Index Investing

Our index investing expertise has been sharpened over decades of building and managing some of the world’s most successful index funds.

Our Expertise

Total indexing assets under management 1

Index investment professionals globally

of experience delivering precision index investing

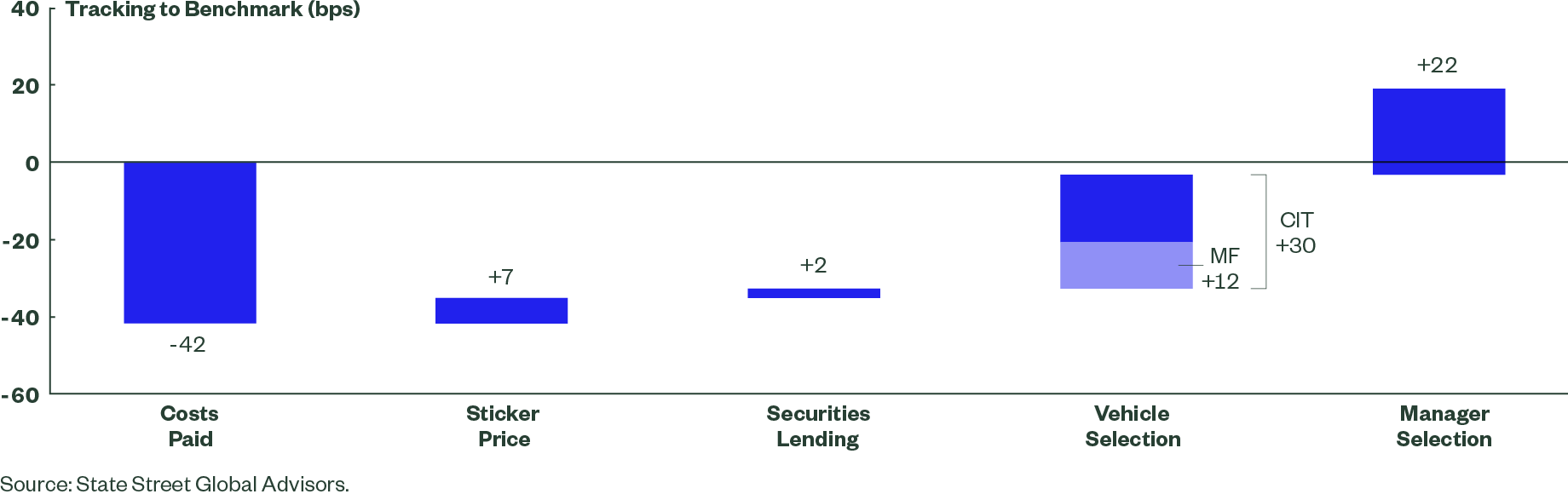

Getting to Operational Alpha

Cost Paid

Fees and trading costs for international equity mandates can gradually erode portfolio value over time and create a drag on relative benchmark performance.²

Sticker Price

Selecting a low-cost index fund generates meaningful savings. For strategies with comparably low fees, better tracking may lead to additional inherent cost savings beyond the IM fee.³

Securities Lending

Securities lending can potentially enhance returns. The risks, potential returns and cost structure of the program should be transparent and well understood by the plan sponsor.⁴

Vehicle Selection

ERISA-qualified CITs pay a lower tax rate on dividends than mutual funds in many developed countries. This leads to material and consistent performance advantages.⁵

Manager Selection

Asset managers with scale and efficient CIT fund structures can generate meaningful cost savings for end investors via internal crossing, translating into better long-term returns.⁶

Applying a DC Lens

In the DC arena, which serves millions of investors and countless transactions, we work at the intersection of efficiency and innovation and endeavour to challenge the status quo by delivering value beyond fees.

Scale becomes a competitive advantage, enabling us to more easily absorb money movement with less impact to fund performance while also supporting greater overall efficiency. Through our ERISA-qualified collective trust investments (CITs), we can deliver a series of benefits that can generate substantial savings to plans and participants:

Crossing Efficiencies

Access to a large-scale internal trading network, allowing managers to sidestep the open market and trade at reduced transaction costs.

Ability to reduce tax exposure on foreign dividends, translating into increased returns relative to mutual funds.

Securities Lending

Entrée to transparent securities lending programs, creating the potential to generate additional income for plans and participants.

Contact us to learn more about our index investing approach specific to DC strategies.