Market Twists and Turns Amid the Banking Turmoil

March’s banking turmoil forged a mixed picture in the market. Even though the market ended the month on an upswing, all is not rosy for the economy, and uncertainty continues to persist.

March’s banking turmoil underscored the point that uncertainty is likely to persist for the foreseeable future. Amid the uncertainty in markets, the Active Quantitative Equity (AQE) team relies on bottom-up diversified stock selection in conjunction with close observation of top-down macroeconomic exposures. This combination of complementary analytical angles enables the team to identify the best quality companies in which to invest.

The Banking Crisis: A Mixed Picture

Any event that threatens the US or global financial system is typically a significant occurrence. In early March, Silicon Valley Bank (SVB) and Signature Bank, two American mid-sized banks, collapsed, marking the biggest failure of a US bank since the Global Financial Crisis (GFC). Shortly after, Credit Suisse, which was already teetering, was bought out by Swiss bank UBS in a move intended to shore up the global banking system and to prevent the former financial institution from collapsing. Concerns about a potential domino effect in banking systems failing continued to persist. Interestingly, during March, the only negatively-impacted segments of the market were financials. Every other sector carried on. In fact, most of the equity markets seemed to celebrate the potential change of the interest rate trajectory and the equity market was up overall. Even though the market was up, we do not think this is necessarily a sign that everything is rosy for the economy.

The sell-off in the first couple of weeks of March reached its worst point when fears of a wider financial system crisis peaked on March 13. After that, fears abated, and the market experienced a sharp rally, rising almost 6% from the low.

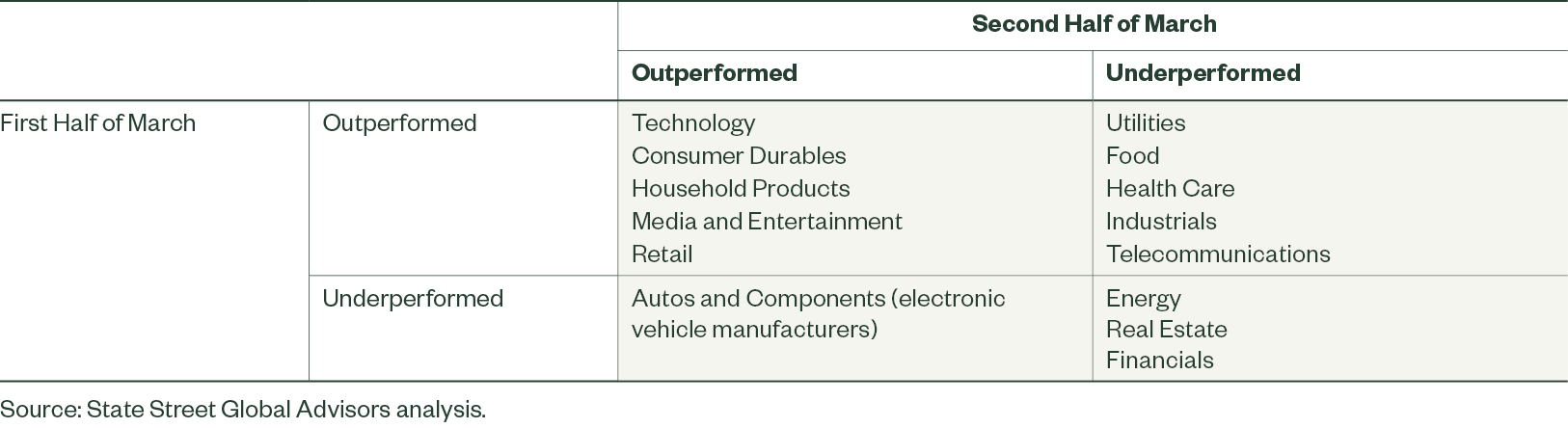

What was interesting about the rebound, is that while the market experienced a reversal, the segments that dragged the market down — banks, financials, insurance, real estate, and energy — also underperformed during the market rebound.

During the market decline, both high growth and defensive groups of companies outperformed. Yet during the rebound, the high growth, more expensive growth segments (e.g. technology, media, and retail) performed more strongly than the market overall, while the cheaper and lower risk segments (e.g. utilities, staples, health care, and telecommunications) underperformed.

Figure 1: March Matrix of Sector Performers

Recovery and Segment Implications

This rebound pattern echoes the strong market conditions we saw in the first year of the COVID-19 pandemic. During that period (and oversimplifying it), the zero-interest rate environment spurred risk taking and multiple expansion of high growth segments of the equity market. Investors went from fearing the worst economic conditions as a result of the global shutdown, to taking a lot of risk as a result of the accommodative monetary policy.

It makes sense that if investors think the failure of SVB and other regional banks could lead to a change in monetary policy and subsequent rate cuts, this would lead to another round of risk taking and multiple expansion.

However, it is also possible that the banking sector turmoil could lead to a weakened economy, which would not be positive for growth stocks, thereby leading to a strong flight to defensive equities as a result.

Currently, across global developed markets, value exposure is found most significantly in telecommunications, traditional autos, banks and energy sectors. High quality stocks are in health care and technology. Segments with strong sentiment include consumer services, capital goods, and retailing. As is evident, these characteristics lead to different preferences.

When we blend them together, our highest picks right now are in financials and health care, while our least preferred are real estate, utilities, and media.

The Bottom Line

The uncertainty around these macroeconomic outcomes is a theme that is likely to endure for the foreseeable future. For this reason, bottom-up diversified stock selection is essential, and needs to be complemented with careful monitoring of top-down macroeconomic exposures, and a blend of characteristics to select the highest quality companies. Value, sentiment, and quality all work together to maximize the chances of success in multiple future economic scenarios.