Emerging Markets and How to Play Them

- Emerging markets (EM) faced enormous headwinds during 2021 and 2022 across asset classes. However, the tides appear to be turning as China has put an end to its zero-COVID policy, economies are bottoming out, the inflation battle is being won, and EM central banks appear to be ahead of the Fed and ECB in their tightening cycle. In this environment, there are numerous ways for investors to access emerging markets, spanning equity, fixed income and dividend exposures.

- Download our full report for further analysis and ETF implementation ideas.

Growth Differentiator

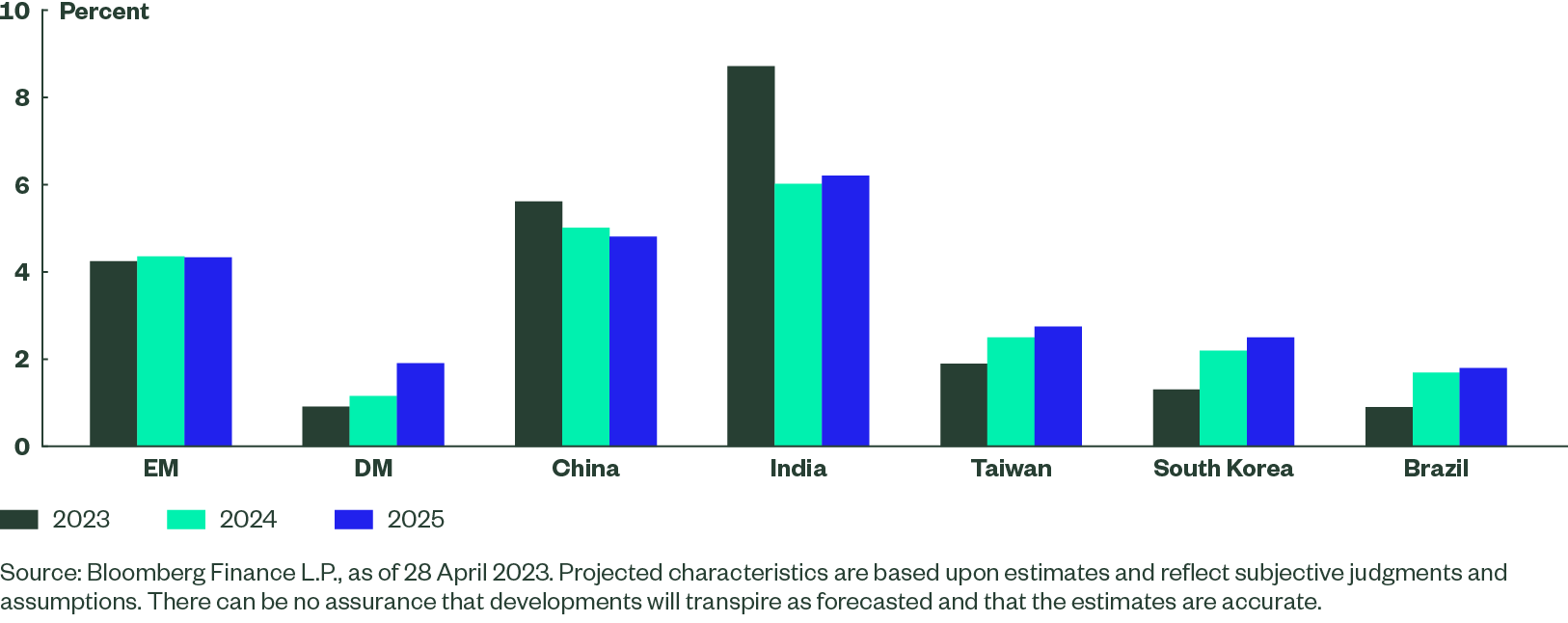

EM remains a pocket of growth in a world of economic slowdown. While developed market (DM) growth is set to decelerate, we expect emerging economies to expand at a solid rate, with India and China driving global growth. While there have been some signs that the rebound in China may be more muted than initially expected, EM growth should still be robust.

Inflation remains elevated but disinflationary forces are in motion, with the decline of food and fuel prices having a particularly significant effect on CPI baskets within EM. This trend should ease pressure on EM central banks in the medium term. Several may be reluctant to deliver rate cuts until it becomes clear that the Fed is at end of the hiking cycle. But with that end looking close, firm growth, lower central bank rates and a possible further weakening of the USD should support EM economies as well as local bonds and equities. Indeed, in the State Street Global Advisors Long-term Asset Class forecasts for Q2 2023, EM equities (+7.7%) and EM bonds (+7.2%) are projected to be the two best performing asset classes over the longer term.1

Figure 1: Forecasted Real GDP Growth

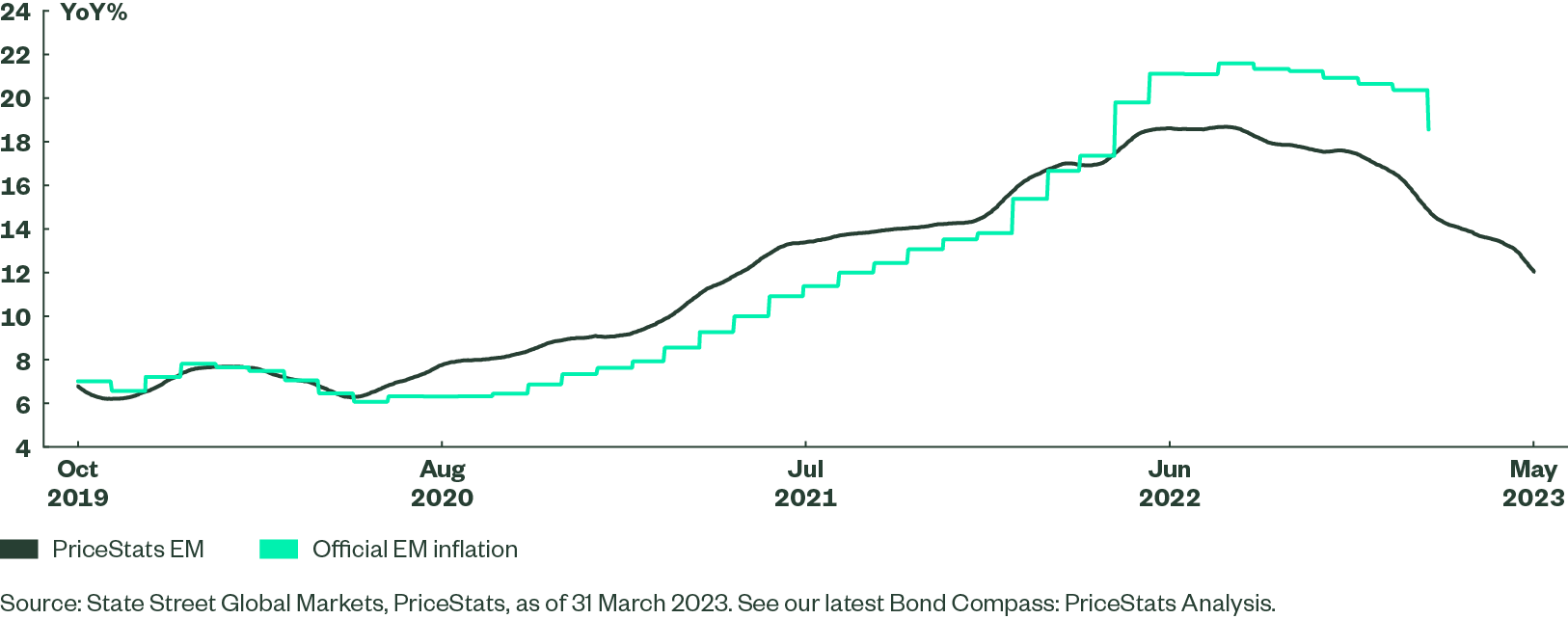

EM Inflation is Slowing

Inflation took off faster in EM, and central banks responded more quickly than their DM counterparts. This difference is becoming clearer in the inflation trend, too. While the level of inflation remains elevated, the rate of disinflation is beginning to accelerate. This is not the result of base effects alone, as monthly prints in some countries are beginning to come in below seasonal averages, especially in Brazil and South Korea. Lower food prices are part, but not all, of this story. It’s also encouraging that, in spite of China’s surprise reopening at the end of 2022, PriceStats online gauges of supermarket and fresh food prices have yet to show signs of acceleration.

This backdrop could support policy normalisation as pressure from developed central banks warrant less of tightening to defend currencies versus the USD in particular.

Figure 2: PriceStats Suggests Online Prices Are Now Easing

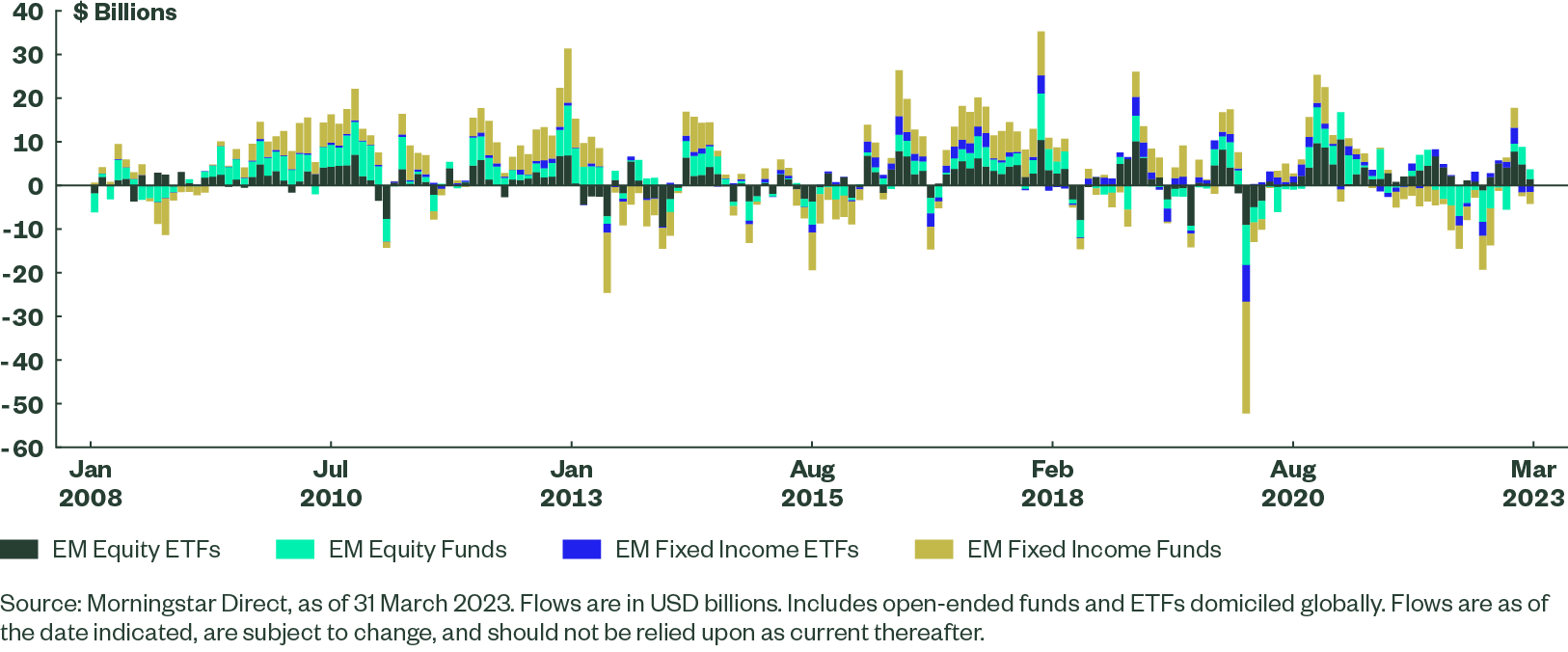

Investors Have Begun to Position Already

While the performance of EM equities has been mixed, investors have poured c. $25 billion into EM equity exposures and $3.7 billion into fixed income funds. These flows have arrived since the first “pivot” that was triggered by weaker-than-expected US CPI in November 2022.

Flows in EM open-ended funds and ETFs were more subdued (on a relative basis) in February 2022 and March 2022 as US inflation failed to show clear signs of easing, but the impetus that started in November 2022 may re-ignite since the Federal Reserve has been signalling at least a pause at the June meeting and inflation prints for April were lower than anticipated. This may support the view that Fed tightening could be done for this cycle.

Figure 3: Emerging Market Funds – Monthly Flows ($bn)

To continue reading our analysis, and to view ETF implementation ideas in both equities and bonds, please download the full report by clicking below.