What the US government shutdown means for markets and the economy

We expect the US government shutdown caused by Congressional deadlock over health insurance subsidies to be brief with little macroeconomic impact. But will the Health Care sector be impacted?

The US federal government has shut down following a Congressional deadlock over a continuing resolution to fund operations beyond September 30, 2025.

Government shutdowns are normally look-through events, and we don’t expect this one to be any different. Investors focused on macro aggregates can look past it, with the caveat that there may be a delay in key data releases for October. Those with a more granular focus may find an opportunity in the Health Care sector, as healthcare policy sits at the center of the budget standoff.

Markets shrug off shutdowns, economy impacted in short term

While US government shutdowns historically have had limited market impact, they can be economically relevant.

Shutdowns affect roughly two million workers, including government contractors and about half the federal workforce, who are either furloughed or required to work without pay. Missed wages and interruptions to government services can impact the economy. But real disruption occurs only if the shutdown lasts for a long time.

And shutdowns, on average, have lasted no more than a week or two—too short a time to be anything more than an irritant to the economy. In fact, any short-term drag on economic activity is generally followed by a rebound, given that federal workers are paid in full retroactively for the time they were unpaid.

Record-long 2018-2019 shutdown an exception

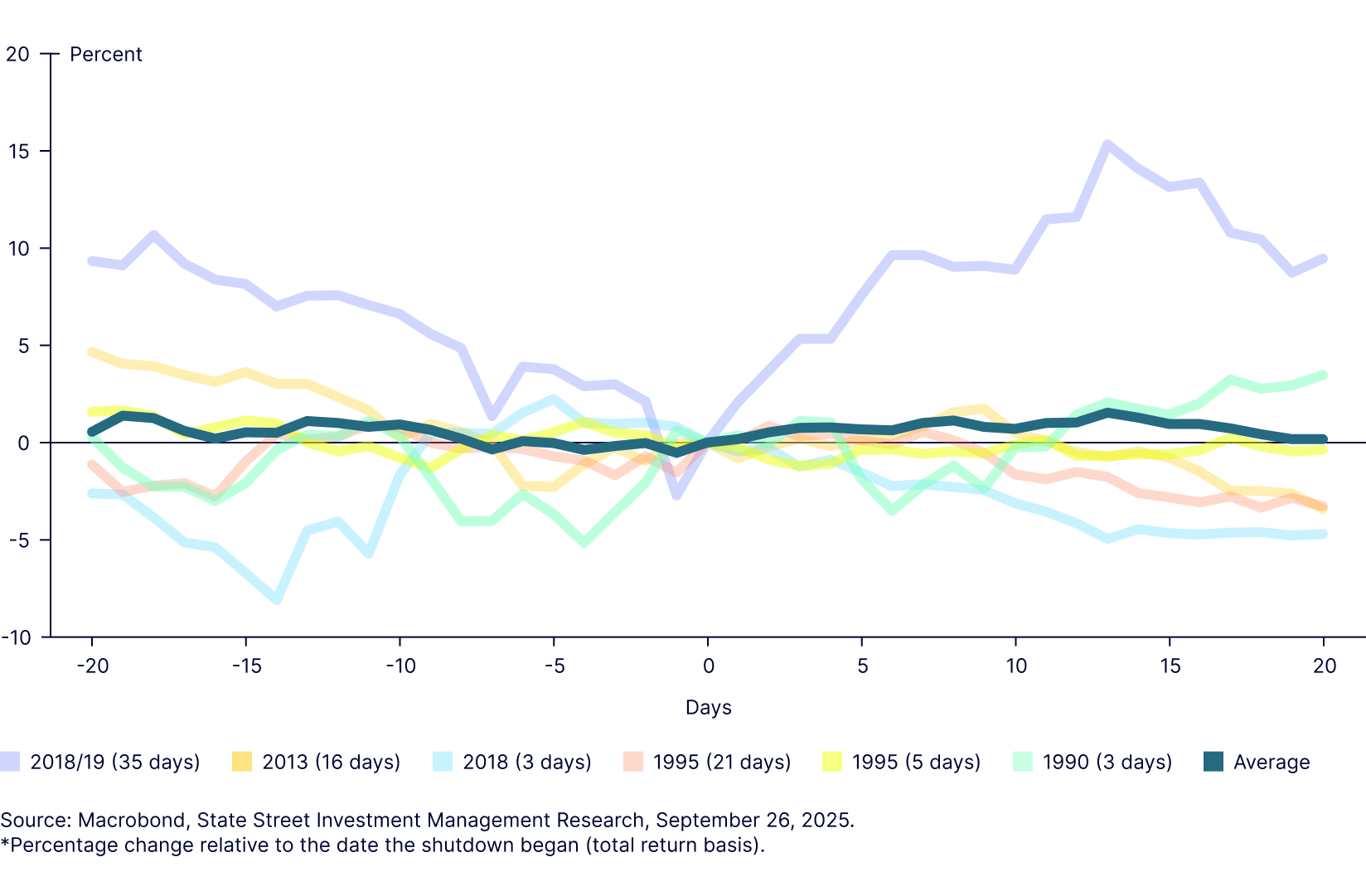

The longest shutdown in US history lasted for 35 days—from December 22, 2018, to January 25, 2019. And it negatively impacted market performance (Figure 1).

Figure 1: S&P 500 performance during government shutdowns*

The 2018-2019 shutdown stemmed from a political standoff between President Donald Trump and Congressional Democrats over funding for a proposed border wall between the US and Mexico. It occurred after the 2018 midterm election where Democrats ended the Republican Party’s unified control of Congress, setting the stage for legislative gridlock.

Broader concerns about slowing global growth and rising interest rates also weighed on investor sentiment and contributed to market volatility, compounding the impact. But even then, the market impact was strongest heading into the shutdown. Markets rebounded shortly after it began and were not particularly bothered by its duration.

Deadlocked over health insurance subsidies

The most market-relevant element of today’s shutdown is the fate of health insurance subsidies, set to expire at year-end. Originally part of the Affordable Care Act (ACA), 2010, these subsidies—delivered through enhanced premium tax credits—have expanded significantly over time, benefitting insurers in particular.

Stressing the need for affordable health insurance, Democrats are pushing for an extension of these enhanced ACA tax credits. Republicans oppose extending them on fiscal austerity grounds.

Rolling subsidies back likely will reduce coverage levels, negatively affecting sentiment in the Health Care sector.

Political calculus and the path to resolution

We’re confident this shutdown will be short and uneventful because the political stakes are clear, and the off-ramp is visible.

Democrats, under pressure from voters to show that they can be effective in opposition, are angling for a tangible policy win. Allowing these subsidies to expire increases health insurance costs for millions of Americans. By taking a stand, they are forcing Republicans to “own” the issue of cutting healthcare.

On balance, the Democrats are more committed to the fight and have more to win and less to lose. For Republicans, beyond the opportunity to blame the Democrats for the shutdown, this is a fight not worth fighting.

Because the fiscal costs of the extension are immaterial—$30 billion per year, about 0.1% of GDP—it may be easier for Republicans to concede without significant budgetary consequences. In other words, Republicans can score political points by allowing the government to shut down, but they stand to lose more from keeping it closed.

Therefore, we expect the Republicans to give in within a week or two and allow the health insurance tax credits to be extended. This scenario reinforces our generally constructive investment outlook on the US Health Care sector. In the meantime, data-dependent investors should brace for delays in key macro data.

Want more market insights?

Stay up to date on the government shutdown and more with our Weekly Economic Perspectives.