Bond vigilantes eye sovereigns’ rhetorical question

Alongside a gap between words and deeds on deficits, our institutional investor flow data and PriceStats inflation analysis support allocations to European and emerging market debt.

Through the lens of investor allocations and online inflation data, these are tricky times for fixed income investors, despite improved returns. Investors’ aggregate allocations to fixed income, relative to equities, have fallen close to their lowest levels since the Great Financial Crisis. In Q3, appetite for sovereign bonds was concentrated either at shorter durations, US Treasury Inflation-Protected Securities (TIPS), or in select emerging markets (EM).

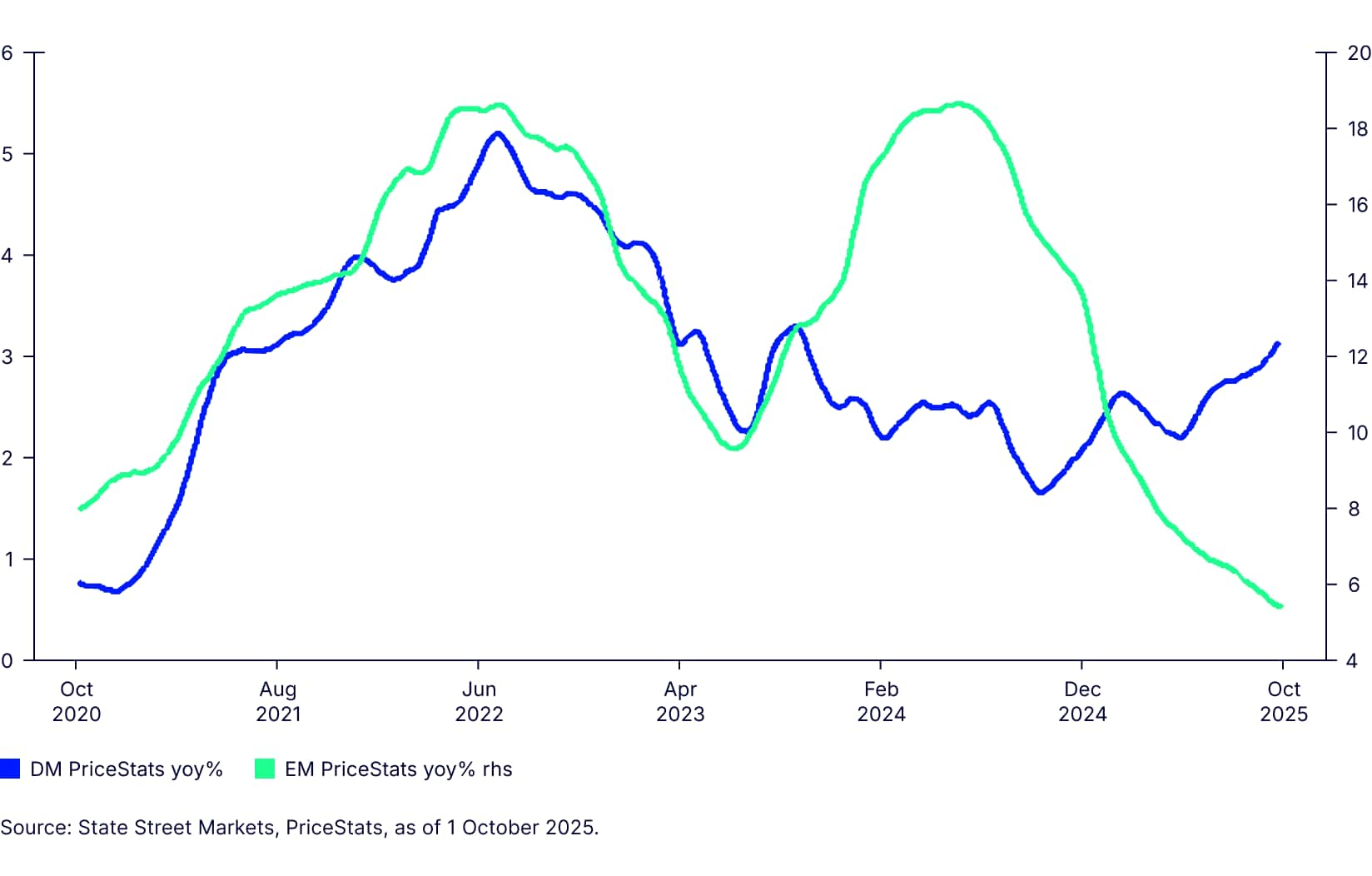

Concerns over fiscal spending, and lukewarm political commitments to reign in debt remain prevalent. Figure 1 shows that four of the bottom five sovereign markets in terms of investor demand over the quarter—Japan, US, France, and the UK—all face questions about whether their governments’ rhetoric on reducing fiscal spending will be matched by credible action. Purchases of UK and France sovereigns was in the bottom decile of Q3 flows over the past five years.

Conversely, Spain — one of Europe’s strongest growing economies—appeals, alongside some EM economies, especially Brazil. Demand for US TIPS also began to accelerate in Q3 and is now at its strongest level since the peak of tariff fears, suggesting inflation concerns cannot yet be discounted. Our PriceStats data through the end of September supports this thesis.

Figure 1: Investor sovereign selections in Q3

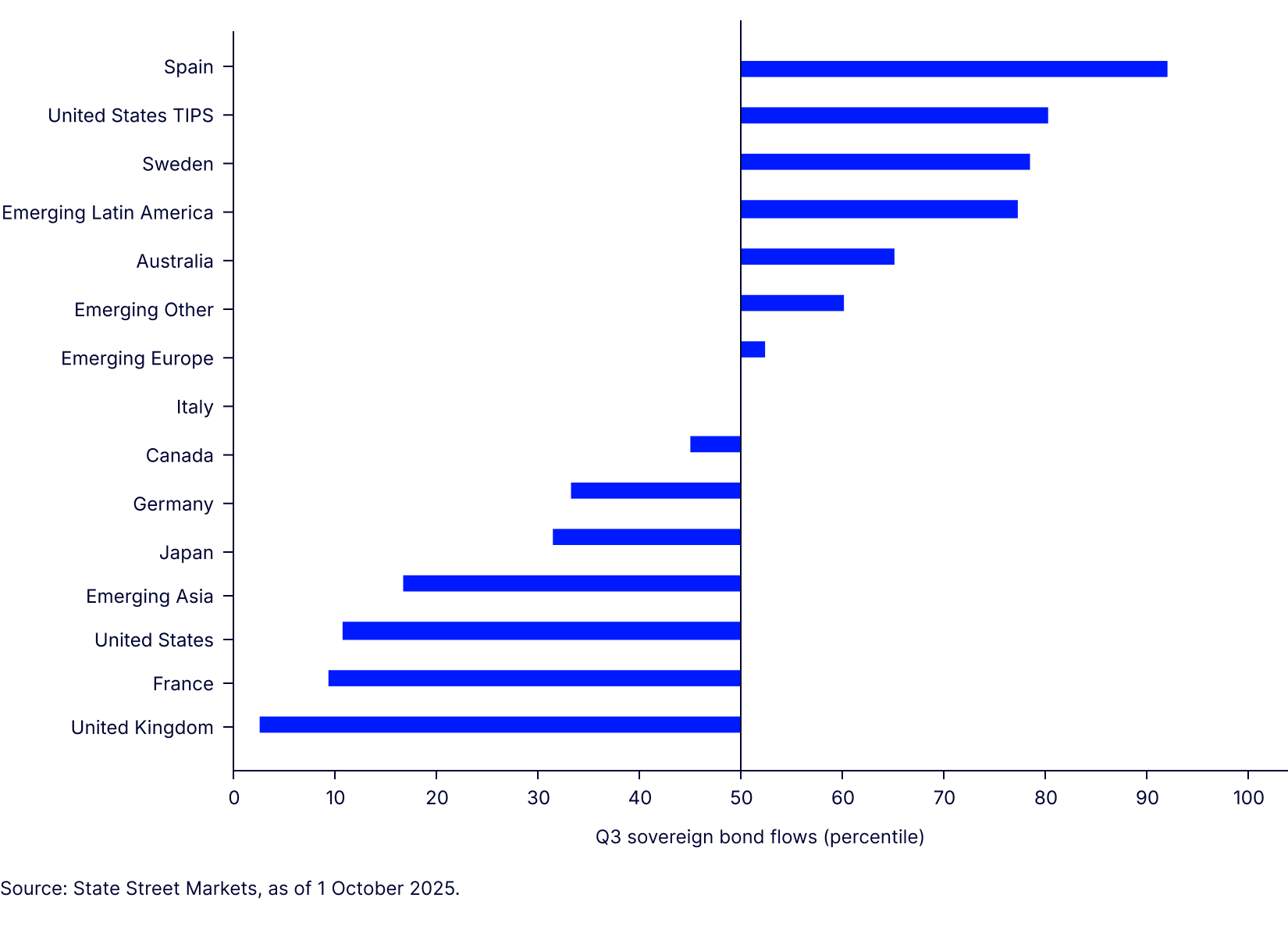

In addition to inflation and deficit worries, our indicators show a lack of investor demand for longer duration. Asset manager flows into longer durations remained below average across Q3 (Figure 2) continuing a year-long aversion trend. Sentiment is more mixed at shorter durations, and even in the belly of the curve, but demand for duration in excess of 10 years remains in the bottom quartile of historic data, particularly for the UK and the US. Investors are cautious due to fiscal uncertainties relating to the US government shutdown impasse, and the UK’s autumn budget.

Figure 2: Investor Q3 duration selections

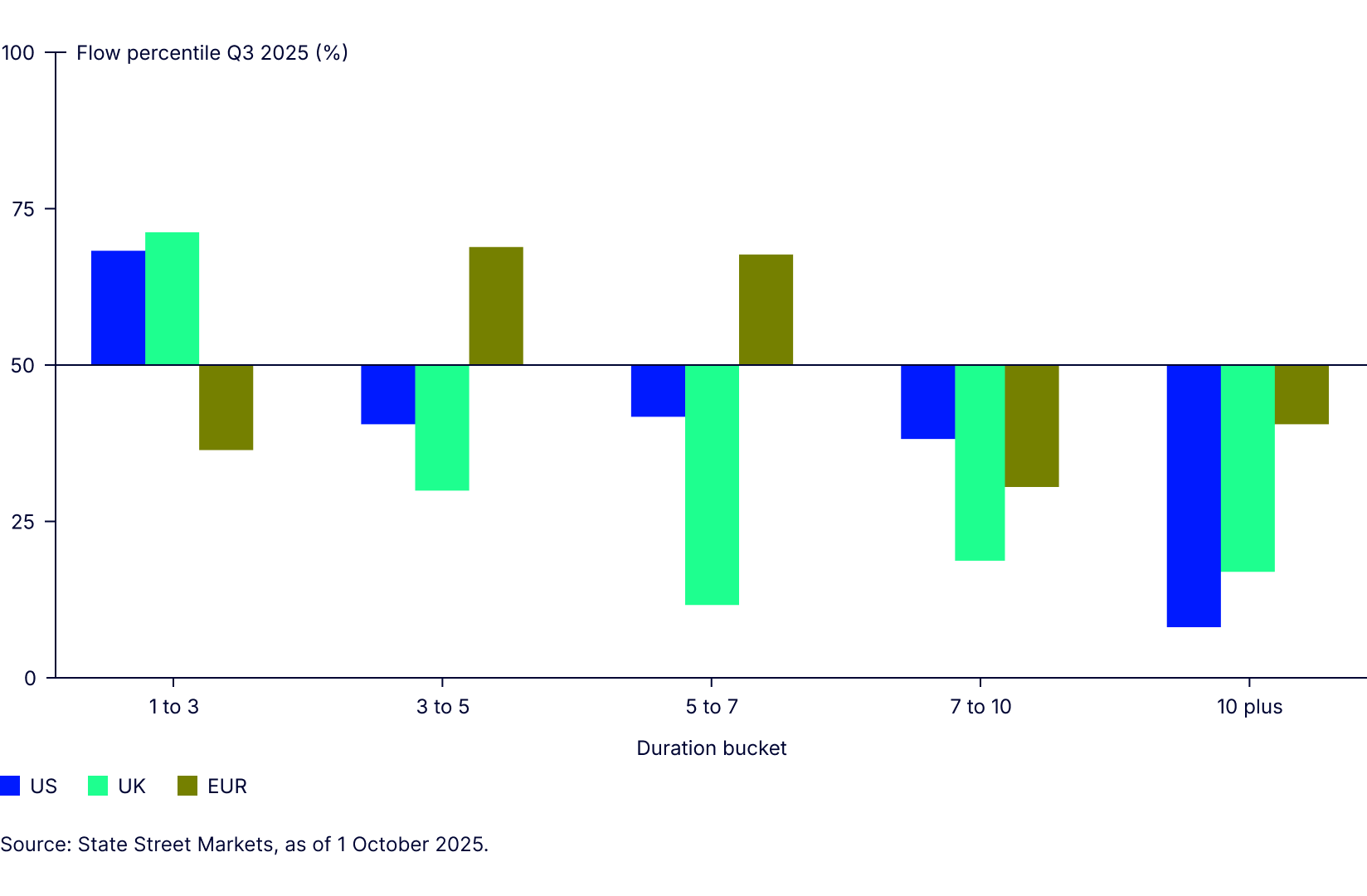

Inflation developments will compound scepticism toward sovereigns. As we noted in our piece on US inflation, PriceStats data shows US inflation continued to accelerate in September. The data indicates that the annual inflation rate has increased by nearly a full percentage point since May. The key question now for Q4 is whether price formation will follow its historically benign path because of seasonal discounts. If not, year-end and 2026 inflation forecasts may need to be revised higher.

The US is not the only developed market experiencing higher annual inflation rates. PriceStats data shows notable quarterly accelerations in Germany, France, and Canada, driving the aggregate developed market inflation measure upwards (Figure 3). This contrasts with the continued EM disinflation trend. Higher inflation economies such as Turkey and Argentina, and lower inflation economies like Brazil, Korea, and Poland are experiencing declines. This trend highlights the continued relative improvement in EM local currency bond fundamentals.

Figure 3: PriceStats annual inflation trends