An Active Fundamental Approach to the US Market

- Our investment philosophy emphasizes a combination of quality and sustainable growth at a reasonable valuation.

- Our proprietary quality assessment framework helps us build high conviction portfolios with exposure to companies with durable earnings growth that can consistently deliver alpha over the long term.

State Street Global Advisors’ Fundamental Growth and Core Equity (FGC) team has been managing active fundamental equities since our first mutual fund was established in 1935. Our overarching value proposition is based on outperforming the market through concentrated portfolios of high quality names with better than average earnings growth and lower than average volatility. Our investment philosophy is built around the combination of quality, sustainable growth and a reasonable valuation.

Despite the ongoing concerns about slowing global growth, persistent inflation and higher rates, our team believes that the US equity market still offers a unique opportunity set of high-quality, long-term “compounder” companies that can be a core component of any strategic asset allocation. These are globally competitive franchises, operating in a supportive political environment, that benefit from technological innovation, dynamic management teams, and disciplined capital structures. While there are always short-term fundamental risks, the long-term prospects for the highest-quality companies in the US market demand a sizable allocation regardless of your tactical asset allocation call.

As active fundamental managers with a long and successful track record, we have a biased view on how exposure to the US market can be best achieved. The widening performance differential between the best and worst US companies helps to justify this bias, revealing an investment landscape that is ideal for adding alpha through stock selection. As managers of concentrated, high-conviction portfolios, we help investors navigate the extremes in the market by avoiding overpriced growth stocks while also steering clear of lower-quality value traps. Our philosophy is based on “quality at a reasonable price,” which helps us construct concentrated, yet balanced, portfolios that provide better-than-average growth combined with the stability of lower-than-average volatility. Decisions are informed by our proprietary, forward-looking, framework for assessing quality.

Differentiated Philosophy

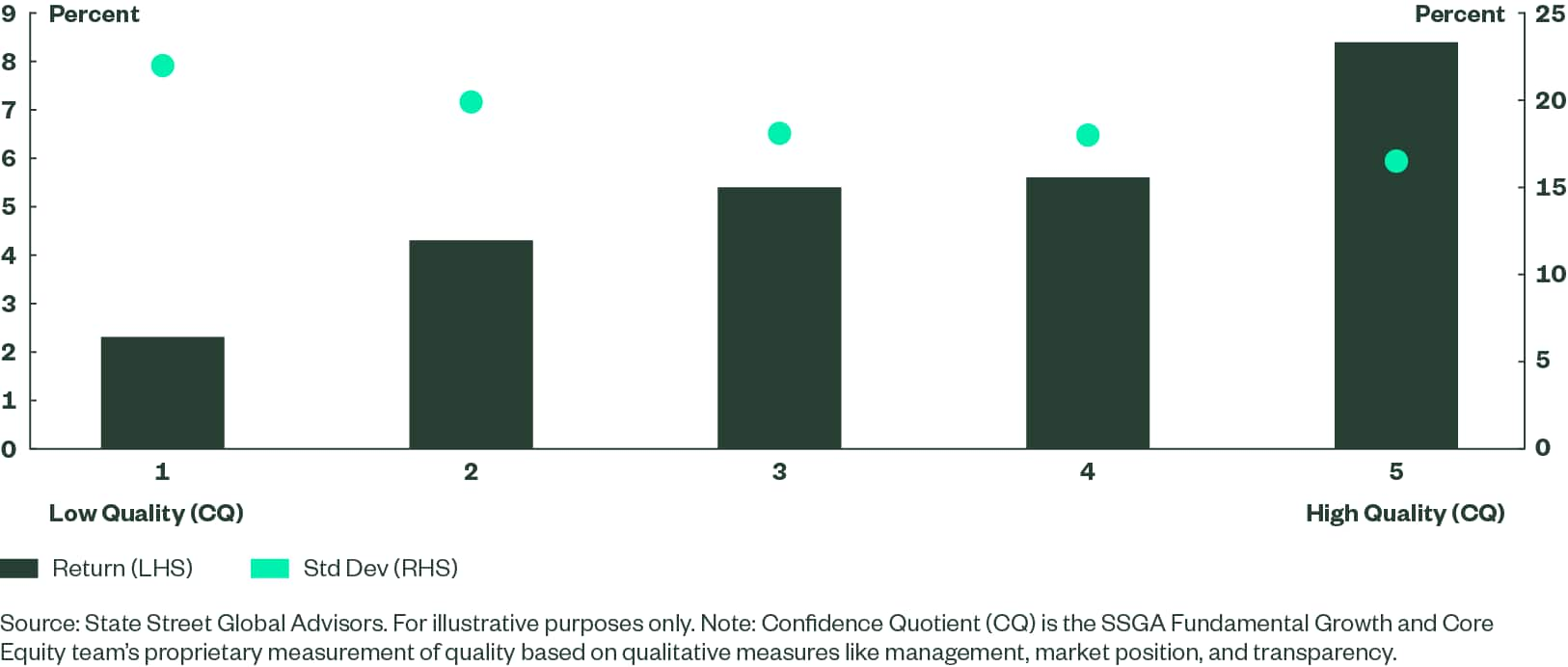

Our focus on quality is supported by a proprietary framework that we call Confidence Quotient (CQ). The CQ scoring framework reflects each analyst’s conviction in a company’s quality and its ability to deliver sustainable earnings growth.

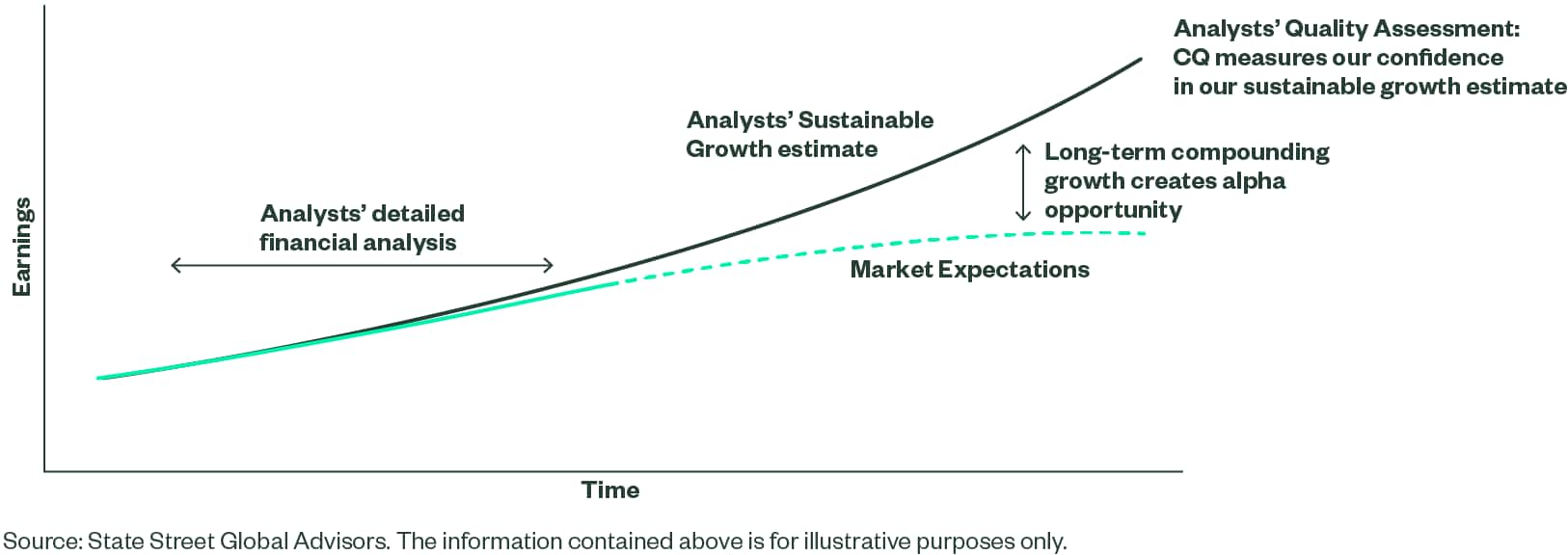

Figure 1: Fundamental Research Approach

Unlike traditional measures of quality that emphasize a simple combination of historical returns, earnings volatility and debt, we define quality on a forward-looking basis and focus on qualitative measures like the competitive moat, our confidence in the management team, the appropriateness of the capital allocation strategy, the transparency of the business model and the fundamental momentum of the business drivers.

We leverage our long-tenured research team to quantify these “soft” metrics using our detailed CQ framework. With over 30 investment professionals globally and 14 sector analysts, with deep domain knowledge, covering the US market we constantly debate and reassess these CQ scores as fundamentals evolve.

We marry this view on quality with detailed financial analysis, where our analysts produce a series of proprietary data around intermediate-term earnings estimates and a long-term growth assessment. We also have an integrated ESG approach built into the CQ framework that ensures we consider the implications of sustainability and the associated business risks when it comes to the durability of this growth outlook.

Lastly, we maintain what we call a reasonable valuation discipline. Valuation is more of an art than a science. Philosophically we think about discounted cash flows as the basis for establishing an intrinsic value for a stock, but in reality, forecasting the long-term growth and returns is easier said than done. Our financial modeling gives us a feel for the intermediate-term earnings trajectory but our long-term through-cycle growth estimates combined with our CQ-defined quality metrics informs our level of conviction in the durability of growth and the associated price we are willing to pay.

Results Driven

Some call this approach GARP (growth-at-a-reasonable price) but we like to call it QARP (quality-at-a-reasonable price). While our core mandates have historically plotted slightly more “growthy” than the market overall, this has less to do with an affinity for growth investing and is more an artifact of the correlation between growth and quality. Our CQ-defined quality universe filters out lower quality names that typically plot in the value end of the spectrum while our valuation discipline helps us avoid overpaying for growth at the other end of the spectrum. The result is a high quality portfolio that provides long term alpha generation and lower volatility.

Figure 2: Return and Standard Deviation by CQ Quintile (2007–2022)

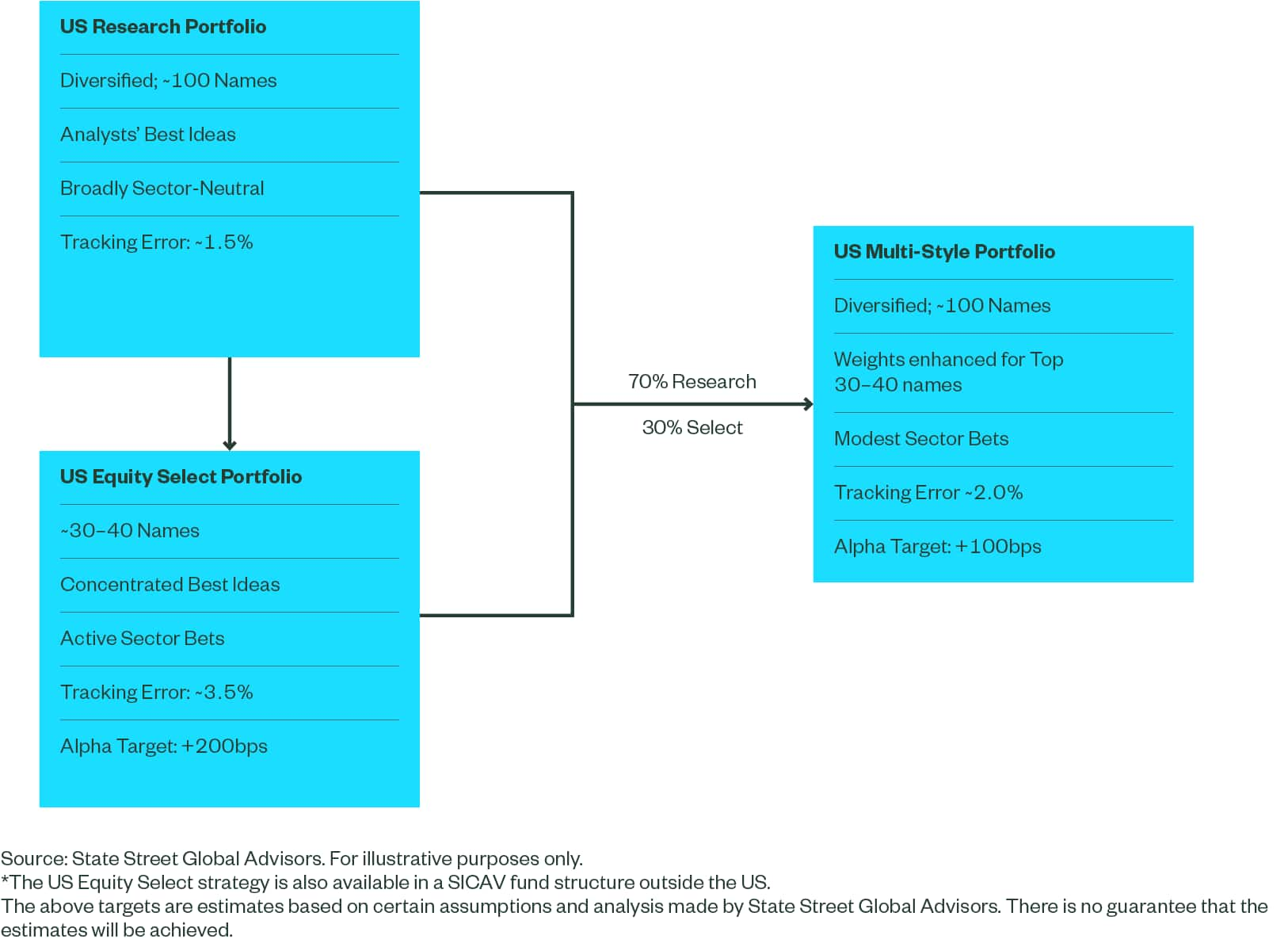

Two Flavors of US Active Fundamental Core

We offer two active US core strategies built on the same philosophy and research platform. These two flavors of active fundamental equity are benchmarked against the S&P 500 Index but have different levels of concentration to meet different client needs. Our flagship concentrated strategy is the US Equity Select strategy*, a core mandate benchmarked against the S&P 500 with 30–40 names and a tracking error that typically runs in the 3–4% range.

We also have a version with 100 names, US Multi-Style Equity, with lower tracking error for clients that want to emphasize lower volatility over potential alpha. This version is built on the best ideas across the analyst team and then re-weighted to enhance the exposure to the highest conviction names that are also held in US Equity Select.

Figure 3: Multi-Style Construct

The Bottom Line

In conclusion, those looking for core exposure with the benefit of alpha generation should consider our US Equity mandates. We offer high quality, low turnover, sleep well at night type of portfolios. Our concentrated funds don’t rely on style shifts or factor tilts to drive performance. They rely on fundamental analysis of durable companies with reliable management teams that reinvest for future growth. We maintain a disciplined valuation framework that gravitates towards long-term cash flow compounders but avoids valuation extremes. And we’re supported by an experienced global research team with a proven track record.