Defined Contribution

DC Investment Solutions

Whether index or active, target date or single strategy, our investment options are managed with a commitment to precision and the objectives to retain exposure to growth, manage downside risk, further diversification and curate a meaningful core menu.

Our DC Investment Options

Leveraging a full range of institutional capabilities to enhance retirement outcomes.

Target Date Funds

Unlocking the Value of Diversification

Our index-based target date funds apply a finer lens to asset class and index selection, utilizing twice as many asset classes as other leading index-based managers. In doing so, our differentiated glidepath management approach strives to mitigate the risks investors face along their savings journey.

Of peers, on average 1

Of peers, on average 1

Underlining strategies

Retirement Income

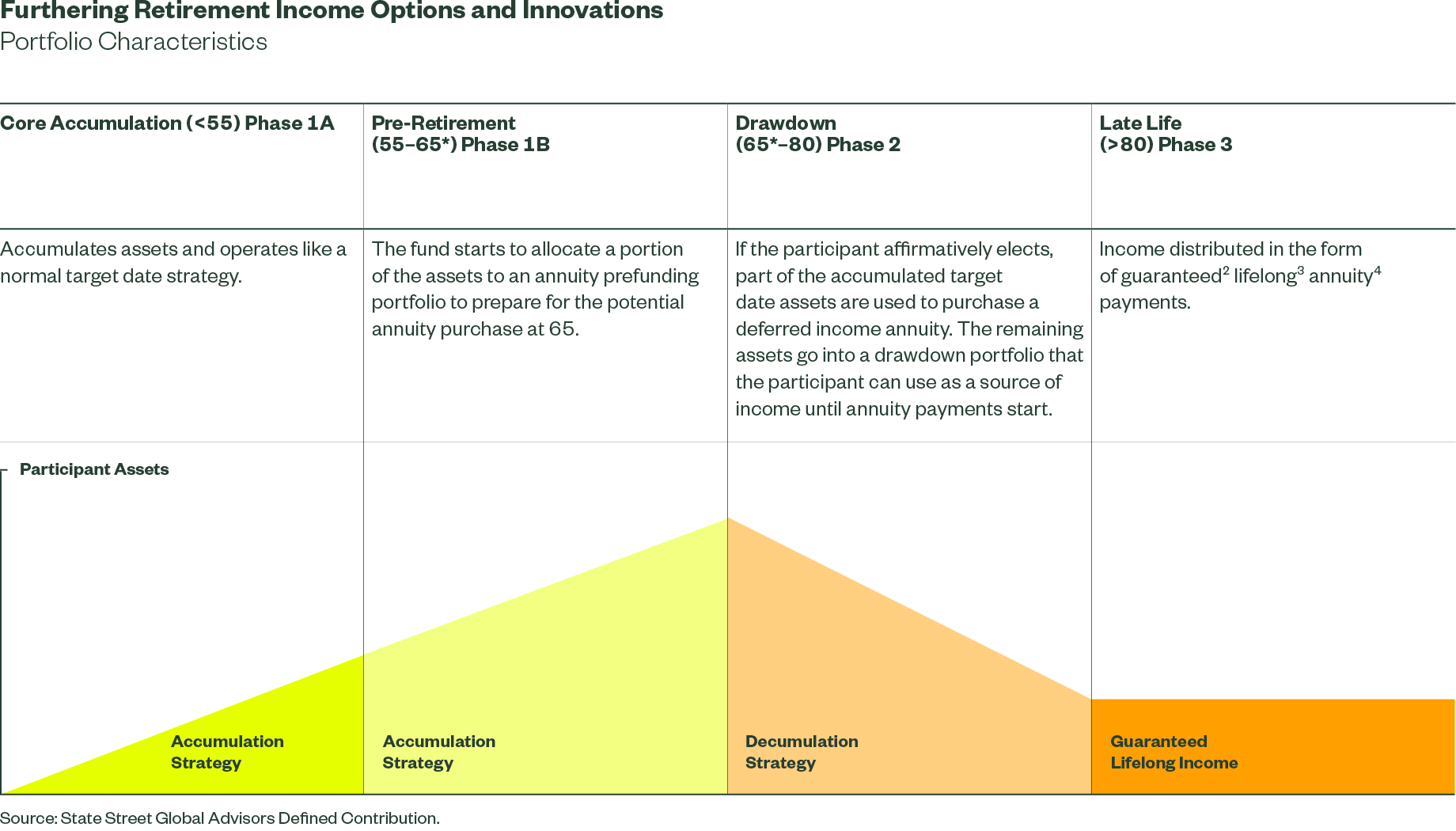

Making Life Savings Last a Lifetime

People are living longer, a trend that translates into longer retirements and requires spending strategies to make money last. Retirement income offers a solution to the uneven spending that is driven by the great unknowns: health care, debt, lifespans.

Index Investing

Choosing the Right Manager Matters

Our index investing approach balances human insights with technology, a style that is particularly meaningful in the DC space, where individual and institutional interests coincide. At State Street, we provide access to investing scale, sophisticated investment vehicle selection and securities lending options.

Active Solutions

Applying Precision for Pre-Retirees

Active management can play an important role in providing participants, particularly those closest to retirement, with meaningful levels of replacement income. However, the pre-retiree population doesn’t have as much time to absorb market volatility as their younger counterparts, meaning active strategies for this segment are most effective when returns are gained strategically, not in feverish pursuit of alpha.

Institutional Cash Management

In addition to the asset categories highlighted above, we offer institutional cash management services with a specific application for DC plans, offering a low-risk, “stable value” option for plan lineups.

Learn more about Defined Contribution at State Street Global Advisors.